In-Vehicle Networking Market Size & Growth:

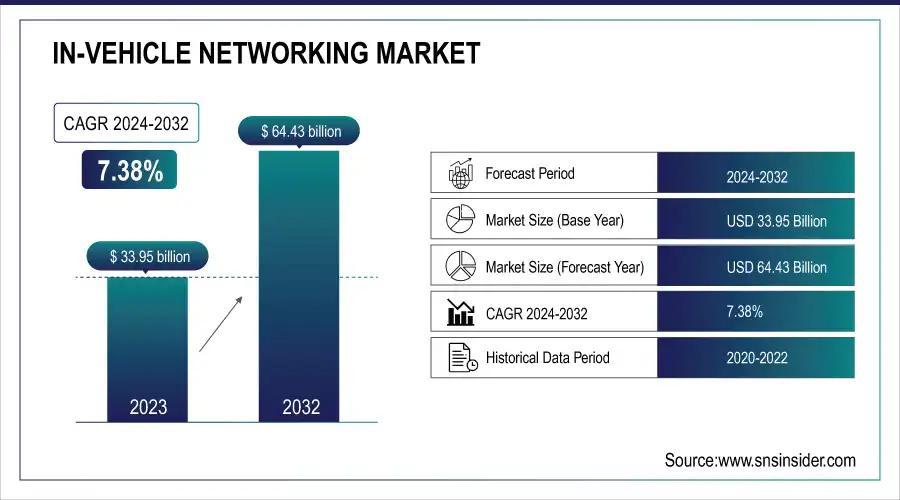

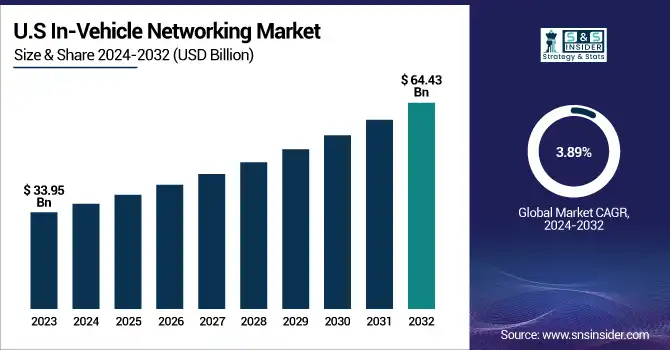

The In-Vehicle Networking Market was valued at USD 33.95 Billion in 2023 and is projected to reach USD 64.43 Billion by 2032, growing at a CAGR of 7.38% from 2024 to 2032. This growth is driven by the increasing adoption of connected, electric, and autonomous vehicles that require seamless, high-speed, and low-latency communication between electronic control units (ECUs).

To Get more information on In-Vehicle Networking Market - Request Free Sample Report

With the U.S. market alone valued at USD 8.0 billion in 2023 and expected to reach USD 11.31 billion by 2032, expanding at a CAGR of 3.89%. The integration of advanced systems such as infotainment, telematics, ADAS, and battery management in EVs has elevated the importance of robust in-vehicle communication architectures. Emerging technologies like automotive Ethernet and advancements in traditional protocols like CAN, LIN, and FlexRay are enhancing data bandwidth and reducing latency, aligning with industry benchmarks for phase noise and energy efficiency.

In-Vehicle Networking Market Dynamics:

Drivers:

-

Unified Regulatory Push and Geopolitical Shifts Fuel Demand for Secure In-Vehicle Networking

The in-vehicle networking market is expanding rapidly, driven by the rise of connected and autonomous vehicles (CAVs) and growing global concern over data privacy and cybersecurity. Companies like Waymo and Uber are advancing the sector—Waymo with millions of miles in autonomous driving tests, and Uber through partnerships with 14 autonomous vehicle firms for robotaxi rollouts—underscoring the need for reliable V2X (vehicle-to-everything) systems. In the U.S., the Federal Trade Commission (FTC) now classifies driver behavior data as sensitive, while the Federal Communications Commission (FCC) explores protections under the Safe Connections Act (SCA). State-level laws, including California’s SB 1394 and Tennessee’s HB 2615, further enhance consumer control over vehicle data. Federally, the proposed Auto Data Privacy and Autonomy Act seeks unified standards and restricts data transfers to foreign nations like China and Russia. Globally, Tesla’s declining Chinese market share and dependence on Baidu amplify security concerns, accelerating demand for secure, regulation-ready networking architectures.

