Infusion Pump Software Market Report Scope & Overview:

The Infusion Pump Software Market size was USD 862.12 Million in 2023 and is expected to reach USD 1655.17 Million by 2032 and grow at a CAGR of 7.52% over the forecast period of 2024-2032. The report provides a detailed analysis of adoption rates across key regions in 2023, highlighting market penetration and growth drivers. It examines regulatory compliance by country, focusing on FDA, MDR, and other healthcare standards. The report explores integration trends, assessing cloud-based vs. on-premises solutions and their compatibility with EHR/EMR systems. Market share distribution of leading players is analyzed, along with cybersecurity measures ensuring HIPAA and GDPR compliance. Advancements in AI-driven dose error reduction and automation in drug delivery are covered under innovation trends. Additionally, the report evaluates emerging cybersecurity protocols to safeguard patient data. These insights offer a comprehensive view of market dynamics, technological advancements, and regulatory influences shaping the industry.

Get more information on Infusion Pump Software Market - Request Sample Report

Market Dynamics

Drivers

-

Increasing number of surgical operations which drives the market growth.

The rising volume of surgical procedures is one of the prevalent factors stimulating the Infusion Pump Software Market expansion, driven by the need for advanced drug delivery mechanisms to provide accurate and optimal drug delivery in hospitals and surgical centers. As the number of chronic diseases, elderly citizens, and minimally invasive surgeries grow, so do the need for infusion pumps combined with intelligent software. One example is introducing systems that automate drug dosing, to minimize human error and to make sure doses are as safe as possible for patients going through critical procedures. Moreover, the administration of post-operative pain medication or anesthesia is considered continuous infusion, which again is facilitated by the infusion pump software. The rising implementation of innovative infusion pump software which assists in promoting surgical outcomes and efficiency due to the modernization of global healthcare infrastructure is further fueling the growth of the market.

Restraint

-

Infusion pumps are frequently subject to product recalls which may hamper the market growth.

This factor is one of the major factors that hamper the growth of this market since frequent product recalls of infusion pumps significantly affect consumer confidence, regulatory approvals, and thus the overall adoption rates of infusion pumps. Software glitches, hardware defects, and cybersecurity vulnerabilities often lead to unsafe conditions such as incorrect dosages, delayed infusions, or undelivered or misdelivered devices—precisely what will lead to recalls. Regulators such as the U.S. FDA and the European Medicines Agency (EMA) have rigorous safety standards, and multiple recalls can mean closer monitoring of products, which means a delay in getting a product on the market to meet demand, potentially costing tens of millions in revenue. Moreover, due to the concerns regarding reliability and safety coupled with the high cost of infusion pump systems, healthcare facilities may avoid the adoption of new ones. However, while manufacturers are focused on reducing software quality issues, preventing cybersecurity threats, and complying with changing regulations, tackling the hurdles posed by recalls will be key to maintaining momentum and growth within the industry.

Opportunity

-

Specialty infusion systems are becoming more popular and create the opportunity.

The pump software market would be the increased utilization of specialty infusion systems due to the rising demand for specialty therapeutic solutions enabling drug delivery for complex therapies. Specialty infusion pumps are used to deliver high-priced biologics, chemotherapy drugs, and precision medicines that require closer monitoring and tighter dose control than the typical hospital or ambulatory infusion pump. Due to an increasing number of chronic indications like cancer, autoimmune diseases, and rare genetic disorders, many providers are using infusion systems with programmable software to ensure accurate dosing and decrease the risk of medication error. In addition, home-based specialty infusion therapies are booming, which has resulted in the increasing need for software to monitor these therapies remotely and provide the opportunity for on-demand adjustments. The further development of innovative pharmaceuticals, coupled with the growing availability of specialty infusion systems, is likely to act as a catalyst for market growth, opening up new avenues of growth for manufacturers in terms of technological innovation and provider partnerships.

Challenges

-

Rising medication error rates and limited wireless access in most hospitals may create a challenge for the market.

