Intravenous Catheters Market Report Scope & Overview:

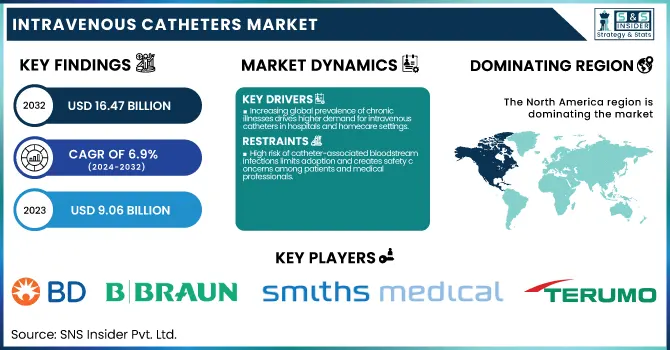

The Intravenous catheters Market was valued at USD 9.06 billion in 2023 and is expected to reach USD 16.47 billion by 2032, growing at a CAGR of 6.9% over the forecast period of 2024-2032.

To Get more information on Intravenous catheters Market - Request Free Sample Report

This report provides key statistical insights and emerging trends in the Intravenous Catheters Market. It emphasizes the increasing need for IV access due to both chronic diseases and admissions into hospitals. The report projects device volume expansion through, examining the trends behind healthcare expenditures. It also discusses the trend towards safety-engineered and antimicrobial-coated catheters and the growing prevalence of closed IV systems. Regulatory matters, including adherence to FDA, CE, and ISO regulations, are also reviewed. These insights provide a holistic picture of the market’s evolution, demand landscape, and product innovation landscape. The market for intravenous catheters is being driven by the prevalence of chronic disease states such as cardiovascular disease, diabetes, and cancer which require frequent intravenous therapies.

The U.S. intravenous catheters market has been growing continuously, and is anticipated to continue its growth trajectory, reaching USD 2.35 billion in 2023 and USD 4.23 billion by 2032. This modest CAGR of 6.78% is compelled by increasing hospitalization rates, wider acceptance of safety-engineered devices, and further escalation of outpatient and home-based IV therapies. Due to the strong healthcare infrastructure, and regulatory compliance standards, the U.S. continues to be a leading market. The Centers for Disease Control and Prevention (CDC) estimates that around 805,000 people have heart attacks in the U.S. each year and that 695,000 deaths were due to heart diseases in 2021. Additionally, advancements in catheter technology, including antimicrobial coatings and safety-engineered designs, have enhanced patient safety and reduced infection risks.

Market Dynamics

Drivers:

-

Increasing global prevalence of chronic illnesses drives higher demand for intravenous catheters in hospitals and homecare settings.

The increase in the incidence of chronic diseases like cancer, cardiovascular disorders, diabetes, and renal failures is considerably raising the demand for long-term as well as continuous medical care, particularly I.V. therapies. The increase in overall patient volume has in turn stoked demand for intravenous catheters, necessary for administering drugs, fluids, and nutrients into the bloodstream. In major regions such as North America, Europe, and certain regions in Asia, such medical conditions prevalence has observed a steep increase owing to the geriatric population. IV catheterization is also critical for post-operative care and chemotherapy sessions. Due to their ease of use and ability to minimize repeated needle suction, intravenous catheters have been preferred for chronic disease management, thereby, controlling and improving patient compliance. These catheters witness high consumption as hospitals, clinics, and homecare agencies expand their IV therapy infrastructure. In addition, the rising emphasis on patient-oriented healthcare and attempts to decrease hospital stays are fuelling the use of portable IV solutions at home, thus driving the market demand. All these trends are a representation of the strong association of chronic illness prevalence with the rising unique intravenous catheter market. As healthcare infrastructure develops globally, this driver is set to significantly contribute to market expansion over the coming years.

Restrain

-

High risk of catheter-associated bloodstream infections limits adoption and creates safety concerns among patients and medical professionals.

Despite the wide usage of intravenous catheters, one of the most pressing concerns is the associated risk of bloodstream infections, commonly referred to as CLABSIs (Central Line-Associated Bloodstream Infections). These infections can cause serious complications, prolonged hospitalizations, increased healthcare expenditure, and, in some cases, death. Healthcare providers have to adhere to strict sterilization and maintenance procedures that, when slightly neglected, can produce infections. This high-risk component has turned off certain health services to an extensive adoption of IV catheters, in specific hair salon settings where coping practices are inadequate. Furthermore, the active role of patients in being aware of possible complications and adverse events has been taking a more cautionary approach, whereby some patients have refused to take IV. Regulatory bodies and health organizations have also been scrutinizing catheter use and infection control standards, which may slow product approvals and delay market expansion. Although innovations, such as antimicrobial-coated catheters, mitigate many of the risks, the fear of infection represents a critical barrier, particularly in developing nations. These safety concerns continue to pose a challenge to the consistent growth of the intravenous catheter market, despite technological advancements and improved manufacturing practices.

