Vehicle-to-Everything Communication Market Report Scope

To get more information on Vehicle-to-Everything (V2X) Communication Market- Request Free Sample Report

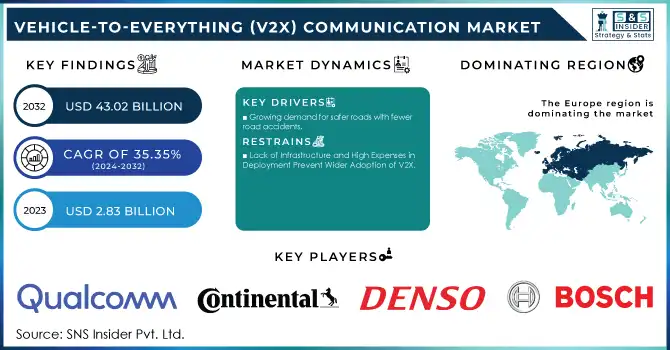

The Vehicle-to-Everything (V2X) Communication Market Size was valued at USD 2.83 Billion in 2023 and is expected to reach USD 43.02 Billion by 2032 and grow at a CAGR of 35.35% over the forecast period 2024-2032.

The V2X (Vehicle-to-Everything) communication market is experiencing rapid growth, driven by advancements in autonomous driving, connected vehicle technologies, and smart city initiatives. V2X encompasses communication types such as Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), and Vehicle-to-Pedestrian (V2P), focusing on improving road safety, reducing traffic congestion, and enhancing transportation efficiency. Governments worldwide are actively investing in V2X deployment; for example, Japan plans to achieve a fully connected transportation system by 2025, while the U.S. and European nations like France and Germany are rolling out policies to accelerate V2X adoption.

Technological breakthroughs, including the integration of 5G-enabled Cellular Vehicle-to-Everything (C-V2X) and edge computing, are key market drivers. These innovations enable low-latency, real-time communication and data processing at the source, critical for autonomous vehicle systems. Automotive and technology companies such as Qualcomm, Toyota, and Volkswagen are launching V2X-enabled products to enhance navigation, safety, and traffic management.

With increasing global concerns about road safety and urban mobility, coupled with significant investments in connected vehicle technologies, the V2X communication market is set to grow substantially. The expansion of 5G infrastructure and smart city developments will further accelerate its adoption, making it a cornerstone of future transportation systems.

Vehicle-to-Everything Communication Market Dynamics

KEY DRIVERS:

-

Growing demand for safer roads with fewer road accidents.

This demand for safer roads has been a significant push for the implementation of V2X communication technology. At present, around 1.35 million people die in road accidents every year globally, and V2X communication can greatly contribute to reducing this number. V2X enhances situational awareness, reduces human errors, and highly improved responses. For example, vehicles with V2X can alert other cars that sudden braking, lane changing, or potential hazard would occur, such as pedestrians crossing the road. Governments all over the world are realizing the merits of this technology in preventing accidents.

According to reports by the U.S. Department of Transportation, V2X technologies can reduce road fatalities up to 80%, stressing its important role in enhancing public safety. An overwhelming number of countries are now making the V2X systems a standard requirement for new as well as old vehicles, which intensifies the growth in the demand for this market.

-

Increasing government initiatives on smart transportation systems contribute to the growing number of these projects.

The governments across the world are investing in smart transport systems, and V2X communication is at the forefront of all these initiatives. Rising demand for smart cities as well as ITS primarily aims to achieve optimal urban mobility and reduce traffic congestion. According to data released by China's Ministry of Industry and Information Technology, or MIIT, it is expected that by 2025, over half of the vehicles in cities will be fitted with the V2X communication technology as part of the entire smart transportation system.

Other than this, the European Union has also set strong ambitions in its C-ITS (Cooperative Intelligent Transport Systems) directive through which it is aiming to make V2X present in at least 35% of the vehicles by 2027. Consequently, such government policies will be accompanied with incentives and investment to be done in infrastructure that creates high demand for the implementation of V2X among automakers and the technology providers, which proves to be a market growth driver.

RESTRAIN:

-

Lack of Infrastructure and High Expenses in Deployment Prevent Wider Adoption of V2X.

One of the biggest obstacles to the widespread implementation of V2X communication is the lack of adequate infrastructure and the cost involved in establishing the technology. V2X systems have their very operation dependent on the availability of vehicle hardware and supporting infrastructure, including smart traffic signals and road sensors. Quite many places in the world have some form of old road infrastructure that would not support V2X technology and require significant upgrade work before it can be put in place. High Upfront Costs for Roadside Units and Cellular Integration Large-scale deployments of V2X are expensive up front to put in the roadside units and integrate with the cellular network.

The switch from DSRC to 5G-enabled Cellular V2X adds a second layer of complexity and expense. Lack of harmonization between DSRC and C-V2X technologies-Regions could largely prefer one over the other and slowed adoption at a global level. All these factors collectively slow down V2X deployment, especially in developing regions with fiscal restraints on infrastructure funding.

Vehicle-to-Everything Communication Market Segment Analysis

BY CONNECTIVITY

In 2023, the Dedicated Short-Range Communication (DSRC) segment dominated the market with 56% market share due to its long presence and ability to establish itself in performing V2V and V2I communication. It has always been the technology of preference in Europe and North America because it provides low-latency communication that is necessary for applications where fast decision-making is required, such as collision avoidance and emergency notifications. The reliability and strong security protocols associated with DSRC made it the trusted choice for automakers as well as the providers of infrastructure.

However, 4G and 5G-based C-V2X is expected to grow with the fastest cagr over the forecast period. The shift towards C-V2X is on account of its ability to offer better coverage, lower latency, and higher data throughput compared to DSRC.

