Lung Cancer Surgery Market Size & Trends

Get More Information on Lung Cancer Surgery Market - Request Sample Report

The Lung Cancer Surgery Market Size was valued at USD 5.4 billion in 2023 and is expected to reach USD 7.9 billion by 2032 and grow at a CAGR of 4.3% over the global forecast period of 2024-2032.

The lung cancer surgery market has soared significantly during the past couple of years, primarily with contributions from advancements in medical technology, growing awareness towards early detection, and improvement in healthcare infrastructure. So far, surgical intervention remains the most viable treatment alternative for patients with lung cancer who, depending on the extent of their illness, are within the operational limitations of having localized tumors or those who can benefit from surgical intervention. Lobectomy, pneumonectomy, or more recent methods such as video-assisted thoracic surgery of these procedures have become very popular in years because they can reduce postoperative complications and serve to contribute to quick recovery. According to the Global Cancer Observatory, lung cancer ranked as the second most commonly diagnosed cancer in 2020, with a total of 2,206,771 new cases. It was also the leading cause of cancer-related mortality, resulting in 1,796,144 deaths.

Robotic surgery is one of the advancements that continue to emerge in lung cancer surgery. These systems offer magnification and enhanced precision to surgeons thus allowing them to decrease large incisions and, hence good patient outcomes. For example, the Temple University Hospital recently introduced the Ion endoluminal system using robotic technology to reach lung nodules for biopsy, allowing better mobility and navigation through narrow airways. Further emphasis on this trend is coming from other industry participants as well, who are constantly developing advanced robotic surgery platforms, like Medtronic's Hugo RAS system, which supports the efficient completion of soft tissue surgeries.

New technologies for imaging, such as cone-beam CT and augmented fluoroscopy, push the market forward by making surgical procedures more precise and less dependent on costly surgical devices. Such technology enables seeing into the details of the procedure, thus improving the outcome for the patient.

Geographically, the market for lung cancer surgery is heavily reliant on healthcare spending, cancer prevalence, and the availability of highly advanced medical facilities. Developed regions, having well-established healthcare infrastructure and more significant developments in the adoption of modern surgical practices, are directing their focus toward making improvements in their infrastructure for lung cancer diagnosis and treatment. This global effort will, in turn, accelerate the growth of the lung cancer surgery market in the years to come.

Lung Cancer Surgery Market Dynamics

Drivers

-

Rising Incidence, Innovation, and Early Detection

The increasing incidence of lung cancer is the major factor affecting the growth of the worldwide lung cancer surgery market. As the number of diagnosed cases is rising, both minimally invasive and traditional open surgeries are being sought on a large scale. In 2020, WHO states that around 18% of the total cancer deaths were due to lung cancer, accounting for 1.8 million deaths. This rising incidence, in turn, fuels the need for surgical interventions immediately. Product innovations and launches are also the market growth drivers. For instance, in September 2020, Koninklijke Philips N.V. unveiled Azurion Lung Edition, a 3D imaging and navigation platform that significantly enhances lung cancer diagnosis and treatment. Combining CT-like 3D images with live X-ray guidance, accelerates and improves the precision of lung cancer procedures, thereby fueling up the demand in the market.

Early detection has been key in altering survival trends of this deadly cancer, lung cancer. Curative therapy of lung cancer in its early stages depends greatly on surgical interventions. For instance, a new AI-based tool called Sybil which was developed by MIT researchers alongside those from Mass General Cancer Center reportedly had the capability of being able to predict lung cancer development with an accuracy level of 86% to 94% in 2023. The market is also propelled forward by partnerships and collaborations. An example here would be the August 2023 joint development agreement with Silicon & Software Systems Ltd. in the development of a device for the detection and monitoring of lung cancer by VOCxi Health, an industry that is keen on broadening the frontiers of diagnostics through strategic alliances.

Restraints

-

Elevated Expenses Associated with Lung Cancer Surgery

-

Post-Surgical Complications in Lung Cancer Treatment

-

Limited Awareness in Developing Regions

Lung Cancer Surgery Segmentation Analysis

By Product Type:

The Robotic-Assisted Surgery Systems was the dominating lung cancer surgery segment in 2023 with a market share of 23.4%, primarily due to the increasing adoption of high precision and low invasiveness offered by these robotic platforms and improved patient outcomes. These systems are used over conventional surgical instruments as they bring in lesser need for large incisions and better visualization for complex procedures. The Monitoring & Visualizing System segment will be growing at the fastest pace as imaging-related technology advances, like increased surgical accuracy with fewer complications in the use of augmented fluoroscopy and cone-beam CT.

By Surgery Type:

Minimally Invasive Surgery was the leading segment in the market with a 67.1% share in 2023, with the adoption of video-assisted thoracic surgery, among others, in preference to increased benefits, such as lower postoperative complications and quicker recovery times. This segment is also growing rapidly with the introduction of robotic systems in surgery, furthering the reductions in invasiveness. On the other hand, Open Surgery is still needed for more complicated cases as it requires larger resections; however, the rate of growth is relatively slower.

By Procedure:

Lobectomy held the largest market share, considering its common usage. It topped this segment in 2023 with a share of 20.5%. Lobectomy is considered the gold standard for the treatment of early-stage lung cancer and has the best survival rates. The Segmentectomy/Wedge Resection segment is expected to witness the most rapid growth because the less invasive procedure is gaining the maximum prominence for patients with small or localized tumors or with limited lung capacity.

