Dietary Supplements Market Report Scope & Overview:

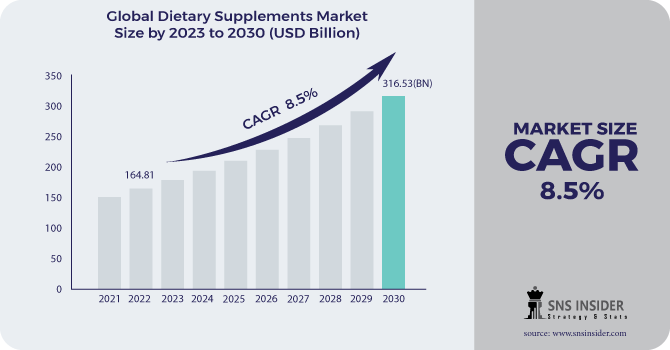

Dietary Supplements Market size was esteemed at USD 164.81 billion out of 2022 and is supposed to extend at an accumulated yearly development rate (CAGR) of 8.5% from 2023 to 2030 and reach USD 316.53 Billion by 2030.

Dietary supplements are substances that help buyers in driving a sound way of life by giving fundamental supplements and by bringing down dangers of medical issues like joint inflammation or osteoporosis. Famous dietary supplements contain strands, minerals, for example, iron spices like garlic and echinacea, amino acids, compounds, and nutrients like vitamin D and B12, and are accessible in various structures like tablets, pills, powders, cases, concentrates, and fluids.

Get More Information on Feed Flavors and Sweeteners Market - Request Sample Report

Expanding mindfulness among buyers concerning individual wellbeing and health is supposed to drive the development of the dietary supplements market during the conjecture time frame Dietary supplements can be taken at explicit spans and can be remembered for dinners to enhance day-to-day nourishing prerequisites of the body.

Market Dynamics:

Driving factor:

-

Change in shopper inclination because of expansion in the center around wellbeing and anticipation

Restraining factor:

-

The significant expense of dietary supplements.

Opportunities:

-

Shift towards plant-based Supplements.

Challenges:

-

The absence of confidence in nutraceuticals' medical advantages, the significant expense of nutraceuticals, and shoppers' absence of information about nutraceuticals.

Impact of Covid-19:

With the abrupt effect of COVID-19, the market has seen a flood of sought items that give stomach-related and safe well-being, which emphatically affected the market. Subsequently, the deals of supplements like protein, nutrients, omega-3 unsaturated fats, and others saw gigantic development. Thus, it prompted various item dispatches to take care of the developing interest. Besides, to satisfy the flooding request along with keeping up with well-being standards, the producers have been zeroing in on expanding their deals by empowering their clients to shop online all things being equal.

Key Market Segments:

By Ingredient:

- Vitamins

- Botanicals

- Minerals

- Proteins & Amino Acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

By Form:

- Tablets

- Capsules

- Soft gels

- Powders

- Gummies

- Liquids

By Application:

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/Hair/Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

By End-user:

-

Adults

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

By Type:

-

OTC

-

Prescribed

By Distribution Channel:

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

-

Online

.png)

Get Customized Report as per Your Business Requirement - Request For Customized Report

Regional Coverage:

-

North America

-

The USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Regional Analysis:

North America overwhelmed the market for dietary supplements and represented the biggest income portion of 34.8% in 2021. It is projected to observe a CAGR of 5.6% over the gauge period by the developing utilization of items with high dietary benefits and low calory content. Moreover, expanding mindfulness about the utilization of supplement items in Mexico because of new item dispatches is supposed to drive the interest for dietary supplements over the estimated time frame. In the Asia Pacific, the market is supposed to observe higher-income development over the gauge time frame.

The district is supposed to be the biggest market for dietary supplements by 2030 attributable to the developing customer base in the nations including India, China, South Korea, and others. Expanding the use of well-being improving items in the locale attributable to developing per capita pay and expanding mindfulness is supposed to drive the interest for dietary supplements over the conjecture time frame. The European district represented a huge income share in 2021 and is supposed to develop at 6.9% over the estimated period. Higher buyer mindfulness and higher per-capita discretionary cash flow in created nations like France, Germany, and the U.K. are supposed to drive the market over the estimated time frame.

Key Players:

Amway Corp., Glanbia PLC, Abbott, Bayer AG, Pfizer Inc., ADM, Nu Skin Enterprises, Inc., GlaxoSmithKline plc, Bionova, Ayanda, Arkopharma, Herbalife International of America, Inc., Nature’s Sunshine Products, Inc.

Glanbia PLC-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2021 | US$ 164.81 Billion |

| Market Size by 2028 | US$ 316.53 Billion |

| CAGR | CAGR 8.5% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Ingredient (Vitamins, Minerals) • by Form • by Application • by End User • by Distribution Channel by Regio |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amway Corp., Glanbia PLC, Abbott, Bayer AG, Pfizer Inc., ADM, Nu Skin Enterprises, Inc., GlaxoSmithKline plc, Bionova, Ayanda, Arkopharma, Herbalife International of America, Inc., Nature’s Sunshine Products, Inc. |

| Key Drivers | •Change in shopper inclination because of expansion in the center around wellbeing and anticipation. |

| Restraints | •The significant expense of dietary supplements. |