Isoamyl Acetate Market Report Scope & Overview:

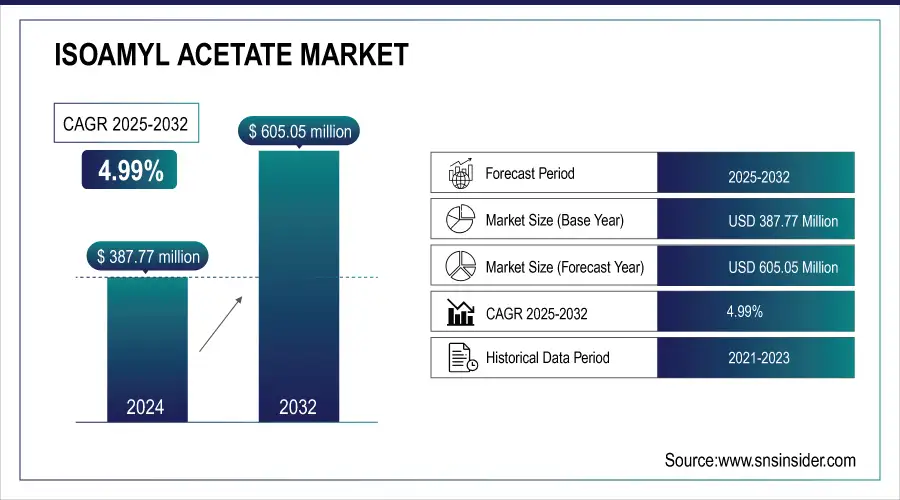

The Isoamyl Acetate Market size was valued at USD 387.77 Million in 2024 and is expected to reach USD 605.05 Million by 2032, growing at a CAGR of 4.99% of 2025-2032. An increase in demand for eco-friendly paint & coating solvents such as isoamyl acetate across industrial applications such as paints, coatings & varnish is projected for market growth. With the increasing environmental regulations for industries and the demand to minimize hazardous chemicals, isoamyl acetate is a strong candidate to replace commonly used solvents such as acetone, toluene, and xylene. This change is in sync with the global trend towards environmentally sustainable and green chemicals as a result of regulatory demands and increasing consumer awareness and preferences. Packaging shipments from the U.S. packaging industry reached an estimated USD 180 billion in 2022 according to the U.S. Census Bureau, signaling mounting demand for premium packaging solutions. These trends are directly impacting the printing ink industry, which is also an important sector for packaging materials that require solvent-type isoamyl acetate to achieve high-resolution printing.

Get More Information on Isoamyl Acetate Market - Request Sample Report

Key Isoamyl Acetate Market Trends

-

Rising demand in the food & beverage sector as a natural flavoring agent, especially in confectionery, bakery, and beverages.

-

Increasing use in the cosmetics and personal care industry for fragrances due to its fruity, banana-like aroma.

-

Growing adoption in the pharmaceutical industry as a solvent and flavor masking agent in drug formulations.

-

Expansion in industrial applications, including coatings, paints, and adhesives, due to its effective solvent properties.

-

Shift toward bio-based and sustainable production of isoamyl acetate, driven by green chemistry initiatives.

-

Rising popularity in specialty chemicals and laboratory testing (e.g., olfactory testing) boosting niche demand.

-

Strong growth in Asia-Pacific markets, supported by expanding food, cosmetics, and pharmaceutical manufacturing sectors.

Isoamyl Acetate Market Growth Drivers

-

Increasing demand in the flavor and fragrance industry drives the market growth.

The increasing demand in the flavor and fragrance industry is a major driver of the isoamyl acetate market, fueled by rising consumer preferences for natural and pleasant-smelling products. Isoamyl acetate is an important component in producing synthetic flavors and fragrances for food and beverages because of its typical banana-like fruity note. Strong growth in the global flavor and fragrance market as applications proliferate in food and drink, cosmetics, and personal care. The International Fragrance Association notes that the global fragrance market generated more than USD25.2 billion in 2022 and continues to grow, spurred over the years by rising demand globally for middle and high-end fragrance products in particular across regions such as Asia-Pacific and Latin America. Isoamyl acetate is also approved as safe by the U.S. Food and Drug Administration (FDA), contributing to its use in flavored foods and drinks such as candy, confectionery, and flavored beverages.

The growth of the market for these synthetic flavoring agents has been driven by consumers leaning towards consuming more natural flavors as well as exotic flavors. Regulations by the European Food Safety Authority (EFSA) in Europe also supported isoamyl acetate, which is anticipated to drive demand for food flavoring applications. Such rising demand is consequently sparking growth opportunities for the isoamyl acetate market.

Isoamyl Acetate Market Restraints

-

Fluctuating in the raw material prices may hamper the market growth.

