Blood Testing Market Size & Overview:

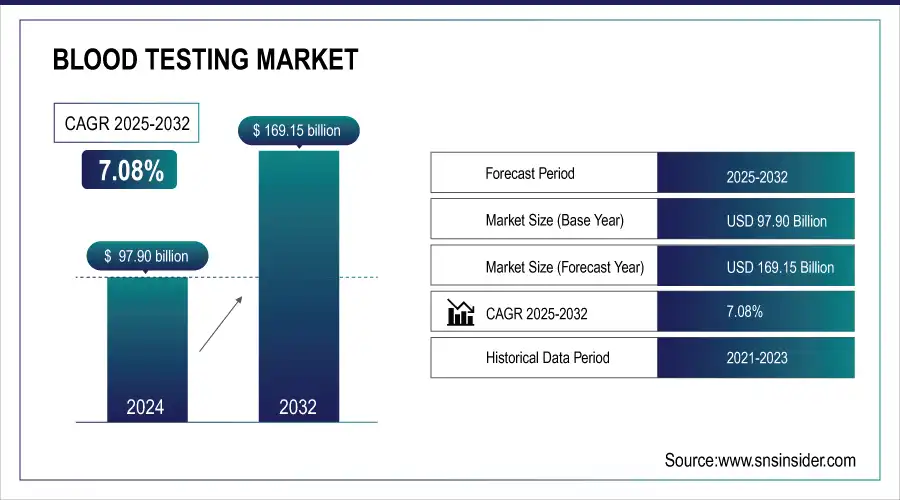

The global blood testing market was valued at USD 97.90 Bn in 2024 and is expected to reach USD 169.15 Bn by 2032, growing at a CAGR of 7.08% from 2025 to 2032.

To get more information on Blood Testing Market - Request Sample Report

Increased medical expenditure from government and regulatory bodies has highly contributed to the growth in the blood testing market. The bodies have been encouraging patients to undergo regular diagnostic tests, thereby increasing the demand for services in the blood testing sector in the forecasted period. Moreover, the research activities undertaken in developed countries have also emerged as a significant contributor to this growth. For example, scientists at the National Center for Global Health and Medicine in Japan found a blood test that can offer even early signs of severe cases of COVID-19. The viability of such tests was proven by the issuance of 500 prototype machines. Ventures such as these are becoming pivotal to pushing the regional market in Asia forward.

Blood test prescriptions are rapidly changing with the advancement of diagnostic technologies and growing emphasis on personalized medicine. More and more doctors prescribe routine blood tests to maintain chronic conditions as well as prophylactic measures and early detection of diseases, and monitor the response to treatments. The biggest prescription increases have been noted in advanced blood tests like molecular diagnostics, genetic screening, and liquid biopsy techniques for non-invasive cancer diagnosis. Continuous glucose monitoring systems are very commonly prescribed as a part of diabetes management, giving real-time insight into blood glucose levels. Blood biomarker tests for personalizing treatment of cardiovascular diseases, cancer, and autoimmune disorders are increasingly used. Advanced diagnostic tools are becoming more accessible, yet the use of these tests is moving towards much more frequent, personalized, and even more precise measurements of blood.

Another thing is home blood drawing kits. Now, people can withdraw minute quantities of blood through a prick from their fingers. Such tests include glucose and cholesterol levels, hormone levels, and even antibodies for COVID-19. Many businesses such as LabCorp and Everlywell offer services that help people receive treatment from the comfort of their homes, especially the aged and sickly or in remote areas. Results are then made available to the patients online while permitting them follow-up consultations with their healthcare providers in due time.

Market Size and Forecast:

-

Market Size in 2024 USD 97.90 Billion

-

Market Size by 2032 USD 169.15 Billion

-

CAGR of 7.08% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Blood Testing Market Trends:

-

Growing reliance on blood tests for early detection and management of chronic conditions such as diabetes, cardiovascular diseases, and cancer.

-

Rising adoption of personalized medicine utilizing blood biomarkers to deliver tailored treatment strategies for improved patient outcomes.

-

Increasing demand for non-invasive diagnostic methods like liquid biopsies for faster and more accurate cancer detection.

-

Advancements in blood testing technologies enhancing accuracy, speed, and convenience, driving wider clinical and home-based applications.

-

Expanding use of routine blood testing to monitor patient health, track treatment responses, and prevent disease progression effectively.

