Industrial Enzymes Market Report Scope & Overview:

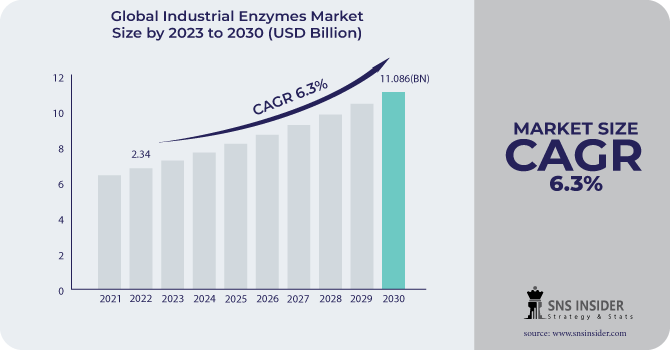

The Industrial Enzymes Market size was USD 6.8 billion in 2022 and is expected to Reach USD 11.086 billion by 2030 and grow at a CAGR of 6.3 % over the forecast period of 2023-2030.

Industrial enzymes are the enzymes that are commercially used in a variety of industries like Food & Beverages, Animal Feed, Healthcare, Textiles & Leather Processing, and Others industries. Plants and animals are the source of enzymes, Carbohydrases, Proteases, Lipases, and Others are the most often used enzymes in various industries.

Based on application, the food and beverage segment dominated the industrial enzymes market, accounting for 21% of total revenue in 2022. The increased usage of enzymes in the production of food and drink products is to increase product shelf life and quality. Vegetable and fruit processing, cheese processing, oils and fats processing, and other food processing industries such as dairy, brewing, and baking products use both bespoke enzyme solutions and proprietary enzyme products.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing demand for cosmetics and personal care products

Enzymology is a growing field in dermatology and cosmetics that focuses on finding enzymes to improve skin look and avoid disorders. Coenzymes support enzyme processes in the skin, promoting a youthful appearance. Enzymes are used in cosmetics for skin resurfacing, anti-aging, and treating acne and pigmentation disorders. They fight free radicals caused by pollution and other potentially hazardous conditions. Superoxide dismutase (SOD) is an important antioxidant enzyme that protects cells from oxidative damage.

RESTRAIN

-

Safety concerns while using industrial enzymes

Due to their catalytic action, enzymes normally pose few concerns to users. However, due to their chemical composition, they may also pose risks due to their source, residual microbiological activity, activity-related toxicity, and allergenicity. Enzymes can behave as allergens when inhaled as dust and can trigger severe reactions. To prevent the development of aerosols, liquid enzyme preparations are preferred over dry ones, although spilled enzyme powder needs to be cleaned up right away. Environmental and health concerns from protease enzymes, notably respiratory issues, exist. The focus of regulatory authorities is on potentially dangerous substances employed in the manufacture of enzymes. During the projected period, safety issues could present a challenge to the market and impede expansion.

OPPORTUNITY

-

Research and development activities in industrial enzymes

In recent years, the industrial enzymes market has undergone substantial technological advancements, with new advances in enzyme engineering, fermentation, and bioprocessing. Researchers are continually working to create new and improved enzymes with improved features like stability, specificity, and activity. New enzymes with better features such as thermostability, pH tolerance, and substrate selectivity are being developed. Enzyme engineering to improve performance and selectivity. Because these novel enzymes can be employed in a broader range of applications, demand for industrial enzymes is increasing.

-

Innovations in technologies and wide industry scope

CHALLENGES

-

Stringent regulations of industrial enzymes

According to the Association of Manufacturers and Formulators of Enzyme Products (AMFEP), enzymes used in the production of bioethanol, textile and leather, and paper and pulp must be registered under the EU REACH Regulation prior to the manufacturing process or imported into the EU in quantities less than one ton per year. Even though strict laws are enforced for their usage in industries in the European Union, the United Kingdom, and Canada, there is a lack of a unified regulatory system for the use of industrial enzymes. These regulatory arrangements may be a barrier to the expansion of the industrial enzymes industry.

IMPACT OF RUSSIA-UKRAINE WAR

Russia and Ukraine are amongst of major user of enzymes due to their large industrial base in both countries. Enzymes are mostly used in the industrial sector. The war has disrupted industrial activities in Ukraine due to the destruction caused by Russia. Methanol, which will export 1.4 million tonnes to the EU in 2021, is Russia's main chemical product. An estimated 15% of Europe's methanol demand comes from Russian exports, thus if those shipments need to be replaced, the market will be significantly affected. Thus, industrial activities have been delayed as a result of the sanctions imposed on Russia and the destruction, and the need for enzymes has decreased temporarily.