Common fluctuation in the prices of raw materials is a major hamper for the isoamyl acetate market thus affects production and profitability. The production of Isoamyl acetate involves the utilization of raw materials namely isoamyl alcohol and acetic acid, having a price-sensitive nature subjected to global supply-demand dynamics, geopolitical factors as well as crude oil price fluctuations. A major feedstock is isoamyl alcohol, which originates from petroleum-based sources and its price responds strongly to global oil markets. Changes in crude oil prices such as those observed in the past couple of years due to global trade tensions, blockages, and OPEC policies directly affect petroleum derivatives prices with isoamyl alcohol making no exception. The same methanol chain is the basis for acetic acid as well, and fluctuations in price due to supply constraints only add to these uncertainties in producer costs.

Isoamyl Acetate Market Opportunities

-

Growing Demand for Natural and Organic Products

-

Innovations in the Food and Beverage Sector

Isoamyl Acetate Market Segment Outlook:

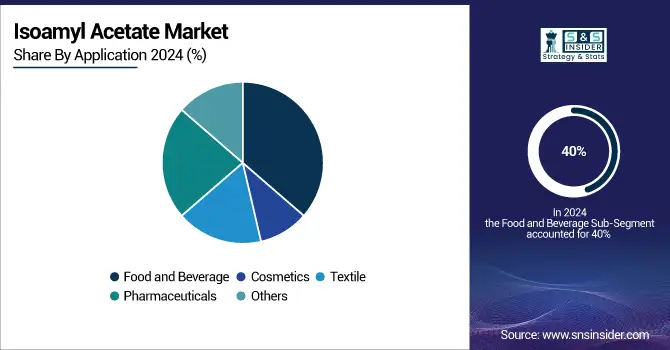

By Application

Food and Beverage held the largest market share around 40% in 2024. Isoamyl acetate has the highest market share in Food and Beverage owing to its wide application as a flavoring agent. This compound is preferred due to its unique fruit flavor, particularly banana-like aroma which makes this ingredient suitable for many food products such as confections, biscuits, and beverages. The manufacturers are gradually using isoamyl acetate in the formulation of end products due to increasing consumer need for good aesthetic pleasantness such as natural flavors. Based on statistics from the U.S. Department of Agriculture (USDA), the market size is predicted to expand to a total of around USD 1.5 trillion by 2025, boosted by trends including premiumization and health awareness for Americans, even if they are delivered outside of United States borders. In a competitive landscape where companies are always looking to differentiate their products, the versatility and sensory attributes of isoamyl acetate continue to drive significant use in this sector.

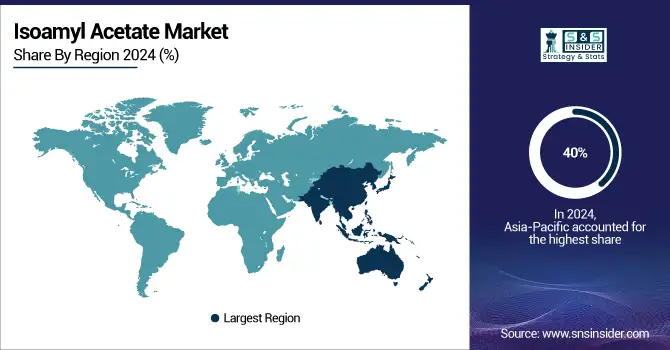

Isoamyl Acetate Market Regional Analysis

Asia Pacific Isoamyl Acetate Market Insights

Asia-Pacific region held the largest market share around 40% in 2024. This is owing to rapid industrialization, the growth of the food and beverage industry, and rising consumer preference for flavored products. This is spurred by the economic boom in the likes of China, India, and Japan with the rise of disposable income and a new appetite to taste premium and innovative food. Moreover, the rapidly growing cosmetics and personal care industry in the region owing to the youthful population and rising urbanization is likely to propel demand for isoamyl acetate as a fragrance and flavoring agent during the forecast period. International flavor trends have been adopted and the focus on quality products is considerable as well. Regulatory support from governments in the form of legislation permitting the usage of food-grade additives & flavoring agents to use in food products serves as a positive gap filler towards market trends for the biomass isoamyl acetate development which will lead to upscaled consumption demand for execution. Thus, robust economic growth along with changing consumer behavior and economy-friendly regulations would consolidate the Asia-Pacific isoamyl acetate market over the forecast timeframe. Furthermore, the companies focused on the expansion in the isoamyl acetate market for instance, in 2023, BASF announced the expansion of its production capacity for isoamyl acetate at its manufacturing facility in Nanjing, China. This expansion aims to meet the increasing demand for flavoring agents and solvents in the food and beverage, cosmetics, and personal care industries. The company emphasized its commitment to sustainable practices and high-quality production standards.

Europe Isoamyl Acetate Market Insights

The European Chemicals Agency also reported that global demand for bio-based and green solvents is growing between 6-7% a year, with more attention being paid to sustainable solvents and green chemicals. Programs such as the U.S. Safer Choice Program administered by the EPA support manufacturers who use safer solvents and other chemicals, while governments across Europe and the U.S. are encouraging such decisions.

