Bakery Products Market Report Scope & Overview:

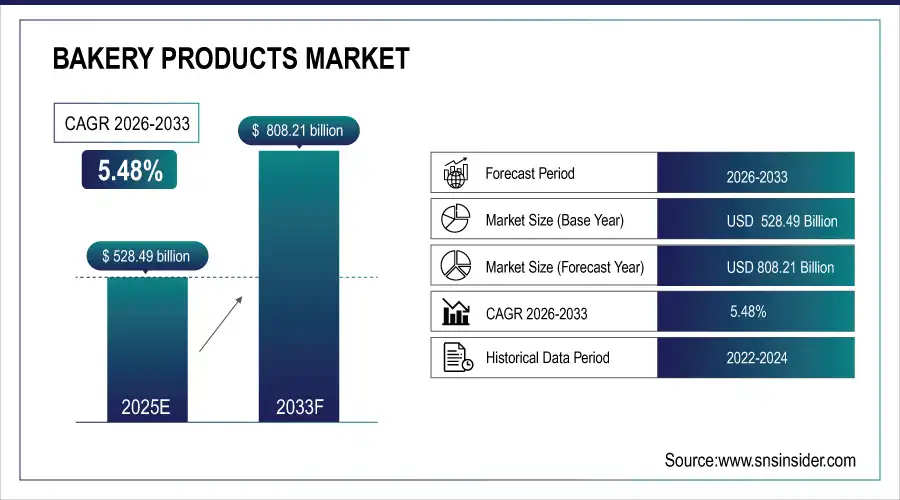

The Bakery Products Market Size was valued at USD 528.49 Billion in 2025E and is projected to reach USD 808.21 Billion by 2033, growing at a CAGR of 5.48% during the forecast period 2026–2033.

The Bakery Products Market Study provides detailed information regarding the consumption and industry trends to the market growth. The report divides the market by product type, ingredient, form, end use and distribution channel. Increasing preference for ready to eat food products and high-end baked goods propel the market growth.

Cakes and pastries output grew to 18 million tons in 2025, supported by rising urban demand and convenience trends.

Market Size and Forecast:

-

Market Size in 2025: USD 528.49 Billion

-

Market Size by 2033: USD 808.21 Billion

-

CAGR: 5.48% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Bakery Products Market - Request Free Sample Report

Bakery Products Market Trends:

-

Rising inclination toward convenience and on-the-go food products is supporting the market growth for frozen and packaged bakery.

-

Innovation in healthful ingredients especially whole grains, plant-based proteins and reduced sugars is driving healthier bakery products.

-

Proliferation of modern retail and e-commerce facilitates broader product access, supporting on-the-go consumption of bakery products.

-

The automation and smart baking technology landscape is getting smarter with increasing efficiency, consistency and shelf life in bakeries.

-

Increasing customer preference for all-natural and sustainably produced ingredients is driving companies to launch bakery items that are organic, clean label, and premium.

U.S. Bakery Products Market Insights:

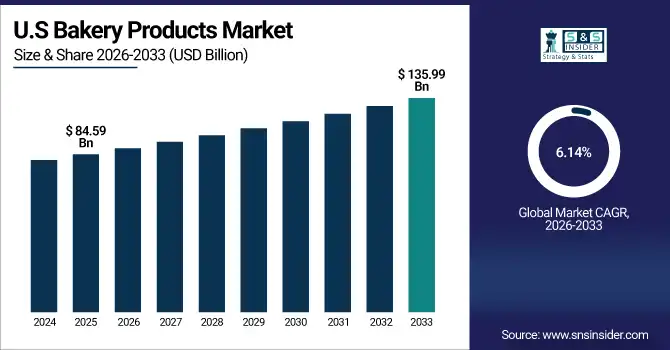

The U.S. Bakery Products Market is projected to grow from USD 84.59 Billion in 2025E to USD 135.99 Billion by 2033, at a CAGR of 6.14%. Growth is supported by functional, clean-label and frozen bakery products, the rise of retail chains, use of e-commerce and trends toward convenient options and for premium bakery offerings.

Bakery Products Market Growth Drivers:

-

Rising consumer preference for convenient, healthier, and on-the-go bakery options is fueling market expansion.

Demand for convenient, healthier bakery options is driving Bakery Products growth, fueled by rising urbanization and busy lifestyles. Bread production was 35 million tonnes in 2025, and confectionary ranges of cakes, pastries and biscuits over 40 million tonnes. Nations such as the U.S., India, and China will introduce packaged and frozen bakery options by advertising fortified and clean-label products. These are driving the production, consumption and innovation of functional and on-the-go bakery products.

