Industrial Fine Grinding Mills Market Report Scope & Overview:

The Industrial Fine Grinding Mills Market was valued at USD 1.43 billion in 2025 and is expected to reach USD 2.52 billion by 2035, growing at a CAGR 5.88% of from 2026-2035.

The Industrial Fine Grinding Mills market covers equipment used to process materials into fine and ultra-fine particles for mining, chemicals, pharmaceuticals, food, and cement applications. Market growth is driven by demand for precise particle size control, improved material performance, process efficiency, and increasing adoption of energy-efficient, automated grinding technologies.

Industrial fine grinding mills adoption grew about 5.8% in 2025, driven by rising demand for energy-efficient, high-precision material processing across key industrial sectors.

Industrial Fine Grinding Mills Market Size and Forecast

-

Market Size in 2025: USD 1.43 Billion

-

Market Size by 2035: USD 2.52 Billion

-

CAGR: 5.88%

-

Base Year: 2025

-

Forecast Period: 2026-2035

-

Historical Data: 2022-2024

To Get more information On Industrial Fine Grinding Mills Market - Request Free Sample Report

Key Trends in the Industrial Fine Grinding Mills Market:

-

Rapid shift toward energy-efficient and low-emission grinding technologies

-

Growing adoption of stirred media and jet mills for ultra-fine applications

-

Increased integration of automation, digital monitoring, and predictive maintenance

-

Rising demand for ultra-fine and micron-level particle size control

-

Expansion of customized and application-specific grinding solutions

U.S. Industrial Fine Grinding Mills Insights:

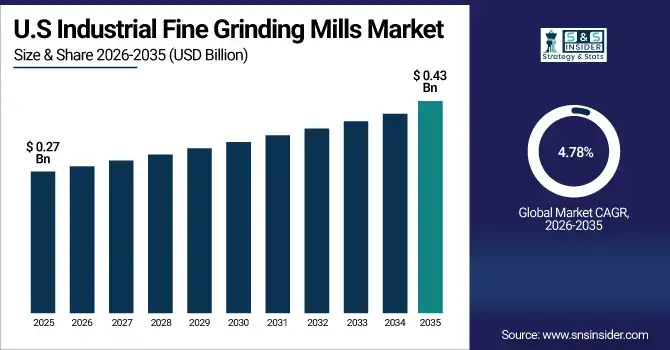

The U.S. Industrial Fine Grinding Mills Market is projected to grow from USD 0.27 Billion in 2025 to USD 0.43 Billion by 2035, at a CAGR of 4.78%. Growth is driven by rising mining and mineral processing activities, expanding pharmaceutical and specialty chemical production, increasing demand for ultra-fine particle sizes, replacement of aging milling equipment, and greater adoption of energy-efficient, automated, and digitally monitored grinding technologies to improve productivity and reduce operating costs.

Industrial Fine Grinding Mills Market Growth Drivers:

-

Increasing Focus on Energy Efficiency and Sustainable Grinding Operations

Industries across mining, chemicals, pharmaceuticals, and advanced materials are prioritizing energy-efficient and sustainable grinding solutions to reduce operating costs and meet environmental regulations. Energy consumption accounts for nearly 33% of total milling operating expenses, driving demand for optimized grinding technologies. Moreover, modern fine grinding mills deliver 18% energy savings compared to conventional systems. This growing emphasis on sustainability and cost efficiency is accelerating the adoption of advanced fine grinding mills with improved design, automation, and lower environmental impact.

Industrial Fine Grinding Mills Market Restraints:

-

High Capital and Operating Costs Limiting Market Adoption

Advanced fine grinding mills require substantial upfront capital due to complex design, precision components, and integration of automation and control systems. In addition to purchase costs, ongoing expenses related to energy consumption, maintenance, wear parts, and skilled labour further increase the total cost of ownership. These financial barriers can limit adoption, particularly among small and mid-sized manufacturers, and often result in longer payback periods, slowing the replacement of conventional grinding equipment with advanced fine grinding solutions.

