Biofuel Additives Market Report Scope & Overview:

Get E-PDF Sample Report on Biofuel Additives Market - Request Sample Report

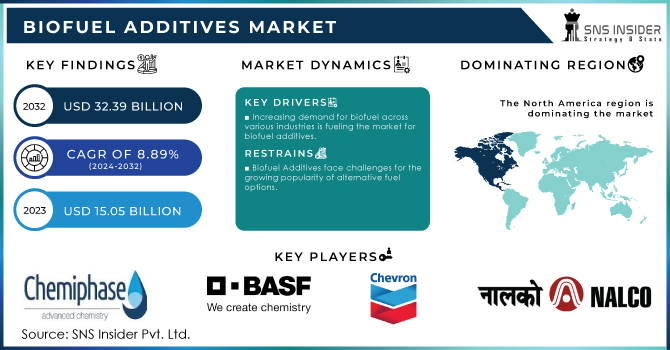

The Biofuel Additives Market Size was valued at USD 15.05 billion in 2023 and is expected to reach USD 32.39 billion by 2032 and grow at a CAGR of 8.89% over the forecast period 2024-2032.

The growth of the automotive sector, especially in developing nations like India, China, and Southeast Asian countries, is a major factor driving the biofuel additives market. These areas are going through fast industrialization and urban growth, resulting in a rise in vehicle ownership and manufacturing. As the quantity of cars on the streets increases, the need for eco-friendly and efficient fuels also rises. Authorities in these areas are enforcing strict emission rules to address air pollution and lessen carbon footprints. This leads to an increased need for biofuels, which are seen as more environmentally friendly options compared to conventional fossil fuels. Biofuel enhancers are essential for improving the effectiveness, durability, and emission characteristics of biofuels, ensuring they are compatible with contemporary engines. Therefore, the increasing automotive industry in these developing markets is directly fueling the growing need for biofuel additives, leading to market expansion.

For instance, in BASF SE launched a new series of biofuel additives aimed at improving fuel stability and performance. This action was a component of their overall plan to meet the increasing need for biofuels, which is being fueled by stricter environmental regulations around the world.

Moreover, governments around the world have implemented the usage and awareness of biofuels through supportive policies like mandates and tax breaks. These measures create a favorable environment for biofuel adoption, which in turn, propels the biofuel additives market forward. This confluence of factors technological advancements, surging demand for green energy, and supportive policy frameworks positions the biofuel additives market for significant growth as we navigate towards a more sustainable transportation future.

For example, according to the Environment Impact Assessment 2023 data, the U.S. produced around 1.7 million barrels per day of biofuels, including ethanol and biodiesel. This production level highlights the significant role of biofuels in the U.S. energy mix, which drives the demand for biofuel additives to ensure fuel quality and performance.

Furthermore, ongoing research and development in biofuel production and biofuel additive technology are driving market growth. The technology helps to make products more efficient and cost-effective.

Market Dynamics

Drivers

-

Increasing demand for biofuel across various industries is fueling the market for biofuel additives.

The growing demand for biofuel across various industries is significantly fueling the market for biofuel additives. As industries seek to reduce their carbon footprint and comply with stricter environmental regulations, biofuels have emerged as a key alternative to traditional fossil fuels. However, the use of biofuels presents challenges related to engine performance, storage stability, and emissions, which has led to an increased reliance on biofuel additives. These additives are essential in enhancing the efficiency and performance of biofuels by improving combustion, reducing emissions, and preventing fuel degradation. Industries such as transportation, power generation, and aviation are increasingly adopting biofuels, driving the need for advanced additives that can optimize fuel properties and ensure engine compatibility.

Restrain

-

Biofuel Additives face challenges for the growing popularity of alternative fuel options.

Changes in the price of raw materials greatly inhibit the expansion of the Biofuel Additives industry. Crude oil, a key ingredient for numerous plastics, can experience fluctuating prices because of geopolitical tensions, disruptions in the supply chain, and shifts in global demand. These fluctuations in prices may raise manufacturing expenses, posing challenges for manufacturers in keeping pricing and profitability stable. Consequently, growth in the market is limited, particularly in sectors such as automotive and electronics, which rely on cost-effectiveness to stay competitive. This fluctuation also affects extended agreements and financial strategy, posing additional obstacles to market stability.

Market Segmentation

By Product Type

The antioxidants type dominated the biofuel additives market and held a share of around 32.22% in 2023. It is driven by the global surge in biodiesel production. These additives act as shields against oxidative damage during storage and transportation, keeping biofuels stable and performing optimally. With biodiesel production projected to nearly triple by 2031, the demand for antioxidant additives is expected to follow suit. The biofuel additives market extends beyond antioxidants, encompassing a variety of products like corrosion inhibitors and detergents, all crucial for optimizing biofuel performance in this ever-evolving industry.

