Battery Management System Market Report Scope and Overview:

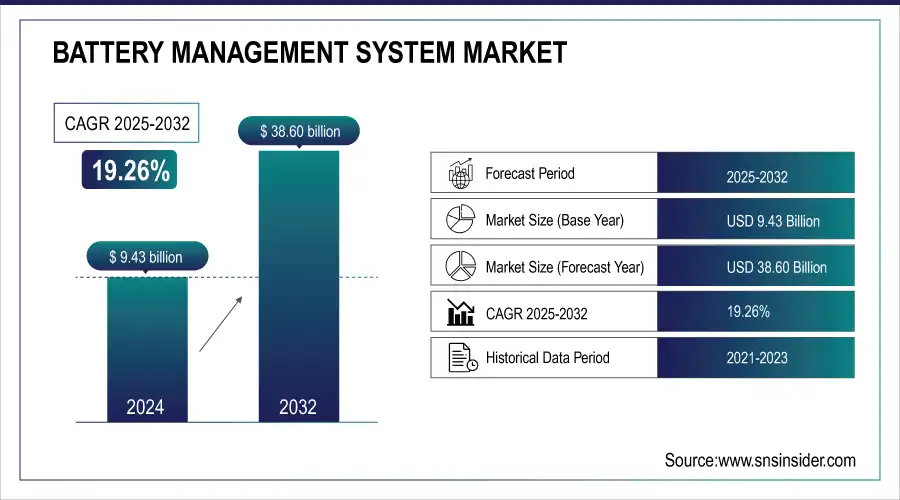

The Battery Management System Market size was valued at USD 9.43 Billion in 2024. It is estimated to reach USD 38.60 Billion by 2032, growing at a CAGR of 19.26% during 2024-2032.

Get More Information on Battery Management System Market - Request Free Sample Report

The battery management system (BMS) market has experienced notable expansion recently due to the increasing need for effective energy storage and the growing usage of EVs, renewable energy systems, and portable electronics. The BMS oversees and controls a range of factors like voltage, current, temperature, and state of charge (SoC) to avoid problems such as excessive charging, excessive discharging, and overheating. As the interest in renewable energy sources such as solar and wind grows, there is a rising demand for effective energy storage options. In the U.S., there has been a notable increase in government funding for renewable energy storage, aimed at improving energy security and sustainability. The Inflation Reduction Act (2022) invested USD 369 billion in climate and energy initiatives, such as vital tax credits and incentives for energy storage setups. In fiscal year 2023, the Department of Energy (DOE) has allocated around USD 5 billion for energy storage research, development, and demonstration projects. Moreover, USD 3 billion was dedicated to enhancing domestic capabilities in battery manufacturing and recycling. BMS plays a crucial role in maintaining the effectiveness and lifespan of such storage systems, particularly in extensive solar farms and wind power setups. Through the optimization of battery performance, BMS allows for more dependable and eco-friendly energy grids, making it easier to incorporate renewable energy sources into the overall power supply.

Battery Management System Market Size and Forecast:

-

Market Size in 2024: USD 9.43 Billion

-

Market Size by 2032: USD 38.60 Billion

-

CAGR (2025–2032): 19.26%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Battery Management System Market Highlights:

-

BMS ensures efficient operation of devices like smartphones, laptops, and wearables. Companies like Qualcomm integrate BMS in chipsets to monitor battery status, optimize performance, and maintain safety

-

Strict safety regulations for lithium-ion batteries and government investments, such as California’s USD 300 million allocation for battery storage in 2023, are driving BMS adoption globally

-

Increased use of solar and wind energy creates a higher demand for energy storage systems. BMS monitors large-scale battery arrays, manages charge and discharge cycles, prevents issues like overcharging, and ensures reliable power supply

-

Rising global electric vehicle demand, driven by incentives and emission regulations, boosts BMS market growth. BMS enhances battery performance, safety, lifespan, and efficiency for automotive energy storage systems

-

Implementing BMS across diverse battery technologies and applications is complex. Compatibility with inverters, battery packs, and energy management systems requires customization, increasing development time and costs

-

Continuous software and firmware updates are necessary to maintain optimal BMS performance, adding to operational complexity for adopters

The BMS in consumer electronics guarantees the efficient operation of devices such as smartphones, laptops, and wearable technology. For example, Qualcomm incorporated their BMS technology into their Snapdragon chipsets to constantly track the status of the battery. These systems are created to manage battery life and performance, maximizing power usage while maintaining the devices' functionality. Strict safety regulations, particularly regarding the transportation of lithium-ion batteries, are also influencing the BMS market. In 2023, California allocated approximately USD 300 million towards battery storage initiatives, enabling progress in BMS development. Governments globally are encouraging the transition to electric transportation and clean energy, leading to increased adoption of BMS in various sectors due to regulatory backing.

