Bio Solvents Market Report Scope & Overview:

Get More Information on Bio Solvents Market - Request Sample Report

The Bio Solvents Market Size was valued at USD 4.0 Billion in 2023. It is expected to grow to USD 5.7 Billion by 2032 and grow at a CAGR of 4.01% over the forecast period of 2024-2032.

The global bio-solvents market is primarily driven by the increasing environmental concerns and the stringent government regulations. This is because of their environmentally-friendly nature where their ability to derive from natural feedstock such as vegetables has been beneficial in their increased productivity. Furthermore, the increasing demand for bio-solvents is from the key end-use industries such as paints and coatings, adhesives, and pharmaceutical industries, which is increasing their growth.

In 2023, the European Commission reported that bio-based solvents accounted for approximately 15% of the total solvents market in the EU, driven by stringent regulations under the EU Green Deal and the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation, which encourage the use of eco-friendly alternatives to reduce environmental impact.

Advancements in technology and an increase in R&D activities have carried the development of high-quality performance bio-solvents, hence their demands. For instance, there are strict regulations by the U.S. government and the European Union requiring biomaterials in the manufacturing of the products.

The regulations play a significant role in explaining the shape of the global bio-solvents market as they have made it a requirement for chemical manufacturers and related industries to employ the use of bio-based products. For example, the Farm Security and Rural Investment Act of the Public Law 107-171 in the U.S. and the Registration, Evaluation, Authorization, and Restriction of Chemicals by the European Union is a response to the risks associated with the use of synthetic solvents.

In 2023, Evonik introduced VESTASOL IP, a bio-solvent for coatings and paints, which aligns with the European Union’s Green Deal regulations for reducing volatile organic compounds (VOCs).

Synthetic solvents can irritate the skin, eyes, and nose, and their use releases volatile organic compounds that are harmful to the environment. The health impact of such synthetic solvents ranges from dizziness, headache, and unconsciousness if inhaled. Major restrictions from the leading authorities in most countries, especially in Europe and North America will as well fuel the bio-solvents market as they are meant to limit the use of these toxic solvents. For example, it is reported that the EPA and the DEFRA have imposed restrictions on the toxicity content of the solvents.

Bio Solvents Market Dynamics

Drivers

-

Consumer Preference for Eco-Friendly Products.

-

Low volatile organic compounds drive market growth.

Bio solvents are highly favored in the industries on account of their low volatile Organic compounds emanation. VOCs are the core aspects of air pollution as well as the formation of smog, posing adverse health effects, including the respiratory system and long-term exposure-related illnesses. Unlike the petrochemical traditional solvents that emit a lot of VOCs, bio-solvents are derived from nature and have the least impact on the environment. This form of the solvent, therefore, is highly viable for use in paints and coatings, cleaners as well and personal care products which are environmentally sensitive and rely on minimal air pollution. Governments across the globe impose stringent regulations to limit VOCs. Therefore, all industries are required to adopt bio-solvents as their core constituent.

This form of the solvent complies with the regulation and the tendency of investing in a sustainable alternative secures the green aspect. The European Environment Agency (EEA) noted that bio-solvents, which typically emit 60-90% fewer VOCs compared to petrochemical solvents, have played a crucial role in reducing urban air pollution across the EU in alignment with the Clean Air for Europe (CAFE) Directive.

Restraint

-

Inconsistent quality and supply hampers market growth.

The key factor that restricts the expansion of the bio-solvents market is the inconsistency in their quality and supply. As raw materials undergo many changes when grown, such as vegetable oils and other natural feedstocks, it is hard to predict and ensure the uniform quality of the final product. Their quality may change from yield to yield, making them hard to rely on in industrial applications. As a result, potential manufacturers are hesitant about using bio-solvents instead of traditional ones for their needs, such as in paints, coatings, or adhesives, which require the same properties throughout the final product’s lifespan. In addition, the supply can be disrupted due to many factors, such as the failure of a provider to deliver a specific amount, variability in agriculture yields due to seasonality, and fierce competition with other potential users, limiting the product’s availability at best. Potential manufacturers would stop using bio-solvents, as they are unable to ensure that consistent supplies are used for the manufacturing process. As a result, they would stick to traditional solvents with predictable supply chains, thus inhibiting the bio-solvents market’s growth.

