Flavors & Fragrances Market Report Scope & Overview:

Get More Information on Flavors & Fragrances Market - Request Sample Report

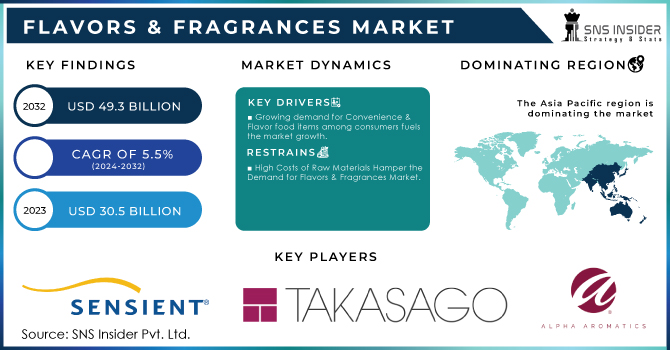

The Flavors & Fragrances Market Size was valued at USD 30.5 billion in 2023, and is expected to reach USD 49.3 billion by 2032, and grow at a CAGR of 5.5% over the forecast period 2024-2032.

Several key drivers and trends govern the growth and development of the flavors & fragrances market. In a growing awareness of health and wellness, natural and organic flavors have gained consumer demand. One of the top trends now is towards natural, sustainably sourced products. More specifically, fragrances have had a high shift towards the use of environmentally friendly and organically sourced ingredients. Brands like Young Living and doTERRA are tapping into this trend, with their essential oil-based products and other natural fragrance options, while marketing to those who are environmentally conscientious.

Another major driver is the interesting demand for an increase in innovative, exotic flavors in food items and beverages. Interest is soaring in experiencing new, more exotic tastes through food and drinks; this has been driven by the need from Gen Z for bolder and more innovative flavor offerings. Top restaurants are rapidly joining this trend by adding diversified sauces and flavor profiles to their menu—a bigger market trend in which restaurants are working hard to offer new, exciting culinary experiences.

Personalization and customization are also significantly impinging on the flavors & fragrances market. Developments in technology have allowed companies to offer customized fragrance and flavor solutions that can be tailored to every individual's liking. Digital channels through which consumers can create their scent profile themselves are gaining popularity and enhancing customers' experience. Brands such as Scentbird and FragranceX already dominate in light of offering customized fragrance options as brands rapidly turn towards personalized consumer products.

The other important driver in the market remains regulatory frameworks. Increasingly tight controls on the use of chemicals and ingredients in formulations have companies reformulating to observe safety and quality standards. For instance, the REACH regulation from the European Union has forced the reformulation of products to avoid restricted substances, furthering the impetus for innovation while continuing to ensure consumer safety throughout the sector.

Growth in emerging markets has also lent a hand to the growth of the flavors & fragrances market. With economies developing in regions like Asia-Pacific and Latin America, demand for premium and luxury products that come with unique flavors and fragrances is increasing. Improving economic conditions in these regions bring with them a rise in the middle class, which drives consumption. Companies like Symrise and International Flavors & Fragrances participate in growth by preparing products for local tastes. On the other hand, technological developments—the encapsulation technique—are also raising the quality and stability of products, further supporting market growth.

Market Dynamics:

Drivers:

-

Growing demand for Convenience & Flavor food items among consumers fuels the market growth

Rising demands for convenience and flavorful food products in the consumer market provide an impetus to the flavors & fragrances market, displaying an inclination towards ease of use and taste satisfaction. As a result of increasingly hectic lifestyles with fast schedules, consumers look forward to ready-to-eat and easy-to-cook meal options without compromising on flavor. This trend is evident in the rise of pre-packaged meals, snack foods, and instant products gracing stores with bold, innovative flavor profiles. A case in point is McCormick & Company's increasing offerings of seasoning blends and flavor enhancers to answer consumer demand for flavorful and convenient meal solutions. In addition, an increasing interest in gourmet-flavor chips or exotic popcorn varieties evidences how the brands respond to consumer desires: convenience with unique taste experiences. All this demand feeds the surge for advanced flavor technologies and formulations that ensure even quick, easy food options deliver a high-quality taste that meets evolving consumer expectations.

