Heterogeneous Catalyst Market Key Insights:

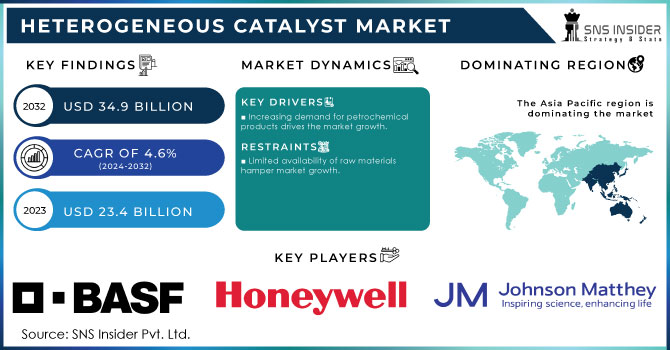

The Heterogeneous Catalyst Market size was valued at USD 23.4 Billion in 2023. It is expected to grow to USD 34.9 Billion by 2032 and grow at a CAGR of 4.6% over the forecast period of 2024-2032.

Get More Information on Heterogeneous Catalyst Market - Request Sample Report

Catalyst recovery and recycling are increasingly implemented in the heterogeneous catalyst market as industries are becoming focused on sustainability and resource appropriateness. Recovery capabilities have advanced, allowing catalyst extraction and recycling after their initial use. The advantage is in the reduction of waste accumulation and a lower carbon footprint resulting from catalyst disposal. Solvent extraction, adsorption, and hydrothermal treatment among other developed technologies aid in the recycling of catalysts, allowing businesses to recycle precious metal-based and other catalysts, which lower the overall operational costs.

According to the U.S. Environmental Protection Agency, industrial recycling and recovery programs may reduce the environmental footprint of industrial processes by up to 30% in terms of waste and resources. Aside from inducing a circular economy, the trend also enhances the economic feasibility of catalytic processes, identifying as a common choice for industries required to fulfill regulatory requirements and maximize sustainability.

Biocatalysts and biomimetic catalysis are rapidly gaining traction in the heterogeneous catalyst market as industries seek more efficient and environmentally friendly alternatives to traditional chemical processes. Biocatalysts, derived from natural enzymes, are highly specific and efficient in facilitating chemical reactions under mild conditions, which can significantly reduce energy consumption and minimize byproduct formation. Their ability to catalyze complex reactions with high selectivity makes them invaluable in various applications, including pharmaceuticals, food production, and biofuels.

According to the U.S. Department of Energy (DOE), biocatalysis can reduce the environmental impact of chemical processes by decreasing energy consumption by up to 90% compared to traditional chemical reactions. This statistic underscores the potential of biocatalysts and biomimetic catalysis to enhance efficiency and sustainability in various industries, aligning with the growing emphasis on greener manufacturing practices.

Market Dynamics

Drivers

Increasing demand for petrochemical products drives the market growth.

The demand for petrochemical products has been increasing and the production of the latter requires efficient catalytic processes as these chemicals are the basis of many other industries. The American Petroleum Institute projects that by 2025 the U.S. production of petrochemicals will reach 120 billion pounds, which constitutes an average yearly growth of 3% and is presumably also the increase in the upcoming year.

Similarly, as the fuel industry tries to switch to cleaner and more efficient fuels, for example, the hydroforming process, the demand for heterogeneous catalysts grows. These agents reduce the unsaturated hydrocarbon in the feed to gasoline and diesel fuels, thus making the latter high-value and environmentally friendly. In this way, the demand in the petrochemical sector is growing as it finds a way to expand production as a byproduct accompanies it.

Restraint

-

Limited availability of raw materials hamper market growth.

One of the key constraints facing the Heterogeneous Catalyst Market is the limited availability of raw materials, especially critical components as precious metals for the production of catalysts as they are a precious aspect of the materials, which are vastly employed owing to their extraordinary catalytic properties. However, these precious materials delivery’s costs are high, and prices fluctuate, as the extraction of these materials is centralized in a limited number of regions, maintaining its supply at risk of being limited as a result of certain geopolitical factors or taking part in high price volatility. For instance, the U.S. Geological Survey claims that more than 80% of all platinum is extracted in South Africa and can be further impacted by mining problems or the introduction of certain regulations to change production.

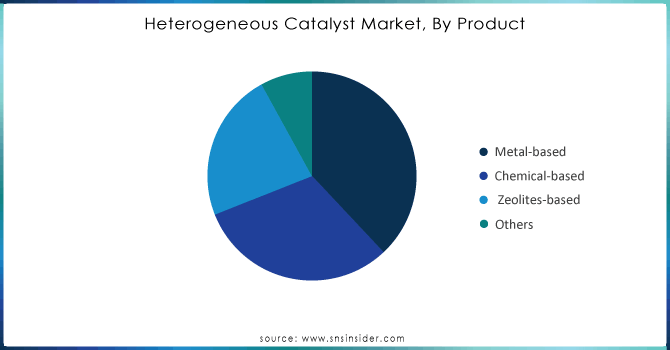

Market Segmentation Analysis

By Product

Metal-based products held the largest market share around 43% in 2023. It is because these among others including platinum, palladium, and rhodium are frequently employed in processes such as petroleum refining, petrochemicals, and automotive manufacturing. In the petrochemical industry, these products assist with catalytic percussion and hydrotreating, which are both critical to the oil industry’s ability to manufacture fuels, along with the related goods. Moreover, the use of metal-based substances is integral to the operation of catalytic converters, which assists in limiting vehicle emissions and safeguarding the environment.