Opportunities

-

Expanding healthcare infrastructure in emerging economies unlocks new opportunities for intravenous catheter market penetration and product adoption.

In developing countries in Asia-Pacific, Latin America, and some regions of Africa, governments and private sectors are making significant investments in healthcare infrastructure, building hospitals and clinics, and improving homecare facilities. The healthcare development boom is favourable for the adoption of intravenous catheters, as well as other advanced medical devices. With improved access to quality healthcare, demand for vital services like IV therapy is also surging. In addition, the rising prevalence of medical tourism in regions like India, Thailand, and Brazil is drawing patients from all over the world, thus propelling the demand for intravenous catheters for surgical and therapeutic applications. Educational programs for medical professionals, public health initiatives, and government-subsidized programs managing chronic diseases are also becoming essential contributors to improving IV catheter utilization. Once foregone due to affordability and access, these regions are now rapidly evolving into substantial markets driving global medical device consumption. The most significant beneficiaries will be companies introducing low-cost, simple-to-use, and secure catheter solutions to these marketplaces. This changing landscape presents significant opportunities in terms of revenue generation and long-term growth for the market players who are looking to expand their global presence.

Challenges

-

Shortage of trained healthcare professionals in remote and rural regions challenges effective intravenous catheter usage and patient safety protocols.

The intravenous catheters are sophisticated devices, which when used efficiently require trained manpower for understanding catheter insertion, monitoring, and maintenance of patent IV access in a very precise manner to prevent related complications. Meanwhile, the world faces a critical shortage of trained nurses, technicians, and paramedics, particularly in rural and remote regions. Inadequate staffing often leads to improper catheter placement, higher infection rates, and poor overall patient outcomes. This problem is perhaps even more pronounced in low- and middle-income countries, with health systems that are still developing. Even if catheters could be procured, their optimal use is limited by skill gaps, reducing their benefits to patients and contributing to poor patient experiences. Moreover, the absence of consistent training programs and certifications further aggravates the situation. Healthcare organizations struggle to implement standard operating procedures, and patients may receive substandard care. In these scenarios, IV catheters' potential remains largely untapped, a factor that's negatively impacting their penetration within the market. Unpacking this problem has a long road ahead and will require systemic reform, a boost in investment in healthcare workforce training and collaboration with education institutions. In the meantime, the lack of trained professionals will remain a significant challenge in realising the full potential of the intravenous catheter market.

Segment Analysis

By Type

In 2023, peripheral catheters segments held the largest revenue share of 42% due to a broad range of applicable pathways in hospitals and outpatient settings. These catheters are the most preferable for short-term therapies, due to their features of ease of insertion and pathological removal, low risk of complications, and versatility within different clinical contexts. This demand is further fueled by innovations, such as antimicrobial coatings that minimize infection risks and safety-engineered designs that eliminate needle-stick injuries. Furthermore, peripheral catheters are progressively being utilized in home healthcare crafting by government and insurance regulations for reimbursement policies favoring the new cost-effective treatment approaches away from the hospital.

Peripheral catheters also benefit from innovations like ultrasound-guided insertion techniques that enhance procedural accuracy. The rising geriatric population requiring short-term intravenous therapies further drives demand. For example, integrated/closed peripheral catheters are gaining traction due to their ability to prevent backflow and reduce mechanical phlebitis risks. These factors collectively position peripheral catheters as a dominant segment in the intravenous catheters market.

By End-Use

The hospital pharmacy segment captured the largest market share in terms of revenue at 49% in 2023, as the segment plays a vital role in providing prescribed medication during patients' inpatient treatment. Direct procurement of pharmaceuticals by hospitals is meant to provide therapeutic drugs promptly for acute and chronic conditions such as cardiovascular diseases, neurological disorders, and infections. According to the World Health Organization (WHO), cardiovascular diseases caused approximately 17 million deaths globally in 2015, highlighting the need for efficient hospital pharmacy systems.

A hospital pharmacy is also included in managing emergency care in cases like road accidents that need long-term patients admission. Compounded drugs are tailored to individuals and are so powerful that they may help create more effective treatments. This segment dominates due to favorable policies for health reimbursement and high hospitalization rates in North America. Moreover, advancements in digital health technologies enable hospitals to streamline medication delivery processes further boosting growth.

