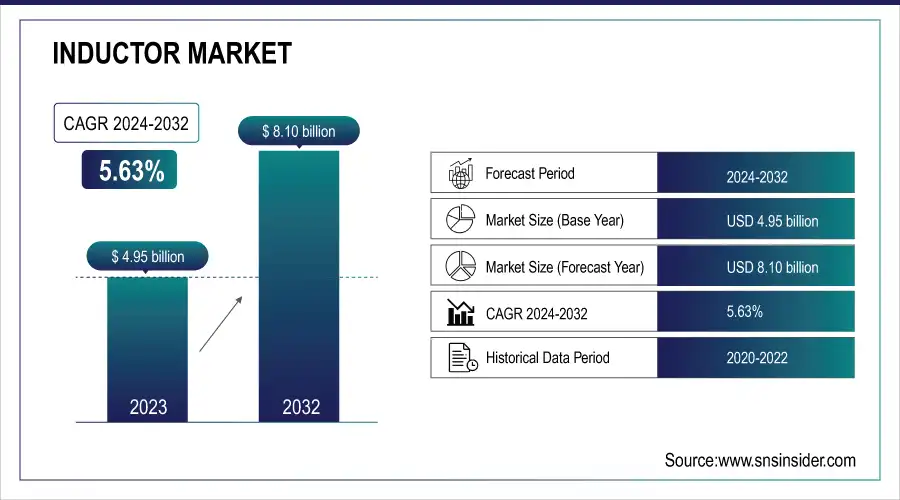

Inductor Market Size & Growth Analysis:

The Inductor Market was valued at USD 4.95 Billion in 2023 and is projected to reach USD 8.10 Billion by 2032, growing at a CAGR of 5.63% from 2024 to 2032.

This growth is driven by rapid advancements in technology, rising demand for compact and energy-efficient electronic devices, and the increasing penetration of inductors in various sectors such as automotive, consumer electronics, and telecommunications.

To Get more information on Inductor Market - Request Free Sample Report

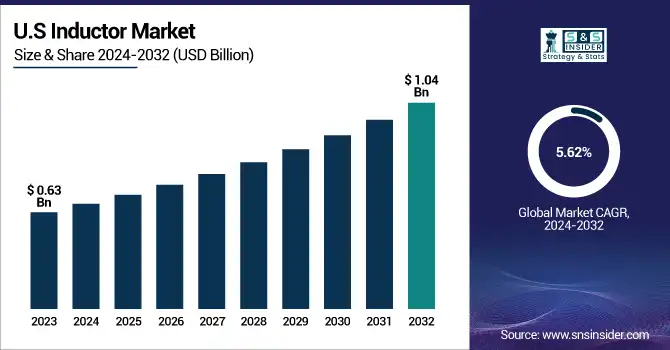

In the United States the inductor market was valued at USD 0.63 billion in 2023 and is expected to reach to USD 1.04 billion by 2032, growing at a CAGR of 5.62% over the same period. Technological trends like the adoption of multilayered and surface mount inductors are transforming performance efficiency and miniaturization, while the industrial and heavy-duty sectors are seeing increased integration of inductors in automation systems and power management. Furthermore, the RF and telecommunication segments continue to rely on high-frequency inductors to support the growing need for faster, more reliable communication systems.

Inductor Market Dynamics:

Drivers:

-

Inductors are becoming essential components in the evolution of modern consumer electronics.

The rising adoption of consumer electronics is a key driver for the inductor market, as devices such as smartphones, laptops, tablets, and wearables increasingly rely on inductors for critical functions like power regulation, signal filtering, and energy storage. As consumers demand more compact, efficient, and high-performance electronics, manufacturers are incorporating advanced inductor technologies to meet these evolving requirements. The widespread use of wireless charging, high-speed data transfer, and energy-efficient circuits further amplifies the need for reliable and miniaturized inductors. Moreover, as the trend toward smart homes, connected devices, and portable electronics accelerates, inductors play an indispensable role in ensuring consistent performance, signal integrity, and power stability. This growing dependency on consumer electronics across both developed and emerging markets continues to create significant opportunities for inductor manufacturers, positioning them as critical components in the evolution of modern digital lifestyles.

Restraints:

-

Silent strain in managing heat challenges limits modern inductor design.

