Predictive Maintenance Market Report Scope & Overview:

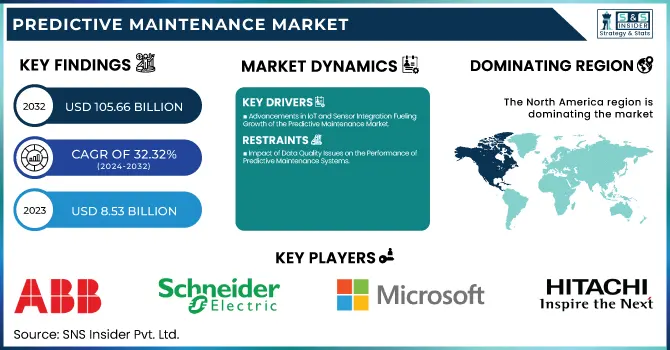

The Predictive Maintenance Market was valued at USD 8.53 billion in 2023 and is expected to reach USD 105.66 billion by 2032, growing at a CAGR of 32.32% from 2024-2032.

To Get more information on Predictive Maintenance Market - Request Free Sample Report

The predictive maintenance market is witnessing significant growth, fueled by progress in machine learning, the Internet of Things, and data analytics, allowing organizations to implement more effective maintenance approaches. Research indicates that predictive maintenance solutions result in cost reductions of as much as 40% in comparison to reactive maintenance and 8% to 12% when compared to preventive maintenance. Furthermore, they can decrease equipment downtime by as much as 50% and lengthen machine longevity by 20%. These advantages are particularly significant in sectors such as manufacturing, energy, and transportation, where the reliability of assets is essential for smooth operations. By incorporating sensors and live data collection, companies can constantly track equipment performance, foresee possible failures, and plan maintenance tasks more efficiently. This engaging strategy enables organizations to maximize their resources, lower expenses, and improve overall operational effectiveness.

This increased focus on predictive maintenance is primarily motivated by the need for operational efficiency and the wish to prevent unplanned downtime, which may result in considerable financial setbacks. Sectors featuring intricate machinery and extensive operations, like oil and gas, automotive, and utilities, are especially reaping the rewards of this trend. For instance, in June 2024, Hitachi Industrial Equipment Systems introduced the "Predictive Diagnosis Service" for air compressors, employing machine learning to assess data from remote monitoring. As companies understand the significance of reducing disruptions, predictive maintenance solutions are increasingly essential for improving productivity and asset dependability, driven by the demand for digital transformation and Industry 4.0.

The future of the predictive maintenance market is vast, with great innovation potential as algorithms of artificial intelligence and machine learning continue to grow more precise failure predictions. 5G will further amplify these changes by allowing data to be transmitted faster and in a more reliable manner, further improving decision speed. As predictive maintenance solutions become affordable for small and medium-sized enterprises, their uptake will spread wider. Continued advancement in analytics and sensor technology can only promise the bright future of predictive maintenance and thus significant growth opportunities and innovations within a very large number of sectors.

Predictive Maintenance Market Dynamics

Drivers

-

Advancements in IoT and Sensor Integration Fueling Growth of the Predictive Maintenance Market

Predictive maintenance is revolutionized by the continuous expansion of the Internet of Things and the integration of advanced sensors into industrial machinery. IoT-enabled devices allow real-time monitoring of equipment performance, giving constant feedback on key operational parameters such as temperature, vibration, and pressure. These sensors capture critical data that predictive maintenance systems rely on to identify anomalies and potential failures before they occur. Continuous equipment monitoring would result in proactive maintenance, hence the elimination of downtime, thereby making equipment last longer. In today's economy, the connection to IoT with the advent of more affordable sensor technologies can provide more effective solutions to predictive maintenance by improving efficiency and reducing costs on maintenance. In this way, the potential market for IoT continues to increase due to the use of this system in predictive maintenance.

-

The Role of Data Availability and Cloud Computing in Enhancing Predictive Maintenance Capabilities

The advancement of high volumes of industrial data in conjunction with cloud computing has dramatically improved the efficiency and cost-effectiveness of predictive maintenance systems. Cloud platforms enable the storage and processing of large, streaming volumes of real-time data through sensors and IoT devices and machinery. Using cloud-based technologies, predictive maintenance systems can take in massive volumes of data across a wide spectrum of sources. Analysis becomes fast and insights readily actionable. Because it seamlessly incorporates cloud computing into operations, its associated on-premises infrastructure reduces costs with greater accessibility to data and more efficient processing speed. Further development in cloud technology fosters predictive models to accurately forecast the failure of equipment, providing the companies with opportunities to align schedules for maximum uptime and optimal use of facilities. The synergy between data availability and cloud computing will continue to drive the growth of predictive maintenance in various industries.