Restraints:

-

High Development and Integration Costs Restrict Broad Adoption of Advanced In-Vehicle Networking Systems.

High development and integration costs remain a significant restraint in the in-vehicle networking market, primarily due to the complex nature of modern automotive communication systems. Advanced technologies like Ethernet and Vehicle-to-Everything (V2X) require extensive research and development, driving up initial investment for OEMs and Tier-1 suppliers. The integration of multiple protocols—such as CAN, LIN, FlexRay, and automotive Ethernet—demands not only sophisticated hardware but also compatible software stacks, testing tools, and validation processes to ensure seamless communication between various electronic control units (ECUs). Moreover, adapting these technologies to support high-speed, low-latency data exchange across safety-critical systems (e.g., ADAS and infotainment) ads further complexity and cost. The transition from traditional bus-based architectures to more centralized and zonal architectures also entails reengineering legacy platforms, training personnel, and upgrading diagnostic tools, all of which increase operational expenses. These high costs pose a barrier for smaller players and slow widespread adoption across budget and mid-range vehicle segments.

Opportunities:

-

Empowering in-vehicle networks through the integration of 5G and edge intelligence unlocks faster data transmission and next-gen V2X capabilities.

The integration of 5G and edge computing into automotive systems is creating a transformative opportunity in the in-vehicle networking market. 5G’s ultra-low latency and high data throughput allow for seamless vehicle-to-everything (V2X) communication, which is essential for supporting autonomous driving, real-time traffic updates, and advanced infotainment features. Edge computing complements this by processing data closer to the vehicle, reducing reliance on cloud infrastructure and ensuring faster decision-making for safety-critical Technology s like collision avoidance and lane keeping. Together, 5G and edge computing support high-speed connectivity and distributed intelligence, enabling more responsive, data-intensive operations. This integration is particularly beneficial for connected and autonomous vehicles, as it improves situational awareness and facilitates complex data exchanges between vehicles, infrastructure, and cloud platforms. As these technologies continue to roll out globally, they present a major growth avenue for automakers and suppliers developing future-ready, scalable in-vehicle networking architectures.

Challenges:

-

High Cost Structures Limit Broader Adoption of Advanced In-Vehicle Networking Solutions

Advanced in-vehicle networking systems, particularly those involving Ethernet, V2X communication, and sensor fusion, require significant research and development investments, expensive chipsets, and complex software and hardware integration. These high financial requirements often present major challenges for smaller OEMs and Tier-2 suppliers that may lack the resources to implement or scale such advanced technologies. The integration of high-bandwidth systems also demands thorough testing, skilled personnel, and comprehensive validation to meet strict safety and compliance standards, adding to development expenses. Furthermore, long-term costs are driven by ongoing maintenance, cybersecurity measures, and the need to design systems capable of supporting over-the-air updates. These factors make many manufacturers reluctant to fully commit to deploying these technologies, slowing adoption and innovation across the market. This cost challenge is especially pronounced in price-sensitive markets, where achieving a balance between affordability and advanced functionality continues to be a significant hurdle for companies operating in the in-vehicle networking space.

In-Vehicle Networking Market Segment Analysis:

By Technology

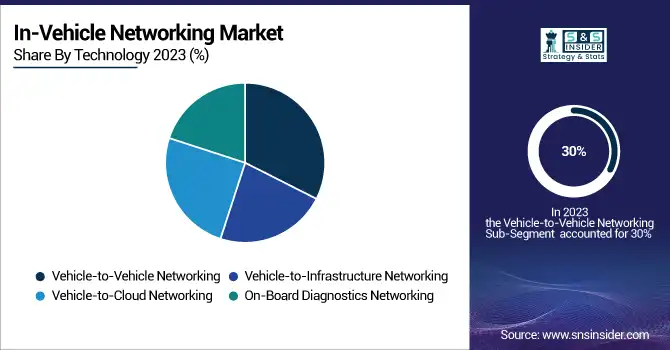

Vehicle-to-Vehicle (V2V) networking dominated the in-vehicle networking market in 2023, accounting for approximately 30% of the overall market share. This leadership is primarily attributed to the growing emphasis on road safety, collision avoidance, and real-time communication between vehicles. V2V systems enable cars to exchange data such as speed, direction, and location, significantly reducing accident risks and enhancing situational awareness. Governments and regulatory bodies in regions like North America and Europe have been actively promoting V2V adoption through pilot programs and safety mandates, accelerating its Vehicle Type. Additionally, the increasing integration of advanced driver-assistance systems (ADAS) and autonomous driving features in modern vehicles has further fueled demand for robust V2V networks. Automakers are also investing heavily in V2V technologies to meet future regulatory requirements and consumer expectations. As the foundation for Vehicle-to-Everything (V2X) ecosystems, V2V networking continues to be a critical pillar in the evolution of connected and intelligent transportation systems.