Chemical-based products, such as acids, bases, and complex organic compounds, are extensively used across various sectors. In particular, high demand for these chemicals is recorded in pharmaceutical, polymers, and specialty chemical manufacturing. The main benefit of utilizing chemical-based products is that the reaction conditions can be adjusted to precise requirements, which is especially important for the pharmaceutical industry.

Need Any Customization Research On Heterogeneous Catalyst Market - Inquiry Now

By Application

The environmental application segment held the largest market share around 35% in 2023. The role of the catalysts in environmental applications is especially meaningful due to the vital role played by the heterogeneous catalysts in the processes designed to address pollution and reduce emissions. For instance, catalytic converters installed in vehicles use metal-based catalysts, such as platinum and rhodium, to promote the conversion of harmful gases, such as carbon monoxide, nitrogen oxides, and volatile organic compounds, into less harmful emissions. These catalysts reduce air pollution, contributing to the improvement of overall air quality and making transportation more sustainable.

In the petroleum refining industry, heterogeneous catalysts are applied to the production of fuels, such as gasoline, diesel, and jet fuel, from crude oil. Catalytic processes, such as cracking, hydrotreating, or hydrocracking, rely on these heterogeneous catalysts to break down large and complex hydrocarbon molecules, eliminate the presence of impurities, and improve the quality of the final product. Metal-based catalysts, such as platinum or palladium, are used in the refinery processes to increase the reaction rate and the products’ selectivity, thus increasing the yield of these practical products and meeting their specifications.

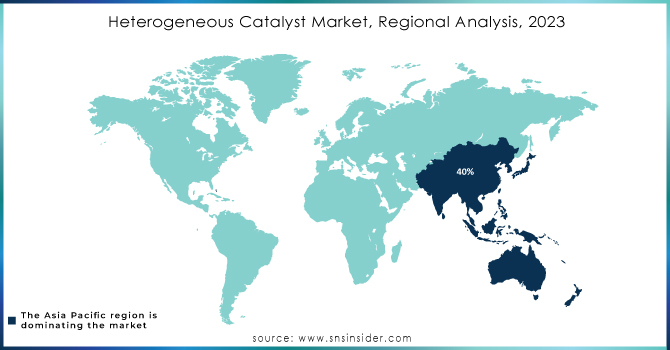

Regional Analysis

The Asia Pacific region held the highest market share around 40% in 2023. It is due to several factors, including rapid industrialization, increased demand for petrochemical products, and a strong focus on sustainable energy solutions. Countries like China and India are driving significant growth in the petrochemical and refining industries, where heterogeneous catalysts play a crucial role in optimizing production processes and enhancing yields. Moreover, government initiatives aimed at reducing emissions and promoting cleaner technologies further bolster the adoption of heterogeneous catalysts in the region. For instance, according to the Asian Development Bank (ADB), the chemical industry in Asia is expected to grow at an annual rate of 5.5% through 2025, with a substantial portion attributed to advancements in catalyst technologies. This growth is accompanied by investments in research and development to innovate and improve catalytic processes, thereby solidifying Asia Pacific's position as a leader in the heterogeneous catalyst market.

Key Players

-

BASF SE (NanoSelect, Palladium Catalysts)

-

Johnson Matthey (HyFlux, Pd EnCat)

-

Clariant AG (SynDane, ActiSorb)

-

Evonik Industries AG (Dynasylan, Aerojet)

-

Albemarle Corporation (KetjenFine, NEBULA Catalyst)

-

Honeywell International Inc. (UOP Oleflex, EnviNOx)

-

W. R. Grace & Co. (DuraForm, Davison)

-

Solvay S.A. (Cataflam, Alve-One)

-

Umicore (CeraLink, SPINEL)

-

Royal Dutch Shell PLC (Shell S-100, Shell M48)

-

Süd-Chemie AG (now part of Clariant) (Synetix, Puracel)

-

Arkema S.A. (Siliporite, Albone)

-

ExxonMobil Corporation (Mobil DT Catalyst, ZSM-5 Catalyst)

-

INEOS Group (Chlorsorb, Polydyne)

-

China Petroleum & Chemical Corporation (Sinopec) (FCC Catalyst, MTO Catalyst)

-

Almatis Inc. (Alphabond, Calcined Aluminas)

-

Axens (Atomer, DMDS Evolution E2)

-

Tosoh Corporation (Zeolum, HSZ Series)

-

LyondellBasell Industries (Catalloy, Metocene)

-

Haldor Topsoe (TK-200, TITAN)

Recent Developments:

-

In 2023, BASF introduced the OASE digilab, an advanced analytics tool designed to enhance process efficiency in natural gas and hydrogen processing using heterogeneous catalysts.

-

In 2023, Evonik introduced a new line of Aerojet catalysts, which improve catalytic efficiency in fuel cells, supporting the shift toward cleaner energy solutions.

-

In 2022, Johnson Matthey expanded its portfolio with a new range of EnCat catalysts focused on enabling greener and more efficient chemical processes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 23.4 Billion |

| Market Size by 2032 | US$ 34.9 Billion |

| CAGR | CAGR of4.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Metal-based, Chemical-based, Zeolites-based, Others) •By Application (Petroleum Refining, Chemical Synthesis, Polymer, Environmental), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Johnson Matthey, Clariant AG, Evonik Industries AG, Albemarle Corporation, Honeywell International Inc., W. R. Grace & Co., Solvay S.A., Umicore, Royal Dutch Shell PLC, Süd-Chemie AG, Arkema S.A., ExxonMobil Corporation, INEOS Group, China Petroleum & Chemical Corporation, Almatis Inc., Axens, Tosoh Corporation, LyondellBasell Industries, Haldor Topsoe, and Others |

| Key Drivers | •Increasing demand for petrochemical products drives the market growth. |

| RESTRAINTS | •Limited availability of raw materials hamper market growth. |