Herbicides Market Report Scope & Overview:

The Herbicides Market Size was valued at USD 37.73 Billion in 2023 and is expected to reach USD 63.24 Billion by 2032, growing at a CAGR of 5.92% over the forecast period of 2024-2032.

To Get more information on Herbicides Market - Request Free Sample Report

The herbicides market is subject to ongoing changes, driven by factors such as evolving agricultural practices, sustainability concerns, and regulations. Demand for synthetic and bio-herbicides is expected to increase as the global food demand increases and herbicidal resistance becomes widespread. Price trend analysis of major herbicides is influenced by raw material prices and changes in the supply chain. Industries, being one of the main polluters of our planet, are governed with stricter regulations to curb their effects and the need for bio-based alternatives has also come into being. Government funding programs bolstering herbicide research stimulate innovation and enable the development of safer, more efficient formulations. The herbicide sector also has an economic footprint in terms of jobs, trade, and rural development. Detailed insights in all these facets of herbicides market are featured in our exclusive report available at a discount.

Herbicides Market Dynamics

Drivers

-

Rising Adoption of Integrated Weed Management Strategies Enhances the Growth of the Herbicide Market

The growing demand for integrated weed management (IWM) solutions in modern agriculture is driving herbicides market growth. Farmers are progressively integrating chemical, biological, and cultural methods of controlling weed growth that protect against resistance development. Herbicides are the most significant component of IWM due to their ease of use, broad-spectrum control, and higher crop yields and farm productivity. Transition to no-till and conservation agricultural practices naturally leads to heavier reliance on herbicide use for chemical weed management ultimately increasing overall herbicide use. The development of these new herbicide products aims to help improve crop yields, while technologies such as smart services are employed to support farmers as well as identifies harmful weeds to reduce crop damage. The growing concern regarding weed resistance problems has bolstered the demand for herbicide rotation and diverse active ingredients, which consequently fortifies market growth. Global food demand is increasing as the amount of on-farm arable land is limited, enabling the role of herbicides ranges from sustainable to precision agriculture, and as a result, the market is likely to escalate.

Restraints

-

Growing Health and Environmental Concerns Over Chemical Herbicide Residues Restrict Market Growth

Increasing health and environmental risk associated with chemical herbicide residues is a major factor hindering the growth of the herbicide market. Synthetic herbicides, in general, utilize active ingredients that can survive in soil, water, and even food crops, raising the risk of human health problems. Long-term exposure to certain herbicides has been associated with respiratory problems, endocrine disruption and carcinogenic risks, leading to tighter regulation across the world. Governments and regulatory agencies such as the Environmental Protection Agency (EPA) and the European Food Safety Authority (EFSA) have restricted the use of some herbicides, due to their health hazards, such as glyphosate and paraquat. Moreover, consumer awareness and demand for organic and chemical-free food products are compelling farmers to switch toward alternative weed management solutions. This is leading to the gradual inroad of increased regulatory scrutiny and changing consumer preferences that will be a headwind to the ongoing growth of the herbicide market.

Opportunities

-

Growing Investments in Sustainable and Organic Farming Open New Avenues for Bio-Herbicide Adoption

Increasing focus on sustainable and organic farming practices is driving strong demand for bio-herbicides, creating lucrative opportunities in the global bio-herbicides market. An increasingly important way in which governments and agricultural organizations are supporting eco-friendly weed control solutions is through funding programs, grants for research and subsidies. The growing demand for organic food products and sustainable agriculture are driving farmers to shift from synthetic herbicides to biological and plant-derived substitutes. Thus, there is a push around the world towards startups and biotech firms to develop new bio-herbicides based on microbes and enzymes. Moreover, the market for organic certification is becoming a priority for retail chains and food manufacturers, thus pushing the demand for residue-free herbicide solutions. Such a transition creates a lucrative opportunity for players in the market to enhance their bio-herbicides portfolio, to cater to the changing dynamics of modern agriculture.

Challenge

-

Volatility in Raw Material Prices and Supply Chain Disruptions Impact Herbicide Production and Profitability

The herbicide market is going through the heat of supply chain distress and raw material prices volatility. Price volatility can also be seen in key herbicide ingredients, including active compounds and chemical solvents, primarily due to geopolitical conflicts and trade restrictions, which increase firm production costs, as well as fluctuating oil prices. Moreover, supply disruptions, including transportation bottlenecks and labor shortages, have affected the supply of essential raw materials, resulting in higher production costs. The ongoing worldwide energy crisis and environmental regulations have likewise impacted the chemical making industry and constrained herbicide production. To hedge against these issues and maintain more cost-effective reserve consolidation, they need to source in an economical way and use alternative materials.