Battery Management System Market Drivers:

-

The renewable energy sector is seeing an increased need for effective battery monitoring.

The rise in usage of renewable energy sources like solar and wind has led to an increased need for energy storage options, further fueling the growth of the BMS market. Renewable energy sources have natural disruptions, and effective energy storage is important for maintaining dependable and steady power output. Battery storage systems are being incorporated into renewable energy systems to store extra energy produced during periods of high production and release it during times of increased demand or reduced renewable generation. The monitoring and optimization of large-scale battery storage systems rely on BMS to ensure safe and efficient operation. Energy storage is increasingly important in the shift towards renewable energy as the world aims to reduce carbon emissions. Significant funds are being allocated towards grid-scale battery storage solutions to bolster the increasing presence of renewable energy in power grids. Governments and energy companies are more and more utilizing these systems to manage supply and demand, lessen dependence on fossil fuels, and strengthen grid resilience. BMS allows energy storage systems to effectively control extensive battery arrays, oversee charge and discharge cycles, and avoid problems like thermal runaway, overcharging, or deep discharging. The increasing request for incorporating renewable energy will drive the market forward as the demand for advanced battery management systems grows.

-

The surge in electric vehicle adoption is driving demand for advanced battery management systems.

The growing trend worldwide towards electric vehicles (EVs) is a key factor in driving the Battery Management System (BMS) market. With an increase in strict emissions regulations and incentives for buying EVs, the demand for electric vehicles has sharply risen. BMS is crucial in electric vehicles as it oversees battery charging and discharging, enhances performance, and guarantees battery pack safety and lifespan. The effectiveness of battery management is crucial for the performance of energy storage systems in electric vehicles. BMS guarantees efficient power utilization, prevents overcharging, and safeguards batteries from undue damage. In turn, it prolongs the life of the battery and sustains the efficiency needed for electric vehicles to fulfill performance and range requirements. The electric vehicle market is expanding quickly with large car makers deciding to create more electric models and nations such as Norway, the UK, and China enforcing strong measures to eliminate traditional engine vehicles. This increase is driving up the need for more advanced BMS solutions that can meet the changing requirements of electric vehicle batteries, like higher capacity and quicker charging speeds.

Battery Management System Market Restraints:

-

Challenges in integrating battery management systems (BMS) into diverse technological environments.

Integrating Battery Management Systems into existing systems and technologies can be complex and challenging. BMS solutions need to interface seamlessly with various other components, such as battery packs, inverters, and energy management systems. This integration requires meticulous planning and customization to ensure compatibility and optimal performance. The complexity of integration is heightened by the diversity of battery technologies and configurations, which vary widely between applications such as Automotive electronics, automotive, and renewable energy storage. Each application may have different requirements for voltage, capacity, and communication protocols. As a result, BMS solutions must be tailored to specific use cases, increasing the complexity of the integration process.

Furthermore, the need for continuous updates and maintenance of BMS software and firmware adds to the complexity. Integration challenges can lead to increased development time, higher costs, and potential delays in product launches, which can be a deterrent for potential adopters.