Vehicle-to-Cloud (V2C) networking is projected to be the fastest-growing segment in the in-vehicle networking market from 2024 to 2032. This growth is driven by the rising demand for real-time vehicle diagnostics, over-the-air (OTA) software updates, infotainment services, and fleet management solutions. V2C enables continuous communication between vehicles and centralized cloud platforms, allowing automakers and service providers to collect data, optimize performance, and enhance user experiences remotely. The integration of artificial intelligence (AI) and predictive analytics further strengthens the value of V2C systems by enabling personalized services and proactive maintenance alerts. As electric vehicles (EVs) and autonomous driving technologies proliferate, the need for cloud connectivity to manage complex data ecosystems becomes more critical. Additionally, the widespread rollout of 5G networks supports low-latency, high-bandwidth communication, making V2C implementations more efficient and scalable.

By Vehicle Type

The passenger cars segment dominated the in-vehicle networking market in 2023, accounting for approximately 45% of total revenue share, driven by the surge in connected car technologies and growing consumer demand for advanced infotainment, telematics, and driver-assistance features. With the rising integration of ADAS (Advanced Driver-Assistance Systems), V2X communication, and Ethernet-based networking in modern passenger vehicles, automakers are increasingly investing in robust in-vehicle architectures to support seamless data exchange and real-time connectivity. The proliferation of electric and hybrid cars, especially in urban regions, has also contributed to this segment’s leadership, as these vehicles often come equipped with sophisticated networking solutions. Moreover, the expanding middle-class population and increased disposable income in emerging economies have boosted the adoption of high-tech vehicles, further cementing the passenger car segment’s dominance. The trend is expected to continue as OEMs prioritize in-car digital experiences, safety features, and remote diagnostics to meet evolving consumer and regulatory expectations.

The electric vehicles (EVs) segment is projected to be the fastest-growing in the in-vehicle networking market from 2024 to 2032, fueled by the global shift toward clean mobility, regulatory emissions mandates, and rising investments in EV infrastructure. EVs require highly efficient and low-latency communication networks to manage complex systems such as battery management, motor control, regenerative braking, and charging functions. As a result, demand for advanced in-vehicle networking solutions particularly Ethernet, CAN FD, and V2X communication is accelerating within this segment. Automakers are integrating next-generation architectures that support over-the-air (OTA) updates, enhanced cybersecurity, and real-time diagnostics, ensuring seamless system coordination and safety compliance. Additionally, the increasing Vehicle Type of autonomous features in EVs necessitates robust data exchange between sensors, controllers, and cloud platforms.

By Network Type

The wireless network segment is expected to dominate a substantial share of the in-vehicle networking market, accounting for around 25% of total revenue by 2033. This growth is driven by the increasing integration of wireless technologies such as Wi-Fi, Bluetooth, cellular (4G/5G), and Dedicated Short-Range Communication (DSRC) in connected and autonomous vehicles. Wireless networking enables real-time communication between vehicles and external systems (V2X), supporting navigation, infotainment, telematics, diagnostics, and over-the-air (OTA) updates without relying on physical cabling. As vehicles become more software-defined, automakers are prioritizing wireless solutions for scalability, flexibility, and cost-efficiency. Moreover, advancements in 5G and edge computing enhance the speed, reliability, and low latency of these networks, making them crucial for autonomous driving and smart mobility. With growing consumer demand for connected experiences and increasing government support for intelligent transportation systems, wireless networks are poised to remain a pivotal enabler of next-gen in-vehicle connectivity.

The cellular network segment is projected to be the fastest-growing segment in the in-vehicle networking market over the forecast period of 2024–2032. This rapid growth is fueled by the widespread rollout of 5G technology, which provides high-speed, low-latency communication essential for autonomous driving, real-time navigation, and over-the-air (OTA) updates. Cellular networks enable seamless Vehicle-to-Everything (V2X) communication, connecting vehicles with infrastructure, pedestrians, and other vehicles to enhance safety and efficiency. Automakers are increasingly partnering with telecom providers to embed advanced cellular modules into vehicles, supporting connected services such as remote diagnostics, emergency response, and infotainment streaming. Additionally, regulatory support for intelligent transport systems and smart city initiatives is accelerating cellular integration in both developed and emerging markets. As vehicles evolve into connected mobility platforms, the demand for robust, high-performance cellular networking solutions will continue to rise, positioning this segment as a key driver of innovation in the automotive ecosystem.