Expanding demand for convenient and healthier bakery options contributed to production of 75 million tons in 2025, driven by bread, cakes, and biscuits consumption.

Bakery Products Market Restraints:

-

Rising raw material prices and supply chain disruptions are limiting large-scale bakery production and profit margins.

Rising raw material prices and supply chain disruptions are restraining Bakery Products Market growth. In 2025, demand for wheat and sugar was 15–20% more than what was available breads, cakes and biscuits. Small and medium-sized bakeries cannot compete with the large industrial producers who have economies of scale. Uncertain flour and oil prices, and transportation difficulties, have again restrained constant production. While consumer demand for convenient and healthier bakery products is increasing, these cost pressures and supply limitations prevent large-scale production expansion.

Bakery Products Market Opportunities:

-

Growing demand for functional, clean-label, and fortified bakery products offers profitable opportunities for product innovation.

Rising need for functional, clean label and fortified bakery products is boosting market growth. By 2025, 22 million tons were produced of healthier bakery products. Urbanization, increasingly health-conscious consumers and growing retail and ecommerce channels are driving innovation. More-advanced ingredient blends, fortified flours and convenient packaging now allow bakeries to respond quickly to the demands of their customers, allowing new and established producers a cost-effective opportunity.

Functional, clean-label, and fortified bakery products for 30% of new bakery product launches in 2025, driven by health-conscious consumers and e-commerce expansion.

Bakery Products Market Segmentation Analysis:

-

By Product Type, Bread held the largest market share of 37.86% in 2025, while Cakes & Pastries are expected to grow at the fastest CAGR of 6.12%.

-

By Ingredient Type, Wheat Flour dominated with a 48.23% share in 2025, while Oats are projected to expand at the fastest CAGR of 7.05%.

-

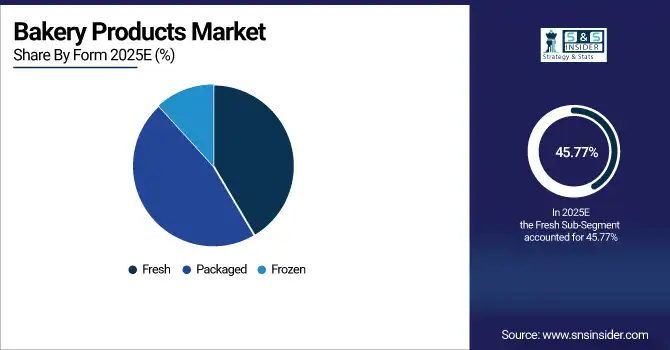

By Form, Fresh accounted for the highest market share of 45.77% in 2025, and Packaged is projected to record the fastest CAGR of 5.92%.

-

By End User, Household segment held the largest share of 61.34% in 2025, while Foodservice users are expected to grow at the fastest CAGR of 6.18%.

-

By Distribution Channel, Supermarkets & Hypermarkets dominated with a 54.61% share in 2025, while Online Retail is projected to record the fastest CAGR of 7.28%.

By Product Type, Bread Dominates While Cakes & Pastries Expands Rapidly:

Bread sector dominates the Product Type segment in 2025 with 13.2 million tons were produced owing to daily habitual consumption at household level, staple diet inclination and well-established industrial production units. Its leadership is further buttressed by strong brand, repeat and extensive retail. Cakes & Pastries sector is the fastest growing Product Type segment with 5.1 million tons in 2025 supported by increased urban demand, on-the-go lifestyles and café/bakery openings. Growth is further aided by premiumization and seasonal gifts.

By Ingredient Type, Wheat Flour Dominates While Oats Expands Rapidly:

Wheat Flour sector dominated the Ingredient Type segment with 20.5 million tons in 2025 for breads, cookies and cakes across the world. High availability, low cost and well-developed supply chains in major regions make it a formidable leader. Oats sector is the fastest-growing Ingredient Type segment in 2025, as consumers are now looking for healthy and clean-labelled processed food and functional bakery products. It is further accelerated by breakfast-focused lines and fortified bakery breakthroughs.

By Form, Fresh Dominates While Packaged Expands Rapidly:

Fresh dominated the Form segment with 15.1 million tons in 2025 on account of increasing consumer inclination toward freshly baked goods both at homes and across foodservice outlets. It is such a competitive force due to bakery chains, local market penetration and high rate of repeat purchases. Packaged sector is the fastest growing Form segment, reaching 6.5 million tons in 2025 driven by convenience, urban snacking and online retail demand expansion. Meanwhile, shelf-life advancements and on-the-go product concepts also add momentum to growth.