The printing industry has been witnessing a significant surge in demand for high-quality prints in sectors such as packaging and labeling, driving the market growth for isoamyl acetate. It is widely used in printing inks as a solvent due to its good solubility and quick-drying nature. Consequently, making it one of the most vital components in manufacturing intense, clear, and lasting prints as per rising needs from different industries like food & beverage; consumer goods, and pharmaceuticals. Higher demand for quality printing solutions owing to the increasing focus on packaging designs and product differentiation. In addition to this, growing ecological regulations are driving the printing industry toward less toxic and environmentally friendly solvents isoamyl acetate additionally bolstering its acceptance.

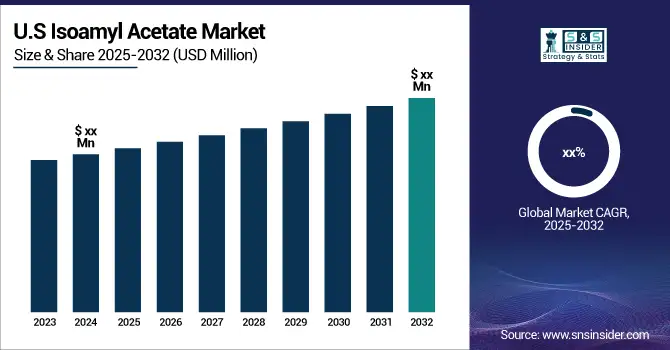

North America Isoamyl Acetate Market Insights

Isoamyl acetate market in North America is growing at a moderate rate owing to its significant market demand from the food & beverage industry, such as flavorant, especially in confectionery, bakery, and beverages. The mature cosmetics and personal care industry in the region also plays a large part, as isoamyl acetate has applications in fragrances and perfume. The rising industrial coatings and paints market in the U.S. and Canada is also contributing to the market expansion.

Latin America (LATAM) Isoamyl Acetate Market Insights

The industry for sodium propionate in Latin America (LATAM) is also projected to be boosted by the increasing purchasing power of the middle-class population in the region, particularly with the growing consumption of processed foods and beverages and the growing fragrance and cosmetic markets in Brazil and Mexico. Rising industrialization and urban lifestyle transitions are encouraging the use of isoamyl acetate in household cleaning agents and coatings. In addition, the increasing export of food and cosmetics from the area will help maintain demand.

Middle East & Africa (MEA) Isoamyl Acetate Market Insights

In Middle East & Africa (MEA), growth in the isoamyl acetate market is significantly driven by increased consumption of perfumes and cosmetics, especially in the Gulf countries with surging demand for luxury fragrances. Additionally, the food & beverage sector is growing, with isoamyl acetate being utilized as a flavouring agent in confectionary and beverages. In addition, the increasing rate of urbanization, the growing disposable income, and growing investments in the paints and coatings industry are propelling market growth in MEA.

Need any customization research on Isoamyl Acetate Market - Enquiry Now

Competitive Landscape for Isoamyl Acetate Market:

BASF SE

BASF is a global chemical leader, offering a broad portfolio of products across chemicals, materials, and performance solutions. In the isoamyl acetate market, the company emphasizes innovation and scalability to meet rising demand from end-use industries.

- In 2023, BASF announced an expansion of its production capacity for isoamyl acetate at its Nanjing facility in China, aimed at catering to the growing demand from the food and beverage industry.

Merck KGaA

Merck KGaA is a leading science and technology company with expertise spanning life sciences, healthcare, and specialty chemicals. Within the isoamyl acetate segment, the company focuses on high-purity and food-grade solutions for the flavor and fragrance market.

- In 2023, Merck KGaA expanded its product portfolio by introducing food-grade isoamyl acetate, specifically designed to meet the rising consumer preference for natural and high-quality flavoring agents in food and beverage applications.

Isoamyl Acetate Companies are:

-

Merck KGaA

-

Thermo Fisher Scientific

-

Chemoxy International Ltd.

-

BASF SE

-

Dow

-

Finetech Industry Limited

-

Ernesto Ventós, S.A.

-

Kraton Corporation

-

Eastman Chemical Company

-

Cargill, Inc.

-

Mitsubishi Chemical Corporation

-

Nippon Shokubai Co., Ltd.

-

Aroma Chemicals

-

Jungbunzlauer

-

Axyntis

-

Takasago International Corporation

-

Givaudan

-

Fujifilm Diosynth Biotechnologies

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 387.77 Million |

| Market Size by 2032 | US$ 605.05 Million |

| CAGR | CAGR of 4.99% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Food and Beverage, Cosmetics, Textile, Pharmaceuticals, Other End-user Industries) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Merck KGaA, LGC Limited, Thermo Fisher Scientific, Chemoxy International Ltd., BASF SE, Dow, Finetech Industry Limited, Ernesto Ventós, S.A., Others players. |