In Vivo CRO Market Overview:

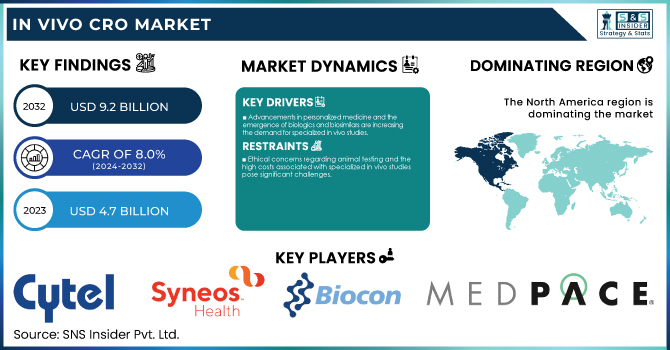

The In Vivo CRO Market size was valued at USD 4.7 billion in 2023 and is expected to reach USD 9.2 billion by 2032, growing at a CAGR of 8% over the forecast period 2024-2032.

To Get more information on In Vivo CRO Market - Request Free Sample Report

The in vivo CRO market report presents key statistical insights and trends of the market, including incidence and prevalence of diseases to identify the demand for in vivo research. This report discusses drug development timelines and the various ways CROs accelerate preclinical research. It also explores trends in investing, including how much pharmaceutical and biotech companies are funding. The report identifies trends in regulatory compliance, including information on FDA, EMA, and GLP. These insights offer a comprehensive view of the market’s evolution, growth drivers, and challenges shaping the industry. The growing demand for preclinical research and development services and an increase in investment of drug discovery and development are driving revenue growth of the In-Vivo CRO market. In 2023, the United States spent a reckoning $41.7 billion on biomedical research (NIH), including considerable funds on preclinical research.

In Vivo CRO Market Dynamics

Drivers

-

Advancements in personalized medicine and the emergence of biologics and biosimilars are increasing the demand for specialized in vivo studies.

Advancements in personalized medicine, along with the rise of biologics and biosimilars, are significantly driving the demand for specialized in vivo studies within the Contract Research Organization (CRO) market. Personalized medicine customizes treatments based on patient-specific profiles, which requires thorough in vivo tests to ascertain the safety and efficacy of such targeted therapies. In 2023, the FDA approved 16 new personalized treatments for rare disease patients, a substantial increase from six in 2022, highlighting the accelerated development in this sector. The biologics field, which includes highly complex molecules such as proteins and monoclonal antibodies, requires complex in vivo tests for their unique mechanisms of action and other properties. Likewise, extensive in vivo studies are required to establish biosimilarity for biological products that demonstrate high similarity to existing approved biologics. The growing burden of chronic diseases has also driven the demand for innovative biologic therapies and hence this has boosted the demand for in vivo CRO services. In addition, the sophisticated nature of new drug development has prompted pharmaceutical and biotechnology companies to outsource these services to dedicated CROs. The convergence of personalized medicine and the growth of biologics and biosimilars is propelling the in vivo CRO market, as these developments necessitate specialized preclinical studies to bring advanced therapies to market efficiently and safely.

Restraints:

-

Ethical concerns regarding animal testing and the high costs associated with specialized in vivo studies pose significant challenges.

The In Vivo Contract Research Organization (CRO) Market is significantly impacted by ethical concerns for animal testing. In 2022, France conducted nearly 2 million animal tests, contributing to approximately 10 million such tests across Europe annually. Animal experimentation is ineffective, with 95% of testing drugs that pass safety in animal studies subsequently failing in human clinical phase testing stages due either to toxicity or ineffectiveness. Such a discrepancy raises both ethical and scientific concerns, and there is a global movement toward alternative means of conducting research. Advanced methods such as organ-on-chip technologies and artificial intelligence provide both more predictive and economical solutions, decreasing dependence on models involving animals. Political initiatives in the U.S. and the Netherlands further promote this transition, but nevertheless, financial, regulatory, and validation challenges remain. The lack of standardized cruelty-free labeling further complicates consumer choices. Therefore, such ethical concerns, high costs, and regulatory complexities are major restraints for the In Vivo CRO market, emphasizing the demand for humane and efficient research methodologies.

Opportunities:

-

Expansion into emerging markets and the integration of advanced technologies, such as genetically modified animal models and non-invasive imaging techniques, offer growth prospects.

The In Vivo Contract Research Organisation (CRO) Market is expected to witness substantial growth, thanks to opportunities in developing economies and embrace for advanced technologies. There is a growing pharmaceutical and biotechnology industry in many emerging economies, especially Asian economies. This growth can be primarily attributed to the availability of affordable services in India and China, economic development, and advanced healthcare infrastructure. India is projected to have the highest CAGR in the region between forecast period, owing to the number of experts available in the country, coupled with low operational costs and recognition of intellectual property rights. In addition to geographical expansion, the integration of advanced technologies presents a substantial opportunity for in vivo CROs. The development of sophisticated animal models and in vivo imaging technologies enhances the accuracy and efficiency of preclinical studies. For example, the acquisition of SYNCROSOME by ETAP-Lab in October 2023 expanded ETAP-Lab's capabilities in offering advanced in vivo CRO services, thereby strengthening its position in the market. In summary, such technological advancements give CROs more tools to deliver more complete and relevant data for their pharmaceutical and biotechnology customers.