By Application

The telematics segment dominated the in-vehicle networking market in 2032, accounting for around 29% of total revenue share. This leadership is driven by the growing demand for real-time vehicle monitoring, fleet management, navigation, remote diagnostics, and insurance telematics solutions. Telematics systems leverage cellular, GPS, and satellite technologies to transmit critical data between vehicles and central systems, enabling enhanced operational efficiency, driver safety, and predictive maintenance. Automakers are increasingly integrating telematics control units (TCUs) into vehicles to support connected services, regulatory compliance, and over-the-air (OTA) software updates. The rise in ride-sharing platforms, logistics optimization, and government mandates for emergency assistance systems (such as eCall in Europe) has further accelerated telematics adoption. Additionally, consumers now expect vehicles to offer smart connectivity features, which has led OEMs to prioritize telematics integration as part of their digital transformation strategies. As a result, the telematics segment continues to be a cornerstone of the evolving automotive connectivity landscape.

The Driver Assistance Systems segment is the fastest-growing area in the in-vehicle networking market during the forecast period of 2024–2032. This rapid growth is fueled by rising demand for safety, comfort, and automation across both passenger and commercial vehicles. Advanced Driver Assistance Systems (ADAS) rely heavily on in-vehicle networks to enable real-time communication between sensors, cameras, LiDAR, radar, and central processing units. These systems support critical functions such as adaptive cruise control, lane-keeping assist, collision avoidance, and automated parking. As regulatory bodies in regions like North America, Europe, and Asia-Pacific mandate safety features, automakers are under pressure to integrate ADAS technologies at scale. Additionally, growing consumer awareness and preference for safer driving experiences are accelerating market penetration. The increasing electrification of vehicles and the shift toward autonomous mobility further underscore the need for robust, low-latency networking frameworks that can handle high data throughput, making ADAS integration vital to future automotive innovations.

In-Vehicle Networking Market Regional Outlook:

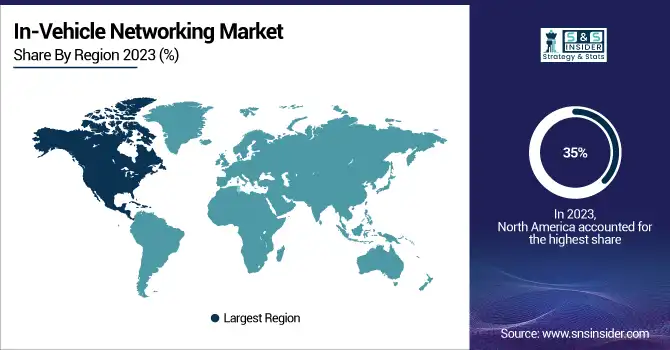

North America dominates the in-vehicle networking market with the largest revenue share of approximately 35%, driven by rapid technological advancements, strong automotive infrastructure, and early adoption of connected vehicle technologies. The United States plays a central role in this growth, with major automakers and tech firms like General Motors, Ford, Tesla, Qualcomm, and Intel actively investing in autonomous driving, V2X communication, and 5G integration. Government support through regulatory frameworks and funding for smart transportation initiatives, including connected infrastructure and road safety programs, further accelerates innovation. Additionally, the region benefits from high consumer demand for advanced driver-assistance systems (ADAS), infotainment, and telematics, especially in premium vehicles. Canada's rising investment in smart mobility and Mexico's growing role in automotive manufacturing also contribute to the regional boom. With a mature ecosystem and increasing focus on cybersecurity and data privacy, North America remains a global leader in shaping the future of vehicle networking technologies.