By End User, Household Dominates While Foodservice Expands Rapidly:

Household sector dominated the End User segment in 2025, registering consumption of 28.5 million tons due to an increase in demand for bread and daily bakery products in Asia-Pacific and North America. The dominance of the sector is due to the adoption of convenience and home consumption patterns. Foodservice sector is the fastest growing End User segment, which consumed 7.8 million tons in 2025 due to the expanding of cafés, hotels, restaurants, and institutional catering. Moreover, the development of quick-service restaurants and catering services contributed to the growth.

By Distribution Channel, Supermarkets & Hypermarkets Dominate While Online Retail Expands Rapidly:

Supermarkets & Hypermarkets sector dominated the Distribution Channel segment in 2025, on account of high availability and organized retail expansion leading to bulk purchasing trends. Its powerful marketing and loyalty initiatives ensure repeat sales, further cementing its stronghold. Online Retail sector is the fastest growing Distribution Channel segment, delivering 4.6 million tons by 2025 on account of e-commerce penetration, easy home delivery and frozen & packaged bakery products. Tech- driven logistics and smartphone penetration are further boosting Growth.

Bakery Products Market Regional Analysis:

Asia-Pacific Bakery Products Market Insights:

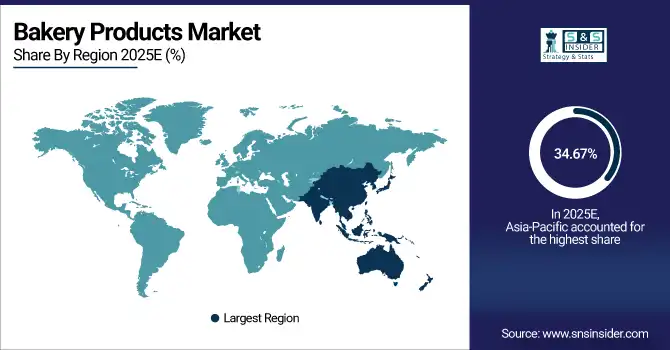

Asia-Pacific dominated the Bakery Products Market with a 34.67% share in 2025, owing to substantial population base and enormous daily consumption of bread and snack products coupled with the presence of indigenous bakery manufacturing units in countries such as China, Japan and India. Over 8.5 million tons of bread and cakes came from China and 6.2 million tons of biscuits and pastries from India. Solid urban demand, increasing retail networks and expanding café/bakery chains underpin sustained market leadership in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Bakery Products Market Insights:

China's production of more than 8.5 million tons of bread and cakes, and over 4.3 million tons of biscuits and pastries in 2025, was mainly consumed by households, whereas cafés/restaurants showed increasing demand. Market growth is further driven by increasing urbanization, growing per capita income, convenience trends and rising retail and bakery chain outlets.

North America Bakery Products Market Insights:

The North America Bakery Products Market is the fastest-growing region with the CAGR of 6.28% during 2026-2033 as a result of increasing demand for functional, clean-label and frozen baker products. In 2025, the U.S. made more than 4.7 million tons of bread and cakes and 3.1 million tons of biscuits and pastries. This development is underpinned by: rising supermarket chains; spread of e-commerce; busy, on-the-go lifestyles and rise of café and foodservice consumption.

-

U.S. Bakery Products Market Insights:

In 2025, the U.S. made more than 4.7 million tons of bread and cakes, and 3.1 million tons of biscuits and pastries, consisting of 3.9 and 1.9 million tons for household use or foodservice/industrial uses, respectively. Growth is primarily driven by convenience demand, urban way of life and increasing retail and e-commerce channels.

Europe Bakery Products Market Insights:

Europe made over 9.4 million tons of bread and cakes and some 7.5 million tons of biscuits and pastries in 2025. Germany was first (3.1 million tons), followed by France with 2.4 and Italy at 1,9. Household consumption was the largest user, with cafés and restaurants and industrial use also showing a notable contribution. Urbanisation, premium bakery and retail expansion are all fueling volume growth.

-

Germany Bakery Products Market Insights:

In 2025, bread and cakes represent the volume of more than 3.1 million tons and biscuits and pastries with over 1.6 million tons processed by Germany, with households taking the most part thereof followed by foodservice/industry. Market dominance is supported by high bakery culture, premium products and urban consumption trends and the growth of retail and café chains.