By Cancer Stage:

The Early-Stage category accounted for the majority share of the market, 62.3% in 2023, as surgery remains the primary mode of treatment for patients diagnosed with lung cancer in early stages where the tumor is localized and has not spread. The advanced stage is likely to have a higher growth rate because late-stage diagnoses are on the increase, as are improvements in surgical techniques, which allow the surgeon to resect greater complex tissues in advanced-stage cancer cases.

By End-user:

In 2023, hospitals led the market with 42.1% because they can accommodate more complex lung cancer surgery, especially when advanced imaging and robotic systems are used. The infrastructural facilities and trained professionals are available in hospitals for open as well as minimally invasive surgeries. However, ASCs are increasing at the fastest rate because more patients opt for outpatient departments for the operation, considering a reduced cost, lesser stay, and quick recovery.

Regional Outlook

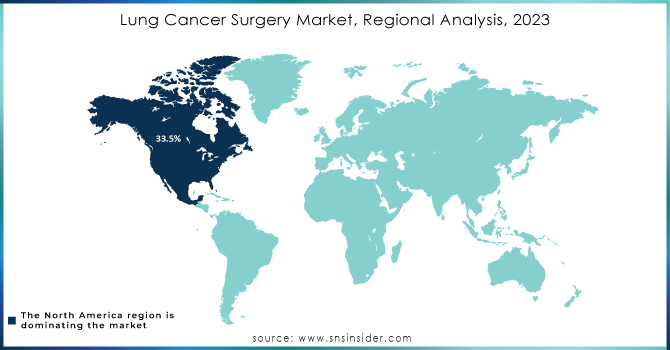

North America was the dominant region in the lung cancer surgery market, accounting for over 35.3% of the market share in 2023. This growth is largely due to a robust healthcare infrastructure, significant investments in research and development, and a high incidence rate of lung cancer. According to the American Cancer Society, an estimated 238,340 new cases of lung cancer are expected to be diagnosed in the U.S. in 2023, leading to an increase in surgical interventions.

In Europe, the market is driven by the growing adoption of minimally invasive surgery techniques such as video-assisted thoracic surgery (VATS) and robotic-assisted surgeries. The European Society of Thoracic Surgeons (ESTS) reported that over 60,000 lung cancer surgeries are conducted annually in Europe, with a shift towards more advanced, less invasive approaches.

Asia-Pacific is witnessing rapid growth, particularly in countries like China and Japan, due to the rising adoption of new technologies and increasing lung cancer cases. In China, lung cancer is the leading cause of cancer-related mortality, with approximately 780,000 new cases annually, according to the World Health Organization (WHO). As healthcare access improves, the demand for lung cancer surgeries, including traditional and minimally invasive options, is expected to rise significantly.

Need any customization research on Lung Cancer Surgery Market - Enquiry Now

Key Players

-

Accuray Incorporated (CyberKnife System)

-

GE Healthcare (Revolution CT Scanner)

-

Johnson and Johnson (Harmonic Scalpel)

-

Olympus Corporation (BF-1TQ160 Bronchoscope, PNT Series Endobronchial Ultrasound (EBUS))

-

Siemens Healthineers AG (Biograph Horizon, Acuson S2000)

-

Ethicon Endo Surgery Inc. (Ethicon Endo-Surgery Harmonic Products)

-

Richard Wolf GMBH (Lung Surgery Instruments)

-

Scanlan International Inc. (Thoracic Surgical Instruments)

-

Angiodynamics (OncoSecure Port System)

-

Neomend Inc. (NeoBond and NeoPatch)

-

Trokamed GMBH (Thoracic Surgery Instruments)

-

Covidien (Endo GIA Staplers, Ligasure Devices)

-

BSD Medical Corp. (BSD-2000 System) and others.

Recent Developments

In February 2023, Intuitive Surgical Inc., a leading developer and manufacturer of medical products for healthcare providers, acquired Auris Health Inc., a medical device company specializing in robotic-assisted bronchoscopy systems. This acquisition provides Intuitive Surgical with a new platform to further advance its development of robotic-assisted systems for lung cancer surgeries.

In April 2023, Medtronic announced the launch of its Hugo robotic-assisted surgery (RAS) system in additional markets, expanding its reach for thoracic surgeries, including lung cancer surgeries. This move further strengthens Medtronic's position in the robotic surgery market by offering minimally invasive solutions with enhanced precision.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.4 billion |

| Market Size by 2032 | USD 7.9 billion |

| CAGR | CAGR of 4.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Surgical Instruments, Monitoring & Visualizing System, Endosurgical Equipment, Robotic-Assisted Thoracic Surgery Systems, Others) • By Surgery Type (Open Surgery, Minimally Invasive Surgery) • By Procedure (Lobectomy, Segmentectomy/Wedge Resection, Pneumonectomy, Sleeve Resection, Extended Resection) • By Cancer Stage (Early-Stage, Advanced-Stage) • By End-user (Hospitals, Ambulatory Surgical Centers, Specialty Clinics) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Accuray Incorporated, GE Healthcare, Johnson and Johnson, Olympus Corporation, Siemens Healthineers AG, Ethicon Endo Surgery Inc., Richard Wolf GMBH, Scanlan International Inc., Angiodynamics, Neomend Inc., Trokamed GMBH, Covidien, BSD Medical Corp and others. |

| Key Drivers | • Rising Incidence, Innovation, and Early Detection |

| Market Restraints | • Elevated Expenses Associated with Lung Cancer Surgery • Post-Surgical Complications in Lung Cancer Treatment • Limited Awareness in Developing Regions |