International Express Delivery Market Report Scope & Overview:

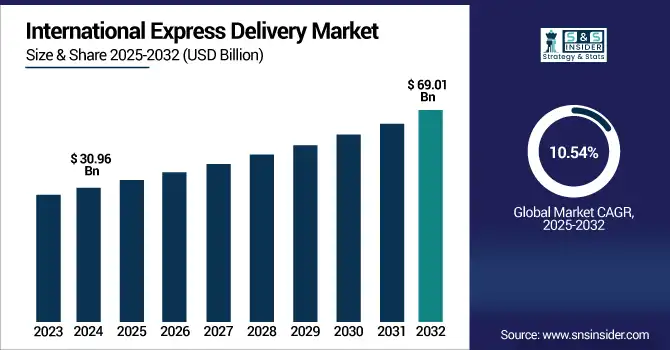

The International Express Delivery Market Size was valued at USD 30.96 billion in 2024 and is expected to reach USD 69.01 billion by 2032 and grow at a CAGR of 10.54% over the forecast period 2025-2032.

Get Customized Report as per Your Business Requirement - Enquiry Now

The market facilitates fast and time-bound transportation of parcels and documents across international borders, driven by increasing global trade and e-commerce demand. This market is powered by major players offering premium, trackable services that ensure timely deliveries across continents. Technological advancements, expanding air freight infrastructure, and rising consumer expectations are key growth drivers. Additionally, sectors like pharmaceuticals and electronics heavily depend on reliable express delivery networks. Despite its promising outlook, the market faces challenges including high operational costs, complex customs regulations, and geopolitical uncertainties. Continued innovation and strategic global partnerships remain vital for market expansion and efficiency.

According to a study, the international express delivery market is witnessing strong momentum, with millions of parcels shipped globally each day. Over 70% of cross-border e-commerce retailers rely on express delivery services to meet customer expectations. The sector handles over 40% of global air cargo by volume, underlining its critical role in global trade. Additionally, nearly 60% of express shipments are business-to-consumer (B2C), driven by rising demand for fast, reliable delivery across industries like electronics, fashion, and healthcare.

The U.S. International Express Delivery Market size was USD 5.09 billion in 2024 and is expected to reach USD 11.63 billion by 2032, growing at a CAGR of 10.87% over the forecast period of 2025–2032. The U.S. Market is the rapid growth of cross-border e-commerce and increasing consumer demand for fast, reliable shipping. The U.S. dominates the North American market due to its advanced logistics infrastructure, high internet penetration, and presence of major global courier companies. Additionally, the country’s strong trade links and high volume of international shipments further solidify its leadership in the regional market.

Market Dynamics

Key Drivers:

-

Rising Cross-Border E-Commerce and Consumer Expectations Drive Growth in the International Express Delivery Market Globally

The rapid expansion of cross-border e-commerce has become a major driver for the international express delivery market. As global consumers increasingly shop online from international retailers, there is a growing need for reliable, time-sensitive shipping solutions. This surge in international online retail has raised consumer expectations for fast and transparent delivery. To meet these demands, express logistics providers are investing heavily in technology, automation, and expanded delivery networks. The increased reliance on air cargo, real-time tracking, and last-mile delivery innovations has further supported this trend. As businesses aim to meet next-day or two-day international delivery promises, express services have become vital, especially in electronics, fashion, and healthcare. Consequently, the demand for premium international shipping services is pushing the market forward, creating opportunities for logistics firms to innovate and scale globally. The continued rise of global digital commerce is expected to fuel this momentum throughout the forecast period.

In May 2024, DHL Express announced a $192 million investment in its U.S. facilities to enhance international shipping capabilities and reduce delivery times. This development reflects how leading players are scaling infrastructure to manage the volume and speed required by modern e-commerce.

Restraints:

-

High Operational Costs and Fuel Price Volatility Restrain the International Express Delivery Market Growth

One of the primary restraints in the international express delivery market is the high operational cost structure associated with cross-border logistics. Express delivery services rely heavily on air freight, which incurs significantly higher transportation costs compared to standard shipping. These costs are further exacerbated by fluctuating fuel prices and the rising expenses of maintaining aircraft fleets, delivery vehicles, and warehousing operations. Labor shortages and rising wages in the logistics sector also contribute to the financial burden on service providers. In addition, customs duties, taxes, and compliance with international regulations add complexity and cost to operations.

