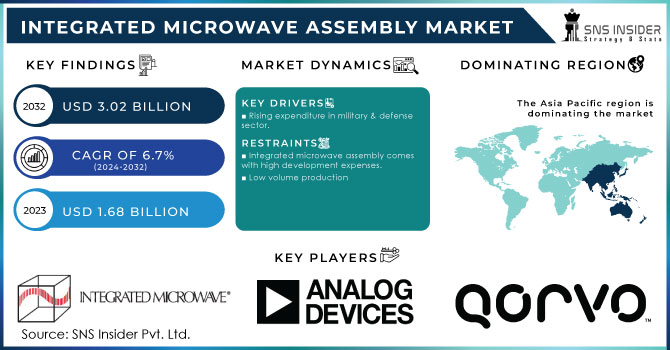

Integrated Microwave Assembly Market Report Scope & Overview:

The Integrated Microwave Assembly Market was valued at USD 1.95 billion in 2023 and is expected to reach USD 3.49 billion by 2032, growing at a CAGR of 6.71% over the forecast period 2024-2032. Higher adoption rates in the IMA market are being powered by 5G, satellite communications, and defense technology advancements. Some product types, amplifiers, transceivers, and filters are tracking demand depending on the application sector, such as aerospace or telecom. Regional market performance demonstrates high growth within regions such as North America and Asia-Pacific, with highly progressive technologies and infrastructure playing a part in pushing market growth. Also, energy use and efficiency are expected to increasingly come into play as manufacturers seek to deliver low-power, high-performance solutions targeting energy-sensitive applications such as satellites and military systems.

Get more information on Integrated Microwave Assembly Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Growth Drivers in Integrated Microwave Assembly Market: Defense Demand 5G Integration UAVs and Aerospace Advancements

Various factors like the demand for advanced communication systems, growing military and defense expenditure, and the adoption of satellite-based technology have stimulated the Integrated Microwave Assembly (IMA) market size. The defense sector continues to be the leading end-user, as IMAs provide an essential function in radar, electronic warfare, and secure communication applications. The deposit-to-aces ratio in these arising IMAs has been fueled by the integration of 5G networks and high-frequency communication technologies and reflects cost-effective performance and design across the Ku-Band and Ka-Band frequency bands. Increasing adoption of UAVs and Unmanned Systems, and rapidly growing aerospace and avionics are going to give a further push for the market to grow.

Restrain:

-

Restrain in Integrated Microwave Assembly Market Impacted by Supply Chain Issues Raw Materials and Regulations

One more major constraint is that of the raw materials and supply chain limitations rather common in the global landscape that tends to be volatile due to prevailing geopolitical situations. Reliance on certain suppliers for materials like high-frequency ceramics, or rare-metal materials mainly leads to supply disruptions, which along with the increase of production costs along with the prices of high-frequency electronics can increase the costs of production. Manufacturing needs to be scaled, however, and that may prove challenging in markets requiring rapid manufacturing deployment, too. Moreover, the production of IMAs is complex and involves compliance with strict regulatory requirements for safety and environmental standards that prolong the time and resources taken to manufacture IMAs, which is likely to act as a barrier to market growth.

Opportunity:

-

Opportunities in IMA Market Driven by Space Exploration AI Advancements and Growing Defense Investments

Opportunities in the IMA market are abstract from the growing capital on space exploration, satellite communication, and commercial wireless infrastructure. As LEO satellites are deployed in higher quantities to deliver broadband globally, IMAs will be increasingly fundamental to seamless connectivity. Finally, on the other hand, promising opportunities for market participants also arise due to the development of next-generation electronic warfare and defense systems combined with advancements in artificial intelligence (AI) enabled signal processing. Asia-Pacific emerging markets, specifically China and India, will present high growth potential on account of increasing defense budget allocations and growing space technology investment.

Challenges:

-

Challenges in IMA Market High Manufacturing Costs Skilled Labor Miniaturization and Performance Demands Drive Innovation

Challenges in the integrated microwave assembly (IMA) market include high costs of manufacturing and materials. Many key components used in IMAs, such as high-end semiconductors and substrates tend to be very costly, which results in a high cost to the final device. Moreover, the complex nature of the designs and the need for precision assembly introduce skilled labor with higher-level technologies thereby increasing the cost. Consequently, this can challenge smaller companies to get started and compete against larger entities. Moreover, the trend of miniaturization and demand for high performance in microwave devices further challenges the manufacturers to innovate consistently which is an expensive affair.