Challenges:

-

Stringent regulatory requirements and the variability in preclinical models can hinder the efficiency and reliability of in vivo testing.

The In Vivo Contract Research Organization (CRO) market is largely affected by stringent regulatory requirements and heterogeneity in preclinical models. In India, for instance, contract drug manufacturers often experience project initiation delays of 8 to 15 days, whereas their Chinese counterparts can commence within 3 days. The reason for this gap is mainly related to long approval times and complex regulatory requirements that limit the throughput of in vivo studies. Moreover, there are challenges in translating results from animal studies into human applications due to variability among the range of available preclinical models. Nevertheless, inter-species differences in disease pathology and physiology may introduce variability in the results, potentially impacting the process of drug development.

In Vivo CRO Market Segmentation Analysis

By Model Type

The rodents segment held the largest market share 80% of the market in 2023. The dominance of rodent models has several factors behind it, such as rodents and humans having a similar genetic basis, short life cycles, and cost-effectiveness for research. Rodents made up 95% of all animals used to conduct research in 2023, according to the U.S. Department of Agriculture (USDA), with mice comprising the overwhelming percentage at 61% and rats at 18%. According to the National Center for Biotechnology Information (NCBI), 2023 data indicated over 70% of published biomedical research papers incorporated rodent models. The extensive characterization of the genomes of rodents and the availability of transgenic strains also facilitates their use as an animal model for preclinical research. The NIH (National Institutes of Health) Knockout Mouse Project (KOMP) has produced more than 8,500 unique mouse strains that are useful in investigating their gene functions and disease mechanisms. Furthermore, the European Mouse Mutant Archive (EMMA) reported a 25% increase in requests for rodent models in 2023. The pharmaceutical industry's focus on developing targeted therapies and personalized medicine has also contributed to the popularity of rodent models. In 2023, the FDA approved 53 new drugs, and 85% of these underwent preclinical testing using rodent models. This trend highlights the importance of rodent-based research for drug development and the continued large share of this segment in the In Vivo CRO market.

By Modality

In 2023, the small molecules segment accounted for the majority of revenue. This is due to small molecule drugs being very relevant in the industrial context as well as their far-reaching application in preclinical studies. In the FDA's report, small molecules represented 62% of all new drug approvals in 2023, underlining their role in the drug development pipeline. The National Cancer Institute (NCI) reported that 75% of oncology drugs in clinical trials in 2023 were small molecules, further emphasizing their prevalence in therapeutic research. Small molecules continue to dominate in preclinical discovery due in part to their accessible pharmacokinetic properties and ease of optimization. The NIH's Molecular Libraries Program has screened over 500,000 small molecules for potential therapeutic applications, providing a vast resource for drug discovery efforts. Moreover, the public-private partnership known as the European Lead Factory highlighted a 30% increase in small molecule screening projects in 2023 over 2022. The cost-effectiveness and scalability of small-molecule production also contribute to their popularity in preclinical studies. The U.S. Government Accountability Office (GAO) reported that the average cost of developing a small molecule drug is approximately 20-30% lower than that of a biologic drug. The cost-effectiveness of these drugs, along with the established regulatory routes for small molecule drugs, continued to include importance in the In Vivo CRO market.

By Indication

In 2023, oncology was the leading in vivo CRO segment across the globe, with a revenue share of 28% This high market share can be attributed to the high prevalence of cancer around the globe and the need for new and effective therapies. According to the World Health Organization (WHO), cancer accounted for around 10 million deaths worldwide in 2023, making it one of the leading causes of death. According to the National Cancer Institute (NCI), cancer research funding in the USA reached $6.9 billion in the year 2023, with a 5% growth compared to last year. The U.S. Food & Drug Administration (FDA) reported a 20% increase in Investigational New Drug (IND) applications for cancer therapies in 2023 versus 2022, which supports a healthy pipeline of oncology drugs advancing into in vivo testing, according to the FDA's Oncology Center of Excellence. The European Medicines Agency (EMA) has also reported that in 2023 cancer treatments accounted for 35% of all marketing authorization applications.

The increasing popularity of personalized medicine and targeted therapies in oncology has additionally driven the growth of in vivo CRO services. The NIH's Cancer Genome Atlas Program has characterized over 20,000 primary cancer and matched normal samples spanning 33 cancer types, providing valuable data for developing targeted therapies. This wealth of genomic information has led to an increased focus on patient-derived xenograft (PDX) models, with the NCI's Patient-Derived Models Repository reporting a 40% increase in PDX model requests in 2023.