IMPACT OF ONGOING RECESSION

Recession has largely affected industrial activities and it will be affected as long as the recession survives. Inflation has led to high labor costs, high transportation costs, and high costs of raw materials which have led to industrial expenses. During inflation, manufacturers may reduce the production activities of enzymes. A significant user of industrial enzymes is the food and beverage sector. The Food and Drink Ingredients Association forecasts a 5% decrease in investment in the food and beverage sector in 2023. This has thus indirectly impacted the need for enzymes.

MARKET SEGMENTATION

By Type

-

Carbohydrases

-

Proteases

-

Lipases

-

Other

By source

-

Plant

-

Animal

By Application

-

Food & Beverages

-

Animal Feed

-

Healthcare

-

Textiles

-

Leather Processing

-

Detergents and Cleaners

-

Other

REGIONAL ANALYSIS

North American region dominated the market of industrial enzymes, accounting for 38% of total revenue in 2022. This is owing to a strong presence of numerous end-use like food & beverage, medicines, personal care & cosmetics industries, and laundry detergent, as well as a considerable scope for R&D operations in major countries in the region. These strains increase the product's efficiency in food items. The United States leads the market due to the highest revenue share in the world, primarily due to biofuel and beverage production. Also, the growing demand for craft beer is most likely driving the expansion of the industrial enzyme industry.

Europe emerged as the second-largest consumer owing to enzyme demand in pharmaceutical, and cosmetic products. Enzyme demand is expected to be driven by the presence of major pharmaceutical and cosmetic companies in the region. The rapidly rising population and textile industry in the region are projected to drive demand for enzymes in textile processing. The European Commission's preference for reducing greenhouse gas emissions and supporting biofuel production is likely to boost market growth over the projection period. Russia is projected to see a big boost in meat production because the enzyme is widely utilized in meat processing to improve meat softness.

Asia Pacific is the fastest-growing region due to the demand for industrial enzymes in meat production especially in China. A shift toward the development of the food, healthcare, and pharmaceutical industries has driven the demand for enzymes. Other significant factors influencing market revenue growth include increased consumer awareness of food safety, high demand for nutraceuticals, rising investments in research & development activities, and a high frequency of chronic disorders. In addition, the need for enzymes is rising across a range of industrial and specialist sectors, and the textile and leather industries are expanding quickly, helping to support market revenue growth in the area to some extent.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Industrial Enzymes Market are DuPont, Novozymes, Royal DSM, AB Enzymes, BASF SE, NOVUS INTERNATIONAL, Advanced Enzyme Technologies, Adisseo, Chr. Hansen Holding A/S, Associated British Foods Plc, Koninklijke DSM N.V., BioProcess Algae, LLC, and other key players.

DuPont-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, Barcelona-based Zymvol's goal is to transfer enzymes from the pharmaceutical business to the chemical and food industries. Zymvol has raised €1.3 million to speed up the development of new industrial enzymes through computer simulations to promote the enhanced and sustainable use of these building proteins.

In 2022, Novozymes has announced a merger with Chr. Hansen is a Danish pharmaceutical, agricultural, and food ingredients corporation. Novozymes made this deal as a tactical move to strengthen its position in the market.

In 2022, BASF SE sold its BASF Nutrilife baking enzymes business to Lallemand Inc. an enzyme manufacturer. Lallemand has a distinct product portfolio that includes platforms for yeast and bacterium technology.

| Report Attributes | Details |

| Market Size in 2022 | US$ 6.8 Billion |

| Market Size by 2030 | US$ 11.086 Billion |

| CAGR | CAGR of 6.3 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Carbohydrases, Proteases, Lipases, and Others) • By source (Plant, Animal) • By Application (Food & Beverages, Animal Feed, Healthcare, Textiles, Leather Processing, Detergents and Cleaners, Bio-Fuel, Cosmetics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | DuPont, Novozymes, Royal DSM, AB Enzymes, BASF SE, NOVUS INTERNATIONAL, Advanced Enzyme Technologies, Adisseo, Chr. Hansen Holding A/S, Associated British Foods Plc, Koninklijke DSM N.V., BioProcess Algae, LLC |

| Key Drivers | • Increasing demand for cosmetics and personal care products |

| Market Restrain | • Safety concerns while using industrial enzymes |