Blood Testing Market Growth Drivers:

-

The Surge of Chronic Diseases and Technological Innovations Fueling Growth in the Global Blood Testing Market

The increasing prevalence of chronic diseases, including diabetes, cardiovascular diseases, and cancer, distinctly propels the advancement of the global blood testing market. WHO statistics reveal that nearly 60% of all deaths are attributed to chronic diseases. Cardiovascular diseases are responsible for approximately 17.9 million deaths annually. There has been an absolute surge in the prevalence of chronic diseases. Therefore, regular blood tests are always required for early diagnosis and appropriate management. For example, diabetic management would involve frequent blood glucose level monitoring and, a highly increasing demand for blood testing devices.

Furthermore, cancer diagnosis and treatment often require a series of blood tests that monitor patients' health and mark the improvement or deterioration of their health. A recent boom in personalized medicine relies on blood biomarkers to provide customized treatments tailored for specific patients hence increasing demand. Other technologies that can be associated with growth in the market include novel blood-testing technologies, such as liquid biopsies for non-invasive cancer detection. These offer less invasive and faster methods that are more accurate and hence result in more frequent and earlier diagnoses of diseases. In all, the main rising ingredients include chronic diseases, which are on the rise; therefore, the need for further observation; and, in addition, the ever-changing technological advancements associated with blood testing that help establish a firm foundation for expansion in this blood testing market.

Blood Testing Market Restraints:

The blood testing market faces restraints such as high costs of advanced diagnostic technologies, which limit accessibility in low- and middle-income regions. Stringent regulatory approvals slow down the introduction of innovative products, while concerns about data privacy and test accuracy hinder adoption. Additionally, shortage of skilled healthcare professionals and infrastructure gaps restrict widespread utilization of advanced blood testing solutions.

Blood Testing Market Segment Analysis:

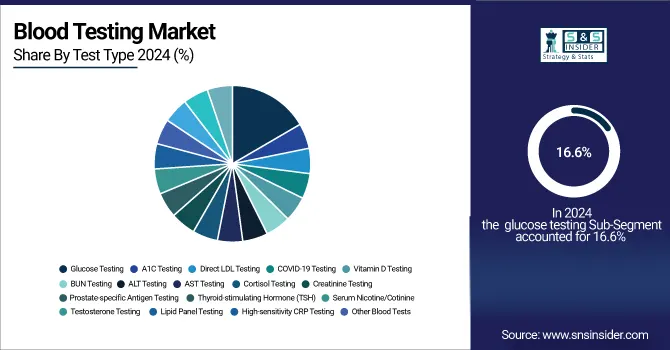

By Type

The glucose testing segment dominated the blood testing market in 2024. It accounted for a share of revenue at 16.6%. The main reason for this dominance is because of the widespread use of these tests all over the world. Over the past few years, diabetes has been increasing in incidence, and this is expected to grow further in the coming years. A report from the International Diabetes Federation published in December 2021 states that, in 2021, about 537 million adults aged between 20 and 79 lived with diabetes. This number is expected to grow even further to as much as 783 million by 2045, creating a lot of need for blood glucose testing, and therefore, calls for growth in this market.

The advancement of technological features in glucometers, such as Bluetooth connectivity and wireless capabilities, has made the products used even more significantly. Of special interest in the smart glucose monitoring devices list include Dario Health Smart Meter, iHealth Align, iHealth Smart, and Glooko. Service companies offering commercial services for this industry include Mayo Clinic, LabCorp America, and Quest Diagnostics. Consumables to go along with conducting glucose tests include test strips, lancets, syringes, and diabetes testing kits.

The A1C testing market is also expected to witness significant growth over the forecast period. A1C testing, also known as glycated hemoglobin testing, is foreseen to gain substantially due to its convenience. This blood test is critical for understanding average levels of blood sugar. Thus, it is used in the diagnosis and monitoring of treatment of diabetes. In addition, A1C tests are specifically beneficial for point-of-care applications in terms of long-term assessment of blood sugar control.

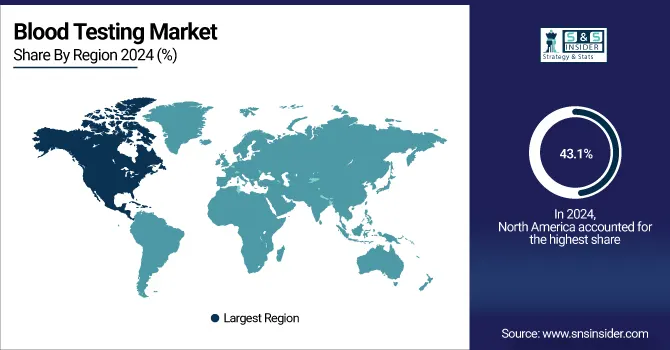

Blood Testing Market Regional Analysis:

North America Blood Testing Market Insights

In 2024, North America dominated the blood testing market with a share of more than 43.1%. Strategic initiatives from government entities and major market participants to promote plasma donations are expected to fuel growth in this region. Blood donation centers across the country are increasingly focusing on increasing plasma collection from people who have recovered from illnesses. This regional growth is being driven by new government initiatives, advancements in healthcare infrastructure, and various technological innovations. Several regulatory bodies, including the FDA as well as the Federal Trade Commission, play a huge role in regulating diagnostic tests. Implementation of Clinical Laboratory Improvement Amendments is expected to increase the use of testing services in the United States.