Restraints

-

Impact of Data Quality Issues on the Performance of Predictive Maintenance Systems

Quality and accuracy in the data collected from sensors and other monitoring systems are highly dependent on the effectiveness of predictive maintenance. Poor data quality, such as inaccurate readings or incomplete datasets, can result in erroneous predictions regarding the equipment health; hence improper maintenance actions may be undertaken. Sensor malfunctions, inconsistency in data collection, and environmental factors that might affect the sensor may compromise the reliability of the predictive model. Inaccurate data increases the risk of either over-maintenance or under-maintenance, leading to avoided or unexpected downtime. The success of predictive maintenance solutions therefore calls upon the collection of high-quality data across all monitoring system points. Organizations without reliable data face challenges in attaining optimal operational efficiency - a significant impediment to the wider application and effectiveness of predictive maintenance technologies.

-

Challenges of High Initial Investment Hindering Widespread Adoption of Predictive Maintenance Solutions

The implementation of predictive maintenance systems often requires significant upfront investment in terms of sensor installations, advanced software used and data storage solution integrated into their existing infrastructure. Such a scenario can be a huge investment burden for small and medium-sized enterprises, as they are unlikely to make large investments for such purposes. This may even offer low visibility in terms of long-term return on investment, thus creating delay in the investment decision. The large firms with their capital can afford the investment, but smaller organizations would not be able to repay their costs without clear and immediate financial benefits. This high initial cost prevents many potential adopters from entering the market or fully implementing predictive maintenance strategies, which slows the market's overall growth and limits its potential for widespread industry adoption.

Predictive Maintenance Market Segment Analysis

By Component

In 2023, the Solution segment dominated the predictive maintenance market with a revenue share of approximately 83%. This dominance can be linked to the growing use of innovative technologies like IoT, AI, and machine learning, which are central to predictive maintenance solutions. These technologies allow for real-time tracking, precise forecasting, and enhancement of maintenance plans, fueling the need for cohesive solutions. As companies aim to improve operational effectiveness and minimize downtime, the dependence on these extensive, technology-based solutions keeps increasing

The Service segment is expected to grow at the fastest CAGR of 36.53% from 2024 to 2032, driven by the increasing need for continuous assistance, personalization, and system upkeep. As companies adopt predictive maintenance systems more frequently, the demand for specialized services to enhance and oversee these solutions becomes essential. Services like installation, consulting, and system updates are crucial for maintaining the optimal performance of predictive maintenance technologies, driving the swift expansion of the segment due to increasing industry demands.

By Monitoring Technique

In 2023, the Vibration Monitoring segment led the predictive maintenance market with a revenue share of approximately 27%. This dominance is due to the widespread use of vibration analysis in industries such as manufacturing, automotive, and energy, where equipment reliability is paramount. Vibration monitoring provides real-time insights into the condition of rotating machinery, enabling early detection of faults and preventing costly breakdowns. As organizations prioritize asset longevity and operational efficiency, vibration monitoring remains a preferred choice for predictive maintenance.

The Oil Analysis segment is projected to grow at the fastest CAGR of 35.62% from 2024 to 2032, driven by the growing emphasis on prolonging equipment longevity and lowering maintenance expenses. Oil analysis is essential for identifying early indications of wear, contamination, and lubrication problems in equipment. As industries pursue more accurate and economical maintenance options, oil analysis provides practical insights that improve equipment efficiency and reduce downtime, positioning it as a quickly growing sector in predictive maintenance.

By Enterprise Size

In 2023, the Large Enterprises segment dominated the predictive maintenance market with a revenue share of approximately 72%. This dominance is largely driven by the substantial financial resources and infrastructure that large organizations possess, enabling them to invest in advanced predictive maintenance technologies. With complex, high-value equipment and the need for operational efficiency across large-scale operations, these enterprises are increasingly adopting predictive maintenance to minimize downtime, reduce costs, and extend asset life, solidifying their position in the market.

The Small & Medium Enterprises segment is projected to grow at the fastest CAGR of 34.83% from 2024 to 2032, as SMEs increasingly recognize the value of predictive maintenance in enhancing productivity and reducing operational costs. With advancements in cloud-based solutions and IoT technology, predictive maintenance tools have become more affordable and accessible, enabling SMEs to adopt these systems. As SMEs seek ways to stay competitive, the growing availability of cost-effective solutions and tailored services makes predictive maintenance an attractive option, fueling the segment's rapid expansion.

Regional Analysis

In 2023, North America dominated the predictive maintenance market with a revenue share of approximately 39%, primarily due to the region's early adoption of advanced technologies such as IoT, AI, and machine learning. North American industries, particularly in manufacturing, energy, and automotive, have heavily invested in digital transformation to optimize operational efficiency. The region’s robust infrastructure, coupled with the presence of key market players and favorable government regulations, has positioned North America as the leader in the predictive maintenance space.