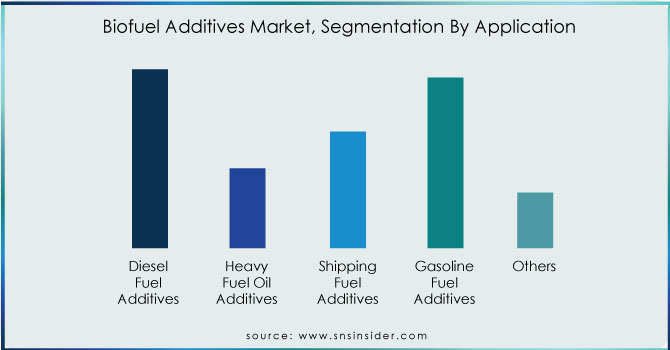

By Application

Diesel fuel additives held the highest market share around 37.82% in 2023. This dominance stems from its ability to address key challenges of diesel fuel. Biofuel additives act as stabilizers, taming the volatility of diesel over time and ensuring smooth engine performance. Additionally, they enhance lubrication, reducing wear and tear. Cetane boosters, a specific type of diesel fuel additive, improve fuel efficiency and accelerate engine ignition by increasing the cetane number. Diesel injector detergents play a crucial role in maintaining optimal engine performance by keeping injector nozzles clean and preventing starting issues. The rise in demand for diesel fuel, particularly biodiesel, due to stricter environmental regulations, further fuels the growth of this segment.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

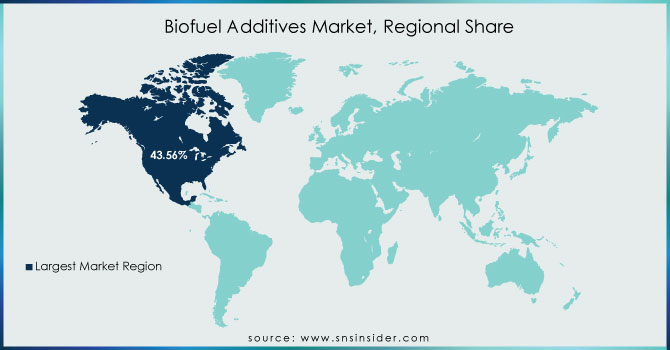

Regional Analysis

North America region held the largest market share around 43.56% in 2023. This is due to the high demand for automotive fuels, established players, and ongoing growth in general aviation. Despite rising electric vehicle sales, biofuel consumption remains significant, with diesel alone accounting for a substantial portion of US energy needs. The U.S. has been a pioneer in biofuel production, primarily driven by the Renewable Fuel Standard (RFS) program, which mandates the blending of renewable fuels with gasoline. The combination of robust biofuel production, supportive government policies, and a strong regulatory framework has positioned North America as the leading region in the biofuel additives market.

Asia Pacific is the fastest-growing region, fueled by booming vehicle populations in China, India, and Japan, and the increasing demand for petroleum products including biofuels. While government initiatives promoting electric vehicles may pose a future challenge, current demand for biofuel additives across various industries keeps the Asia Pacific market on a strong growth trajectory.

Key Players:

Chemiphase Ltd. (UK), BASF SE (Germany), Chevron Oronite Company LLC (US), Fuel Quality Services, Inc. (FQS) (US), Infineum (UK), Biofuel Systems Group Ltd. (UK), The Lubrizol Corporation (US), NALCO (India), Afton Chemical (US), Evonik Industries AG. (Germany), Clariant AG (Switzerland).

Recent Development:

-

In March 2024: Bunge and Chevron joined forces their joint venture, Bunge Chevron Ag Renewables LLC, received final approval to construct a new oilseed processing plant. The facility will be located on the Gulf Coast in Destrehan, Louisiana, adjacent to their existing processing plant.

-

In October 2023: Infineum breaks new ground with Infineum P6895A, the industry's first commercially available lubricant additive package designed to meet the demanding Stellantis test for SAE.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 15.05 Billion |

| Market Size by 2032 | US$ 32.39 Billion |

| CAGR | CAGR of 8.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Antioxidants, Detergents, Lubricity Improvers, Corrosion Inhibitors, Octane & Cetane Improvers, Cold Flow Improvers, Dyes & Markers, Others) • By Application (Diesel Fuel Additives, Heavy Fuel Oil Additives, Shipping Fuel Additives, Gasoline Fuel Additives, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Chemiphase Ltd. (UK), BASF SE (Germany), Chevron Oronite Company LLC (US), Fuel Quality Services, Inc. (FQS) (US), Infineum (UK), Biofuel Systems Group Ltd. (UK), The Lubrizol Corporation (US), NALCO (India), Afton Chemical (US), Evonik Industries AG. (Germany), Clariant AG (Switzerland). |

| Key Drivers | • Increasing use of biofuels in the transportation sector. • Rising need for clean and effective fuel. |

| RESTRAINTS | • Increasing number of electric vehicles produced. • The market's rising demand for electric automobiles |