Immune Health Supplements Market Size & Trends:

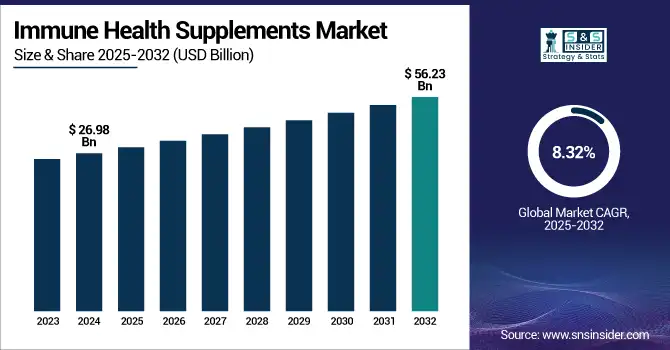

The Immune Health Supplements Market size was valued at USD 26.98 billion in 2024 and is expected to reach USD 56.23 billion by 2032, growing at a CAGR of 8.32% over the forecast period of 2025-2032.

To Get more information on Immune Health Supplements Market - Request Free Sample Report

The immune health supplements market is experiencing strong growth as a result of increasing health consciousness, growing emphasis on preventive medicine, and the rising incidence of lifestyle and infectious diseases. Buyers are taking greater recourse to vitamins, minerals, probiotics, and botanicals to boost immunity, particularly in the post-pandemic period. Rising e-commerce platforms and the need for clean-label, plant-based solutions are also fueling market growth. Advances in supplement technology and personalized nutrition are also driving the market's consistent upward trend.

The U.S. immune health supplements market size was valued at USD 8.43 billion in 2024 and is expected to reach USD 17.44 billion by 2032, growing at a CAGR of 9.57% over the forecast period of 2025-2032. U.S. leads the North American immune health supplements market due to its possession of a superior healthcare infrastructure, enhanced consumer knowledge, and ample demand for prevention-driven health solutions. The leading makers of dietary supplements and a well-entrenched web-based channel make the nation the market leader as well.

For instance, as per NCBI, a large percentage of the U.S. population has nutrient deficiencies in some of the most important immune-boosting vitamins and minerals. Statistics indicate that 45% are deficient in vitamin A, 46% in vitamin C, 95% in vitamin D, 84% in vitamin E, and 15% in zinc, according to the percentage of people below the Estimated Average Requirement (EAR).

Supplements have been demonstrated to minimize these gaps, and lower levels of inadequacy have been noted among those consuming supplements. Due to the continuing and expanding shortage of these important nutrients, especially those key to immune system function, public health policy must include recommendations for ensuring adequate intake of supplements.

Immune Health Supplements Market Dynamics

Drivers

-

Growing Health Awareness Driving the Market Growth

Increased consciousness among consumers regarding the need to have a healthy immune system has been the key driver of the immune health supplements market. Due to heightened concern regarding lifestyle diseases, environmental aspects, and the general decline in health, more consumers are now opting for supplements to improve their immunity. For instance, as per a survey conducted by the National Center for Complementary and Integrative Health (NCCIH), nearly 60% of Americans consume some type of dietary supplement, with immune-boosting supplements being one of the most frequently requested. Health-conscious people are more experience to opt for preventive approaches such as supplements instead of waiting to cure diseases once they have developed. The market for vitamin C, zinc, and probiotics, which find broad use in immunosupport, has also increased substantially in the past few years. With consumers increasingly informed about the importance of nutrition in preventing disease, health consciousness will continue to drive the immune health supplements market growth.

-

The Growing Aging Population is Propelling the Market Growth

The aging population globally is one of the major drivers of the growing demand for immune health supplements market trends. With age, the immune system of a person becomes weaker, and they become more prone to diseases and infections. This population change is a significant driver of the growth of immune-boosting supplements, as older people try to preserve their immune system. For instance, based on the United Nations statistics, by 2030, a sixth of the globe's population will be 60 years old or more, which will be a strong call for supplements that can aid in immune system support at this age. The US population above age 65 years is also anticipated to hit close to 95 million in the year 2060, with this older segment of people further relying on immune health supplements such as vitamin D, probiotics, and omega-3 fatty acids for stronger immune functions. This surge in the aged segment will, therefore, boost the immune health supplement market.

Restraint

-

Lack of Scientific Validation is Restraining the Market Growth.

Most immune health supplements sold in the market are marketed with little clinical proof of their effectiveness. This fuels doubt among consumers and medical professionals, particularly regarding products that exaggerate health benefits. Regulatory bodies such as the FDA do not preapprove dietary supplements before sale, which results in variability in quality and effectiveness, potentially hindering consumer confidence and uptake and restraining the immune health supplements market analysis.

Immune Health Supplements Market Segmentation Analysis

By Product

In 2024, the vitamin and mineral supplements segment dominated the global immune health supplements market with a 38.60% market share. This was due to the general acceptance of the essential nutrients, including vitamins C, D, B complex, and minerals zinc and selenium, for their ability to enhance immunity. The growing demand for immunity boosters among consumers, particularly following the COVID-19 pandemic, has driven the segment immensely. The established health benefits and widespread availability of these supplements have also strengthened their market leadership. The herbal supplements segment is expected to grow at the highest rate in the market through the forecast period.