Herbicides Market Segmental Analysis

By Type

The Synthetic Herbicides dominated the herbicide market and accounted over 85.2% market share in 2023. Among synthetic herbicides, glyphosate holds a significant share in terms of value in the herbicide market. Synthetic herbicides dominate the market as they are highly effective on a wide range of weeds, relatively inexpensive, and widely used in large-scale agriculture. Glyphosate is still the most widely used herbicide worldwide, due to its efficacy in controlling weeds in genetically modified (GM) crops such as corn, soybeans, and cotton. The U.S. Environmental Protection Agency (EPA) and several agricultural organizations recognize its importance for enhancing crop yield and minimizing labor costs in weed management. Glyphosate is commonly used and has raised concerns about the environmental impact and risks for health, but major agricultural economies like the United States, Brazil or India are likely to continue to use it massively without alternatives that are as cost-effective or efficient.

By Mode of Action

In 2023, Selective Herbicides accounted for the majority of the total herbicides market with a market share of around 65.3%. Selective herbicides are widely favored than non-selective herbicides as they target specific weeds without harming crops. These herbicides are widely used in row crops like cereals, grains and oilseeds. The Incremental Demand for Selective Herbicides The growing adoption of herbicide-tolerant crop varieties, mainly in North and South America, has further pushed the demand for selective herbicides. The Food and Agriculture Organization (FAO) has indicated that herbicide usage in the production of staple crops worldwide has been increasing steadily, and that the discovery of selective herbicides has played an important role in agricultural productivity. In addition, government subsidies and regulatory approvals of newer, more environmentally friendly selective herbicides have also helped perpetuate their use.

By Crop Type

In 2023, Cereals & Grains dominated the Herbicides market with the largest share of approximately 42.5%. This subsegment led the market as it is one of the most widely cultivated crops in the world due to which profits through higher yields are achieved due to the need for regular weed management for grains such as wheat, rice, and corn in bulk amounts. Within nations, even among those that are the largest producers of cereals globally such as China, India, and the U.S. increased use of herbicides has been reported as a strategy to remedy popular weed resistance concerns and enhance food security. The U.S. Department of Agriculture (USDA) and the Indian Ministry of Agriculture's reports state that rising population pressures and the need for greater agricultural output has increased the demand for herbicides across the globe. Herbicides are central to maintaining crop productivity for farmers, especially in no-till farming systems, where herbicide applications replace mechanical tillage.

By Formulation

In 2023, Liquid Herbicides captured a majority share of the herbicide market with an approximate market share of 72.4%. Liquid herbicides are preferred because they are easier to apply, absorbed better, and are more effective in weed control. Because they are leaves and can be sprayed for foliar applications, they are the choice of large-scale adjustments. Moreover, the rising implementations of precision agriculture techniques including automated spraying systems and drones will continue to fuel the demand for liquid herbicides. According to the reports of the European Crop Protection Association (ECPA) and the Food and Agriculture Organization, such herbicides are more compatible with contemporary agricultural implements and require simpler and less laborious applications compared to granular herbicides. This segment continues to gain traction and this growth is due in large part to the rapid adoption of liquid formulations globally, especially in developed agricultural economies.

By Application

In 2023, Foliar Spray dominated the Herbicides market and accounted for the highest share at over 48.2%. Foliar spray treatment is the most widely used, effective, and common method of applying herbicide, providing preference for immediate contact with weeds and a rapid absorption. This approach has been extensively employed in various crop types, such as cereals, oilseeds, and fruits. Foliar spray applications have been further amplified by the growing adoption of precision spraying technologies (e.g. drones and automated sprayers). Experts in Brazil such as the Brazilian Agricultural Research Corporation (Embrapa) and government agricultural agencies have also highlighted the benefits of foliar spray herbicides in preventing herbicide more efficiently according to dosages and minimising environmental impact. Moreover, with the increasing concerns over herbicide resistance, the foliar sprays are often combined with some innovative formulations and adjuvants to further enhance the effectiveness of existing ones, thereby assuring their market dominance.

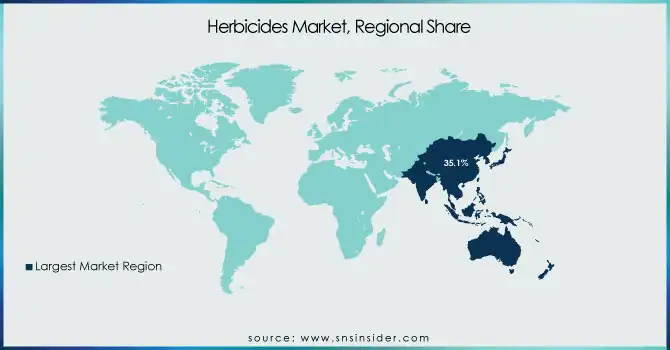

Herbicides Market Regional Outlook

In 2023, Asia Pacific dominated and held a share of around 35.1% in the herbicide market. It is fueled by the region’s rapid growth of agriculture business, demand for high-yield crops and wide-ranging use of herbicides that target weed resistance. Countries like China, India and Indonesia make major contributions to the consumption of herbicides, the most significant user of which is also China, with its enormous farmlands and reliance on herbicides for growing rice, wheat, and corn. Its consumption of herbicides has surged by more than 6% a year to maintain crop output as labor gets scarcer, according to the National Bureau of Statistics of China. The Sub-Mission on Agricultural Mechanization (SMAM) and growing adoption of herbicide-tolerant crops have also contributed to increased herbicide sales in India. According to the Indian Council of Agricultural Research (ICAR), the use of herbicides in the country has increased significantly owing to a shortage of labour and the cost benefits of using them compared to manual weeding. Southeast Asian nations, including Thailand and Vietnam, have also witnessed growing herbicide use in commercial agriculture, especially for palm oil and sugarcane plantations. The rising inclination for synthetic herbicide, particularly glyphosate and 2,4-D, as well as increasing investments in bio-herbicides, has further bolstered the Asia Pacific region's dominance in the global herbicide industry.

