High-Performance Fluoropolymers Market Report Scope & Overview:

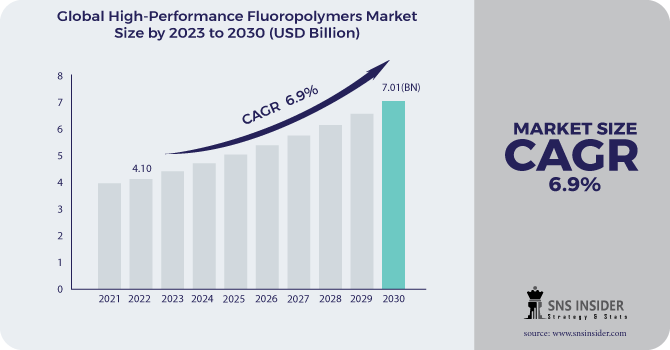

The High-Performance Fluoropolymers Market size was valued at USD 4.39 billion in 2023 and is expected to reach USD 8.14 billion by 2032 and grow at a CAGR of 7.10% over the forecast period 2024-2032.

Get More Iinformation on High-Performance Fluoropolymers Market - Request Sample Report

The high-performance fluoropolymers market report provides a detailed analysis of production capacity and utilization rates, highlighting key producers with PTFE leading the market. It examines feedstock price trends, focusing on fluorspar price fluctuations due to export restrictions and rising mining costs. The report also explores regulatory impacts, including compliance challenges related to PFAS restrictions. Sustainability metrics such as emission control, waste management, and PFAS-free innovations are analyzed, along with R&D advancements in bio-based fluoropolymers for EV batteries and semiconductors. Additionally, it covers digital adoption trends, emphasizing AI-driven material selection and regulatory compliance software.

High-Performance Fluoropolymers Market Dynamics

Drivers

-

Increasing demand for lightweight parts in the aviation & automobile sectors drives market growth.

The rising need for lightweight components particularly from the aviation and automobile sector which aims at improving fuel efficiency and reducing emissions is one of the prominent reasons for Elementor, and hence drives the market growth. HPFs remain a key enabler for achieving the next generation of lightweight high-strength and heat-resistant components for aircraft and vehicles, replacing traditional metal parts. The automotive industry is seeing a major ramp-up of electric vehicle (EV) manufacturing, utilizing fluoropolymer-based materials in battery components, wire insulation, and fuel systems for improved durability and thermal stabilization. Likewise, in aviation, these materials lead to reduced fuel consumption and better aerodynamics and fuel efficiency by making the aircraft lighter and more efficient. Moreover, the increasing adoption of lightweight, high-performance fluoropolymers in regulations related to emissions reduction with strict environmental regulations is poised to create the most lucrative opportunities for the fluoropolymer resin market over the forecast period.

Restraint

-

Higher cost of high-performance fluoropolymes which may hamper the market growth.

The higher price of high-performance fluoropolymers (HPFs) works as a major hindrance to the growth of this market as high-performance fluoropolymer materials are more expensive than conventional polymers, owing to their complex production process and high-cost fluoropolymer raw materials such as fluorspar. Cost is also an accessible factor, as HPFs come at a price due to advanced processing techniques, enhanced regulatory compliance, and the necessity for specialized manufacturing equipment, which limits HPF applicability to price-sensitive industries. Due to their excellent thermal, chemical, and mechanical properties; these materials are essential to sectors such as automotive, aerospace, and electronics; however, cost limitations often incentivize manufacturers to use cheaper alternatives or limit widespread adoption.

Opportunities

-

Rising Adoption in renewable energy applications creating an opportunity for the market.

High-performance fluoropolymers have been gaining traction in renewable energy applications, which is creating new sales potential for the market as well. The growing price of solar panels, wind turbines, and hydrogen gas cells calls for materials that can survive the elements while still performing at a generation level. Due to their unparalleled chemical resistance, UV stability, and thermal endurance, fluoropolymers find extensive application for solar photovoltaic (PV) backsheets, protective coatings for wind turbine blades, and membranes for hydrogen fuel cells. This use case is ideal for renewable energy infrastructure as it can improve efficiency, durability, and performance in extreme environments. The growing emphasis on clean energy solutions and directives toward achieving carbon neutrality in several nations across the globe is projected to augment the market growth of fluoropolymer-based energy storage, transmission, and power generation applications.

Challenges

-

Limited raw material availability major challenges for High-Performance Fluoropolymers market.

One of the key factors hampering the High-Performance Fluoropolymers (HPFs) market is the raw material availability as HPF production is based on a limited range of fluorspar, one of the critical minerals needed for its production. Supply chain disruptions and the consequent price volatility have been major issues plaguing the chemical sector which, in tandem with ongoing geopolitical tensions, export restrictions and mining swings, have reduced the overall production capacity of fluoropolymers. Strong fluorspar reserves are often accompanied by export control practices from countries that do hold the reserves, in prioritizing domestic industry over external supply during constrained market conditions. The associated extraction and refining costs further complicate matters and make pricing stability difficult to sustain among manufacturers. The growing demand for high-performance fibers in automotive, aerospace, semiconductors and renewable energy sector is a primary driver for these HPF suppliers to address high raw material supply risks at competitive prices for players in the market. In response, companies are investigating different sourcing solutions, recycling technologies and sustainable production methods for fluoropolymers.

High-Performance Fluoropolymers Market Segmentation Analysis

By Type

ETFE held the largest market share around 36% in 2023. It is owing to their excellent chemical resistance, high tensile strength, and superior weatherability compared to other high-performance fluoropolymers (HPFs). Used in many commercial applications, from buildings to light structural design in aerospace and automotive industries, ETFE has low density, self-cleansing, UV-resistant, and extreme weather-resistant properties, as well as along service life. Its high transparency and flexibility, along with the durability over glass and other traditional materials, has propelled the market share of the material in various architectural applications such as stadium roofs, facades and greenhouses. Growing usage of ETFE films in solar panel protection and semiconductor manufacturing is also expected to drive its demand during the coming years.

