Hybrid Valve Market Scope & Overview:

The Hybrid Valve Market Size was esteemed at USD 1.27 billion in 2023 and is supposed to arrive at USD 2.23 billion by 2032 with a growing CAGR of 6.47% over the forecast period 2024-2032. This report offers a detailed analysis of the utilization rates, technological adoption, and export/import data for hybrid valves by region, providing a comprehensive look at market dynamics across various geographies. It also highlights regional trends in hybrid valve innovation, with a focus on R&D investments driving future advancements. Additionally, the report examines the adoption rates of emerging technologies like IoT-enabled hybrid valves, along with insights into supply chain disruptions and their impact on market operations. The trends reflect a growing shift towards automation and sustainability in valve technology, alongside increasing regulatory pressures.

To get more information on Hybrid Valve Market - Request Free Sample Report

Market Dynamics

Drivers

-

The integration of IoT and automation in hybrid valves is driving market growth by improving control, efficiency, and remote monitoring in key industries.

Technological advancements, particularly the integration of smart technologies like the Internet of Things (IoT) and automation, are significantly driving the demand for hybrid valves. Industries demanding precision and real-time data have been highly attracted to these valves which are now even more effective with improved control, efficiency, and remote monitoring capabilities. IoT-enabled hybrid valves allow operators to monitor the performance of valves remotely, enabling them to reduce downtime and optimize operations by analyzing real-time data for predictive maintenance. Automation simplifies their function with less human involvement for precise valve operations in complex industrial environments. This evolution of technology has resulted in an increase in the hybrid valve market in industries such as oil & gas, water & wastewater, and chemicals where the superior performance of the equipment is a requirement. Furthermore, the current focus on energy efficiency, sustainability, and smart systems is positioning hybrid valves to play a pivotal role in the future of industrial operations, creating additional impetus for the growth of the global hybrid valve market.

Restraint

-

High initial costs of hybrid valves, due to advanced materials and technologies, pose a barrier to adoption, especially for smaller businesses, despite long-term efficiency benefits.

The high initial costs associated with hybrid valves are one of the key factors limiting their widespread adoption, particularly among smaller businesses or those in cost-sensitive industries. Due to their frequent incorporation of sophisticated materials such as tungsten carbide, titanium alloy, or duplex nickel, these valves are relatively expensive to manufacture. Also, hybrid valves have complex technologies like IoT capabilities and automation integrated into them, which hike their price even more. Though more expensive to install in the beginning, these valves can lead to O&Ms decreases and improved reliability that pays for initial costs over the lifespan of the valve. However, despite the price-related challenge, the hybrid valve market is on a path of gradual growth, supported by an increase in industrial demand, where these can be used substantially in sectors such as oil & gas, water & wastewater, and energy. This is also driving up the market for automation and smart infrastructure as industries look for new, smarter ways to work and optimize their performance and sustainability.

Opportunities

-

Emerging markets are driving hybrid valve adoption, fueled by industrial growth, stricter regulations, and the demand for energy-efficient, cost-effective solutions.

Expanding emerging markets present a significant opportunity for the hybrid valve market, driven by rapid industrialization in developing regions such as Asia-Pacific, Latin America, and the Middle East. With the growth in these economies comes a greater need for technologically advanced systems such as hybrid valves to improve operational efficiency, minimize maintenance costs, and comply with strict environmental standards. Hybrid valves are attractive to sectors such as oil & gas, water & wastewater, and chemicals, as they can optimize energy use and improve the way that fluids are controlled. Moreover, hybrid valves offer the perfect answer to reducing energy consumption and carbon emissions, as governments in these regions impose tough environmental policies. This adoption is already driving robust growth for the market through increasing investments in industrial infrastructure and integration of automation technologies. This type of trend suggests that hybrid valve technologies will continue to be developed for more cost-effective and sustainable per market needs in emerging markets.

Challenges

-

Integrating hybrid valves with legacy systems is challenging due to the need for costly modifications and compatibility adjustments, which can hinder adoption.