Battery Management System Market Segment Analysis:

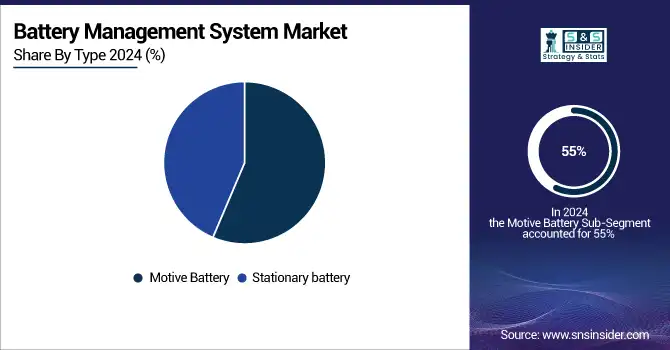

By Type

The motive battery segment held a major market share of 55% and led the market in 2024. The quick acceptance of electric vehicles (EVs), forklifts, and other industrial machinery that need efficient battery management is fueling this growth for optimal performance and safety. Manufacturers must invest in reliable battery management systems for motive batteries used in mobile applications to improve battery life, prevent overcharging, and monitor real-time performance. For instance, Tesla utilizes BMS in their electric vehicles to oversee sizeable lithium-ion battery packs.

The stationary battery segment is to experience a rapid growth rate during the forecast period. Stationary batteries are mainly utilized for backup power, grid energy storage, and renewable energy systems. The growing need for reliable power supply, along with rising investments in renewable energy infrastructure, has increased the demand for efficient BMS in this sector. Samsung SDI utilizes BMS in energy storage systems for managing large-scale stationary battery operations, whereas Schneider Electric integrates BMS into uninterruptible power supplies to guarantee power reliability in critical operations.

By Battery Type

Lithium-ion batteries dominated in 2024 with over 40% market share, due to their high energy density, lightweight, and long cycle life. Due to their effectiveness and dependability, they are extensively utilized in Automotive electronics, electric vehicles (EVs), and renewable energy storage. For example, Panasonic is an important player using lithium-ion technology in their Automotive electronics. Similarly, Tesla's electric cars and energy storage options, like the Powerwall, utilize cutting-edge lithium-ion batteries for top-notch performance and durability. The sophisticated management systems in these batteries guarantee top-notch performance and safety, making them the favored option in many uses.

The lead-acid batteries are expected to experience a faster CAGR during 2025-2032, because of their affordability and durability, especially for backup power and automotive uses. They are becoming more and more common in UPS and grid energy storage systems. Exide Technologies specializes in high-performance lead-acid batteries for automotive and industrial use, whereas Johnson Controls is improving lead-acid battery technology for automotive and renewable energy purposes.

By Topology

Centralized topology BMS led the market with a 45% market share in 2024. This centralized method enables the effective collection of data and consistent control of battery aspects like voltage, temperature, and charge/discharge cycles. The centralized system is commonly chosen for its simple design and implementation, which makes it cost-efficient and simpler to upkeep. For example, LG Chem uses centralized systems in its extensive energy storage solutions to simplify management and control.

Modular topology BMS is accounted to have the fastest growth rate during 2025-2032. This methodical strategy provides increased scalability and flexibility, enabling more accurate monitoring and control over individual battery cells or cell clusters. Modular BMS are very useful in situations that need a high capacity or intricate setups, as they can be easily expanded or modified to meet specific requirements. Samsung SDI utilizes a modular battery management system in its renewable energy storage systems with high capacity, enabling flexible and customizable solutions.

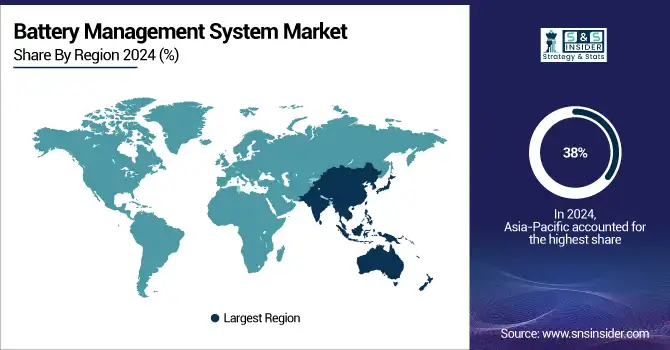

Battery Management System Market Regional Analysis:

Asia-Pacific Battery Management System Market Trends:

Asia-Pacific dominated in 2024 with a 38% market share, due to the quick growth of EV manufacturing and increased use of renewable energy, especially in China, Japan, and South Korea. China is at the forefront of electric vehicle manufacturing, with companies such as BYD, CATL, and NIO making significant investments in BMS technology for both automotive and energy storage purposes. Moreover, countries such as India are also committing resources to electric transportation and grid energy storage, which is driving the growth of the BMS market in the area.