Segment Analysis

By Product

Amplifiers held the largest share of 35.8% in the Integrated Microwave Assembly (IMA) market in 2023. This considerable market penetration is mainly attributed to the increasing usage of amplifiers in several communication systems such as satellite, wireless, and defense. The necessity to amplify the signal and transfer it with optimal efficiency establishes their relevance, which in turn guarantees their place as the king of the industries for a long time to come. The significance of amplifiers in the functioning of radar systems also makes a strong case for maintaining their share in the commercial and military domains, fuelling the amplifier market.

Transceivers are expected to experience the fastest growth in terms of Compound Annual Growth Rate (CAGR) from 2024 to 2032. The increasing adoption of integrated communication systems, which need both transmission and reception capabilities in a single unit, is driving this growth. Transceivers are essential for the fast and reliable delivery of wireless data in the 5G, satellite, and next-gen radar spaces. As the technology of 5G rolls out around the world and communication infrastructures are being worked on more and more each day, transceivers are expected to be in high demand thus driving their swift expansion into the market in the coming years.

By Frequency

The Integrated Microwave Assembly (IMA) market was dominated by Ku-band in 2023 with a share of 18.7%. The reason is that it is used globally, specifically in satellite communications, broadband internet, television broadcasting, and military communications. The Ku-band provides an optimum degree of coverage area, signal strength, and a much lower price than bands at higher frequencies; thus, it finds application in commercial and government sectors alike. By offering dependable communication links with high capacity, its market growth has remained robust, especially in rural or underdeveloped areas with minimal other communication infrastructure.

The C-band will have a higher Compound Annual Growth Rate from 2024–2032. This trend is being propelled by the growing need for dependable satellite communication in various high-stakes industries, such as defense, aviation, and maritime. Because of how the C-band falls under the spectrum frequency, it can more readily penetrate through such disruptive phenomena as rain or snow compared to higher-frequency bands; because of its ability to penetrate these disruptions to a greater degree, the C-band is well-fitted to applications where reliability is crucial, the C-band is preferred. In addition to that, the current pace of global expansion of 5G networks and the high bandwidth demand for data-heavy applications will drive rapid growth for C-band.

By Industry

The military and defense segment held the largest share of 42.7% of the overall Integrated Microwave Assembly (IMA) market in 2023. The majority of this dominance comes from the fact that IMAs are pivotal to advanced defense systems such as radar, communication, electronic warfare, and surveillance applications. The growing use of microwave systems in military, and defense products for greater situational awareness and battlefield communication drives demand for high-performance, reliable, and secure military microwave systems in military and defense technologies. The military and defense sector has emerged as one of the prominent sectors boosting the demand for IMA on account of the continuous modernization of defense systems as well as increasing emphasis on advanced military operations.

The communication industry is anticipated to grow with fastest Compound Annual Growth Rate during the forecast period from 2024 to 2032. Key factors driving the rapid growth are technological innovations in 5G, satellite communication, and broadband infrastructure. Microwave systems have been used extensively for long-distance communication for decades; however, as communication networks see increasing sophistication, there is a need for microwave systems to have higher data capacity, higher efficiency, and higher reliability. The communication segment is anticipated to witness the fastest growth as the demand for improved communication systems in commercial and government sectors, data-heavy applications, and global connectivity between individuals.