One of the key challenges in the Hybrid Valve Market is the integration with legacy systems. Other sectors work with existing, aging infrastructure, and it can be expensive and impractical to retrofit their systems with cutting-edge hybrid valves. Hybrid valves typically need alterations to a facility's existing piping, control systems, or valve setups; these changes tend to contribute to increased downtime, maintenance costs, and installation times. Such a price can also discourage companies from harnessing hybrid valves, notably small to medium-sized businesses that likely have limited budgets. However, due to the advancements in automation & IoT and increasing demand for energy efficiency, the Hybrid Valve Market is booming day by day. In this avenue, a clear trend is visible for retrofitting and upgrading legacy systems to incorporate newer technologies. Hybrid valve solutions that can flexibly adapt to company processes are also being developed by manufacturers and can help to overcome this gap between the previous systems and modern innovations. This trend is anticipated to boost the growth of the market, as it will help industries at the time of technological upgrades to transit smoothly in the new market.

Segmentation Analysis

By Material

The Steel segment dominated with a market share of over 32% in 2023, due to its exceptional strength, durability, and cost-effectiveness, making it a go-to option across diverse industries. Steel valves are incredibly versatile and provide reliable performance even in difficult conditions, which is critical in industries like oil and gas, chemicals, and water treatment. Its low cost, corrosion resistance, and ease of manufacturing also support its extensive use. Steel valves continue to be the valve of choice for both critical infrastructure and industrial applications due to their ability to endure extreme levels of pressure and heat. When used in applications that require robust and high-performance valves, its long service life and low maintenance needs help keep steel at the top of most valve markets, supporting the growth of industries dependent on these features.

By Valve Size

The 6" to 25" valve size segment is a significant player in the hybrid valve market due to its essential role in large-scale industrial applications, particularly in chemical operations, oil and gas pipelines, and power plants. These are used for controlling the flow of fluids, gases, and steam through large pipes and similar systems. Because of their size and capacity, they are perfect for handling the large volumes and pressures usually associated with large infrastructure projects. They play a critical role in the safe, efficient, and controlled handling of materials, bridging the gap between complex systems and keeping operations running smoothly and safely. Growth in this segment is fueled by demand in industries where heavy-duty, reliable valves are needed to manage large-scale, high-stakes operations.

By Industry

The chemicals industry segment dominated with a market share of over 34% in 2023, due to its critical role in controlling complex systems within chemical plants. Hybrid valves are commonly used to control the unique sounds and vibrations that are produced by devices such as centrifuge machines, mixers, high-pressure pumps, and pipes. This functionality is critical to ensure optimal performance and prevent mechanical failures. The growing adoption of hybrid valves for various applications is mainly driven by the need for compliance with strict environmental regulations that require efficient as well as sustainable solutions. Besides, Hybrid valves also enhance operational efficiency further by reducing downtime, and saving in performance as well as maintenance costs. Consequently, the chemicals sector remains an influential force in the hybrid valve market.

Key Regional Analysis

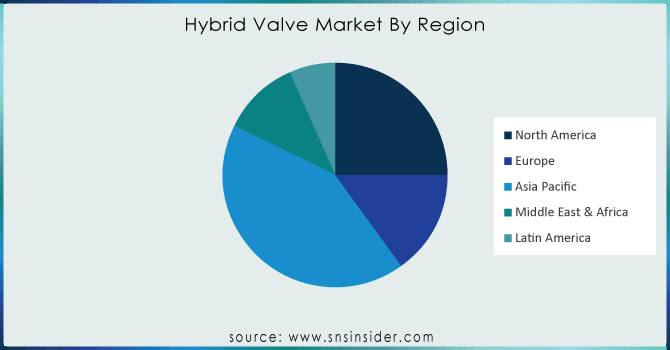

North America region dominated with a market share of over 38% in 2023, primarily driven by the region's robust industrial infrastructure and the presence of leading valve manufacturers. The combination of automation and smart valve solutions, along with technological advancements, has ensured increased regional dominance. Hybrid valves are gaining traction in all of the above-mentioned key industries that range from oil & gas for sectors that require robust flow control, water treatment for smooth flow management, and laptops leading to the water treatment industry for controlling distribution and as well as the chemical processing, where valves are used to count the flow of chemicals under volatile conditions. Moreover, North America also has strict regulations surrounding the use of industrial processes, about safety and quality standards, which favors the use of high-performance hybrid valves, hence further aiding in the region's dominance in the market.