Moreover, North America emerged as the fastest growing region during the forecasted period, with a significant CAGR in the forecast period. The increase is largely driven by the proliferation of genetically modified (GM) crops, rising herbicide resistance, and further development of precision agriculture. The United States commands the regional market, with the U.S. Department of Agriculture (USDA) having reported that nearly 90% of corn and soybean acreage is planted with herbicide-tolerant varieties. Increasing numbers of glyphosate resistant weeds present increased demand for those newer herbicides such as products based on dicamba and glufosinate. Wheat and Canola farming in Canada is supported by the Canadian Food Inspection Agency (CFIA) from the aspect of better herbicide use, enabling the markets with the growth of herbicide, thus, enhancing the growth of the market. On the other hand, increased agricultural exports in Mexico and the incorporation of agrochemical technologies have resulted in higher demand for herbicides, especially for fruit and vegetable crops. The introduction of such advanced herbicide formulations have been made possible due to government regulations like the Environmental Protection Agency (EPA) approvals in the US, and investments in bio-herbicide research which too spur the market growth of North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Bayer AG (Roundup, DiFlexx, Alion)

-

BASF SE (Sharpen, Zidua, Arsenal)

-

Syngenta Group (Gramoxone, Callisto, Acuron)

-

Corteva Agriscience (Resicore, Durango, Embed)

-

FMC Corporation (Command, Authority, Spartan)

-

UPL Limited (Interline, Lifeline, Sinaloa)

-

Nufarm Limited (WeedMaster, Credit Xtreme, Panther)

-

Sumitomo Chemical Co., Ltd. (Valent Fierce, Pyroxasulfone, Panther Pro)

-

ADAMA Agricultural Solutions Ltd. (Agil, Brevis, Trivor)

-

Nissan Chemical Corporation (Pyrazolate, Pyrazosulfuron-ethyl, Benthiocarb)

-

PI Industries (Nominee Gold, Osheen, Londax Power)

-

Jiangsu Yangnong Chemical Co., Ltd. (Butachlor, Bensulfuron-methyl, Oxadiazon)

-

Wilbur-Ellis Holdings, Inc. (AgriDex, Interline, Parazone)

-

Amvac Chemical Corporation (Impact, Scepter, Clarity)

-

ICL Group Ltd. (Basagran, Goal)

-

Drexel Chemical (Atrazine, Acclaim Extra, Karmex)

-

Kenvos Biotech Co., Ltd. (Glufosinate, Quizalofop, Clodinafop)

-

Shandong Tianfeng Biotechnology Co., Ltd. (Imazapic, Metsulfuron-methyl, Fomesafen)

-

DuPont de Nemours, Inc. (Accent, Cinch, Canopy)

-

Israel Chemicals Ltd. (Goal, Basagran)

Recent Highlights

-

October 2024: FMC launched Ambriva Herbicide, a potent herbicide solution specifically designed to help wheat farmers in India control the prevalent Phalaris minor weed that is damaging wheat crop yields. The new herbicide employed innovative formulation technology to improve the efficiency and effectiveness of weed control while reducing the impact on the environment and contributing to sustainable agricultural systems.

-

May 2023: BASF launched Facet and Duvelon herbicides to help rice and tea farmers to control weeds. These products were also designed to improve crop protection, enabling farmers to achieve higher yields while minimizing sustainability impacts.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 37.73 Billion |

| Market Size by 2032 | USD 63.24 Billion |

| CAGR | CAGR of 5.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Synthetic Herbicides [Glyphosate, Atrazine, 2,4-Dichlorophenoxyacetic Acid (2,4-D), Acetochlor, Paraquat, Others], Bio-Herbicides [Microbial-Based, Essential Oil-Based, Others]) •By Mode of Action (Selective Herbicides, Non-Selective Herbicides) •By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Turf & Ornamentals, Others) •By Formulation (Liquid, Granular, Others) •By Application (Foliar Spray, Soil Treatment, Seed Treatment, Post-Harvest Application, Aquatic Herbicide Application, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bayer AG, BASF SE, Syngenta Group, Corteva Agriscience, FMC Corporation, UPL Limited, Nufarm Limited, Sumitomo Chemical Co., Ltd., ADAMA Agricultural Solutions Ltd., Nissan Chemical Corporation and other key players |