Need any customization research on Battery Management System Market - Enquiry Now

North America Battery Management System Market Trends:

North America is accounted to have a rapid CAGR during 2025-2032, because of the widespread use of electric vehicles (EVs), renewable energy options, and well-known car companies. The U.S. and Canadian governments offer incentives and tax benefits for EV production, which boosts demand for BMS. The strong technology environment in the region, involving companies such as Tesla, Ford, and General Motors, actively integrating advanced BMS into EVs and energy storage systems, enhances the market even more. Moreover, North America is at the forefront of battery technologies for grid energy storage and telecommunications, with utilization by companies like Johnson Controls and Nuvation Energy.

Europe Battery Management System Market Trends:

Europe is driven by emission regulations, EV expansion, and renewable energy adoption. Germany, France, and Norway lead in market penetration, with Volkswagen, BMW, and Siemens advancing BMS technology for automotive and energy storage applications.

Latin America Battery Management System Market Trends:

Latin America’s BMS market grows due to rising EV adoption, renewable energy deployment, and lithium production. Brazil and Chile are key markets, driven by investments in energy storage and automotive applications.

Middle East & Africa Battery Management System Market Trends:

MEA is expanding BMS adoption through renewable energy projects, smart grids, and urban EV deployment, particularly in UAE and Saudi Arabia, supporting long-term market growth.

Battery Management System Market Key Players:

-

Sensata Technologies, Inc. (Lithium Balance n3-BMS, i-BMS Battery Management System)

-

NXP Semiconductors (MC33771C Battery Cell Controller, MC33772C Battery Cell Controller)

-

Renesas Electronics Corporation (ISL78600 Multi-cell Battery Monitor, ISL78714 Li-ion Battery Management IC)

-

Analog Devices Inc. (LTC6813 High Voltage Battery Monitor, AD7280A Multicell Battery Stack Monitor)

-

Texas Instruments Incorporated (BQ76952 Battery Monitor, BQ34Z100-G1 Battery Fuel Gauge)

-

STMicroelectronics (L9963 Battery Management IC, L9960 BMS Gate Driver)

-

Leclanché SA (Leclanché BMS V2, Leclanché Gen 2 BMS)

-

Nuvation Energy (Nuvation Low-Voltage BMS, Nuvation High-Voltage BMS)

-

Elithion Inc. (Elithion Lithiumate Pro, Elithion Lithiumate Lite)

-

Eberspacher Gruppe GmbH & Co. KG (Eberspacher BMS Compact, Eberspacher BMS Pro)

-

Infineon Technologies AG (TLE9012AQU Battery Monitoring IC, TLE9015DQU Isoface Transceiver IC)

-

Exponential Power (Exponential Power BMS Flex, Exponential Power Advanced Lithium BMS)

-

Bosch Group (Bosch Automotive BMS, Bosch Energy Storage BMS)

-

LG Chem / LG Energy Solution (LG BMS for EV Batteries, LG Stationary Energy Storage BMS)

-

Samsung SDI (Samsung BMS for EVs, Samsung ESS BMS)

-

CATL (Contemporary Amperex Technology Co.) (CATL Cell Management System, CATL Smart BMS)

-

BYD Company Ltd. (BYD BMS for Electric Vehicles, BYD Energy Storage BMS)

-

Panasonic Corporation (Panasonic Automotive BMS, Panasonic Stationary BMS)

-

VARTA AG (VARTA Lithium BMS, VARTA Smart Battery System)

-

Johnson Controls International (JCI Energy BMS, JCI Automotive Battery Management Solutions)

Battery Management System Market Competitive Landscape:

Hyundai Motor Company: Hyundai Motor, headquartered in South Korea, is a leading global automaker known for its wide range of passenger vehicles, electric vehicles (EVs), and commercial vehicles. The company focuses on innovation, sustainability, and advanced mobility solutions, including investments in electric powertrains, autonomous driving, and connected car technologies.