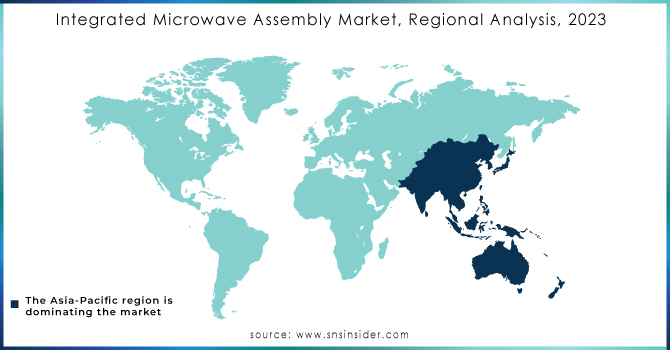

Regional Analysis

In 2023, North America represented the largest share of 34.1% in the Integrated Microwave Assembly (IMA) market. The region's leadership could be explained as a consequence of an advanced technological infrastructure, a high-level investment in defense and aerospace, and the existence of key players in satellite communication and telecommunications. IMAs are extensively used in applications such as radar systems, secure communications, and surveillance; the U.S. military and defense sector is heavily dependent on IMAs. The demand in North America is primarily driven by major defense contractors such as Lockheed Martin and Raytheon, along with companies such as Boeing and Honeywell, requiring high-performance microwave solutions. The growing procedure of 5G networks and business satellite communications even more bolster the regional market.

Asia Pacific is expected to experience the fastest growth in terms of Compound Annual Growth Rate (CAGR) from 2024 to 2032. Such growth is being driven by the demand for advanced communication systems as well as countries such as China, Japan, and India, where substantial investments in satellite technologies, telecommunication, and defense infrastructures are being made. As an example, the demand for IMAs is strongly driven by the China 5G Network · Satellite communication system expansion. Likewise, integrated microwave solutions are also necessary due to Indian defense modernization efforts and advanced space programs by organizations such as the Indian Space Research Organisation (ISRO), which has seen most of its satellite launches during the decade.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key players

Some of the major players in the Integrated Microwave Assembly Market are:

-

Teledyne Microwave Solutions (Power Amplifiers, Frequency Converters)

-

Broadcom (Microwave Amplifiers, RF Mixers)

-

Raytheon Technologies (Microwave Modules, Antenna Systems)

-

L3Harris Technologies (Radars, Communication Systems)

-

Keysight Technologies (Microwave Test Systems, RF Signal Generators)

-

Analog Devices (Microwave Amplifiers, RF Transceivers)

-

NXP Semiconductors (Microwave Switches, Power Amplifiers)

-

MACOM Technology Solutions (Power Amplifiers, Signal Processors)

-

Qorvo (Microwave Integrated Circuits, Power Amplifiers)

-

Satcom Direct (Satellite Communication Systems, Microwave Modems)

-

Virginia Diodes Inc. (Microwave Frequency Sources, Signal Generators)

-

Mini-Circuits (Mixers, Attenuators)

-

Smiths Interconnect (High-Power Microwave Modules, Low Noise Amplifiers)

-

Teledyne Storm Microwave (Switching Systems, Low Noise Amplifiers)

-

CPI - Communications & Power Industries (High-Power Amplifiers, Microwave Tubes)

Recent Trends

-

In January 2025, Teledyne Storm Microwave signed a global franchise agreement with Richardson RFPD to distribute its RF/Microwave interconnect products worldwide. The partnership aims to enhance product availability for sectors including avionics, electronic warfare, and satellite communications.

-

In August 2024, L3Harris demonstrated its Distributed Spectrum Collaboration and Operations (DiSCO) system during the Valiant Shield 2024 exercise, showcasing real-time electronic warfare capabilities.

-

In June 2024, Keysight Technologies highlighted innovations in spectrum solutions for 5G and 6G, showcasing advancements in microwave technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.95 Billion |

| Market Size by 2032 | USD 3.49 Billion |

| CAGR | CAGR of 6.71% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Frequency Converters, Frequency Synthesizers, Amplifiers, Oscillators, Transceivers, Others) • By Frequency (Ku-Band, C-Band, Ka-Band, L-Band, X-Band, S-Band, Other-Bands) • By Industry (Avionics, Military & Defense, Communication, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Teledyne Microwave Solutions, Broadcom, Raytheon Technologies, L3Harris Technologies, Keysight Technologies, Analog Devices, NXP Semiconductors, MACOM Technology Solutions, Qorvo, Satcom Direct, Virginia Diodes Inc., Mini-Circuits, Smiths Interconnect, Teledyne Storm Microwave, CPI - Communications & Power Industries. |