Technical Enzymes Market Report Scope & Overview:

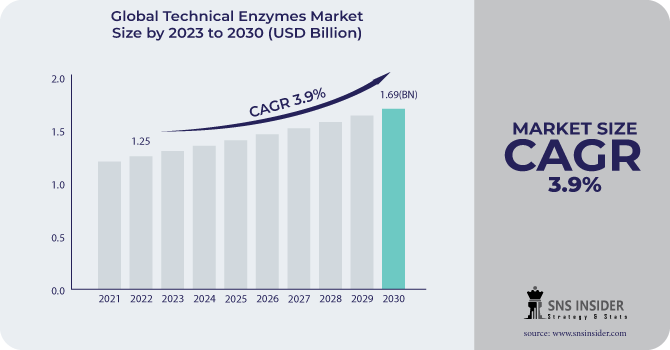

The Technical Enzymes Market size was USD 1.25 billion in 2022 and is expected to Reach USD 1.69 billion by 2030 and grow at a CAGR of 3.9 % over the forecast period of 2023-2030.

Technical enzymes are enzymes that are used in industrial applications. The use of technical enzymes in the biofuel business has increased. Consumer preference for biofuels as an alternative to gasoline for reducing hazardous auto and industrial emissions has increased their use in many industrialized countries. Enzymes are a safer alternative because methyl tert-butyl ether is a blending component used to oxygenate gasoline and is dangerous to human health.

Based on sources, Microorganisms are the main source of technical enzymes because they can be cultured in large amounts in a short period of time, and genetic manipulations on bacterial cells can be done to enhance enzyme production for use in multiple sectors such as biofuel, pulp and paper, textile and leather, and starch processing. Furthermore, manufacturers prefer microbial enzymes over plant and animal enzymes because they are more active and stable.

MARKET DYNAMICS

KEY DRIVERS

-

Rising enzyme usage in the food industry

There are several applications for technical enzymes in the food business. Enzymes can speed up and lower the cost of food processing while also enhancing the flavor, texture, and shelf life of food products. Enzymes are employed to enhance the baking performance and dough characteristics of bread and other bakery goods. To break down starch into sugars, for instance, alpha-amylase is utilized, which helps to enhance the texture and crumb of bread. Meat is tenderized and given a better flavor by enzymes. For instance, papain breaks down proteins to tenderize meat. The market is growing as a result of the expanding demand for enzymes in the food industry.

-

Growing environmental concerns and advances in technology

RESTRAIN

-

Lack of awareness about the benefits of enzymes

The benefits of utilizing enzymes are not generally known by many individuals. They might not be aware that enzymes can enhance food products' quality, safety, and sustainability. The use of enzymes in new uses may be hampered by this ignorance. Enzymes occasionally cost more than conventional chemical additions. Some firms, especially small businesses, may find this to be a challenge.

-

Growing health problems and high enzyme prices

OPPORTUNITY

-

Rising use of technical enzymes in various applications

Among the commercially available technical enzymes used are Cellulases, Proteases, Amylases, Lipases, and others. It is also used in the production and processing of textiles. Technical enzymes are often utilized as bulk enzymes in a number of industries such as detergents, pulp and paper, and textiles, but they are also used in the synthesis of biofuels and organic commodities. The rising investment in the food & beverage, and pharmaceutical industries, as well as rising Research & Development efforts, will drive overall market demand for Technical Enzymes in the approaching years.

CHALLENGES

-

Stringent regulatory requirements

Regulatory standards often include safety testing, labeling specifications, and Good Manufacturing Practices (GMP), though they might differ from country to country. It may be challenging and expensive for enzyme manufacturers to launch new products due to the strict regulatory standards. This may make it harder for enzymes to be used in novel applications.

