Cognac & Brandy Market Report Scope & Overview:

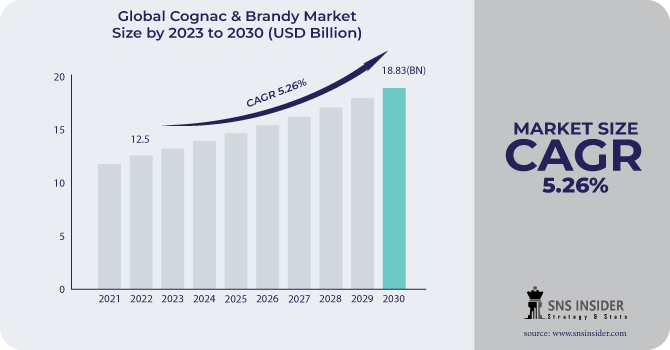

The Cognac & Brandy Market size was USD 12.5 billion in 2022 and is expected to Reach USD 18.83 billion by 2030 and grow at a CAGR of 5.26 % over the forecast period of 2023-2030.

Cognac and Brandy are both distilled spirits made from the juice of white grapes. The global appeal of luxury alcoholic liquors and millennial demand for craft beverages is expected to widen the market's scope in the coming years.

Get PDF Sample Copy of Cognac & Brandy Market - Request Sample Report

The worldwide food and beverage business has seen an increase in demand for higher-quality products in recent years. Premiumization entails a higher emphasis on flavor, the adoption of high-quality ingredients, and more attractive packaging, all of which enable a variety of producers to create premium spirits.

Super beverages lead the market in terms of kind due to high demand due to their excellent quality and flavor. The worldwide food and beverage industry has seen an increase in demand for more super-premium items in recent years. According to the British publication The Guardian, sales of super-premium spirits increased by 21% in 2022.

MARKET DYNAMICS

KEY DRIVERS

-

Changing consumer preferences

-

Influence of digitalization, Advertising on the population

E-Commerce is getting more popular for purchasing cognac and brandy. This is owing to the ease and convenience of online shopping. Digital networks provide youthful customers with a wealth of knowledge about cognac and brandy. They can learn about the various brands and flavors available by reading reviews and watching videos. This knowledge can assist people in making informed judgments about which cognac and brandy to buy. They can shop online or via smartphone apps, and have their goods delivered to their houses. This ease of use is important for young consumers who are frequently busy and on the run.

RESTRAIN

-

Rising health consciousness

-

The rising demand for non-alcoholic content beverages

Cognac and brandy are distilled wine-based alcoholic beverages that are often consumed plain or in cocktails. However, as consumers become more health conscious and aware of the hazards connected with alcohol usage, there has been an increasing trend toward low or non-alcoholic beverages in recent years.

OPPORTUNITY

-

The rising popularity of cocktail culture to favor the market

Alcohol consumption has become a social norm during special events and other festivities, especially in developed countries such as the U.K. and the U.S. where customers prefer to enjoy a drink in their free time. Cognac & brand are widely popular due to their complex flavor and subtle texture which can be enjoyed in cocktails or on their own fits into the growing cocktail culture and is likely to fuel the spirits sales in the future. Aside from that, the growing popularity of ready-to-drink cocktails or canned cocktails among millennials contributes to the growth. As a result, companies are seeking to increase their capacity for producing high-quality drinks while focusing on ingredient innovation.

CHALLENGES

-

Competition from other alcoholic beverages

-

Government regulations

Governments all throughout the world place restrictions on the manufacture, sale, and marketing of alcoholic beverages. These rules can differ from one country to the next. Governments frequently put limitations on the selling of alcoholic beverages, such as requiring producers to obtain permits or sell their products only in specific places.

IMPACT OF RUSSIA UKRAINE WAR

The war between Russia and Ukraine has had a tremendous influence on the Cognac and Brandy business. The war has hampered Cognac and Brandy's production in Ukraine and Russia. Ukraine is a key producer of grapes required in Cognac manufacturing, and the war has harmed the country's farms and wineries. Russia is also a significant producer of Cognac and Brandy, and the war has made it difficult for manufacturers to obtain supplies and export their wares. Consumers in Europe and the United States have been less eager to purchase Cognac and Brandy from Russia, and tourism to Russia has decreased, reducing demand for Cognac and Brandy in the country. According to the International Wine and Spirit Research (IWSR), sales of Cognac and Brandy in Russia are anticipated to fall by 20% by 2023. According to the IWSR, Cognac and Brandy sales in Europe will fall by 5% in 2023.