Heat dissipation issues present a significant restraint in the inductor market, particularly as devices become smaller and more powerful. In compact electronics, managing thermal performance is crucial to maintaining efficiency and preventing component failure. Inductors generate heat during operation, especially under high current or frequency conditions, which can affect surrounding components and overall system reliability. As devices are increasingly miniaturized, there's less physical space to integrate effective cooling mechanisms, making thermal management more complex. This challenge often necessitates the use of specialized materials or designs, increasing production costs and limiting design flexibility. Ensuring optimal heat dissipation without compromising size, performance, or cost remains a persistent technical barrier for manufacturers in the evolving electronics landscape.

Opportunities:

-

Tuning into the 5G Era as Inductors Spark Next-Gen Wireless Evolution

The global rollout of 5G technology offers a transformative opportunity for the inductor market, especially in the domain of Radio Frequency (RF) and high-frequency Inductance s. India, in particular, has emerged as a global leader in 5G adoption, with coverage reaching nearly 80% of the population and over 270 million subscribers, thanks to its Digital India initiative. This rapid expansion drives a parallel surge in demand for components like inductors that enable faster, more reliable data transmission. Simultaneously, technological advancements such as Adtran’s launch of the AccessWave50—the industry’s first full C-band tunable 50Gbit/s SFP56 DWDM PAM4 pluggable transceiver—are revolutionizing 5G Designed to enhance network efficiency and reduce energy consumption, this solution enables operators to expand capacity while simplifying deployment and minimizing costs. Such innovations significantly amplify the need for high-performance inductors, positioning manufacturers to benefit from the surging demand for scalable, energy-efficient infrastructure that supports next-gen connectivity.

Challenges:

-

Raw Material Instability Raises Production Costs in the Inductor Market

Raw material price volatility poses a significant hurdle for the inductor market, especially with key materials like copper, ferrite, and rare earth elements experiencing frequent cost fluctuations. Copper, widely used in winding coils, is particularly susceptible to global supply-demand shifts, geopolitical tensions, and energy prices, all of which contribute to unstable pricing. Similarly, ferrite materials used in core manufacturing face supply chain uncertainties due to mining regulations and environmental constraints. These unpredictable costs can disrupt budgeting, inflate production expenses, and reduce profit margins for manufacturers. The inability to predict material prices accurately also complicates long-term contracts and strategic planning, forcing companies to adjust pricing models or absorb costs, both of which impact market competitiveness.

Inductor Industry Segment Analysis:

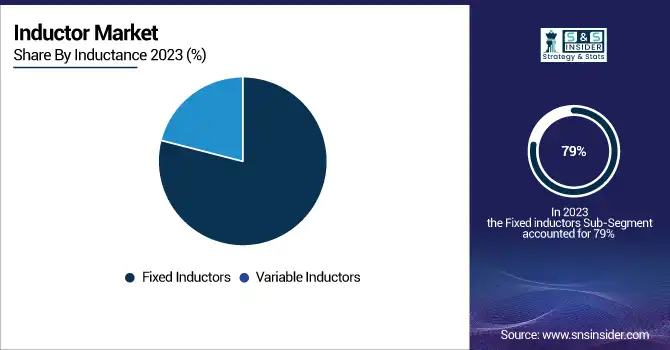

By Inductance

Fixed inductors accounted for approximately 79% of the total inductor market revenue in 2023, solidifying their position as the dominant segment. This strong market share can be attributed to their widespread Inductance in consumer electronics, automotive electronics, power supplies, and industrial equipment where stable inductance values are critical. Unlike variable inductors, fixed inductors offer greater reliability, compact size, and cost-effectiveness, making them the preferred choice in circuits requiring consistent performance. Their simplicity in design and ease of integration into surface mount and through-hole technologies further enhance their market appeal. The growing adoption of miniaturized and energy-efficient electronic devices continues to drive demand for fixed inductors, reinforcing their leading market position across multiple end-use industries.

The Variable Inductors segment is projected to be the fastest-growing category in the inductor market during the forecast period from 2024 to 2032. This growth is driven by the increasing demand for tunable and adaptive circuit components in Inductance s such as RF communication, signal processing, and testing equipment. Variable inductors offer flexibility by allowing inductance values to be adjusted dynamically, which is crucial in modern communication systems that operate across varying frequencies. Their relevance is expanding with the rise of 5G networks, IoT devices, and advanced wireless technologies that require precise tuning. As industries move toward more complex and multifunctional electronic systems, the demand for variable inductors is expected to surge, positioning them as a key growth driver in the market.