IMPACT OF RUSSIAN-UKRAINE WAR

Russia and Ukraine are large producers of technical enzymes. The war has impacted the production and supply of technological enzymes from these countries, resulting in shortages and higher pricing. Novozymes, a Danish enzyme company, in 2022 has stated that the battle will cause it to lose 10-15% of its revenue. As a result, the Ukraine-Russia conflict has caused a shortage of cereals and grains in the food market, particularly in Europe, raising questions about whether these resources are still needed for biofuel production (1st Generation). As enzymes are used in the biofuel industry any disruption in supply may disrupt the technical enzymes market.

IMPACT OF ONGOING RECESSION

The recession has had an impact on the food and beverage, detergent, textile, pulp, and paper industries, all of which use enzymes in their manufacturing processes. In 2022, consumption of paper and board in Europe fell by 3.5% year on year, with a greater drop at the end of 2022 than previously predicted, as the Eurozone entered a recession fueled in large part by record-high energy and raw material prices. Paper for recycling usage in Europe is expected to fall by 6.4% by 2022. The decrease in these application sectors may result in a decrease in the use of enzymes in this business.

MARKET SEGMENTATION

By Type

-

Amylases

-

Cellulases

-

Proteases

-

Lipases

-

Other

By Source

-

Animals

-

Micro-Organisms

-

Plants

By Form

-

Liquid

-

Dry

By Application

-

Biofuel

-

Textile and Leather

-

Paper and Pulp

-

Starch Processing

-

Other

.png)

REGIONAL ANALYSIS

North America dominates the technical enzymes market owing to the development of unique and superior-performing products and sophisticated technology. Technical enzymes are now accessible for a wide range of applications in paper pulp, starch processing, textile & leather, biofuel, and other industries, which is expected to boost growth in the region.

Asia Pacific is expected to increase at the fastest rate in 2022. Rapid industrialization led to rising demand for technical enzymes in the textile & leather, starch processing, and paper & pulp sectors is expected to open up lucrative growth prospects for manufacturers in countries like China, India, and Japan. This supremacy is mostly due to changes in technological advancements in equipment, synthetic fibers, logistics, and business globalization.

Europe region has a substantial market share for technical enzymes, accounting for a significant share of the global market. Rapid industrialization in Germany and France has increased the enzyme demand. The growth of the market in Europe is being driven by the increasing demand for enzymes in the food & beverage, textile, detergent, and personal care industries.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Technical Enzymes Market are BASF SE, DuPont, Associated British Foods plc, DSM, Novozymes, Dyadic International Inc, Advanced Enzyme Technologies, Maps Enzymes Ltd., EPYGEN LABS LLC., Megazyme, Noor Enzymes Pvt Ltd, Nature BioScience Pvt. Ltd, Biocatalysts, and other key players.

DuPont-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, IFF introduced Enzymatic Biomaterials technology for biopolymers was developed. Designed to provide considerable sustainability benefits while providing performance comparable to or better than fossil-based materials DEB technology contributes to the growing demand for ecologically sustainable, high-performance biopolymers.

In 2023, Fermenta Biotech Ltd granted Aurigene Pharmaceutical Services Ltd an exclusive license to manufacture Molnupiravir using its proprietary enzymatic technology.

| Report Attributes | Details |

| Market Size in 2022 | US$ 1.25 Billion |

| Market Size by 2030 | US$ 1.69 Billion |

| CAGR | CAGR of 3.9 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cellulases, Proteases, Amylases, Lipases, Other) • By Source (Animals, Micro-Organisms, Plants) • By Form (Liquid, Dry) • By Application (Biofuel, Textile and Leather, Paper and Pulp, Starch Processing, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | BASF SE, DuPont, Associated British Foods plc, DSM, Novozymes, Dyadic International Inc, Advanced Enzyme Technologies, Maps Enzymes Ltd., EPYGEN LABS LLC., Megazyme, Noor Enzymes Pvt Ltd, Nature BioScience Pvt. Ltd, Biocatalysts |

| Key Drivers | • Rising enzyme usage in the food industry • Growing environmental concerns and advances in technology |

| Market Restrain | • Lack of awareness about the benefits of enzymes • Growing health problems and high enzyme prices |