Active Pharmaceutical Ingredient Market Size Analysis

Get More Information on Active Pharmaceutical Ingredient Market - Request Sample Report

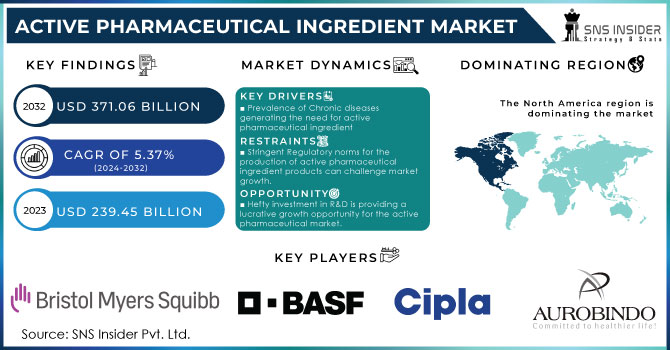

The Active Pharmaceutical Ingredient Market Size was valued at USD 239.45 billion in 2023 and is expected to reach USD 371.06 billion by 2032 and grow at a CAGR of 5.37% over the forecast period 2024-2032.

Progress in active pharmaceutical ingredient manufacturing, the expansion of biopharmaceuticals, and the aging of the global population are the API market’s key motorists. The market will be boosted by the rise in chronic diseases such as cancer and cardiovascular disease. The global geriatric population is growing rapidly. According to the UN, in 2022, the 65-and-older age group accounted for 771 million people, and by 2030 and 2050, it is expected to number 994 million and 1.6 billion, respectively. The most rapid growth in the number of persons over age 60 will be in Africa, with a threefold increase in the number of persons over 60 years to 18.8 billion, and in Latin America, where, by 2050, there will be one-fifth of a billion such persons. Due to aging, there is a high risk of the onset of many diseases, including cardiovascular and neurologic ones, which also suggests that the rapidly growing global geriatric population will become a high-impact rendering driver of the API market.

The rise in the incidence of infectious and hospital-acquired infections will be a high-impact rendering driver of this market. Moreover, further development of genetic, cardiovascular, and neurologic disorders will become a high-impact rendering driver of this market. According to WHO, CVDs are the cause of death of 17.9 million people per day and are expected to cause nearly 25 million deaths by 2030. The growing number of cigarette smokers worldwide, along with rising obesity levels and eating habits, are likely to drive market growth. A report released by the United Nations in May 2023 revealed that the number of girls with obesity increased by 75 percent and boys by 61 percent in Europe.

MARKET DYNAMICS

KEY DRIVERS:

- Prevalence of Chronic diseases generating the need for active pharmaceutical ingredient

- An increase in demand for generic medicines is driving the active pharmaceutical ingredient market.

RESTRAINTS:

- Stringent Regulatory norms for the production of active pharmaceutical ingredient products can challenge market growth.

- The higher manufacturing costs of active pharmaceutical ingredient products can limit the adoption of active pharmaceutical ingredients.

OPPORTUNITY:

- Technological Advancements in novel drug development as well as customized medicine production are driving the active pharmaceutical ingredient market.

- Hefty investment in R&D is providing a lucrative growth opportunity for the active pharmaceutical market.

SEGMENTATION ANALYSIS:

By Synthesis

The synthetic APIs segment held 70.65% largest revenue share in 2023. The most important driving factor for the synthetic API market is the high volume of generic drugs. Synthetic and Chemical API Manufacturers' Expansion on the Back of APIs to Promote Generic Drugs, Points Toward High Revenue The overall market is expected to increase due to the rise in IoT demand. This is going to create a huge scope for the CDMOs that operate in this segment. This makes the opportunity even more attractive for CDMOs as many such companies seek to outsource, to achieve greater profitability by lowering production costs. In October 2023, Cambrex completed its USD 38 Million small molecule API manufacturing facility. It doubled the size of its manufacturing facility, adding more capacity to accommodate additional customers as their needs grew.

By Ingredients

The APIs segment related to the innovative API holds more than 60 percent revenue share of almost all segments, yet this number is expected to rise even higher through 2023. This market growth is anticipated due to an increase in funding and favorable regulations provided for R&D facilities Several novel innovative products will be coming down the pipeline soon, thanks to copious research in this field. In addition, increased support from regulatory bodies for the approval of new drugs is expected to create favorable market growth; this can be attributed to an increase in government focus on healthcare and pharmaceuticals as a result of COVID-19.

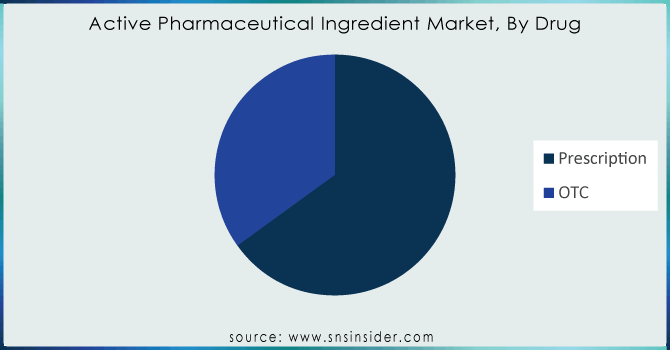

By Drug

The prescription segment accounted for the largest share of revenue in the overall API market by 2023 Unimaginably, the prescription drugs taken are to a great extent identified by physicians’ prescriptions. The use of prescription drugs, including Proton Pump Inhibitors (PPI) for common indications like heartburn has reached a plateau due to an array of side effects. There has been a change in the prescription rate of Histamine-2 Receptor Antagonist (H2RA), however. Oncology dominated the market for prescription drugs as cancer treatment is largely aided by chemotherapy, targeted therapy, immunotherapy, and hormonal therapy. There is also a growth in the usage of Biology. The number of prescriptions for targeted therapies is booming as more effective novel treatments get approved. Other major players are also launching new targeted drugs.