Opportunity

-

Technological Advancements in Production Processes

-

Rising Regulations Against Hazardous Chemicals

Bio Solvents Market Segmentation Overview

By Product

The bio-alcohol product segment dominated the market and accounted for a share of 47% in 2023. Bio-alcohols are widely adopted by industries such as pharmaceuticals, food, and beverages, where bioethanol and biobutanol serve as greener alternatives to petrochemical solvents. Enhanced performance and lower operating costs of bioethanol and biobutanol fuel their high usage. Their sustainable availability is crucial, with the increasing demand for eco-friendly products. The repelling properties offered enable their adoption by various industries. Moreover, supportive government regulations promoting industries to use renewable resources have contributed to their adoption. Industries are focused on reducing their carbon footprints and minimizing the environmental impacts, which is expected to fuel their execution ability, further boosting the bio-alcohol segment growth.

The D-Limonene segment is anticipated to grow at the fastest CAGR of 4.8% from 2024 to 2032. D-Limonene, derived from citrus fruits, is valued for biodegradability, non-toxicity, and pleasant aroma, which is consumed in a variety of cleaning products, adhesives, and coatings. It owes this application growth to the ongoing shift toward eco-friendly and safe alternatives for industrial and consumer products fostered by the growing awareness regarding health and environmental safety. Such a trend is projected to be enhanced by advancements in extraction technologies, which may improve its competitive advantage.

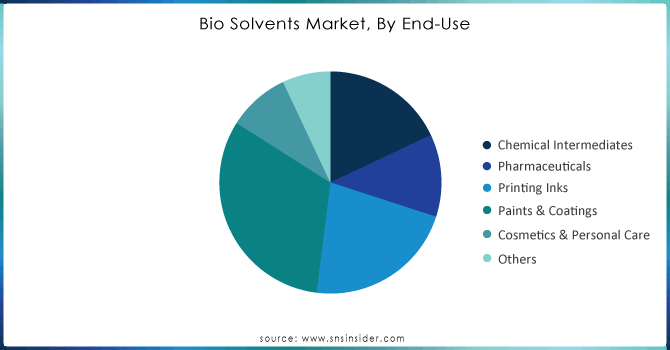

By End-Use

The paint & coatings held the largest market share around 32% in 2023. This is due to the increasing demand for environmentally friendly and sustainable solutions within the coatings industry. The expanding landscape of chemical manufacturers is therefore anticipated to boost the significant growth and thus the segment’s dominance in the forthcoming years. Moreover, with the growing demand for green products by end-consumers alongside strict VOC regulations and an increasing number of manufacturers adopting bio-solvents, the segment will dominate the market share through the forecast period. In addition, the dominance of the segment is attributed to the emergence of bio-solvent formulations.

The latter have expedited their use in an extensive range of coating materials such as waterborne and high-solids systems and have not only boosted their performance but also reduced the environmental impact of these coatings. Therefore, bio solvents are nowadays mainly used in both industrial and decorative applications as the increasing construction and automotive industries also focus on sustainable practices