These factors can limit profit margins and make it difficult for companies to offer competitive pricing, especially in price-sensitive markets. Smaller logistics providers may struggle to keep up, giving a competitive edge to larger firms with better economies of scale. Moreover, the increasing push for sustainable practices, while beneficial long term, often requires substantial upfront investment in green fleets and energy-efficient infrastructure. These collective challenges create a financial pressure point that could hinder market expansion if not managed strategically. As a result, the high and unpredictable operational costs serve as a significant restraint in the sustained growth of the international express delivery industry.

Opportunities:

-

Technological Advancements and Automation Present Opportunities for Efficiency in the International Express Delivery Market

The growing adoption of automation and digital technologies presents a major opportunity for the international express delivery market. These innovations are enabling companies to enhance operational efficiency, reduce delivery times, and improve customer satisfaction. Automation in sorting facilities, AI-powered route optimization, real-time shipment tracking, and robotics in warehousing are transforming logistics at scale. Furthermore, the use of blockchain and IoT is improving transparency in cross-border shipments, building trust among consumers and regulatory bodies. These technologies are especially beneficial in managing complex international logistics where customs clearance, documentation, and real-time data are essential. As customer expectations for faster and more accurate deliveries grow, these technological advancements will be key to maintaining competitiveness. Companies that invest early in automation and digital infrastructure are better positioned to capture market share and meet rising global demand. Hence, technology and automation serve as both an enabler and a differentiator in the evolving express delivery ecosystem.

In February 2024, FedEx launched its AI-powered logistics hub in Tennessee, designed to process thousands of international shipments per hour with minimal human intervention. This development illustrates how automation is not only addressing labor shortages but also reducing human error and speeding up processing times.

Challenges:

-

Complex International Regulations and Customs Delays Pose Major Challenges to the Express Delivery Market Expansion

The market is navigating complex regulatory frameworks and customs procedures. Cross-border shipments are subject to a wide range of import/export laws, tariffs, and documentation requirements that vary by country. These differences often result in delays, added costs, and compliance risks. Companies must adapt to changing regulations quickly to avoid penalties or shipping disruptions, especially in regions with volatile trade policies.

Moreover, manual customs inspections and inefficient border processes can delay time-sensitive express shipments, undermining service guarantees and customer trust. Shipments involving restricted or high-value goods, such as pharmaceuticals or electronics, are particularly susceptible to stringent checks. While major logistics firms invest in customs brokerage services and digital tools to mitigate these issues, challenges persist, especially for smaller or emerging market entrants. These regulatory complexities require constant monitoring, adaptive technology, and experienced personnel to ensure compliance. Without streamlined and harmonized international customs procedures, the express delivery market may struggle to achieve its full global potential.

Segmentation Analysis:

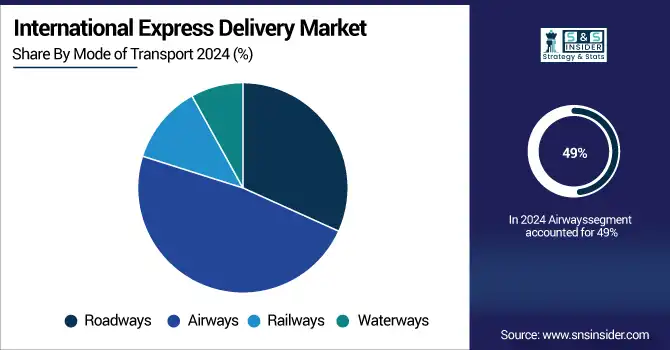

By Mode of Transport

The airways segment holds the largest revenue share of 49% in 2024 due to its unmatched speed and reliability in long-distance, cross-border express deliveries. It is essential for handling high-value, time-sensitive goods across international regions. Airways are a preferred mode for sectors like healthcare, electronics, and fashion, which demand faster turnaround times. In the International Express Delivery Market, this segment continues to dominate, supported by strong logistics networks, global air cargo infrastructure, and seamless tracking capabilities for premium deliveries.

