IGBT and Super Junction MOSFET Market Size & Trends:

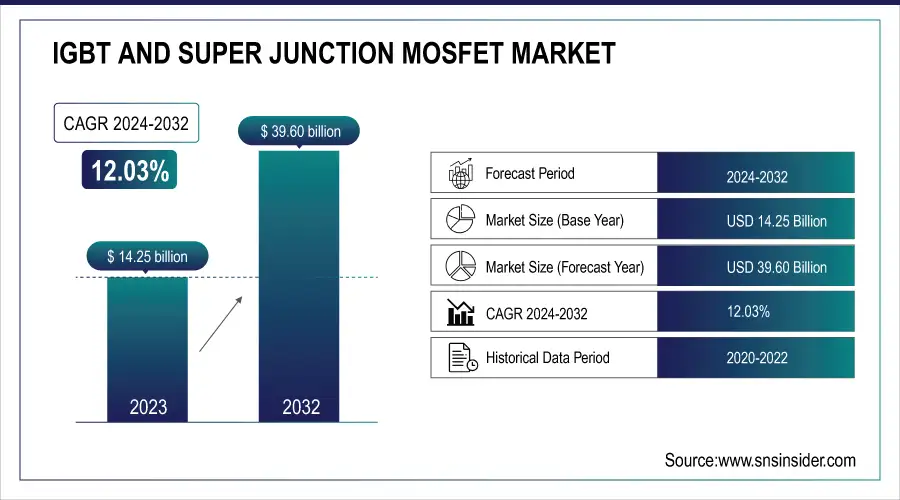

The IGBT and Super Junction MOSFET Market was valued at 14.25 Billion in 2023 and is projected to reach USD 39.60 Billion by 2032, growing at a CAGR of 12.03 % from 2024 to 2032.

Key drivers of this market include the global energy transition and decarbonization efforts, which push for more efficient power conversion technologies. Technological advancements, particularly in materials like SiC (Silicon Carbide) and GaN (Gallium Nitride), continue to boost performance while driving cost reduction strategies and efficiency gains. The adoption of high-performance IGBT and Super Junction MOSFET devices in applications such as renewable energy systems, electric vehicles (EVs), and industrial systems further enhances their demand.

To Get more information on IGBT and Super Junction MOSFET Market - Request Free Sample Report

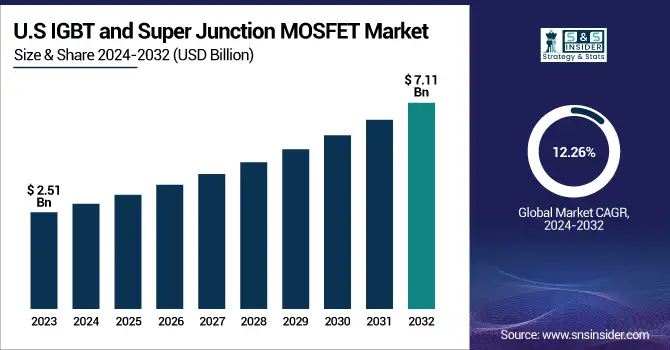

In the U.S., the market was valued at USD 2.51 billion in 2023 and is expected to grow to USD 7.11 billion by 2032, with a CAGR of 12.26%. Manufacturing trends, including the shift toward local production and better supply chain management, also play a significant role in shaping the market’s trajectory.

IGBT and Super Junction MOSFET Market Dynamics:

U.S. tariffs and CHIPS Act boost domestic IGBT and Super Junction MOSFET production by reducing reliance on foreign supply chains.

The U.S. tariff policies and tax incentives under the CHIPS and Science Act are significantly impacting the IGBT (Insulated Gate Bipolar Transistor) and Super Junction MOSFET markets. These power devices are critical for applications like electric vehicles, renewable energy systems, and industrial automation due to their high efficiency and voltage handling. The CHIPS Act promotes domestic semiconductor production by offering tax credits and federal funding, with key investments flowing into states such as Texas, Arizona, and New York. These states are seeing the development of major chip fabrication plants, reinforcing the national strategy to reduce reliance on foreign semiconductor supply chains. ON Semiconductor, for example, is expanding its operations in Arizona to meet the increasing demand for power semiconductors. At the same time, tariffs on Chinese imports may raise costs for silicon and silicon carbide materials key components for IGBTs and Super Junction MOSFETs. While this could challenge manufacturers in the short term, the long-term goal is to strengthen domestic capability and supply chain resilience. These policies are accelerating U.S.-based innovation and production in the power semiconductor space, creating a shift in the global market dynamic and positioning the U.S. as a more self-reliant hub for next-generation power device manufacturing.