By Type

The Film Type segment dominated the inductor market in 2023, accounting for approximately 45% of the total revenue share. This dominance is attributed to its superior performance characteristics, including high stability, low tolerance, and excellent frequency response, making it ideal for Inductance s in telecommunications, automotive electronics, and consumer devices. Film inductors are widely preferred in circuits requiring precision and reliability, particularly in compact and high-frequency environments. Their robust design ensures minimal power loss and better thermal management, which supports their integration into advanced electronic systems. Additionally, with the rising adoption of high-speed communication networks and power-efficient devices, film inductors continue to gain traction, further solidifying their leading position in the global inductor market landscape.

The Multilayered segment is projected to be the fastest-growing inductor type in the global market during the forecast period from 2024 to 2032. This expansion is mainly fueled by the continuous trend toward miniature electronic devices and the need for small, high-performance units in mobile phones, pads, and other handheld devices. Multilayer inductors are smaller in size, offer higher inductance in the same or smaller footprint and are better suited for integration with surface-mount technology. These are broadly used in advanced communication systems and RF modules due to their efficiency in high frequency operation. The active development and establishment of new 5G networks and expanding IoT Inductance s are driving the need for smaller and more efficient inductors, and multilayered inductors are becoming the most important solution for the electronics of the future.

By Core Type

The Ferromagnetic/Ferrite Core segment dominated the global inductor market in 2023, accounting for approximately 60% of the total revenue share. This dominance is attributed to the superior magnetic permeability and efficiency of ferrite materials, which allow for high inductance values with minimal core losses. Ferrite core inductors are widely used in power supplies, RF Inductance s, and signal processing due to their lightweight, cost-effectiveness, and ability to operate effectively across a wide frequency range. Their excellent noise suppression capabilities also make them ideal for electromagnetic interference (EMI) filtering in consumer electronics and industrial equipment. As electronic devices become more compact and efficient, the demand for high-performance ferrite core inductors continues to grow across various end-use sectors.

The Air Core segment is projected to be the fastest-growing category in the global inductor market during the forecast period from 2024 to 2032. This growth is to the growing demand for inductors at high frequency Inductance s like RF circuits, wireless channels, and satellite communications as these inductors offer better performance characteristics due to no core losses and less distortion. While magnetic core inductors saturate, air core offer good inductance stability across a large frequency range due to where the air core does not saturate, making them perfect for precision Inductance s, making air core inductors prevalent in aerospace, telecom and defense systems along with advances in miniaturization and wireless technologies. The trend in electronics to develop lightweight, efficient, high-power components has also been enabled by the increasing use of air core inductors in contemporary circuit designs.

By Shield Type

The Shielded segment dominated the global inductor market in 2023, accounting for approximately 69% of the total revenue share. This dominance is attributed to the growing need for electromagnetic interference (EMI) suppression in compact and sensitive electronic devices such as smartphones, tablets, automotive ECUs, and industrial control systems. Shielded inductors are designed with a magnetic shield around the core, which minimizes noise emissions and prevents signal distortion, making them ideal for high-density circuit environments. Their superior performance in reducing interference and maintaining signal integrity is critical for ensuring reliability in complex electronic assemblies. As devices continue to shrink in size while increasing in functionality, the demand for shielded inductors remains strong, especially in sectors prioritizing EMI compliance and signal quality.

The Unshielded segment is projected to be the fastest-growing category in the inductor market during the forecast period from 2024 to 2032. This growth is driven by increasing Inductance s in cost-sensitive and space-constrained electronics where minimal electromagnetic interference is present or acceptable. Unshielded inductors are generally more compact, lighter, and more economical compared to their shielded counterparts, making them suitable for basic circuits, power supplies, and consumer gadgets. Their simple construction enables efficient thermal management and easier integration into printed circuit boards. As demand rises for low-cost electronic components in rapidly expanding markets such as smart home devices, basic IoT modules, and portable consumer electronics, unshielded inductors are gaining significant traction, offering a balance between performance and affordability.