The roadways segment is projected to grow at the highest CAGR of 12.23% during the forecast period, fueled by expanding domestic express delivery needs. This mode offers flexibility, cost-effectiveness, and reliable access to remote and regional areas. Road transport is widely used for short-haul and last-mile delivery services, especially in rural and semi-urban regions. In the International Express Delivery Market, roadways complement air transport by managing ground-level logistics efficiently, enhancing end-to-end service performance for cross-border and local shipments alike.

By Service Type

Standard express delivery dominates the market with a 37% revenue share in 2024, as businesses and consumers seek a balance between cost and speed. This service type is preferred for non-urgent yet trackable shipments, offering scheduled delivery within a defined timeframe. It is widely used across various industries including retail, manufacturing, and healthcare. In the International Express Delivery Market, standard express solutions remain essential, especially for bulk shipments and medium-priority packages where predictable timelines and affordability are prioritized.

The same-day delivery segment is growing at the highest CAGR of 13.68% during the forecast period, driven by rising customer expectations and e-commerce expansion. This service is vital for urgent deliveries such as legal documents, medical supplies, and high-demand consumer goods. Businesses leverage same-day services to enhance customer satisfaction and brand competitiveness. Within the International Express Delivery Market, same-day delivery is transforming expectations, pushing logistics providers to optimize last-mile operations and offer faster, localized services without compromising reliability.

By Industry

Retail and e-commerce lead the market with a 35% revenue share in 2024, driven by global online shopping trends and cross-border retail growth. Express delivery is integral for fulfilling customer promises of fast and reliable shipping. Retailers prioritize international express logistics to ensure customer satisfaction, reduce cart abandonment, and build loyalty. In the International Express Delivery Market, this segment continues to dominate due to high volumes, product variety, and time-sensitive delivery demands from consumers worldwide.

The electronics segment is growing at the highest CAGR of 15.13% during the forecasted period, fueled by increasing international trade in gadgets, components, and high-value tech goods. These products require fast, secure, and damage-free transportation, making express delivery a preferred option. Precision handling and traceability are crucial, especially for fragile or sensitive electronics. In the International Express Delivery Market, electronics stand out as a key driver for premium delivery services due to their value, urgency, and global demand.

By End User

The B2B segment holds the largest revenue share of 63% in 2024, driven by large-scale commercial transactions across industries. Businesses rely on express delivery for timely supply chain operations, sample transfers, spare parts logistics, and cross-border trade. Efficiency, speed, and tracking are crucial in maintaining seamless business operations. In the International Express Delivery Market, B2B shipments dominate due to their consistent volume, regular frequency, and critical importance in supporting industrial and commercial global supply networks.

The B2C segment is expected to grow at the highest CAGR of 12.83% over the forecast period, supported by rising online shopping and consumer demand for fast, transparent delivery. Individual customers increasingly expect quick turnaround times, convenient service options, and real-time shipment updates. Express delivery services help meet these expectations across borders. In the International Express Delivery Market, B2C growth is transforming service models, encouraging logistics providers to personalize offerings, optimize last-mile delivery, and improve customer satisfaction.

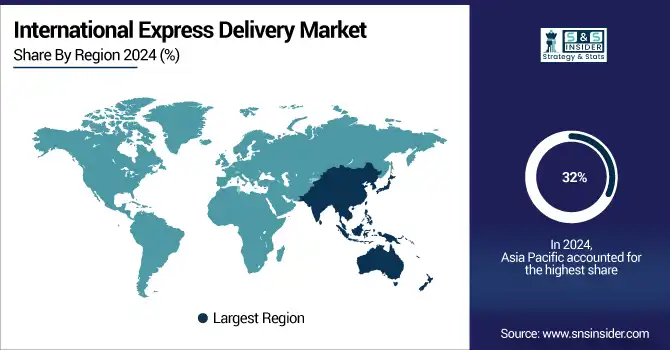

Regional Analysis:

Asia Pacific is the dominant region in the International Express Delivery Market share in 2024, with an estimated market share of 32%. Strong e-commerce growth, urban density, and ongoing investment in cross-border logistics infrastructure drive Asia Pacific’s leadership in this market. China leads the region with the highest share, supported by its expansive digital retail ecosystem, robust manufacturing exports, and advanced logistics networks. Chinese enterprises are leveraging AI-powered tracking systems and smart warehousing to streamline international deliveries. With rising global trade and efficient fulfillment capabilities, China continues to anchor Asia Pacific’s dominant position in the international express delivery space.