BY TECHNOLOGY

Automated Driver Assistance segment holds the dominant position in the market accounting to 36% market share in 2023. This superiority is attributed to recent development toward advanced driver-assistance systems that employ V2X communication to offer information in real-time on road conditions, obstacles as well as other vehicles. Automotive Driver Assistance systems advance vehicle safety and efficiency since they make it possible for the driver to have an informed judgment, have minimal accidents, and optimize fuel consumption.

Vehicle-to-Everything Communication Market Regional Overview

Europe was the largest region for the V2X communication market in 2023, accounting for around 37% of the market share due to a high focus on ITS and initiatives taken by the government through the C-ITS directive, which encourages the implementation of V2X technology across the Europe region. Other countries such as Germany, France, and the UK are also advancing the development and adoption of V2X systems, leading investments in smart city infrastructure and technologies for connected vehicles. In addition, the strong auto sector in Europe drives V2X communication as top car makers roll out the systems.

Asia Pacific is expected to grow at the fastest pace with a projected CAGR of 36.41% during the forecast period from 2024 to 2032. Government initiatives that focus on the development of connected and autonomous vehicles, along with expansion in 5G connectivity, will set an encouraging scenario for V2X technology adoption in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Kay Players in Vehicle-to-Everything Communication Market

Some of the major players in the Vehicle-to-Everything (V2X) Communication Market are

-

Qualcomm (C-V2X chipset, Snapdragon Automotive)

-

Continental AG (V2X Platform, Smart Traffic Solutions)

-

Denso Corporation (Onboard V2X Unit, Wireless Communication Systems)

-

Robert Bosch GmbH (V2X Control Units, Automotive Radar)

-

NXP Semiconductors (V2X Processors, Security Solutions)

-

Infineon Technologies (V2X Chips, Automotive Solutions)

-

Autotalks (V2X Chipsets, DSRC Modules)

-

Delphi Technologies (Vehicle Connectivity Solutions, V2X Modules)

-

Savari (V2X Software Stack, Roadside Units)

-

Cohda Wireless (V2X Software, DSRC Communication Systems)

-

STMicroelectronics (V2X ICs, Automotive Semiconductors)

-

Intel Corporation (Automotive Processors, V2X Platforms)

-

Huawei Technologies (C-V2X Modules, 5G Solutions)

-

Ericsson (C-V2X Infrastructure, Connected Vehicle Solutions)

-

Nissan Motor Corporation (V2X-Enabled Vehicles, Autonomous Vehicle Platforms)

-

General Motors (V2X Systems, Connected Vehicle Platforms)

-

Ford Motor Company (V2X Communication Systems, BlueCruise)

-

Toyota Motor Corporation (V2X Safety Systems, Connected Cars)

-

BMW Group (Connected Car Solutions, V2X Systems)

-

Volkswagen AG (V2X Communication Technology, Connected Vehicle Services)

MAJOR SUPPLIERS (Components AND Technologies)

-

Texas Instruments

-

Murata Manufacturing

-

Analog Devices

-

Broadcom

-

Skyworks Solutions

-

ON Semiconductor

-

Marvell Technology

-

Xilinx (AMD)

-

Renesas Electronics

-

TE Connectivity

MAJOR CLIENTS

-

Tesla

-

BMW

-

Volkswagen

-

Toyota

-

Mercedes-Benz

-

Ford

-

General Motors

-

Honda

-

Hyundai

-

Nissan

RECENT TRENDS

February 2024: Qualcomm has announced the newest addition to its Snapdragon Auto Connectivity Platform, the Qualcomm QCA6797AQ, which is reportedly the world's first Automotive Grade Wi-Fi 7 Access Point solution. The complete Snapdragon Automotive Connectivity platform will enhance a full portfolio of connectivity solutions in vehicles, comprising Cellular 5G/4G, Wi-Fi, Bluetooth, C-V2X, and also technologies for precise positioning, and with the new Qualcomm QCA6797AQ, it now gets Wi-Fi 7 capabilities.

March 2024: The DENSO’s newest brand of aftermarket smart mobility and vehicle-to-everything (V2X) products and solutions is MobiQ, which DENSO Products and Services Americas, Inc. manufactures. DENSO unveiled MobiQ today at ITS America Conference & Expo 2024 in Phoenix.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.83 Billion |

| Market Size by 2032 | US$ 43.02 Billion |

| CAGR | CAGR of 35.35 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Automated Driver Assistance, Intelligent Traffic System, Emergency Vehicle Notification, Passenger Information System, Fleet & Asset Management, Parking Management System, Line of Sight, Non-line of Sight, and Others), • By Component (Hardware and Software), • By Communication Type (Vehicle-to-Vehicle (V2V), Vehicle-to-Pedestrian (V2P), Vehicle-to-Cloud (V2C), Vehicle-to-Infrastructure (V2I), Vehicle-to-Grid (V2G), Vehicle-to-Network (V2N), and Vehicle-to-Device (V2D)), • By Connectivity (Dedicated Short-Range Communication (DSRC) and Cellular) • By Unit Type (Onboard Unit and Roadside Unit) • By Vehicle Type (Passenger Car and Commercial Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm, Continental AG, Denso Corporation, Robert Bosch GmbH, NXP Semiconductors, Infineon Technologies, Autotalks, Delphi Technologies, Savari, Cohda Wireless, STMicroelectronics, Intel Corporation, Huawei Technologies, Ericsson, Nissan Motor Corporation, General Motors, Ford Motor Company, Toyota Motor Corporation, BMW Group, Volkswagen AG. |

| Key Drivers | • Growing demand for safer roads with fewer road accidents. • Increasing government initiatives on smart transportation systems contribute to the growing number of these projects. |

| Restraints | • Lack of Infrastructure and High Expenses in Deployment Prevent Wider Adoption of V2X. |