Need any customization research on Bio Solvents Market - Enquiry Now

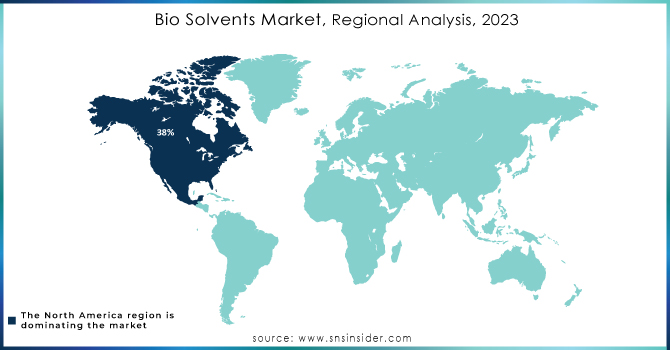

Bio Solvents Market Regional Analysis

North America held the largest market share around 38% in 2023. High demand for ecologically friendly substitutes for traditional petroleum-based solvent cleaners drives the North America bio solvents market. Moreover, with such industry leaders as Cargill Incorporated and Stepan Company operating in the region, North America becomes a core for bio solvents development and commercialization. The U.S. held the largest share of the market in 2023 due to environmental regulations, increased consumer awareness of eco-friendly and healthful products, technological advances, government support, increasing application areas, and global sustainability initiatives. Canada bio solvents market is projected to expand significantly from 2024 to 2032, with the demand being fuelled by the active promotion of renewable resource adoption that sustains and increases demand for bio solvents. Moreover, research and development efforts are increasing, which makes the bio solvents more cost- and performance-effective, making them the perfect alternative to traditional solvents.

Key Players in Bio Solvents Market

-

BASF SE (Sovermol, Lutropur)

-

Dow Inc. (Bio-Prima, Dowanol PnB)

-

Archer Daniels Midland Company (ADM BioSolutions)

-

Cargill, Incorporated (Envirotemp FR3, NatureWax)

-

Corbion N.V. (PURASOLV, PURALACT)

-

AkzoNobel N.V. (Berol, Dissolvine)

-

LyondellBasell Industries Holdings B.V. (Tetrahydrofuran, Bio-based PG)

-

Evonik Industries AG (VESTASOL IP, Rewoferm)

-

Solvay S.A. (Rhodiasolv IRIS, Augeo SL 191)

-

Eastman Chemical Company (BioSustane, Eastman Omnia)

-

Gevo, Inc. (Isobutanol, Ethanol)

-

Stepan Company (STEPOSOL MET-10U, STEPOSOL C-42)

-

GFBiochemicals Ltd. (Levoglucosenone, Gamma-Valerolactone)

-

Myriant Corporation (Bio-based Succinic Acid)

-

Flotek Industries, Inc. (Complex Nano-Fluid, Bio-based Citrus Solvents)

-

Vertec BioSolvents Inc. (VertecBio ELSOL)

-

Azelis SA (ECO-Bio Solvent, GreenBios)

-

Ashland Global Holdings Inc. (Envirez, Greenchem)

-

SEPPIC S.A. (Sepisol, Simulsol)

-

Sasol Limited (Lactosolv, Alkylate Bio-Solvents)

Recent Development:

-

In 2023, BASF expanded its portfolio of sustainable solvents by launching Sovermol 830, a bio-based, non-toxic solvent targeting the coatings industry, enhancing performance while reducing environmental impact.

-

In 2023, Cargill introduced its next-generation bio-based dielectric fluid, Envirotemp FR3, which supports sustainability initiatives and reduces the dependency on petroleum-based solvents.

-

In 2023, Dow introduced Bio-Prima, a new line of bio-based solvents derived from renewable sources. This product line focuses on reducing carbon emissions in industrial applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.0 Billion |

| Market Size by 2032 | US$ 5.7 Billion |

| CAGR | CAGR of 4.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Bio-alcohols, Glycerol Derivatives, D-Limonene, Lactate Esters, 2-Methyltetrahydrofuran, and Others), • By End-Use (Chemical Intermediates, Pharmaceuticals, Printing Inks, Paints & Coatings, Cosmetics & Personal Care, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE Dow Inc. Archer Daniels Midland Company Cargill, Incorporated Corbion N.V. AkzoNobel N.V. LyondellBasell Industries Holdings B.V. Evonik Industries AG Solvay S.A. Eastman Chemical Company Gevo, Inc. Stepan Company GFBiochemicals Ltd. Myriant Corporation Flotek Industries, Inc. Vertec BioSolvents Inc. Azelis SA Ashland Global Holdings Inc. SEPPIC S.A. Sasol Limited and Others |

| Key Drivers | •Consumer Preference for Eco-Friendly Products. • Low volatile organic compounds drive market growth. |

| RESTRAINTS | •Inconsistent quality and supply hampers market growth. |