The Asia-Pacific region is projected to witness the fastest growth in the in-vehicle networking market from 2024 to 2032, driven by rapid urbanization, increasing vehicle production, and accelerating adoption of electric and connected vehicles. Countries like China, Japan, South Korea, and India are heavily investing in smart mobility infrastructure, 5G rollout, and autonomous vehicle R&D. China leads the region with strong government support and major players like BYD, Huawei, and Baidu advancing V2X and telematics solutions. Japan and South Korea contribute significantly through automotive giants such as Toyota, Honda, Hyundai, and Kia, integrating advanced networking systems into new vehicle models. Additionally, growing consumer demand for ADAS, infotainment, and real-time connectivity features is fueling market expansion. As regional OEMs and tech firms focus on innovation and affordability, the Asia-Pacific market is becoming a critical hub for scalable, next-generation vehicle networking technologies that meet both local and global standards.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in In-Vehicle Networking Market are:

-

General Motors (USA) – OnStar telematics, V2X communication, connected vehicle platform

-

Volkswagen AG (Germany) – Car2X systems, cloud-based infotainment, vehicle connectivity suite

-

Cisco Systems (USA) – Automotive network infrastructure, in-car cybersecurity, IoT platforms

-

Toyota Motor Corporation (Japan) – Telematics services, V2X modules, connected mobility solutions

-

Qualcomm (USA) – Snapdragon Auto platforms, C-V2X chipsets, 5G modems

-

Denso (Japan) – V2X units, in-vehicle ECUs, ADAS networking modules

-

AT&T (USA) – In-car LTE/5G, Wi-Fi hotspots, IoT data services

-

Tesla (USA) – Proprietary telematics, OTA systems, real-time data networking

-

Continental (Germany) – Vehicle gateways, network controllers, ITS solutions

-

IBM (USA) – Cloud platforms, AI telematics, automotive cybersecurity

-

Harman International (USA) – Connected infotainment, cloud-based telematics, vehicle data systems

-

Ford Motor Company (USA) – SYNC infotainment, FordPass telematics, ADAS networking

-

NVIDIA (USA) – DRIVE platform, AI in-vehicle computing, autonomous networking

-

Bosch (Germany) – Communication ECUs, V2X modules, ADAS-integrated networks

-

Mercedes-Benz AG (Germany) – MBUX system, OTA update platform, V2X-ready telematics

List of potential (B2B) customers for the in-vehicle networking market, covering automakers, fleet operators, mobility service providers, and smart city infrastructure players:

Automotive OEMs

-

General Motors

-

Ford Motor Company

-

Toyota Motor Corporation

-

Volkswagen Group

-

Hyundai-Kia

-

Stellantis

-

Mercedes-Benz AG

-

BMW Group

-

Honda Motor Co.

-

Tesla, Inc.

Commercial Vehicle & Fleet Operators

-

Daimler Truck

-

Volvo Group

-

Navistar

-

Ryder Systems

-

PACCAR Inc. (Kenworth, Peterbilt)

Autonomous & Mobility Tech Firms

-

Waymo (Alphabet)

-

Cruise (GM)

-

Aurora Innovation

-

Nuro

-

Zoox (Amazon)

Ride-Sharing & Delivery Platforms

-

Uber

-

Lyft

-

Grab

-

Didi Chuxing

-

DoorDash

-

Instacart

Smart City / Infrastructure Providers

-

Cisco Systems (Smart road infrastructure)

-

IBM (Urban mobility platforms)

-

Siemens Mobility

-

Cubic Corporation

-

Kapsch TrafficCom

Recent development:

-

In 18, September 2024, General Motors enabled its EV customers to access over 17,800 Tesla Supercharger stations using a GM-approved NACS DC adapter. This move significantly boosts public fast-charging availability and supports GM’s push toward an all-electric future across the U.S. and Canada.

-

On August 20, 2024, a detailed retrofit guide for Volkswagen/Skoda MQB cars in India was shared by an enthusiast, showcasing the growing trend of aftermarket feature upgrades like park sensors among VAG vehicle owners. The DIY culture is gaining momentum, with users actively customizing vehicles beyond factory specs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 33.95 Billion |

| Market Size by 2032 | USD 64.43 Billion |

| CAGR | CAGR of 7.38% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology(Vehicle-to, Vehicle Networking, Vehicle-to-Infrastructure Networking, Vehicle-to-Cloud Networking, On-Board Diagnostics Networking) • By Vehicle Type(Passenger Cars, Commercial Vehicles, Electric Vehicles, Luxury Vehicles) • By Network Type(Wired Network, Wireless Network, Cellular Network, Dedicated Short Range Communication) • By Application (Telematics, Infotainment, Driver Assistance Systems, Fleet Management) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | General Motors (USA), Volkswagen AG (Germany), Cisco Systems (USA), Toyota Motor Corporation (Japan), Qualcomm (USA), Denso (Japan), AT&T (USA), Tesla (USA), Continental (Germany), IBM (USA), Harman International (USA), Ford Motor Company (USA), NVIDIA (USA), Bosch (Germany), Mercedes-Benz AG (Germany). |