The herbal supplements market is expected to record the fastest growth of all segments of the market throughout the forecast period. The reason behind this growth is rising consumer demand for organic and natural products and a growing preference for plant-based and traditional treatments. Herbal supplements are seen to improve the immune health of the body without negative side effects and hence are a preferable option over synthetic ones. Increased population of vegans and the inclination towards holistic health remedies also support the growth of the segment at a high rate.

By Formulation

In 2024, the capsules segment dominated the market with a 35.56% market share. This is attributed to many factors, including convenience, ease of consumption, precision dosage, and longer shelf life compared to forms such as powders and liquids. Capsules are also preferred by consumers due to their portability and the ability to cover up the taste of some ingredients. In addition, capsules can hold different forms of active ingredients and provide targeted or controlled release for the improvement of the bioavailability and absorption of nutrients. Such aspects make capsules the manufacturer's as well as the consumer's first choice in the immune health supplement market.

The tablets segment is expected to exhibit the fastest growth in the market over the forecast period. This expansion is fueled by the cost-effectiveness, ease of production, and longer shelf life. Tablets present exact dosing and are more stable than capsules, especially in humid conditions, and are thus ideal for mass production and distribution. They are strong, affordable, and can hold more dosages, making them more popular by the day. With producers turning their attention towards producing tablets to match the increasing demand for ease of use and reliability in forms of supplements, the market for tablets is exhibit to rise dramatically in the future.

By Source Type

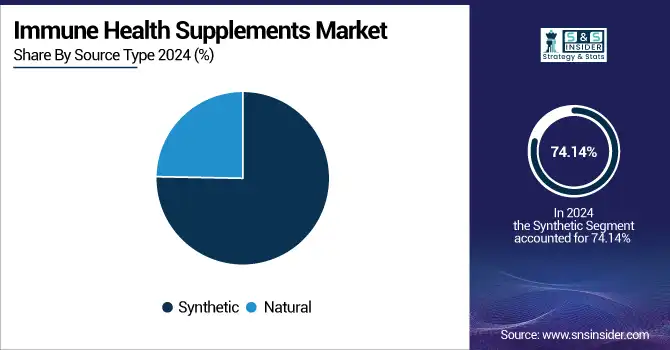

Synthetic segment dominated the immune health supplements market share of 74.14% in 2024 on account of its affordability, assured quality, and ability to produce on a large scale. Synthetic supplements have precise formulation and standard dosing, hence preferred by both customers and producers, looking for consistent and cheap alternatives. Synthesizing such supplements in controlled environments ensures that they are free from contaminants and remain pure, hence very popular in the market.

The natural segment is expected to grow at the fastest rate in the market over the forecast period, with 10.16% CAGR. This growth is fueled by growing consumer interest in natural immune health products and organic products, as well as an increasing trend towards plant-based and traditional remedies. Consumers view natural supplements to boost the body's immune health without any side effects, thus presenting a popular choice over synthetic alternatives. An increase in the population base of vegans and a global shift towards organic health solutions are also responsible for the growth in the segment.

By Mode of Medication

In 2024, the self-medication segment dominated the immune health supplement market with 62.43% market share. Its dominance is due to the increase in consumer willingness to use non-prescription OTC products. Consumers are also looking for prevention-oriented wellness measures, and since supplements such as vitamins C, D, and zinc are easy to find across pharmacies, groceries, and web platforms, such a trend is being supported easily. The COVID-19 outbreak sped up the transition further, as people endeavored to enhance their immune systems on their own.

The prescription segment is anticipated to register the fastest rate of growth in the forecast period. The growth is attributed to rising awareness amongst healthcare providers regarding the advantages of customized, physician-monitored supplementation. Healthcare practitioners are prescribing specific supplements to diagnosed deficits or states, a more targeted and effective means of supporting immune wellness. With an ever-more health-conscious population seeking professional guidance, demand for prescription-strength immune wellness supplements will grow.

By Distribution Channel

In 2024, the offline segment dominated the global immune health supplements market with a 65.5% market share. This leadership is based mainly on the availability of drug stores and pharmacies everywhere, which are reliable sources for healthcare and nutrition products. Individuals prefer to buy supplements at physical stores due to the convenience of immediate availability, the ease of consulting expert staff, and the opportunity to personally examine products. Further, supermarkets and hypermarkets carry a wide range of products, and hence, they are one-stop stores for customers who seek immune health supplements. Ease of access and established trust in offline retailing contribute to their market dominance.

The online distribution channel is expected to grow at the fastest rate in the market over the forecast period. This expansion is driven by the increasing adoption of e-commerce platforms, which offer customers home shopping convenience, a wide product variety, and competitive prices. The COVID-19 pandemic accelerated the shift to online shopping, and this trend remains strong as consumers search for the convenience and security of purchasing supplements online. E-commerce websites provide detailed product information, customer ratings, and door-to-door delivery, contributing to the convenience of shopping overall and being the driving force for the rapid growth of the online channel.