IMPACT OF ONGOING RECESSION

The Cognac and Brandy market has been influenced by the recession, which reduces demand for pricey products since customers have less discretionary income to spend on luxury goods. Consumers are shifting their preferences to less expensive alcoholic beverages such as beer and wine. This may diminish demand for Cognac and Brandy, which are normally more expensive. This may result in decreased production and jobs in the Cognac and Brandy business. As European countries prepare for a probable recession, demand for Indian table grapes has dropped by 20%, potentially jeopardizing growers' price realization. Due to the prolonged recession, the IWSR expects that Cognac and Brandy sales will fall by 1% in 2023.

MARKET SEGMENTATION

by Type

-

High-end Premium

-

Value Premium

-

Super Premium

By Application

-

Cognac

-

Spanish Brandy

-

Armagnac

-

Pisco

Get Customised Report as per Your Business Requirement - Enquiry Now

REGIONAL ANALYSIS

North America is the largest market for cognac and brandy, accounting for a share that is estimated to be worth USD 5 billion in 2022. Factors such as dense population and expanding demand for distilled spirits in Canada and the United States drive up product sales. The rising demand for artisanal spirits, as well as the region's growing number of craft distilleries, all contribute to growth. The United States is the largest cognac and brandy market in North America, followed by Canada.

Europe is predicted to have an increase in spirits revenue due to an increase in the amount of food service franchise outlets providing a variety of spirits, increased customer spending power, and expansion in the tourism industry. Brandy production and consumption in the area have a long history, and many European nations have a high demand for fine brandy. Europe's main cognac and brandy markets are in France, Spain, and Italy.

The Asia Pacific region is the second-largest market for brandy and cognac. The increased popularity of cognac-based drinks and the discernible trend of substituting brandy for whiskey and vodka in beverages has helped the region expand. China, followed by India and Japan, is the Asia Pacific country with the biggest market for cognac and brandy. According to the international magazine, the drinks business, sales of cognac increased by 55% in 2022, while premium brandy sales increased by 32% in China.

The Rest of the World is the smallest market for cognac & brandy, accounting for a share of less than 10% in 2022. However, the market is expected to grow at a faster rate than the other regions over the forecast period. This is due to the increasing demand for premium spirits in countries such as Brazil, Mexico, and South Africa.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Remy Martin, Meukow Cognac, Naud Spirits & Distillery, Suntory, Emperador Distillers Inc, Hennessy LVMH, Pernod Ricard, Suntory, Radico Khaitan Ltd., Thomas Hine & Co., Maison Ferrand, and other key players are mentioned in the final report.

Meukow Cognac-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023 The new Louis XIII Cognac coffret was introduced by Rémy Cointreau Global Travel Retailing. The launch of this magnificent new coffret exemplifies Louis XIII's and the House of Rémy Martin's unwavering commitment to sustainability.

In 2023 Stella Rosa Premium Imported Brandy Expands in the U.S. Stella Rosa, the largest wine importer in the United States, is increasing the availability of Stella Rosa Premium Imports Brandy, their award-winning inaugural spirit, to new states.

In 2022 Fortnum & Mason collaborated with the Frapin single-family estate to create its own cognac, "Hors d' Age." This new cognac is designed to be savored plain or in a stemmed glass with rich chocolate desserts or baked apples.

In 2022 A full-meal cognac pairing is now available from Louis XIII in association with Leela Palace Delhi. We were the first people invited to participate in LOUIS XIII and Leela Palace Delhi's first chef partnership on a food pairing event.

| Report Attributes | Details |

| Market Size in 2022 | US$ 12.5 Billion |

| Market Size by 2030 | US$ 18.83 Billion |

| CAGR | CAGR of 5.26% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (High-end Premium, Value, Premium, and Super Premium) • By Application (Cognac, Spanish Brandy, Armagnac, Pisco) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Remy Martin, Meukow Cognac, Naud Spirits & Distillery, Suntory, Emperador Distillers Inc, Hennessy LVMH, Pernod Ricard, Suntory, Radico Khaitan Ltd., Thomas Hine & Co., Maison Ferrand |

| Key Drivers | • Changing consumer preferences • Influence of digitalization, Advertising on the population |

| Market Opportunity | • The rising popularity of cocktail culture to favor the market |