Asia Pacific is expected to grow at the fastest CAGR of 35.36% from 2024 to 2032, driven by rapid industrialization and the increasing adoption of advanced technologies in countries like China, India, and Japan. As manufacturing hubs expand and industries face pressure to enhance operational efficiency, predictive maintenance solutions are becoming essential for minimizing downtime and reducing costs. The rising awareness of the benefits of predictive maintenance, along with government initiatives to modernize infrastructure, is accelerating the adoption of these technologies across the region, making Asia Pacific the fastest-growing market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

IBM (Maximo, Watson IoT)

-

ABB (Ability, Condition Monitoring)

-

Schneider Electric (EcoStruxure, Asset Advisor)

-

AWS (IoT SiteWise, AWS IoT Greengrass)

-

Google (Cloud AI, Vertex AI)

-

Microsoft (Azure IoT Hub, Dynamics 365 Remote Monitoring)

-

Hitachi (Lumada, Hitachi Vantara)

-

SAP (SAP Predictive Maintenance, SAP Leonardo)

-

SAS Institute (SAS Visual Analytics, SAS Analytics)

-

Software AG (Cumulocity IoT, Software AG IoT Suite)

-

TIBCO Software (TIBCO Spotfire, TIBCO Cloud Integration)

-

Altair (Altair Smart Learning, Altair Smart Maintenance)

-

Oracle (Oracle IoT Cloud, Oracle Autonomous Database)

-

Splunk (Splunk Enterprise, Splunk IT Service Intelligence)

-

C3.ai (C3 Predictive Maintenance, C3 AI Suite)

-

Emerson (Plantweb, Emerson AMS Device Manager)

-

GE (Predix, Asset Performance Management)

-

Honeywell (Honeywell Forge, Honeywell Connected Plant)

-

Siemens (MindSphere, Siemens Predictive Services)

-

PTC (ThingWorx, Vuforia)

-

Dingo (Dingo Predictive Maintenance, Dingo Pro)

-

Uptake (Uptake Fleet, Uptake Insights)

-

Samotics (SAM4, Samotics Edge)

-

WaveScan (WaveScan Maintenance Solution, WaveScan Analytics)

-

Quadrical Ai (AI Predictive Maintenance, Quadrical Platform)

-

UpKeep (UpKeep Maintenance Management, UpKeep Analytics)

-

Limble (Limble CMMS, Limble Analytics)

-

SenseGrow (SenseGrow Predictive, SenseGrow IoT)

-

Presage Insights (Presage Maintenance, Presage Analytics)

-

Falcon Labs (Falcon Insights, Falcon Cloud Solutions)

Recent Developments:

-

In August 2024, ABB launched Trendex, a cloud-based digital tool that enhances the ABB Ability Predictive Maintenance for Grinding platform. It allows users to access high-resolution event data before and after faults, enabling faster diagnostics and minimizing downtime in mineral processing operations.

-

In February 2024, Google Cloud launched a suite of generative AI-powered data analytics tools, including AlloyDB AI and enhanced BigQuery integrations with Gemini models. These tools enable better unstructured data analysis and support vector search, aimed at improving data-driven decision-making and business operations.

-

In August 2024, Microsoft announced its use of AI to enhance internal device management, focusing on predictive maintenance and intelligent troubleshooting. The AI-powered solutions aim to reduce friction, improve employee experience, and proactively address device issues, boosting productivity and reducing support costs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.53 Billion |

| Market Size by 2032 | USD 105.66 Billion |

| CAGR | CAGR of 32.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Service) • By Deployment Model (Cloud, On-premise) • By Enterprise Size (Small & Medium Enterprises, Large Enterprises) • By Monitoring Technique (Torque Monitoring, Vibration Monitoring, Oil Analysis, Thermography, Corrosion Monitoring, Others) • By End-use (Aerospace & Defense, Automotive & Transportation, Energy & Utilities, Healthcare, IT & Telecommunications, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, ABB, Schneider Electric, AWS, Google, Microsoft, Hitachi, SAP, SAS Institute, Software AG, TIBCO Software, Altair, Oracle, Splunk, C3.ai, Emerson, GE, Honeywell, Siemens, PTC, Dingo, Uptake, Samotics, WaveScan, Quadrical Ai, UpKeep, Limble, SenseGrow, Presage Insights, Falcon Labs. |

| Key Drivers | • Advancements in IoT and Sensor Integration Fueling Growth of the Predictive Maintenance Market • The Role of Data Availability and Cloud Computing in Enhancing Predictive Maintenance Capabilities |

| RESTRAINTS | • Impact of Data Quality Issues on the Performance of Predictive Maintenance Systems • Challenges of High Initial Investment Hindering Widespread Adoption of Predictive Maintenance Solutions |