Regional Insights

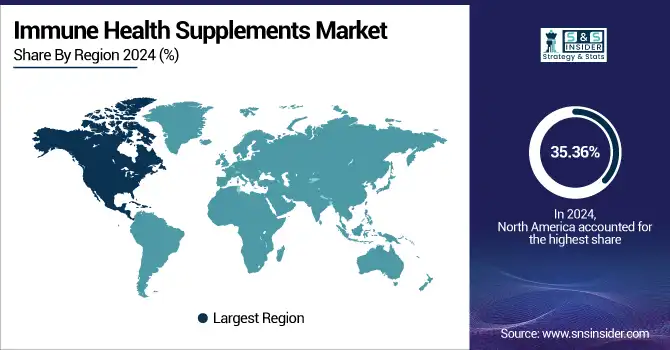

North America led the market with a 35.36% market share in 2024 is driven by high levels of health awareness, supportive regulatory environments, and prevalent incidence of lifestyle diseases and chronic ailments. American and Canadian consumers increasingly invest in preventive care, and there is pervasive use of vitamins, probiotics, and herbal immune boosters. The region has strong distribution channels, e-commerce, and retail pharmacies, and a presence of big nutraceutical companies with a focus on innovation, clean-label offerings, and personalized nutrition, which ensures market leadership. Asia Pacific is the fastest-growing region in the immune health supplement market with a 10.33% CAGR over the forecast period as a result of urbanization, growing disposable income, and rising awareness of immunity-enhancing products. The nations such as China, India, and Japan are also experiencing an uptrend in the demand for traditional and contemporary supplements, particularly herbal and plant-based products. Growth is also facilitated by an increase in online retail channels, governmental efforts towards well-being and health, and the popularity of traditional systems of medicine such as Ayurveda and Traditional Chinese Medicine (TCM), which is creating the region as a hub of future market growth.

Europe is experiencing growth in the market as a result of increasing health awareness, an aging population, and high demand for natural products. Consumers are becoming more interested in preventive solutions, particularly in the post-COVID-19 era, driving demand for clean-label supplements.

For instance, according to NIH, the European Society for Clinical Nutrition and Metabolism informs us that inadequate intakes or status of some micronutrients, such as vitamins A, E, B6, and B12; zinc; and selenium, are linked with poorer clinical outcomes in individuals with viral infections. If supplementation is required, vitamin and mineral supplementation can be used to increase intakes to a level recommended. Routine supplementation with micronutrients, however, in the absence of deficiency, is experienced to have little impact on preventing or treating individual infections, which is driving the market growth in the European region.

Germany is experiencing robust growth in the market, driven by increasing consumer focus on preventive wellness and healthcare. A major segment of the population, especially the aged, actively seeks immunity-boosting supplements due to enhanced health awareness and fear of chronic diseases.

In Latin America, the market is growing with increasing emphasis on preventive healthcare and the increasing incidence of chronic diseases. There is increasing demand from consumers for supplements that can boost immunity and general well-being. The demand for herbal supplements is significantly growing as consumers show a preference for natural and plant-based supplements. Argentina and other nations are expected to see major growth, driven by growing health awareness and the inclination towards better lifestyles.

The MEA region is experiencing moderate growth in the immune health supplements market, driven by increased awareness towards preventive healthcare and the growing incidence of lifestyle disorders. Consumers are increasingly relying on supplements as a means to improve immunity and fill nutritional gaps. The market is also gaining strength from the growing popularity of herbal supplements, which are seen as natural, safe, and non-invasive choices. Saudi Arabia and other countries are projected to see significant growth due to government policies that encourage health and wellness.

Get Customized Report as per Your Business Requirement - Enquiry Now

Immune Health Supplements Market Key Players

The immune health supplements market companies include Nature's Way, NOW Foods, Garden of Life, Thorne Research, Nordic Naturals, Solaray, Pure Encapsulations, MegaFood, Jarrow Formulas, Life Extension, and other players.

Recent Developments in the Immune Health Supplements Market

-

March 2024 – Nestlé Health Science's Garden of Life brand added to its sports nutrition line with the introduction of new products that are both USDA Organic Certified and Non-GMO Project Verified. The products are developed with ingredients designed to provide additional health benefits, such as promoting skin health, digestive health, and weight management.

-

August 2024 – MegaFood launched a new range of Superfood Mushroom supplements. These products are produced solely with 100% fruiting body mushrooms and are free from mycelium-on-grain fillers, ensuring purity and potency.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 26.98 Billion |

| Market Size by 2032 | USD 56.23 Billion |

| CAGR | CAGR of 9.67% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Vitamin & Mineral Supplements, Amino Acids, Omega-3 Fatty Acids, Herbal Supplements, Probiotic Supplements, Others) • By Formulation (Capsules, Tablets, Powder, Liquid, Softgels, Others) • By Source Type (Natural, Synthetic) • By Mode of Medication (Prescription-based, Self-medication) • By Distribution Channel (Offline, Online) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Nature's Way, NOW Foods, Garden of Life, Thorne Research, Nordic Naturals, Solaray, Pure Encapsulations, MegaFood, Jarrow Formulas, Life Extension, and other players. |