High medication error rates, expensive hardware, and lack of proper wireless access in hospitals are among the issues limiting the growth of the global infusion pump software market. Error in medication, particularly due to improper dosing, mis programming of infusion pumps or simply human errors, emphasize the necessity of sophisticated software with anti-error properties like ‘dose-error reduction systems (DERS) and timely notifications. The impact of these smart infusion systems, though, is highly reliant on uninterrupted connectivity, a challenge faced in a lot of healthcare centers, especially in developing areas with poor wireless infrastructure. Difficulty in network access for infusion pumps integration with EHRs and remote monitoring systems can decrease the efficient conduction of automated drug delivery. To mitigate these problems, manufacturers are targeting offline-enabled software, better security measures, and hospital infrastructure to maintain a continuous connection, as well as safer means of medication delivery.

Segmentation Analysis

By Type

Dose Error Reduction Software (DERS) holds the largest market share 58% in 2023. It is used for many hospitals and clinics use DERS-infusion pumps as effective tools to prevent overdosing, underdosing, and high-potential wrong-drug administration which are well known to be major contributors to the occurrence of adverse patient outcomes. Clinical safety is ensured through the device error reduction system of all modern infusion pumps which is eventually imposed by the strict safety principles of regulatory bodies like FDA & EMA on which DERS is indirectly based. Further, the increasing prevalence of chronic diseases and adoption of complex drug regimens is driving demand automation for dose calculation and real-time alerts on deviations, which is also expected to favor demand for DERS-enabled systems. Continuous integration of DERS-powered infusion pumps further powers the growth of the global infusion pump market segment, as healthcare providers emphasize patient safety and compliance with regulatory standards.

By Indication type

General infusion held the largest market share, around 28% in 2023. It is analyzed across different healthcare settings including hospitals, clinics, and ambulatory care settings and the general infusion segment accounted for the largest market share in the infusion pump solution market. Infusion pumps are essential in the continuous or intermittent delivery of fluids, medications, and nutrients to their patients and are used to treat various illnesses including dehydration, pain management, chemotherapy, and other critical care. General infusion pumps are more flexible than specific infusion pumps, in that they can be adaptable and work with smart software solutions that can provide help with accurate dosing, automated alerts, and improved patient safety. Healthcare facilities are increasingly focusing on cost-effective, multi-use infusion solutions, which is further enhancing the dominance of general infusion pumps in the market.

By End User

owing to high patient intake and the high demand for accurate and automated drug delivery systems for a variety of medical treatments. Hospitals have a huge number of surgeries, emergency care, and chronic diseases that require them to run complex and advanced infusion pump software to improve medication safety and efficiency of clinical workflow. Smart infusion systems, which can be integrated with electronic health records (EHRs), offer monitoring in real-time, dose calculations, and compliance with strict regulatory standards from agencies like the FDA and EMA. In addition, hospitals are heavily using highly advanced healthcare technologies which include Dose Error Reduction Software (DERS) and wireless connectivity features to reduce medication errors and enhance patient outcomes. The hospital is the most prominent end-user in terms of adoption of infusion pump software, since healthcare infrastructure is advancing and, therefore will augment the market over the forecast years.

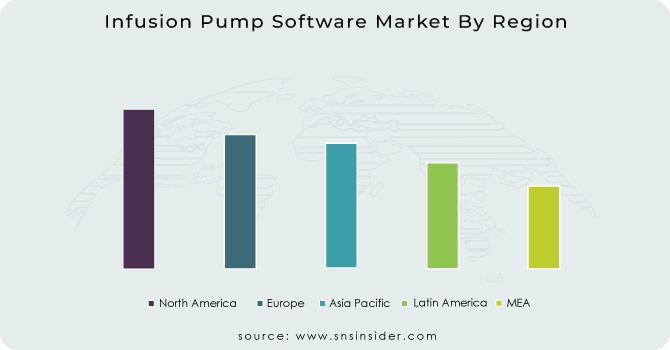

Regional Analysis

North America held the largest market share, around 44% in 2023. The North America Infusion Pump Software Market has the largest market share owing to the well-established healthcare infrastructure, high adoption of advanced medical technologies, and stringent regulatory standards. The continuously evolving smart infusion systems are a result of the presence of leading infusion pump manufacturers and software developers and the strong investment of these companies in research and development activities. Rigorous standards of medication safety and calculation dosages by the U.S. FDA Drive have further warranted the application of the DERS (Dose Error Reduction Software) and integrated electronic health record (EHR) system in hospitals and clinics. D pharmaceutical market report by the use of 2027 emphasizes that in particular, the rising incidence of continual sicknesses like most cancers, diabetes, and cardiovascular ailments due to the growing aged population has greater the need for automatic and clever drug transport solutions.