Latin America Bakery Products Market Insights:

Latin America baked 3.5 million ton of breads & cakes with Brazil 51%, Argentina 32% and Colombia 17% in 2025. Households used the bulk of the products, and cafe-and-restaurant and industrial consumption made up the remainder. Market expansion is supported by urbanisation, growing disposable incomes, growth for packaged and frozen bakery products and the proliferation of the retail and foodservice sectors.

Middle East and Africa Bakery Products Market Insights:

The Middle East & Africa region provides more than 1,800 million tons of bread and cakes in 2025 with UAE accounting for over 0.7 million tons, and South Africa contributing approximately 0.5 million tons. Household consumption was much the largest; food-service and industrial uses made up the balance. Prospects Positive for rising urbanization, expanding retail sector and increasing bakery penetration.

Bakery Products Market Competitive Landscape:

Grupo Bimbo, headquartered in Mexico, dominated the bakery industry in 2025 with 245 bakeries across 35 countries, producing over 10 million tons of bread, cakes, and snacks. The company owns more than 100 brands and has a distribution network including supermarkets, convenience stores and foodservice. This scale, cutting-edge development in healthier and premium products and leading logistics capabilities further underpin its market leadership as the largest company in the bakery businesses.

-

In May 2025, Bimbo Bakeries USA introduced three new products: Sara Lee® Half Loaves, Ball Park® Butter Buns, and Thomas’ High Protein Bagels. The High Protein Bagels contain 20 grams of plant-based protein per serving, catering to the growing demand for high-protein, plant-based options in the bakery segment.

Mondelez International had a strong foothold in the bakery industry by 2025, operating 50 plants across 30 countries and manufacturing about 6.5 million tonnes of biscuits, cookies and cakes. Among those brands are the legendary Oreo and Chips Ahoy! stimulate growth, and strategic acquisitions increased sweet baked goods offerings. Focusing on innovation, world supply chains and premium products lines Mondelez continued to be an influencer of trends in bakery products globally.

-

In March 2025, Mondelez International and Lotus Bakeries launched their first co-branded product in Belgium: Côte d'Or L'Original with crunchy pieces of Lotus Biscoff®. This collaboration combines the rich chocolate of Côte d'Or with the unique flavor of Lotus Biscoff, expanding the Lotus Biscoff® brand in Europe.

ABF led the UK and European market in 2025 with its bakery segment which includes fifteen production plants producing three million tonnes of bread, pastries, and biscuits a year. Its portfolio of more than 20 bakery brands was further consolidated through strategic acquisitions such as Hovis and Allied Bakeries. Operational excellence, strong distribution infrastructure and reliance on branded and packaged offerings have made ABF a leading player in the European bakery products industry.

-

In August 2025, ABF announced its acquisition of Hovis Group, a leading UK bakery brand. This strategic move aims to combine two of the country's most recognized bread brands, enhancing ABF's presence in the UK bakery market and strengthening its portfolio of bakery products.

Bakery Products Market Key Players:

Some of the Bakery Products Market Companies are:

-

Grupo Bimbo

-

Mondelez International

-

Associated British Foods (ABF)

-

Nestlé S.A.

-

General Mills

-

Kellogg Company

-

Britannia Industries

-

Yamazaki Baking Co., Ltd.

-

Finsbury Food Group

-

McKee Foods

-

Flowers Foods

-

Aryzta AG

-

Dawn Foods

-

Europastry

-

Premier Foods

-

Hostess Brands

-

Lantmännen Unibake

-

Bimbo QSR

-

La Lorraine Bakery Group

-

Ottogi Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 528.49 Billion |

| Market Size by 2033 | USD 808.21 Billion |

| CAGR | CAGR of 5.48% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Bread, Cakes & Pastries, Biscuits & Cookies, Savory Snacks, Rusk, Others) • By Ingredient Type (Wheat Flour, Maize Flour, Rice Flour, Oats, Sugar, Fats & Oils, Others) • By Form (Packaged, Fresh, Frozen) • By End User (Household, Foodservice, Industrial) • By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online Retail, Convenience Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Grupo Bimbo, Mondelez International, Associated British Foods (ABF), Nestlé S.A., General Mills, Kellogg Company, Britannia Industries, Yamazaki Baking Co., Ltd., Finsbury Food Group, McKee Foods, Flowers Foods, Aryzta AG, Dawn Foods, Europastry, Premier Foods, Hostess Brands, Lantmännen Unibake, Bimbo QSR, La Lorraine Bakery Group, Ottogi Corporation |