Regional Analysis

In 2023, the North American region led the intravenous catheters market accounting for 35% of the share owing to its advanced healthcare infrastructure along with high prevalence of chronic diseases and higher reimbursement policies. The United States played a pivotal role in this dominance, driven by its robust healthcare system and increasing demand for technologically advanced medical devices. For example, neurological disorders were affecting roughly 100 billion people in the U.S. as of March 2021, according to the American Neurological Association, resulting in a jump in neurosurgeries and, in turn, intravenous catheter demand. Moreover, the availability of quality products is guaranteed by FDA-required regulatory frameworks, which further contributes to market growth. Europe also contributed a significant share of the market owing to the aging population and increasing number of surgical procedures necessitating long-term intravenous therapies. Germany and France are among those that have invested heavily in upgrading their healthcare systems to meet rising patient demand.

Asia-Pacific, however, was the fastest-growing region in 2024-2032. Factors such as the surge in healthcare infrastructure development in China and India, a rise in government expenditure on healthcare projects, and growing awareness regarding sophisticated medical technologies are the factors driving the growth of the market. For instance, China has introduced policies for patient outpatient healthcare insurance coverage development and low out-of-pocket burdens, raising the accessibility of intravenous therapies. In addition, urbanization and changing diets are giving rise to lifestyle diseases, diabetes, and cardiovascular diseases in this region. These factors have notably increased the demand for inserting intravenous catheters.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Becton, Dickinson and Company (BD Nexiva, BD Insyte Autoguard)

-

B. Braun Melsungen AG (Introcan Safety, Vasofix Safety)

-

Smiths Medical, now part of ICU Medical, Inc. (Jelco IV Catheter, DeltaVen Closed System)

-

Terumo Corporation (SurFlash, Surflo Winged Infusion Set)

-

Teleflex Incorporated (Arrow Peripheral IV Catheters, ProtectIV Safety IV Catheter)

-

Medline Industries, LP (Manufacturer & Service Provider) – (Venflon IV Catheter, Medline Safety IV Catheter)

-

Nipro Corporation (SureFlash, Surshield Safety IV Catheter)

-

Vygon SA (Leadercath, Nutriline)

-

AngioDynamics Inc. (BioFlo PICC, VenaCure EVLT)

-

Hospira, Inc. (IntraFlo IV Set, Lifecare PCA)

-

Biosensors International Group, Ltd. (BioCath, BioCath Plus)

-

Retractable Technologies, Inc. (VanishPoint IV Catheter, EasyPoint)

-

Cardinal Health (Manufacturer & Service Provider) – (Monoject Safety IV Catheter, Kangaroo ePump Feeding Set)

-

Smith & Nephew plc (Service Provider) – (IV3000, IV Prep Wipes)

-

3M Health Care (Manufacturer & Service Provider) – (Tegaderm IV Securement, 3M PICC/CVC Securement Device)

-

Scalp Vein Set India (Broselow Pediatric IV Catheter, Scalp Vein Set Pro)

-

Infusion Concepts Ltd. (Vascular Access Cannulae, Closed IV Infusion Sets)

-

RenovoRx, Inc. (RenovoCath Delivery System, RenovoCath Dual-Balloon Catheter)

-

Delta Med SpA (DELTA IV Catheter, Safety IV Cannula)

-

Iskus Health (IS-IVC Safety IV Catheter, IS-Guard Winged IV Cannula)

Recent Developments

-

In May 2024, Teleflex Incorporated Introduced the Arrow EZ-IO Intraosseous Access Procedure Tray, the first FDA-cleared sterile, single-use intraosseous (IO) tray, streamlining IO access procedures.

-

In April 2024, BD introduced "UltraTouch," a blood collection device designed to minimize patient discomfort by ensuring a successful first attempt, helping reduce needle-related anxiety, and enabling accurate, timely test results.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.06 Billion |

| Market Size by 2032 | USD 16.47 Billion |

| CAGR | CAGR of 6.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Peripheral Catheters, Central Venous Catheters, Midline Peripheral Catheters) • By End-use (Retail Pharmacies, Hospital Pharmacies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company, B. Braun Melsungen AG, Smiths Medical (ICU Medical, Inc.), Terumo Corporation, Teleflex Incorporated, Medline Industries, LP, Nipro Corporation, Vygon SA, AngioDynamics Inc., Hospira, Inc. (Pfizer), Biosensors International Group, Ltd., Retractable Technologies, Inc., Cardinal Health, Smith & Nephew plc, 3M Health Care, Scalp Vein Set India, Infusion Concepts Ltd., RenovoRx, Inc., Delta Med SpA, Iskus Health |