Europe held a significant share market share in 2023. It the due to well-established healthcare infrastructure, stringent regulatory framework, along with presence of innovative and advanced infusion technologies. The implementation of the European Medical Device Regulation (MDR) has increased the attention towards the security and regulatory compliance of infusion pump software for safety and eradicating medication errors in patients. Furthermore, the region has a high incidence of oncology and cardiovascular diseases that requires the adoption of smart infusion systems with real-time monitoring and Dose Error Reduction Software (DERS). These nations include Germany, France and the U.K., which have embraced healthcare digitization and have hospitals that are utilizing infusion pumps integrated with both electronic health record (EHR) and cloud-based monitoring systems. In addition to this, rising government initiatives among various countries for safe patient experience and advancement in technologies' drug delivery systems is further contributing towards Europe's stronghold of the market.

Need any customization research on Infusion Pump Software Market - Enquiry Now

Key Players

-

Agilent Technologies (OpenLAB CDS, MassHunter)

-

B Braun Melsungen AG (Space® Infusion Pump System, Perfusor® Space)

-

Fresenius Kabi (Volumat MC Agilia, Infusia VP7000)

-

ICU Medical Inc. (Plum 360, MedNet)

-

Roche Diagnostics (Accu-Chek Combo, Insight Insulin Pump)

-

Micrel Medical Devices (Mini Rythmic Evolution, Rythmic Perf+)

-

Baxter International Inc. (Spectrum IQ, SIGMA Spectrum)

-

Medtronic Plc. (MiniMed 780G, SynchroMed II)

-

Becton Dickinson and Company (Alaris System, BD Intelliport)

-

Terumo Corporation (Terufusion Syringe Pump, Terufusion Infusion Pump)

-

Smith’s Medical (CADD-Solis, Medfusion 4000)

-

Eli Lilly and Company (Tempo Pen, KwikPen)

-

Ypsomed AG (YpsoPump, Orbit Micro)

-

Omnicell Inc. (i.v.STATION, XT Automated Dispensing System)

-

Novo Nordisk (NovoPen 6, FlexTouch)

-

Halyard Health Inc. (ON-Q Pain Relief System, Smart Pump)

-

Insulet Corporation (Omnipod DASH, Omnipod 5)

-

Tandem Diabetes Care (t:slim X2, Control-IQ)

-

3M Healthcare (Ranger Fluid Warming System, Avagard)

-

Moog Inc. (Curlin 6000, Infinity Orange)

Recent Development:

-

In April 2023, Fresenius Kabi announced that its Ivenix Infusion System received an Innovative Technology contract from Vizient, Inc., enabling hospitals to evaluate and procure the system more efficiently.

-

In 2023, Medtronic launched the MiniMed 780G insulin pump system, equipped with advanced algorithms for automated insulin delivery, designed to enhance diabetes management.

Fresenius Kabi-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD862.13 Million |

| Market Size by 2032 | USD 1655.17 Million |

| CAGR | CAGR of7.52 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • BY Type (Dose Error Reduction Software (DERS), Interoperability Software, Clinical Workflow Software) • By Indication type (General Infusion, Pain and Anesthesia Management, Insulin Infusion, Chemotherapy, Enteral Infusion) • By End User (Hospitals, Ambulatory Centers Settings, Home Healthcare Settings, Academic & Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Agilent Technologies, B Braun Melsungen AG, Fresenius Kabi, ICU Medical Inc., Roche Diagnostics, Micrel Medical Devices, Baxter International Inc., Medtronic Plc., Becton Dickinson and Company, Terumo Corporation, Smiths Medical, Eli Lilly and Company, Ypsomed AG, Omnicell Inc., Novo Nordisk, Halyard Health Inc., Insulet Corporation, Tandem Diabetes Care, 3M Healthcare, Moog Inc. |