Drivers

-

Boosting Energy Efficiency with IGBT and Super Junction MOSFETs in Renewable Energy and Electric Vehicle Applications

The global shift towards renewable energy and electric vehicles (EVs) is significantly driving the demand for energy-efficient power electronics, particularly IGBTs and Super Junction MOSFETs. As sustainability becomes a key priority for industries and governments, the need for components that enhance power conversion efficiency is escalating. Power electronics are critical in renewable energy systems like solar and wind, as well as in electric vehicles, where high efficiency and minimal energy loss are essential. Advancements in Super Junction MOSFETs, such as MDMesh M2 and M6 technologies from STMicroelectronics, are contributing significantly to improved efficiency and power density in these applications. Furthermore, the global push for decarbonization is accelerating the adoption of these power devices, helping industries lower their carbon footprint. In 2022, the U.S. saw a 60% increase in solar and wind power capacity, with solar contributing 46% and wind 17%, demonstrating the growing role of renewable energy in the power grid.

Restraints:

-

Competition from Silicon Carbide Semiconductors Threatens IGBT and MOSFET Market Growth.

Competition from alternative technologies, such as wide-bandgap semiconductors like silicon carbide (SiC), presents a challenge to IGBT and Super Junction MOSFET markets. SiC semiconductors offer superior performance in high-temperature, high-voltage, and high-frequency applications, making them more efficient in power conversion systems. Their ability to handle greater power densities with reduced losses makes them an attractive option for industries like electric vehicles and renewable energy. As a result, SiC technology is rapidly gaining traction, positioning itself as a competitive alternative, especially in sectors requiring higher efficiency and thermal performance. This shift could impact the growth and market share of IGBTs and MOSFETs in these applications.

Opportunities:

-

Industrial Automation and Robotics Driving Demand for IGBTs and MOSFETs in Manufacturing

The increasing adoption of industrial automation and robotics in manufacturing processes has led to a growing demand for efficient power control systems. IGBTs and Super Junction MOSFETs play a pivotal role in ensuring high-performance power conversion, motor control, and energy efficiency in automated machinery and robotic systems. They are essential to the precision and reliability in such applications, including variable speed drive, precise motor control, and high-frequency switching. The ever-growing demand for high-performance power electronics devices will accompany industries' efforts to improve productivity while lowering energy consumption. This trend creates massive opportunities for IGBTs and MOSFETs because they play a big role in the success of contemporary automation technologies, which help industrial systems operate on higher system efficiency, with a faster response time, and reduced energy costs.

Challenges:

-

Thermal Management and Reliability Issues in High-Power Applications

One of the major challenges faced by the IGBT and Super Junction MOSFET market is managing heat dissipation in high-power applications. As these devices operate in increasingly demanding environments such as electric vehicles, renewable energy systems, and industrial automation, the thermal load can lead to device degradation or failure if not managed effectively. High junction temperatures can reduce efficiency and lifespan, resulting in the need for advanced cooling solutions, which add complexity and cost to the overall system. Ensuring long-term reliability while maintaining compact form factors poses a significant engineering hurdle. Additionally, thermal cycling and power surges can further affect performance stability, making robust thermal management strategies essential for sustaining device integrity and operational efficiency. Addressing these issues requires ongoing innovation in packaging, materials, and system integration to support the deployment of power electronics in next-generation energy and mobility solutions.