Need any customization research on Active Pharmaceutical Ingredient Market - Enquiry Now

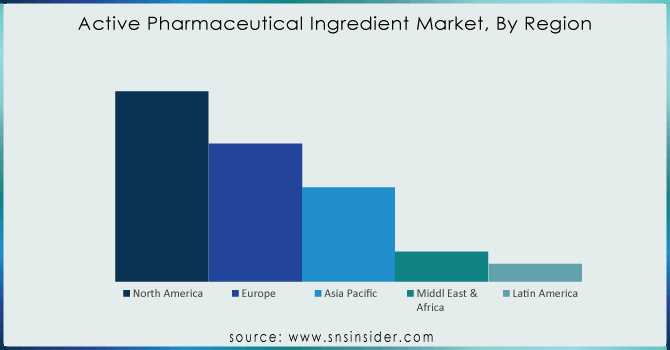

Regional Analysis:

The highest revenue share is held by North America which is 40.01% in 2023. Key drivers include the inclining prevalence of chronic diseases such as cardiovascular, genetic, etc supported by increasing drug research which is anticipated to drive profits following a strong patent pipeline that has aided the active pharmaceutical ingredients market. The global market is powered by the availability of top industry players such as AbbVie Inc.; Curia; Pfizer Inc., Viatris Inc. as well as Fresenius Kabi AG; Viatris, for example, when it was created in a merger of Mylan NV and Pfizer Inc.'s Upjohn unit last year was not born from that kind of mega-deal but now has standing as one with over 100 ANDAs filed annually after the combination. Still big enough to generate billions every quarter even if hardly what we used to think of as Big Pharma., Viatris Ltd. gained approval from the FDA in February 2023; the generic drugs giant became active when won an immediate green light on Generic Restasis; a cyclosporine ophthalmic emulsion indicated ″for all patients suffering from severe dry eye disease. The region shows high-value manufacturing areas including complex & highly potent APIs, gene therapies & biologicals hence offering relative growth.

In addition, in February 2023 the Government of Canada released Good Manufacturing Practices guidance for active pharmaceutical ingredients (GUI-0104) to help anyone working with Active Pharmaceutical Ingredients (APIs) and their intermediates understand how to comply with Part C, Division 2 of the Food and Drug Regulations - GMP. This guideline applies to fabricators, packagers/labelers (including re-packagers/re-labelers), testers, importers and distributors, and wholesalers. This is anticipated to expand the need for API through a government initiative such as this which would further drive the growth of the API in the future.

Additionally, the rising number of API companies investing to enhance manufacturing facilities is expected to fuel market growth. Eurofins moves and grows its API development labs in January 2023 with a new home in Ontario, Canada. Also in May, Piramal Pharma reported that a new active pharmaceutical ingredient (API) plant at the company's facility in Aurora, Ontario is operational and has performed its first production runs. Hence the API Industry is anticipated to grow in the forecast period.

Key Players:

The Key players are Aurobindo Pharma, Bristol Myers Squibb, Eli Lilly and Company, BASF SE, Cipla, Abbvie Inc., Boehringer Ingelheim GmbH, Dr. Reddy’s Laboratories Ltd, Albemarle Corporation, Viatris Inc and Other Players. The key players are emphasizing the preservation of high-quality standards and catering to market demand with an existing customer base in the region at a large scale. This marketing strategy is only helpful if the brand has already established its name and trust in the market. They rely on significant investment in sophisticated new technology & infrastructure capable of high throughput processing & analysis.

Recent Developments:

-

In August 2023, the acquisition of BianoGMP will enable the expansion of EUROAPI CDMO capabilities through a high-growth industry: oligonucleotide manufacturing

-

In July 2023, Teva Pharmaceutical Industries Ltd. laid out a new growth plan and did not rule out selling off its API unit in the future API manufacturing facility about USD 2 billion.

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 239.45 Billion |

|

Market Size by 2032 |

US$ 371.06 Billion |

|

CAGR |

CAGR of 5.37% From 2024 to 2032 |

|

Base Year |

2022 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type Of Synthesis (Biotech, Synthetic) •By Ingredients (Generic APIs, Innovative APIs) •By Application (Cardiovascular Diseases, Oncology, CNS and Neurology, Orthopedic, Endocrinology, Pulmonology Gastroenterology, Nephrology, Ophthalmology) •By Drug (Prescription, OTC) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Aurobindo Pharma, Bristol Myers Squibb, Eli Lilly and Company, BASF SE, Cipla, Abbvie Inc., Boehringer Ingelheim GmbH, Dr. Reddy’s Laboratories Ltd, Albemarle Corporation, Viatris Inc and Other Players |

|

Key Drivers |

•Prevalence of Chronic diseases generating the need for active pharmaceutical ingredient •An increase in demand for generic medicines is driving the active pharmaceutical ingredient market. |

|

Opportunities |

•Stringent Regulatory norms for the production of active pharmaceutical ingredient products can challenge market growth. •The higher manufacturing costs of active pharmaceutical ingredient products can limit the adoption of active pharmaceutical ingredients. |