Industrial Fine Grinding Mills Market Opportunities:

-

Growing Adoption of Automation and Digital Grinding Technologies

The increasing integration of automation and digital technologies presents a significant opportunity for the industrial fine grinding mills market. Advanced control systems, real-time monitoring, and predictive maintenance improve process stability, reduce downtime, and optimize energy use. These technologies enable manufacturers to achieve consistent product quality while lowering operating risks and labour dependency. As industries pursue smart manufacturing and operational efficiency, demand for digitally enabled fine grinding mills is expected to accelerate, creating long-term growth opportunities for equipment suppliers.

Industrial Fine Grinding Mills Market Segment:

-

By Mill Type: In 2025, Ball mills dominated with 36.80% share; Stirred Media mills fastest growing segment during 2026-2035

-

By Operation Mode: In 2025, Dry grinding dominated with 62.40% share; Wet grinding fastest growing segment during 2026-2035

-

By Particle Size: In 2025, Fine grinding dominated with 62.40% share; Ultra-Fine grinding fastest growing segment during 2026-2035

-

By End-Use Industry: In 2025, Mining & Minerals dominated with 41.20% share; Pharmaceuticals fastest growing segment during 2026-2035

Industrial Fine Grinding Mills Market Segment Analysis:

By Mill Type: Ball Mills Lead as Stirred Media Mills Emerge as Fastest-Growing Segment

Ball mills dominate the mill type segment due to their widespread use across mining, cement, and chemical industries, supported by simple operation, scalability, and high installed capacity. Their ability to handle large material volumes makes them a preferred choice for bulk grinding applications.

Stirred media mills are the fastest-growing segment, driven by superior energy efficiency and enhanced performance in ultra-fine grinding applications. Their growing adoption in pharmaceuticals, specialty chemicals, and advanced materials is accelerating market expansion.

By Operation Mode: Dry Grinding Leads as Wet Grinding Emerges as Fastest-Growing Segment

Dry grinding dominates the operation mode segment due to its extensive use in mining, cement, and chemical processing, where moisture control and bulk material handling are critical. Lower processing complexity and reduced handling costs further support its dominance.

Wet grinding is the fastest-growing segment, supported by increasing demand from pharmaceuticals and specialty chemicals that require precise particle dispersion, uniformity, and controlled contamination levels.

By Particle Size: Fine Grinding Leads as Ultra-Fine Grinding Emerges as Fastest-Growing Segment

Fine grinding leads the particle size segment due to its broad application in mining, construction materials, and industrial processing where standard micron-level reduction is sufficient.

Ultra-fine grinding is the fastest-growing segment, driven by rising demand for sub-micron and nano-scale particles in pharmaceuticals, coatings, pigments, and advanced material applications

By End-Use Industry: Mining & Minerals Lead as Pharmaceuticals Emerge as Fastest-Growing Segment

Mining & minerals dominate the end-use industry segment due to continuous demand for ore beneficiation, mineral processing, and high-volume material reduction. Fine grinding mills are essential for improving mineral recovery rates, particle liberation, and downstream processing efficiency, making them a core component of mining and cement operations worldwide.

Pharmaceuticals represent the fastest-growing end-use segment, driven by increasing demand for ultra-fine, high-purity powders used in active pharmaceutical ingredients and advanced drug formulations. Strict quality standards and the need for precise particle size control are accelerating adoption of advanced fine grinding mill technologies in pharmaceutical manufacturing.

Industrial Fine Grinding Mills Market - Regional Analysis

Asia-Pacific Industrial Fine Grinding Mills Market Insights:

In 2025, Asia-Pacific holds the largest market share of approximately 38.5%, making it both the dominant and fastest-growing region in the Industrial Fine Grinding Mills market. The region is projected to grow at a CAGR of around 10.07% during 2026-2035. This leadership is driven by extensive mining and mineral processing activities, large-scale cement production, and expanding chemical and pharmaceutical manufacturing. Rapid industrialization, infrastructure development, and rising adoption of energy-efficient grinding technologies further strengthen the region’s sustained market dominance and growth momentum.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Industrial Fine Grinding Mills Market Insights:

The North America Industrial Fine Grinding Mills market is characterized by strong demand from mining, chemicals, pharmaceuticals, and advanced materials industries. Market growth is supported by continuous replacement of aging equipment, increasing focus on operational efficiency, and adoption of advanced grinding technologies. Manufacturers in the region emphasize automation, digital monitoring, and energy-efficient mill designs to improve productivity and meet sustainability and regulatory requirements.