North America is the fastest-growing region in the International Express Delivery Market in 2024, with an estimated CAGR of 11.60%. Growing cross-border e-commerce, rising demand for time-definite shipments, and expanding logistics technology adoption propel growth across North America. The United States dominates the region, driven by a strong network of global courier companies, extensive infrastructure, and a consumer base demanding rapid deliveries. U.S. firms across retail, healthcare, and industrial sectors increasingly utilize express delivery services to meet global customer expectations. These dynamics solidify the U.S. as a key growth driver and innovation hub in international express delivery within the region.

Europe’s Cross-Border Trade Integration and Sustainability Goals Fuel International Express Delivery Market Expansion in 2024. Increased focus on EU-wide trade efficiency, digital logistics transformation, and demand for low-emission transport options drive market momentum across Europe. Germany dominates the European region, owing to its strategic central location, highly developed transport networks, and export-led industrial economy. German companies are enhancing their cross-border shipping efficiency through automation and smart customs processing. These initiatives, combined with growing parcel volumes in B2B and B2C channels, firmly establish Germany as the regional leader in international express delivery services.

In 2024, the International Express Delivery Market in the Middle East & Africa (MEA) and Latin America will experience steady growth, driven by trade modernization and digital logistics investments. In MEA, the UAE leads with its well-developed air cargo infrastructure, free trade zones, and strategic logistics positioning between Asia, Europe, and Africa. The country’s focus on becoming a global logistics hub continues to attract express delivery investments. In Latin America, Brazil holds the top position due to its growing e-commerce market, improved supply chain systems, and government initiatives to streamline customs and delivery operations. Both regions are rapidly evolving to support cross-border express logistics and international trade.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The international express delivery market companies are DHL Group, FedEx, United Parcel Service, Inc. (UPS), SF Express, CJ Logistics Corporation, La Poste Group, US Postal Service, Correos Express, Blue Dart Express Ltd., Aramex, TNT Express, Japan Post Holdings Co., Ltd., Royal Mail Group, Yamato Holdings Co., Ltd., Canada Post Corporation, Poste Italiane, PostNL, ZTO Express, STO Express, and Deutsche Post AG, and others.

Recent Developments:

-

In February 2025, DHL eCommerce announced a strategic move by acquiring a minority stake in AJEX Logistics Services, a Saudi Arabia-based parcel delivery company. This partnership merges DHL’s global logistics expertise with AJEX’s strong regional footprint, aiming to deliver reliable, cost-efficient, and environmentally sustainable delivery solutions across the Saudi Arabian market.

-

In October 2024, United Parcel Service, Inc. (UPS) upgraded its network and infrastructure across the Asia Pacific region. A major enhancement involved launching a new air route via Sharjah International Airport (SHJ) in the UAE, allowing shipments from mainland China and South Korea to reach destinations like Nigeria, Pakistan, Saudi Arabia, and South Africa within two business days.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 30.96 Billion |

| Market Size by 2032 | USD 69.01 Billion |

| CAGR | CAGR of 10.54% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mode of Transport (Roadways, Airways, Railways, Waterways) • By End User (B2B, B2C) • By Industry (Retail & E-commerce, Healthcare & Pharmaceuticals, Documents & Banking/Legal Services, Automotive, Manufacturing, Electronics, Others) • By Service Type (Standard Express Delivery, Same-Day Delivery, Next-Day Delivery, Time-Definite Delivery, Freight/Heavy Shipment Express) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | DHL Group, FedEx, United Parcel Service, Inc. (UPS), SF Express, CJ Logistics Corporation, La Poste Group, US Postal Service, Correos Express, Blue Dart Express Ltd., Aramex, TNT Express, Japan Post Holdings Co., Ltd., Royal Mail Group, Yamato Holdings Co., Ltd., Canada Post Corporation, Poste Italiane, PostNL, ZTO Express, STO Express, and Deutsche Post AG, others. |