By Mounting Technique

The Surface Mount segment dominated the inductor market with the largest revenue share of around 77% in 2023, driven by the widespread adoption of compact, high-performance electronic devices across consumer electronics, automotive, and industrial sectors. Surface mount technology (SMT) enables smaller component size, automated assembly, and higher circuit density, which are critical for modern miniaturized electronics. Its compatibility with high-speed production lines reduces manufacturing costs and increases efficiency. Additionally, SMT inductors offer excellent electrical performance, including low resistance and high current handling, making them ideal for use in smartphones, laptops, medical devices, and automotive ECUs. As manufacturers continue to prioritize space-saving designs and improved functionality, the demand for surface mount inductors is expected to sustain its dominance in the years ahead.

The Through Hole segment is expected to witness the fastest growth in the inductor market during the forecast period of 2024 to 2032 due to its superior mechanical strength and reliability in high-stress environments. Unlike surface-mount counterparts, through-hole inductors are well-suited for Inductance s that require durability and high power handling, such as industrial machinery, aerospace systems, and automotive electronics. These inductors can endure higher thermal and mechanical stress, making them ideal for harsh operational conditions. Additionally, their compatibility with larger-sized components allows for greater inductance values and better performance in power supply circuits. As industries continue to expand automation and heavy-duty Inductance s, demand for robust and long-lasting inductors is fueling the growth of the through-hole segment.

By End User

The Consumer Electronics segment dominated the inductor market with the largest revenue share of around 30% in 2023, driven by the rapid proliferation of electronic devices such as smartphones, tablets, laptops, wearables, and smart home systems. Inductors play a crucial role in power regulation, noise suppression, and signal filtering within these devices, enabling efficient and reliable performance. The surge in demand for compact, energy-efficient electronics has led manufacturers to integrate advanced inductors that support miniaturization while maintaining performance. Additionally, increasing consumer preference for feature-rich and connected devices has accelerated the adoption of high-frequency and multilayer inductors. As innovation in smart gadgets and IoT-based products continues to expand, the consumer electronics segment is expected to retain its dominant position and act as a key driver for the overall growth of the inductor market during the forecast period.

The Automotive segment is projected to be the fastest-growing end-use category in the inductor market during the forecast period from 2024 to 2032. This rapid growth is fueled by the increasing adoption of advanced electronics in modern vehicles, including electric vehicles (EVs), hybrid electric vehicles (HEVs), and connected cars. Inductors are vital in automotive Inductance s for powertrain systems, infotainment units, advanced driver-assistance systems (ADAS), battery management, and onboard chargers. With the global push toward electrification and stricter emission norms, automakers are integrating more sophisticated electronic systems that demand efficient, high-performance inductors. Moreover, the trend of autonomous driving and vehicle-to-everything (V2X) communication further boosts the need for miniaturized and durable inductors capable of operating in harsh environments.

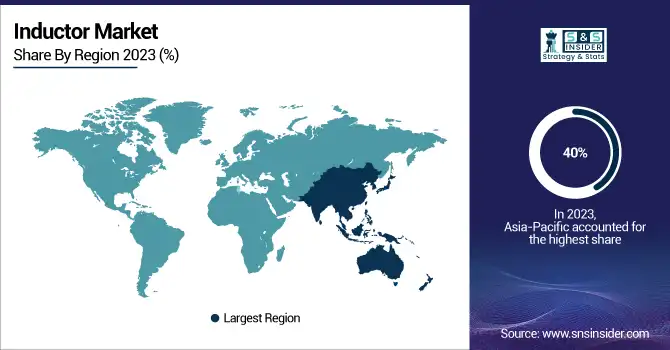

Inductor Market Regional Insights:

The Asia-Pacific region holds the largest share of the inductor market, accounting for approximately 40% of the total revenue in 2023. This dominance is primarily driven by the rapid industrialization and technological advancements across key countries, including China, Japan, South Korea, and India. The region is home to major electronics manufacturers, automotive companies, and telecommunication giants, all of which are major consumers of inductors. Additionally, the increasing adoption of consumer electronics, automotive advancements, and the expansion of 5G infrastructure in Asia-Pacific significantly contribute to the growing demand for inductive components. The region’s robust manufacturing capabilities and cost-effective production processes further bolster its market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is poised to experience the fastest growth in the inductor market from 2024 to 2032, driven by several key factors. The region's strong technological advancements, particularly in the areas of 5G networks, electric vehicles, and consumer electronics, will significantly boost the demand for inductors, especially high-frequency and power inductors. The growing need for efficient energy solutions and robust connectivity infrastructure further supports the market's expansion. Additionally, the region's well-established industrial base, coupled with ongoing investments in R&D, positions it as a leader in driving innovation within the inductor market. The rise in automation and IoT Inductance s will also contribute to the steady demand for inductors in various sectors, ensuring North America's dominance in the global market throughout the forecast period.