By Application

The coatings & liners held the largest market share around 32% in 2023. HPF-based coatings and liners can deliver the highest performance protection against challenge conditions, including a wide range of aggressive chemicals, extreme temperatures, corrosion and wear, as well as top-level protection for industrial equipment, pipelines and storage tanks, and any other critical component. The superior non-stick, low-friction, and weather-resistance properties of the product have induced demand in cookware, semiconductor manufacturing, and architectural applications. Further, the increasing focus on safety, robustness, and performance improvement under extreme operating conditions is also supporting the adoption.

By End-User Industry

Electrical & Electronics held the largest market share around 28% in 2023. The demand for high-performance insulators for key electronic applications is growing. High-Performance Fluoropolymer (HPFs) like PTFE, FEP, and PFA feature among the best dielectric materials (high-voltage insulators) with high thermal stability and chemical resistivity, indispensable in wires, cables, circuit boards, or semiconductor manufacturing. Continued demand for high-frequency, high-voltage, and miniaturized electronic components due to rapidly expanding 5G technology, electric vehicles (EVs), and miniaturized electronics has also accelerated adoption of fluoropolymers.

High-Performance Fluoropolymers Market Regional Outlook

Asia Pacific held the largest market share around 48% in 2023. Fluoropolymers are widely used for high-performance insulation along with circuit boards and chip manufacturing in some of the largest semiconductor factories across China, Japan, South Korea, and Taiwan. Also growing the demand for lightweight and heat-resistant electrical insulation sub-components in batteries and wiring systems is the burgeoning electric vehicle (EV) industry in China and India. Additionally, the presence of an increased number of chemical processing plants in the Asia Pacific region, especially China, has also resulted in demand for corrosion-resistant fluoropolymer coatings & liners. In addition, the expanding requirement for fluoropolymer films and membranes due to various government-driven renewable energy projects, such as solar panels and hydrogen fuel cells, is also driving the market.

North America held the significant market share. It is due to a large number of globally operating High-Performance Fluoropolymers (HPFs) end-use industries such as aerospace, automotive, electronics, chemical processing, and healthcare, North America held the largest share of the high-performance fluoropolymers (HPFs) market in terms of revenue. Airplane components and fuel systems all require lightweight, high-temperature-resistant fluoropolymers to meet stringent performance requirements which has contributed to the growth of the market in the region, which is home to manufacturers of the top-notch aerospace and defense contractors. The growth of the electric vehicle (EV) market in the U.S. and Canada has also translated into increased fluoropolymer consumption in such areas as battery technologies, wiring, and insulation materials.

Key Players

-

Gujarat Fluorochemicals Limited (GFL) (Inoflon, Fluonox)

-

AGC Inc. (Fluon, AFLAS)

-

OJSC (Teflon, Fluoroplast)

-

The 3M Company (Dyneon, Scotch-Weld)

-

China Reform Culture Holdings Co., Ltd. (F46, F4)

-

Solvay S.A. (Hyflon, Algoflon)

-

Dongyue Group (Dyon, Dyneon)

-

Hubei Everflon Polymer Co. Ltd. (Everflon, Everfine)

-

Halopolymer (Halon, Fluoroplast-4)

-

Daikin Industries Ltd. (Neoflon, Polyflon)

-

The Chemours Company (Teflon, Nafion)

-

Saint-Gobain Performance Plastics (Chemfab, Rulon)

-

Arkema S.A. (Kynar, Forane)

-

Mitsubishi Chemical Group (FEM, Aflas)

-

Shanghai 3F New Materials Co., Ltd. (3F PTFE, 3F FEP)

-

Jiangsu Meilan Chemical Co., Ltd. (Meilan PTFE, Meilan FEP)

-

Chenguang Research Institute of Chemical Industry (CGPTFE, CGFEP)

-

Zeus Industrial Products (Aeos, Zeus PFA)

-

RTP Company (RTP 2300, RTP 2100)

-

Shamrock Technologies (FluoroTEX, FluoroSLIP)

Recent Development

-

In 2024, the fluoropolymer industry came under scrutiny for resisting regulations on per- and poly-fluoroalkyl substances (PFAS), also known as "forever chemicals." Investigations uncovered that industry players used various strategies to obstruct regulatory measures, citing potential economic and technological disruptions.

-

In 2023, Toray Industries expanded its product portfolio in the high-performance fluoropolymers market by launching high-strength textiles made from Toyoflon fiber, utilizing low-friction Polytetrafluoroethylene (PTFE) polymers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.39 Billion |

| Market Size by 2032 | US$ 8.14 Billion |

| CAGR | CAGR of 7.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (PTFE, FEP, PFA/MFA, ETFE, Others) • By End-Use Industry (Industrial Processing, Transportation, Electrical & Electronics, Medical, Building & Construction, Consumer Household) • By Application (Coatings & Liners, Components, Films, Additives, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Gujarat Fluorochemicals Limited (GFL), AGC Inc., OJSC, The 3M Company, China Reform Culture Holdings Co., Ltd., Solvay S.A., Dongyue Group, Hubei Everflon Polymer Co. Ltd., Halopolymer, Daikin Industries Ltd., The Chemours Company, Saint-Gobain Performance Plastics, Arkema S.A., Mitsubishi Chemical Group, Shanghai 3F New Materials Co., Ltd., Jiangsu Meilan Chemical Co., Ltd., Chenguang Research Institute of Chemical Industry, Zeus Industrial Products, RTP Company, Shamrock Technologies |