-

Increasing interest in personalized products drives the flavor and fragrance market

The interest in personalized products is believed to be one of the key drivers in the flavors & fragrances market, pointing out a much wider consumer trend toward customized experiences. Such a trend could be manifested within the flavor and fragrance sectors when consumers demand customized products based on their tastes and preferences. In a way, companies are now able to offer customized solutions to specific consumer needs, which is all due to advances in technology. For example, digital platforms like Scentbird allow every user to create a fragrance profile about their unique preferences; this has been very popular among consumers seeking unique and individualized scents. In the same way, flavor companies are taking advantage of technologies in the development of customized flavor experiences around food and beverages, so now consumers can choose and mix flavors following their tastes, thus raising overall satisfaction with products. This personalization is driven not only by consumer demand for unique products but also by formulation and production technologies. Corporations have been making serious investments in sophisticated tools and processes that have enabled them to successfully come up with tailored flavors and fragrances at scale. For instance, Firmenich and Givaudan, whose place is prominent in the industry, are putting into use advanced analytics and sensory technologies to arrive at personalized solutions that will meet the specific desires of consumers. The focus on personalization sets this brand apart from others within the market, providing a far more engaging and satisfying consumer experience in a trend moving toward ever-greater individualization of product offerings.

Restraints:

-

High Costs of Raw Materials Hamper the Demand for Flavors & Fragrances Market

A prominent restraint for the flavors and fragrances market is that raw materials incur high costs. This, in turn, affects decisions on production and pricing strategies within the industry. These are often perceived as premium-priced since many of the natural and organic ingredients that today's consumers demand are considered to be eco-friendly and health-friendly. For example, perfumes or flavorings with a high level of added value can be very costly, having their bases in very scarce and costly essential oils and botanicals to produce, and extremely labor-intensive in their extraction and processing as well. Both Givaudan and Firmenich face these problems in their work of sourcing good raw materials and managing costs. Moreover, much price volatility in raw materials, climate, and political factors, might cause unpredictable production costs, with the final product prices going up, affecting the affordability of the same to the consumer or causing the market to be less competitive.

Opportunities:

-

Expansion into emerging markets

-

Development of innovative flavor and fragrance solutions

KEY MARKET SEGMENTS

By Product Type

The flavors & fragrances market is dominated by the Natural segment, with a market share of 75% in 2023, especially by the sub-segment of Essential Oils. This dominance is driven by the rising consumer demand for natural and organic products, which is said to raise the consumption of essential oils in a wide range of applications, such as personal care, food and beverages, and aromatherapy, among others. These were majorly essential oils such as Lavender, Peppermint, and Eucalyptus, perceived for their health benefits and natural origin. For example, the essential oil of Lavender is mainly used as a raw material in wellness products and in aromatherapy. On the other hand, Peppermint and Eucalyptus are major ingredients in culinary and medicine respectively.

By Application

In 2023, Flavours dominated the flavours & fragrances market with a 50% market share. This increase in demand can be attributed to the increasing need from the side of consumers for more diversified and innovative beverage products, both alcoholic and non-alcoholic. Companies are more and more investing in distinctive flavor profiles tailored to the changing taste and preference of consumers in order to be unique amidst a plethora of products. For example, beverage manufacturers are more and more relying on exotic and complex flavor profiles to allure consumers searching for new taste experiences, duly expressed by the rise of craft beverages and premium soft drinks. Beverage manufacturers are a powerful client base for flavors when innovating and continuously seeking to bring better products to the consumer according to his taste. This trend has just been more obvious to prove the dominant position of the segment of Flavors in the market with major success in flavored waters, energy drinks, and specialty coffees.

Regional Analysis

In 2023, the Asia-Pacific region dominated the market with a market share of 38% in the flavors & fragrances market, owing to the rapidly growing consumer base, the rising middle class, and high demand for new innovative flavors and fragrances. High population growth, coupled with economic development in this region, results in increased disposable income and thereby fuels higher consumption of processed foods and beverages, personal care, and other FMCG products. For instance, countries like China and India have consumed large volumes of flavored beverages and snacks, thus largely contributing to regional dominance. Growing demand for premium and customized fragrance products in emerging markets has also underpinned growth. This is attributed to the large consumer market found within the region, increasing urbanization, and changing tastes and preferences of consumers away from traditional flavors towards new and more exotic ones in terms of flavors and fragrances. For instance, one of the largest flavor and fragrance companies worldwide has the region serving the location for the company's expansion to meet the trends highlighted above, thus exemplifying the critical nature of the region in the world market.

