Hominy Feed MarketReport Scope & Overview:

Get More Information on Hominy Feed Markett - Request Sample Report

The Hominy Feed Market size was USD 1.27 billion in 2023, is expected to Reach USD 2.29 billion by 2032, and grow at a CAGR of 6.8% over the forecast period of 2024-2032.

Hominy feed is a high-energy, high-protein feed ingredient that is made from the by-products of corn milling. It is a good source of fiber and other nutrients, and it is used to feed a variety of livestock animals, including cattle, pigs, sheep, poultry, and fish.

Based on Type, the conventional hominy feed segment is the major segment, accounting for the majority of the global market share of 65% in 2022. This growth is due to the fact that conventional hominy feed is more affordable and widely available than organic hominy feed.

Based on Application, the livestock/animal feed segment is the major segment by end-users, accounting for the majority of the global market share of 85%. This growth is due to the fact that hominy feed is a major ingredient in livestock feed. Pet food manufacturers are also a major segment among end-users. Hominy feed is a good source of protein and fiber, making it a suitable ingredient for pet food.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing demand for poultry and livestock products

High-energy hominy feed is a staple in the production of poultry and cattle. One of the world's fastest-growing meat industries is poultry. This is brought on by a variety of causes, including urbanization, changing food preferences, and increased incomes. The rising demand for hominy feed rises in tandem with the demand for poultry meat. The demand for meat, milk, and eggs is rising, which indirectly drives the livestock industry. Due to urbanization and rising wages, the demand for poultry and animal products is expanding quickly in Southeast Asia. Due to the increased production of these animals, a consistent supply of hominy feed is needed.

RESTRAIN

-

Availability of raw materials

Corn is a major component used to make hominy feed. Hominy feed costs and supplies might fluctuate depending on prices and supply of corn. Corn prices can change due to a variety of factors such as weather, crop output, and global demand. The cost of production of hominy feed may increase when maize prices are high. This may decrease the demand for hominy feed and have an adverse effect on the profitability of hominy feed producers.

OPPORTUNITY

-

Expansion into new markets

Hominy feed producers are growing into new Asian markets such as China, India, and Vietnam. These markets are rapidly expanding, and there is a high need for hominy feed. Hominy feed producers are growing into new African markets like as Ethiopia, Nigeria, and Kenya. These markets are likewise quickly expanding, and there is a high need for hominy feed. Consumers in emerging markets are becoming more affluent as their earnings rise. This is increasing demand for meat and other animal products. This is increasing the demand for hominy feed.

-

Development of new products and applications

CHALLENGES

-

Competition from other feed types

Other feeds, such as corn gluten meal, soybean meal, and canola meal, are frequently regarded as more nutritional and efficient than hominy feed. This can make them more appealing to livestock producers who want to make the most of their feed investments. Furthermore, different feed kinds are frequently less expensive than hominy feed. This is due to the fact that they are created from more plentiful and less expensive raw materials. This may make them more appealing to livestock farmers on a restricted budget. The hominy feed market is being hampered by competition from other feed kinds.

-

Stringent regulatory

IMPACT OF RUSSIAN-UKRAINE WAR

The war between Russia and Ukraine has had a severe influence on the hominy feed companies. Hominy feed is a by-product of maize milling, and Russia and Ukraine are significant corn producers. Ukraine is fourth in global corn exports, accounting for 14% of total global corn exports. It produces 45 million tonnes of corn, about 80% of which is exported, accounting for 14% of world corn exports, while India is a major grain importer. Furthermore, the Russian livestock and feed industry's growth is likely to be limited by a lack of imported genetics, vaccinations, and, most importantly, equipment. Russian enterprises rely on European firms. The decrease in corn supply reduced the impact of hominy feed.

IMPACT OF ONGOING RECESSION

According to a recent International Grains Council estimate, corn prices have increased by more than 30% since the start of the war. This has increased the cost of hominy feed for livestock producers. Also, hominy feed prices have risen by more than 20%. This could lead to a drop in demand for animal products, which in turn could lead to a drop in demand for hominy feed. Feed materials such as corn gluten meal and soybean meal are frequently less expensive than hominy feed. The demand for hominy feed may also be impacted by governmental policy, like as taxes on imported feed ingredients.