IGBT and Super Junction MOSFET Market Segment Analysis:

By Type

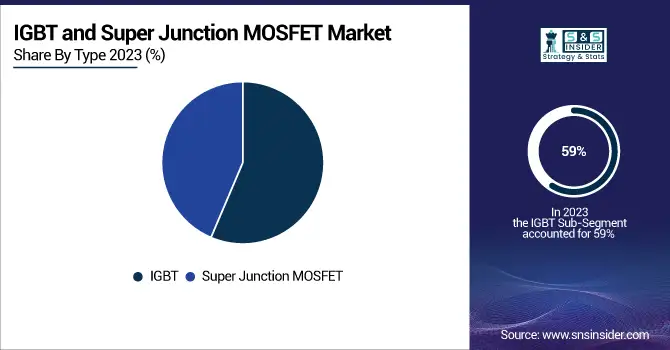

In 2023, the IGBT segment dominated the market by capturing a substantial revenue share of approximately 59%, underscoring its critical role in modern power electronics. This dominance is primarily attributed to its widespread application in high-voltage and high-current scenarios such as electric vehicles (EVs), renewable energy systems, industrial drives, and power supplies. IGBTs combine the high-efficiency and fast-switching features of MOSFETs with the high-current and low-saturation-voltage capability of bipolar transistors, making them ideal for demanding power control applications. Their ability to handle large amounts of power with minimal loss positions them as a preferred choice for manufacturers aiming to improve energy efficiency. Additionally, the growing shift towards electrification in transportation and the expansion of solar and wind energy projects globally have further fueled IGBT adoption. Continuous advancements in IGBT modules, including reduced switching losses and enhanced thermal performance, are expected to sustain their leadership in the market through the forecast period.

The Super Junction MOSFET segment is projected to be the fastest-growing segment in the IGBT and power semiconductor market over the forecast period from 2024 to 2032. This rapid growth is driven by its superior performance in high-voltage and high-frequency applications, particularly in power supplies, chargers, and renewable energy systems. Super Junction MOSFETs offer lower conduction and switching losses compared to conventional MOSFETs, enabling greater efficiency and compact system design. As global energy demands increase alongside the push for miniaturized and energy-efficient devices, manufacturers are adopting Super Junction technology to meet stringent performance and thermal management requirements. Moreover, industries such as electric vehicles, data centers, and industrial automation are increasingly integrating these devices to reduce power losses and improve system reliability. With ongoing R&D efforts and improvements in fabrication techniques, the cost-effectiveness and performance of Super Junction MOSFETs are expected to enhance further, propelling strong market expansion through 2032.

By Application

The Energy and Power segment held the dominant market share of approximately 40% in the IGBT and Super Junction MOSFET market in 2023, driven by the rising demand for efficient power management across energy infrastructure. These components are critical in renewable energy systems such as solar and wind power, where high efficiency, voltage handling, and reliability are essential. As countries continue investing in grid modernization and cleaner energy sources to meet carbon neutrality goals, the need for robust power electronic solutions is growing rapidly. IGBTs and Super Junction MOSFETs enable smooth energy conversion and distribution in power generation, transmission, and storage systems. Moreover, increasing installations of utility-scale solar farms and wind turbines have significantly boosted demand for advanced switching devices that ensure minimal power loss and operational stability.

The Electric Vehicle (EV) segment is projected to be the fastest-growing application in the IGBT and Super Junction MOSFET market from 2024 to 2032. This growth is fueled by the global shift toward sustainable mobility, supported by strong government policies, rising fuel prices, and increasing consumer preference for clean transportation. IGBTs and Super Junction MOSFETs play a vital role in EV powertrains, battery management systems, and charging infrastructure due to their high efficiency, fast switching capabilities, and thermal stability. As automakers scale up EV production and develop next-generation electric drivetrains, the demand for reliable, high-performance power semiconductor components is surging. Additionally, advancements in wide-bandgap device integration are complementing IGBT and MOSFET efficiency in hybrid applications.

IGBT and Super Junction MOSFET Market Regional Outlook:

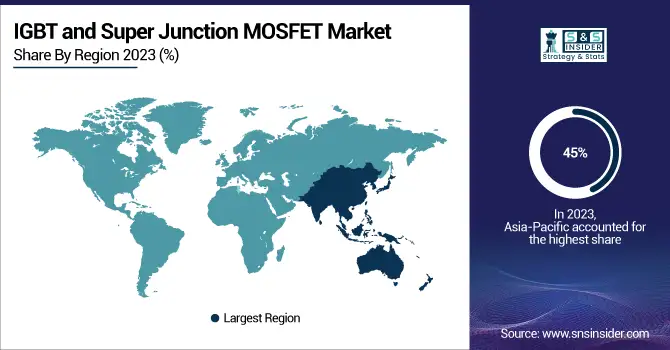

In 2023, the Asia-Pacific region held the largest share in the IGBT and Super Junction MOSFET market, accounting for approximately 45% of the global revenue. This dominance is driven by the region’s strong presence of semiconductor manufacturing hubs, especially in countries like China, Japan, South Korea, and Taiwan. These countries have well-established electronics and automotive industries, which heavily utilize IGBTs and Super Junction MOSFETs for energy, industrial, and electric vehicle applications. The rapid pace of industrialization, growing investments in renewable energy projects, and increasing adoption of electric vehicles across the region have further accelerated the demand for power semiconductor devices. In addition, government initiatives promoting clean energy and e-mobility have fostered local production and innovation in power electronics.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is expected to be the fastest-growing region in the IGBT and Super Junction MOSFET market during the forecast period of 2024–2032. This growth is fueled by increasing investments in electric vehicles, renewable energy infrastructure, and industrial automation. The U.S., in particular, is witnessing a surge in EV production and adoption, supported by federal incentives and state-level mandates for zero-emission vehicles. Additionally, the region's focus on modernizing its power grid and expanding solar and wind energy projects has significantly boosted demand for efficient power semiconductors. Industries across North America are also rapidly adopting automation and robotics, further driving the need for high-performance power devices. Strategic collaborations between technology firms and semiconductor companies, alongside reshoring efforts to strengthen domestic manufacturing capabilities, are expected to contribute to the region’s robust market expansion.

Major Players in IGBT and Super Junction MOSFET Market along with Products:

-

ROHM Co., Ltd. (Japan) – Offers IGBTs, SiC MOSFETs, and power modules.

-

STMicroelectronics (Switzerland) – Provides IGBTs, Super Junction MOSFETs, and power modules.

-

Toshiba Electronic Devices & Storage Corporation (Japan) – Specializes in IGBTs and MOSFETs for power electronics.

-

Infineon Technologies AG (Germany) – Known for IGBTs, MOSFETs, and power modules.

-

Semikron Danfoss (Germany) – Focuses on IGBTs, power modules, and automotive semiconductors.

-

Mitsubishi Electric Corporation (Japan) – Offers IGBTs, MOSFETs, and power semiconductor modules.

-

Fuji Electric Co., Ltd. (Japan) – Provides IGBTs, MOSFETs, and power devices for various applications.

-

StarPower Europe AG (Germany) – Specializes in power semiconductors, including IGBTs and MOSFETs.

-

MACMIC (China) – Known for manufacturing power modules, IGBTs, and MOSFETs.

-

NXP Semiconductors (Netherlands) – Develops MOSFETs, IGBTs, and integrated power management solutions.

List of Suppliers of Raw Materials and Components for IGBT and Super Junction MOSFET Market:

-

Dow Inc. (USA)

-

Sumitomo Chemical Co., Ltd. (Japan)

-

Hitachi Chemical Co., Ltd. (Japan)

-

GlobalWafers Co., Ltd. (Taiwan)

-

Siltronic AG (Germany)

-

Shin-Etsu Chemical Co., Ltd. (Japan)

-

China Northern Rare Earth Group High-Tech Co., Ltd. (China)

-

Lynas Corporation (Australia)

-

Tokyo Electron Limited (Japan)

-

Lam Research (USA)

-

KYOCERA Corporation (Japan)

-

Amkor Technology (USA)

Recent Development:

-

Apr 16, 2025, Infineon Technologies unveils new EDT3 and RC-IGBT chips for electric vehicles, enhancing performance with 20% lower energy losses and extended range. These devices are designed for high-efficiency, high-voltage applications in EV powertrains, supporting sustainable and cost-effective driving experiences.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.25 Billion |

| Market Size by 2032 | USD 39.60 Billion |

| CAGR | CAGR of 12.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(IGBT(Discrete IGBT, IGBT Module), Super Junction MOSFET(Discrete Super Junction MOSFET, Super Junction MOSFET Module)) • By Application (Energy and Power, Consumer Electronics, Inverter and UPS, Electric Vehicle, Industrial System, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ROHM Co., Ltd. (Japan), STMicroelectronics (Switzerland), Toshiba Electronic Devices & Storage Corporation (Japan), Infineon Technologies AG (Germany), Semikron Danfoss (Germany), Mitsubishi Electric Corporation (Japan), Fuji Electric Co., Ltd. (Japan), StarPower Europe AG (Germany), MACMIC (China), NXP Semiconductors (Netherlands). |