The Asia-Pacific region is the fastest-growing market for hybrid valves, owing to rapid industrialization and persistent infrastructural developments in emerging economies such as China, India, and Japan. Across the globe, these nations experience higher demand from major industries such as power generation, oil & gas, and chemicals that specialize in hybrid valves to increase efficiency and operational safety. Moreover, the increasing implementation of industrial automation and smart systems across the region is driving market growth. With industries upgrading their infrastructure to keep up with demand, advanced valve technologies see more adoption, and Asia-Pacific is poised to be the epicenter of growth in the hybrid valve market.

Need any customization research on Hybrid Valve Market - Enquiry Now

Some of the major key players in the Hybrid Valve Market

-

Emerson Electric Co. (Fisher Valves, Rosemount Valves)

-

Flowserve Corporation (Valtek Valves, Durco Valves)

-

Parker Hannifin Corporation (Autoclave Engineers, Pneumatic Valves)

-

IMI plc (IMI Critical Engineering, IMI Precision Engineering Valves)

-

Swagelok Company (Swagelok Valves, Tube Fittings)

-

Danfoss A/S (Danfoss Industrial Valves, Pressure Relief Valves)

-

Alfa Laval AB (Alfa Laval Butterfly Valves, Globe Valves)

-

Circor International, Inc. (Varec, Anderson Greenwood Valves)

-

Cameron International Corporation (Cameron Valves, Control Valves)

-

Spirax-Sarco Engineering plc (Spirax-Sarco Steam Valves, Pressure Relief Valves)

-

Pentair plc (Valves, Actuators, & Control Systems)

-

Schlumberger Limited (Hydraulic Valves, Oil & Gas Valves)

-

Kitz Corporation (Kitz Ball Valves, Check Valves)

-

Crane Co. (Crane Valves, Bi-Directional Valves)

-

GE Oil & Gas (Geomechanics, Valve Systems)

-

Samson AG (Samson Pressure Regulating Valves, Control Valves)

-

Curtiss-Wright Corporation (Curtiss-Wright Valves, Pressure Relief Valves)

-

KSB Group (KSB Valves, Control & Safety Valves)

-

Valmet (Valmet Control Valves, Valve Solutions)

-

WIKA Group (WIKA Pressure Relief Valves, Industrial Valves)

Suppliers for (Known for its high-quality engineered valves and actuators, IMI excels in providing reliable and efficient hybrid valve solutions for critical industrial applications) on Hybrid Valve Market

-

Emerson Electric Co.

-

IMI plc

-

Trillium Flow Technologies

-

CIRCOR International, Inc.

-

Parcol S.P.A.

-

Koso Kent Introl Pvt. Ltd.

-

Wuxi Smart Auto-Control Engineering Co. Ltd.

-

Chemtrols Emet Pvt. Ltd.

-

Dymet Alloys

-

Carter Process Control GmbH

Recent Development

In May 2024: Emerson introduced the AVENTICS Series 625 Sentronic Proportional Pressure Control Valves, delivering precision control with less than 0.5% deviation, advanced data acquisition software, and a wide range of flow and pressure capabilities for high-accuracy applications.

In May 2023: Dymet Alloys participated in AlSTech 2023, a conference focused on iron and steel technology. The event provided valuable insights into the engineering and technical expertise needed by steel producers, suppliers, and consultants.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.27 Billion |

| Market Size by 2032 | USD 2.23 Billion |

| CAGR | CAGR of 6.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Steel, Tungsten Carbide, Duplex Nickel, Titanium Alloy, Others (Brass, Bronze, and Plastic)) • By Valve Size (Up to 1”, 1” to 6”, 6” to 25”, 25” to 50”, 50” and Larger) • By Industry (Oil & Gas, Energy & Power, Water & Wastewater, Building & Construction, Chemicals, Pharmaceuticals, Agriculture, Metal & Mining, Paper & Pulp, Food & Beverages, Others (Semiconductor, Textile, and Glass)). |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Emerson Electric Co., Flowserve Corporation, Parker Hannifin Corporation, IMI plc, Swagelok Company, Danfoss A/S, Alfa Laval AB, Circor International, Inc., Cameron International Corporation, Spirax-Sarco Engineering plc, Pentair plc, Schlumberger Limited, Kitz Corporation, Crane Co., GE Oil & Gas, Samson AG, Curtiss-Wright Corporation, KSB Group, Valmet, WIKA Group. |