Moreover, in 2023, North America emerged as the fastest-growing region for the flavors & fragrances market. Besides, growth is supported by a host of other factors, including strong demand at the consumer end for innovative and premium products, imposing market presence of key players in industries, and increasing investments made in research and development. The advanced consumers in the region are focusing on new flavors and fragrances in beverages, personal care, and gourmet foods. It is anticipated that the share of North America in the Flavors & Fragrances Market will be around 26%. This high percentage is an indication of the fact that this region holds the top position in terms of technology and spent by consumers on advanced and tailored products. For instance, specialty craft beverages and luxury personal care products have seen unprecedented growth in popularity, specifically within the United States and Canada, into which this dynamic market has expanded. It has seen companies like Givaudan and Firmenich expand their operations in North America to meet that growing demand, thereby reinforcing the strategic role of the region in driving market growth.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

Some of the major players in the Flavors & Fragrances Market are Sensient Technologies Corp., Takasago International Corp., Alpha Aromatics, Firmenich SA, Vigon International, Inc., BASF SE, Akay Flavors & Aromatics Pvt. Ltd., Synthite Industries Ltd., Universal Oleoresins, Flavex Naturextrakte GmbH, Young Living Essential Oils, Biolandes SAS, Mane SA, Givaudan, Manohar Botanical Extracts Pvt. Ltd., Ozone Naturals, Elevance Renewable Sciences, Inc., Symrise AG, Indo World, Ungerer & Company, Falcon Essential Oils, doTERRA International, International Flavors and fragrances, and other players.

Recent Developments

-

May 2024: PEPSI launched "Grills Night Out," touting Pepsi as the perfect grilling beverage, complete with tips from Chef Bobby Flay.

-

May 2024: Nothing Bundt Cakes unveiled their largest-ever summer flavor lineup, the Taste of Summer Collection, featuring six flavors.

-

April 2024: Anuvi Chemicals Limited launched a new fragrances and flavors division called Anurom, building on their legacy of eco-friendly standards.

-

March 2024: Sensient launched its Plant-based eating initiative in Europe due to an increase in consumer demand for plant-based products.

-

January 2023: Symrise AG invested in Ignite Venture Studio, which became a source of funding and support for B2C new ventures with innovative personal care solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 30.5 Billion |

| Market Size by 2032 | US$ 49.3 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type {Natural (Essential Oils [Corn mint Essential Oils, Eucalyptus Essential Oils, Pepper Mint Essential Oils, Lemon Essential Oils, Citronella Essential Oils, Patchouli Essential Oils, Clove Essential Oils, Ylang Ylang/Canaga Essential Oils, Lavender Essential Oils], Oleoresins [Paprika Oleoresins, Black Pepper Oleoresins, Turmeric Oleoresins, Ginger Oleoresins, Others]), Aroma Chemicals (Esters, Alcohol, Aldehydes, Phenol, Terpenes, Others)} •By Application {Flavors (Beverages, Savory & Snacks, Dairy Products, Bakery, Confectionary, Animal Feed, Others), Fragrances (Fine Fragrances, Cosmetics & Toiletries, Soaps & Detergents, Aromatherapy, Others)} |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sensient Technologies Corp., Takasago International Corp., Alpha Aromatics, Firmenich SA, Vigon International, Inc., BASF SE, Akay Flavors & Aromatics Pvt. Ltd., Synthite Industries Ltd., Universal Oleoresins, Flavex Naturextrakte GmbH, Young Living Essential Oils, Biolandes SAS, Mane SA, Givaudan, Manohar Botanical Extracts Pvt. Ltd., Ozone Naturals, Elevance Renewable Sciences, Inc., Symrise AG, Indo World, Ungerer & Company, Falcon Essential Oils, doTERRA International, International Flavors and fragrances, and other players. |

| Key Drivers | •Growing demand for Convenience & Flavor food items among consumers •Increasing interest in personalized products |

| RESTRAINTS | •High Costs Of Raw Materials Hamper The Demand For Flavors & Fragrances Market |