Europe Industrial Fine Grinding Mills Market Insights:

The Europe Industrial Fine Grinding Mills market is driven by strong industrial manufacturing, stringent environmental regulations, and a high focus on energy efficiency. Demand is supported by mining, chemicals, pharmaceuticals, and specialty materials industries seeking advanced grinding solutions. European manufacturers emphasize precision engineering, sustainability, and automation, leading to increased adoption of high-performance fine grinding mills designed to reduce emissions, improve process control, and enhance overall production efficiency.

Latin America Industrial Fine Grinding Mills Market Insights:

The Latin America market is driven by expanding mining and mineral processing activities and growing infrastructure development. Increasing adoption of modern, energy-efficient grinding technologies supports improved productivity, material recovery, and operational efficiency across industrial processing sectors.

Middle East & Africa Industrial Fine Grinding Mills Market Insights:

The Middle East & Africa market is supported by mining, cement, and construction sector growth. Rising industrial investments and gradual adoption of modern grinding technologies are improving material processing efficiency and supporting regional industrial development.

Industrial Fine Grinding Mills Market Competitive Landscape:

Metso Outotec, headquartered in Helsinki, Finland, is a global leader in minerals processing and industrial grinding solutions, offering advanced fine grinding mills for mining, cement, and industrial applications. The company focuses on energy-efficient technologies, digital process optimization, and sustainable equipment design.

-

In March 2025: Metso Outotec expanded its stirred media grinding mill portfolio and enhanced digital monitoring solutions to improve energy efficiency and throughput.

FLSmidth, headquartered in Copenhagen, Denmark, is a leading supplier of fine grinding and milling solutions for the mining and cement industries. The company emphasizes automation, process reliability, and low-emission grinding technologies to support sustainable industrial operations.

-

In February 2025: FLSmidth introduced upgraded fine grinding mill systems with integrated predictive maintenance features for large-scale mining operations.

NETZSCH Group, headquartered in Selb, Germany, is a prominent manufacturer of high-performance fine grinding and dispersing equipment serving chemicals, pharmaceuticals, food, and advanced materials industries. The company is known for precision milling, ultra-fine grinding capabilities, and customized solutions.

-

In January 2025: NETZSCH Group launched next-generation ultra-fine grinding mills with improved energy efficiency and advanced control systems for specialty material applications.

Industrial Fine Grinding Mills Market Key Players:

-

Metso Outotec

-

FLSmidth

-

Hosokawa Alpine

-

NETZSCH Group

-

Bühler Group

-

Schenck Process

-

Weir Group

-

Gebr. Pfeiffer

-

Loesche GmbH

-

Christian Pfeiffer Maschinenfabrik

-

Williams Patent Crusher & Pulverizer

-

Union Process, Inc.

-

Retsch GmbH

-

Sweco

-

CPM Holdings, Inc.

-

Bradken

-

Shanghai Zenith Machinery

-

FL Smidth MAAG Gear

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.43 Billion |

| Market Size by 2035 | USD 2.52 Billion |

| CAGR | CAGR of 5.88% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mill Type: (Ball Mills, Jet Mills, Hammer Mills, Attrition Mills, Roller Mills, Stirred Media Mills) • By Operation Mode: (Dry Grinding, Wet Grinding) • By Particle Size: (Fine Grinding, Ultra-Fine Grinding) • By End-Use Industry: (Mining & Minerals, Chemicals, Pharmaceuticals, Food & Beverages, Cement & Construction, Paints ,Coatings & Pigments) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Metso Outotec, FLSmidth, Hosokawa Alpine, NETZSCH Group, Bühler Group, ThyssenKrupp Industrial Solutions, Schenck Process, Weir Group, Gebr. Pfeiffer, Loesche GmbH, Christian Pfeiffer Maschinenfabrik, Eirich Group, Williams Patent Crusher & Pulverizer, Union Process, Inc., Retsch GmbH, Sweco, CPM Holdings, Inc., Bradken, Shanghai Zenith Machinery, FL Smidth MAAG Gear |