Kia Corporation: Kia, a South Korean automotive company and part of Hyundai Motor Group, designs and manufactures passenger cars, SUVs, and EVs. Renowned for stylish designs, reliability, and innovative technology, Kia emphasizes electric mobility, smart vehicle features, and sustainability initiatives to strengthen its global automotive presence

-

August 2024: Hyundai Motor and Kia announced their initiatives to enhance the safety of their vehicles by improving hardware and software. The automakers shared the development of a safer battery management system which is based on the experience of 15 years and efforts in research and development.

Infineon Technologies AG is a German semiconductor company specializing in automotive, industrial, and security solutions. The company develops microcontrollers, power semiconductors, sensors, and security ICs, enabling energy-efficient mobility, renewable energy applications, and secure digitalization. Infineon focuses on innovation in electric vehicles, industrial automation, and IoT technologies, serving global markets with cutting-edge solutions that drive efficiency, safety, and sustainability.

-

May 2024: Infineon declared the new product, a highly integrated MCU that is high voltage-tolerant to enhance and simplify the battery management capabilities of the automotive. Battery health and management are vital for the longevity and operation of electric vehicles and software-defined.

Schneider Electric is a global leader in energy management and automation, headquartered in France. The company provides solutions for power distribution, industrial automation, smart buildings, and energy efficiency. Schneider Electric focuses on sustainability and digital transformation, offering software, hardware, and services that optimize energy usage, enhance operational efficiency, and support renewable energy integration across residential, commercial, and industrial sectors worldwide.

-

May 2024: Schneider Electric proposed the battery energy storage system that would serve as the base of the fundamental, fully integrated microgrid solution of the firm.

NXP Semiconductors is a Dutch semiconductor company specializing in automotive, industrial, and IoT solutions. The company develops microcontrollers, processors, connectivity chips, and security solutions that enable smart, connected devices. NXP focuses on innovation in automotive electronics, secure identification, and edge processing, supporting global digitalization, energy efficiency, and advanced mobility applications across various industries.

-

August 2023: NXP Semiconductors announced the availability of an advanced battery management solution that works with the firm’s S32K39 microcontroller and is designed to maximize power delivery in electric vehicles. The solution focuses on increasing the safety, efficiency, and life of the EV batteries.

Analog Devices, Inc. is a U.S.-based semiconductor company specializing in high-performance analog, mixed-signal, and digital signal processing (DSP) technologies. The company develops sensors, converters, amplifiers, and signal processing solutions for applications in industrial, automotive, communications, and healthcare sectors. Analog Devices focuses on innovation in data conversion, signal conditioning, and precision measurement to enable smarter, more connected, and energy-efficient systems worldwide.

-

April 2023: Analog Devices announced the advanced BMS platform that will increase the dependability and energy density of the batteries in electric vehicles. The system consists of a wireless BMS that does not require traditional wiring and simplifies the battery system in the vehicle, also reducing its weight.

Texas Instruments (TI) is a U.S.-based semiconductor company that designs and manufactures analog and embedded processing products. TI provides microcontrollers, processors, sensors, and analog ICs used across automotive, industrial, communications, and consumer electronics sectors. The company focuses on innovation, energy efficiency, and connectivity solutions, enabling smarter electronics, advanced signal processing, and sustainable technology applications worldwide.

-

January 2023: Texas Instruments unveiled a BMS device BQ79731-Q1 designed for high-voltage applications for the automotive industry. The product has built-in a sophisticated algorithm to ensure proper battery state estimation monitoring voltage, current, and temperature of the battery pack.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.43 Billion |

| Market Size by 2032 | USD 38.60 Billion |

| CAGR | CAGR of 19.26% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Motive Battery, Stationary battery) • By Battery Type (Lithium-ion, Lead-acid, Nicked-based, Others) • By Topology (Centralized, Modular, Distributed) • By Application (Automotive, Industrial, Renewable energy, Telecommunications, Military and Defense, Other) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Sensata Technologies, Inc., NXP Semiconductors, Renesas Electronics Corporation, Analog Devices Inc., Texas Instruments Incorporated, STMicroelectronics, Leclanché SA, Nuvation Energy, Elithion Inc., Eberspacher Gruppe GmbH & Co. KG, Infineon Technologies AG, Exponential Power, Bosch Group, LG Chem / LG Energy Solution, Samsung SDI, CATL (Contemporary Amperex Technology Co.), BYD Company Ltd., Panasonic Corporation, VARTA AG, Johnson Controls International |