By GLP type

In 2023, the GLP toxicology segment held the largest revenue share of the market. The reason is the pivotal role of toxicology studies in establishing the safety of new drugs and medical devices prior to human trial. Mandatory Good Laboratory Practice (GLP) toxicology studies for all Investigational New Drug (IND) applications (FDA). In 2023 alone, the FDA granted more than 4,000 INDs, each of which required significant GLP toxicology data. This is complemented by the regulatory needs across the world in relation to GLP toxicology. According to the supporting document of the EMA, this trend was confirmed in 2023, with 95% of all marketing authorization applications containing GLP toxicology data. Over 30 countries belonging to the Organization for Economic Co-operation and Development (OECD) adhere to the OECD's guidelines for GLP studies, so that there is consistency and reliability in toxicology testing.

This growth can be attributed to the growing sophistication of new therapeutic modalities, including gene therapies and nanomedicines, among others, and an increased need for adequate GLP toxicology. The NIH's National Toxicology Program (NTP) reported a 25% increase in requests for specialized toxicology studies for novel therapeutics in 2023 compared to the previous year. This trend underlines the increasing demand for advanced GLP toxicology services within the In Vivo CRO segment.

In Vivo CRO Market Regional Insights

In 2023, North America led the In Vivo CRO market and held a market share of 49%. This leadership position is due to this region’s strong pharmaceutical and biotechnology industry, with large amounts of R&D being infused into it, especially in the last ten years. In 2023, the U.S. biopharmaceutical industry invested $102 billion in R&D, according to the Pharmaceutical Research and Manufacturers of America (PhRMA), up 5 percent from 2022. The national health agency of the United States NIH, is the largest public funder for biomedical research worldwide, investing $41.7 billion toward research grants in 2023 which will also help propel growth of the In Vivo CRO market in the region.

The Asia Pacific region is projected to grow with the fastest compound annual growth rate (CAGR) during the forecast period. This swift expansion is fueled by the rising outsourcing of preclinical research to countries like China and India, governmental initiatives to develop the life sciences industry, and the growing pharmaceutical market in the region. The "Pharma Vision 2023" policy of the Indian government aspires to establish India as a leading global player in drug manufacturing, resulting in a 15% upsurge in R&D investment by pharmaceutical companies in India in 2023. Similarly, China's "Healthy China 2030" plan has resulted in a 20% year-over-year increase in biomedical research funding in 2023, according to the National Natural Science Foundation of China.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the In Vivo CRO Market

Key Service Providers/Manufacturers

-

Cytel (East Horizon, Enforesys)

-

Syneos Health (Clinical Trial Services, Commercial Services)

-

ICON plc (Clinical Development Services, Commercialization Services)

-

Biocon (INSUGEN, BASALOG)

-

Medpace (Full-Service Clinical Trial Management, Central Laboratory Services)

-

Crown Bioscience International (PDX Models, In Vivo Pharmacology Services)

-

Charles River Laboratories (In Vivo Toxicology, Discovery Services)

-

Labcorp Drug Development (Preclinical In Vivo Studies, Clinical Trial Management)

-

WuXi AppTec (In Vivo Pharmacokinetics, Toxicology Services)

-

PRA Health Sciences (Clinical Research Services, Data Solutions)

-

Parexel International (Clinical Trial Management, Regulatory Consulting)

-

Covance (Nonclinical Safety Assessment, Clinical Development)

-

Envigo (In Vivo Pharmacology, Toxicology Testing)

-

Pharmaron (In Vivo DMPK Studies, Safety Assessment)

-

Frontage Laboratories (In Vivo Bioanalytical Services, Preclinical Studies)

-

Eurofins Scientific (In Vivo Toxicology, Pharmacokinetics)

-

MPI Research (In Vivo Safety Studies, Efficacy Testing)

-

QuintilesIMS (Clinical Trial Services, Real-World Evidence Solutions)

-

PPD (Pharmaceutical Product Development) (In Vivo Pharmacology, Clinical Development)

-

BASi (Bioanalytical Systems Inc.) (In Vivo Toxicology, Pharmacology Services)

Recent Developments

-

In November 2024, Covance, a LabCorp company, launched a new AI-powered platform for analyzing in vivo imaging data, aimed at improving the efficiency and accuracy of preclinical studies. The platform has been reported to reduce analysis time by up to 40% in initial trials.

-

In March 2024, WuXi AppTec expanded its in vivo pharmacology capabilities by opening a new state-of-the-art facility in Suzhou, China. The facility is equipped with advanced technologies for conducting complex in vivo studies, particularly in the areas of immuno-oncology and neuroscience.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.7 Billion |

| Market Size by 2032 | USD 9.2 Billion |

| CAGR | CAGR of 8.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Model Type (Rodent based, Non-Rodent base) • By Indication (Oncology, CNS Conditions, Diabetes, Obesity, Pain management, Autoimmune/inflammation conditions, Others) • By Modality (Small Molecules, Large Molecules) • By GLP Type (GLP Toxicology, Non GLP) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cytel, Syneos Health, ICON plc, Biocon, Medpace, Crown Bioscience International, Charles River Laboratories, Labcorp Drug Development, WuXi AppTec, PRA Health Sciences, Parexel International, Covance, Envigo, Pharmaron, Frontage Laboratories, Eurofins Scientific, MPI Research, QuintilesIMS, PPD (Pharmaceutical Product Development), BASi (Bioanalytical Systems Inc.) |