MARKET SEGMENTATION

By Type

-

Organic

-

Conventional

By Form

-

Whole Hominy

-

Crushed Hominy

By Distribution Channel

-

Direct Sales

-

Indirect Sales

By End-user

-

Livestock / Animal Feed

-

Pet Food Manufactures

-

Ethanol Production

-

Others

REGIONAL ANALYSIS

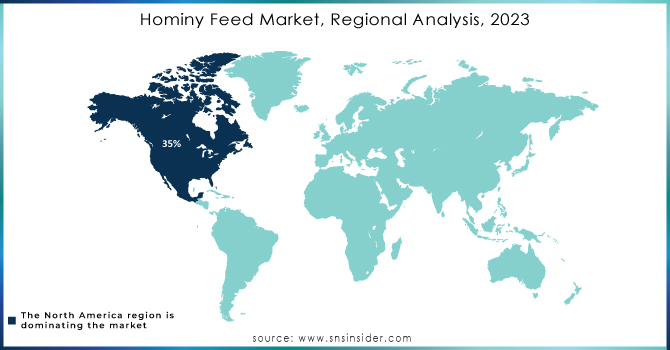

North America will account for more than 35% of the hominy feed market in 2022. The rising demand for safe and nutritious feedstock for animals and poultry is driving the expansion. The region has a big livestock population, and farmers are becoming more aware of the benefits of employing hominy feed in animal diets. Furthermore, the presence of a large number of significant market competitors in the region is helping to the market's growth.

Asia Pacific will account for more than 27% of the hominy feed market in 2022. The increase is attributable to the region's high demand for dairy products. Dairy product consumption is expanding, creating a strong demand for nutritious and healthy feedstock of dairy cattle. Furthermore, the region's expanding poultry industry is fuelling demand for hominy feed.

Europe is the emerging market for hominy feed, with a market share of more than 16% in 2022. The market is being driven by rising consumer awareness of the benefits of employing hominy feed in animal diets. Furthermore, the presence of a large number of significant market competitors in the region is helping the market's growth.

Need any customization research on Hominy Feed Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Hominy Feed Market are Cargill, Archer Daniels Midland Company, Ingredion Incorporated, Associated British Foods, PV Sons Corn Milling, Sharifa Agrotech and Food Processing, Semo Milling, ABST Group, Commodity Specialists Company, Bunge North America, Shandong Mingyue Foodstuffs, Phyto Planet, Dexterous Product Private Limited, LaBuddhe Group, and other key players.

RECENT DEVELOPMENTS

In 2023, Diamond V Mills was purchased by Land O'Lakes for an undisclosed sum. Land O'Lakes now has a significant presence in the feed additive sector, which includes hominy feed additives.

In 2022, Cargill purchased Purina Animal Nutrition with an amount of USD 4.4 billion. Cargill gained a significant position in the animal feed business, especially hominy feed, as a result of this transaction. Purina Animal Nutrition's acquisition of Cargill gave it access to Purina's enormous hominy feed manufacturing and distribution network.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.19 Billion |

| Market Size by 2032 | USD 2.29 Billion |

| CAGR | CAGR of 6.8 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Organic, Conventional) • By Form (Whole Hominy, Crushed Hominy) • By Distribution Channel (Direct Sales, Indirect Sales) • By End-user (Livestock / Animal Feed, Pet Food Manufactures, Ethanol Production, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Cargill, Archer Daniels Midland Company, Ingredion Incorporated, Associated British Foods, PV Sons Corn Milling, Sharifa Agrotech and Food Processing, Semo Milling, ABST Group, Commodity Specialists Company, Bunge North America, Shandong Mingyue Foodstuffs, Phyto Planet, Dexterous Product Private Limited, LaBuddhe Group |

| Key Drivers | • Increasing demand for poultry and livestock products |

| Market Restrain | • Availability of raw materials |