Major Players in the Inductor Market along with their Products:

-

Murata Manufacturing (Japan) - Ceramic Capacitors, Inductors, Resistors, Sensors, RF Components, and Power Modules.

-

TDK (Japan) - Inductors, Capacitors, Magnetic Materials, and Sensors.

-

Vishay Intertechnology (USA) - Resistors, Capacitors, Inductors, Diodes, and Integrated Circuits.

-

TAIYO YUDEN (Japan) - Ceramic Capacitors, Inductors, and Ferrite Beads.

-

Chilisin (Taiwan) - Inductors, Transformers, EMI Filters, and Power Inductors.

-

Delta Electronics (Taiwan) - Power Supplies, Inductors, Transformers, and LED Drivers.

-

Panasonic (Japan) - Capacitors, Inductors, Batteries, Sensors, and Power Modules.

-

ABC Taiwan Electronics (Taiwan) - Inductors, Transformers, Chokes, and Ferrite Beads.

-

Pulse Electronics (USA) - Inductors, Transformers, Magnetic Components, and Antennas.

-

Coilcraft (USA) - Inductors, Transformers, and Magnetics for Power Inductance s.

-

Shenzhen Sunlord Electronics (China) - Inductors, Chip Beads, Transformers, and Resistors.

-

Bourns (USA) - Potentiometers, Resistors, Inductors, and Sensors.

-

ICE Components (USA) - Inductors, Transformers, and Magnetic Components.

-

Kyocera Corp AVX (Japan/USA) - Capacitors, Inductors, Resistors, and Circuit Protection Devices.

-

Bel Fuse Inc. (USA) - Inductors, Transformers, and Circuit Protection Devices.

List of Suppliers who Provide Raw material and component in Inductor Market:

-

Kemet Corporation (USA)

-

AvX Corporation (USA)

-

Sumida Corporation (Japan)

-

TDK Corporation (Japan)

-

Epcos (TDK) (Germany)

-

Murata Manufacturing (Japan)

-

Vishay Intertechnology (USA)

-

Chilisin Electronics Corp. (Taiwan)

-

Panasonic Corporation (Japan)

-

Coilcraft (USA)

-

Shenzhen Sunlord Electronics (China)

-

Bourns, Inc. (USA)

-

Nippon Chemi-Con Corporation (Japan)

-

Taiyo Yuden (Japan)

Recent Development:

-

Jan 6, 2025, Murata Manufacturing Co., Ltd. has introduced the world’s smallest 006003-inch size (0.16 mm x 0.08 mm) chip inductor, reducing volume by 75%. This development supports the miniaturization needs of mobile devices with high-density mounting.

-

March 18, 2025, TDK Corporation has launched the ADL3225VF series automotive power-over-coax (PoC) inductors, supporting up to 1600 mA and a wide frequency range. These inductors offer improved current capacity and reliability in compact designs for advanced driver-assistance systems (ADAS).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.95 Billion |

| Market Size by 2032 | USD 8.10 Billion |

| CAGR | CAGR of 5.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Inductance (Fixed Inductors, Variable Inductors) • By Type (Film Type, Multilayered, Wire Wound, Molded) • By Core Type (Air Core, Ferromagnetic/Ferrite Core, Iron Core) • By Shield Type (Shielded, Unshielded) • By Mounting Technique (Surface Mount, Through Hole) • By End User (Consumer Electronics, Automotive, Industrial, RF & Telecommunication, Military & Defense, Transmission & Distribution, Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Murata Manufacturing (Japan), TDK (Japan), Vishay Intertechnology (USA), TAIYO YUDEN (Japan), Chilisin (Taiwan), Delta Electronics (Taiwan), Panasonic (Japan), ABC Taiwan Electronics (Taiwan), Pulse Electronics (USA), Coilcraft (USA), Shenzhen Sunlord Electronics (China), Bourns (USA), ICE Components (USA), Kyocera Corp AVX (Japan/USA), Bel Fuse Inc. (USA). |