Need any Customization research on Blood Testing Market - Enquiry Now

Asia Pacific Blood Testing Market Insights

The Asia Pacific region will exhibit the highest CAGR during the forecast period, mainly due to a high chronic disease prevalence in countries like China and India. Besides, many multinational companies are heavily investing in this region. For instance, in October 2021, Siemens Healthineers announced its new facility for manufacturing in India dedicated to COVID-19 and molecular assays. A facility in Gujarat will create antigen and antibody (serology) tests, as well as RT-PCR tests for COVID-19.

Europe Blood Testing Market Insights

Europe’s blood testing market is advancing rapidly, driven by the growing burden of chronic diseases, rising aging population, and emphasis on early diagnostics. Strong healthcare infrastructure, supportive reimbursement policies, and adoption of advanced technologies like molecular diagnostics and liquid biopsies strengthen the market. Additionally, regulatory focus on quality standards supports innovation and patient safety.

Latin America (LATAM) and Middle East & Africa (MEA) Blood Testing Market Insights

The blood testing market in LATAM and MEA is expanding, fueled by rising healthcare awareness, urbanization, and increased prevalence of diabetes and cardiovascular diseases. However, limited infrastructure and affordability challenges persist. Governments are investing in healthcare modernization, while private players introduce cost-effective diagnostic solutions, gradually improving access and market growth.

Blood Testing Market Key Players:

-

Danaher Corporation (DxH 520 Hematology Analyzer)

-

Trinity Biotech Plc (Uni-Gold HIV Test, Hemoglobin A1c Testing Systems)

-

Roche Diagnostics (Cobas 8000 Analyzer)

-

bioMerieux SA (VITEK 2)

-

Quest Diagnostics (Quest Diabetes Panel)

-

Abbott (Abbott Alinity, FreeStyle Libre)

-

F. Hoffmann-La Roche AG (Elecsys)

-

Bio-Rad Laboratories, Inc. (BioPlex 2200)

-

Biomerica, Inc. (Hemoglobin A1c Test, Rapid Test Kits)

-

Becton, Dickinson and Company (BD Vacutainer, BD FACS)

-

Siemens Healthineers (Atellica, ADVIA)

-

Thermo Fisher Scientific (Orion Star A Series, Cell & Gene Therapy Kits)

-

Ortho Clinical Diagnostics

-

DiaSorin S.p.A.

-

Sysmex Corporation

-

Hologic, Inc.

-

PerkinElmer, Inc.

-

Grifols, S.A.

-

Werfen (Instrumentation Laboratory)

-

Mindray Medical International Limited

Competitive Landscape for Blood Testing Market:

Becton, Dickinson and Company (BD) is a global leader in medical technology, offering innovative blood testing solutions for diagnostics and disease monitoring. Its portfolio includes advanced hematology systems, molecular diagnostic tools, and consumables that ensure accuracy and efficiency. BD’s commitment to innovation supports early detection, chronic disease management, and improved patient care worldwide.

In April 2024, BD (Becton, Dickinson, and Company) launched its BD Vacutainer UltraTouch Push Button Blood Collection Set in India. This innovative collection set features BD RightGauge technology, enabling the use of a finer needle for blood collection, along with BD's proprietary PentaPoint Technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 97.90 Billion |

| Market Size by 2032 | USD 169.15 Billion |

| CAGR | CAGR of 7.08% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test Type (Glucose Testing, A1C Testing, Direct LDL Testing, Lipid Panel Testing, Prostate-specific Antigen Testing, COVID-19 Testing, BUN Testing, Vitamin D Testing, Thyroid-stimulating Hormone (TSH), Serum Nicotine/Cotinine, High-sensitivity CRP Testing, Testosterone Testing, ALT Testing, Cortisol Testing, Creatinine Testing, AST Testing, Other Blood Tests) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Danaher Corporation, Trinity Biotech Plc, Roche Diagnostics, bioMerieux SA, Quest Diagnostics, Abbott, Hoffmann-La Roche AG, Bio-Rad Laboratories, Inc., Biomerica, Inc., Becton, Dickinson and Company, Siemens Healthineers, Thermo Fisher Scientific, and Others |