Dietary Fibers Market Report Scope & Overview:

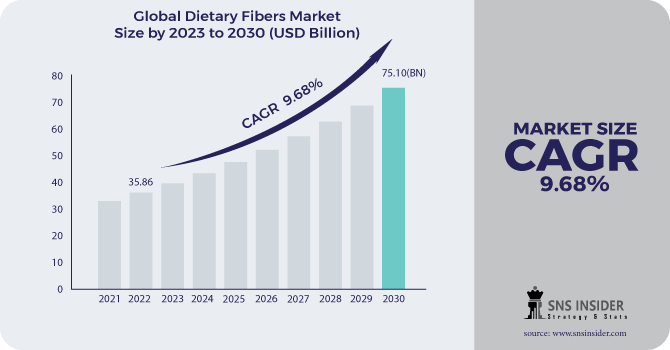

The Dietary Fibers Market Size was esteemed at USD 35.86 billion out of 2022 and is supposed to arrive at USD 75.10 billion by 2030, and develop at a CAGR of 9.68% over the forecast period 2023-2030.

The market for dietary fibers has experienced tremendous growth as a result of rising consumer awareness of the need for a balanced diet and digestive health. Dietary fibers are essential elements found in plant-based meat that have a range of health benefits, including improved digestion, assistance with weight management, and a decreased risk of chronic diseases. There are several different industries represented in this industry, including those for food and drink, medications, dietary supplements, and personal care products.

Get E-PDF Sample Report on Dietary Fibers Market - Request Sample Report

As a consequence of evolving consumer preferences and technical advancements, the market for dietary fibers is growing substantially. Research and development endeavors have led to the discovery of fresh food sources and inventive extraction techniques from plant wastes as new sources of dietary fiber. Processing technology has improved the ability to incorporate fibers into a variety of commodities without compromising taste or texture.

Even if the market for dietary fibers is expanding, a number of issues still need to be resolved. Consumer education is a challenge since so many people are ignorant of the various dietary fibers and their unique advantages. Furthermore, it could be challenging to produce high-fiber products with a positive sensory character. Manufacturers are required to provide accurate information about the nutritional and health-related features of their goods due to regulatory concerns and labeling regulations.

Market Dynamics:

Driving Factors:

-

Increase in consumer preference for typical goods.

-

An increase in concerns about preventative healthcare and the sustainability of dietary components.

Within the framework of the dietary fiber market, there has been a discernible rise in worries about preventative healthcare and the sustainability of dietary components. Dietary fiber is becoming more popular as people look for proactive ways to manage their health because of its potential health advantages, including better digestion and weight control. The demand for sustainable and ethically produced fibers is growing in tandem with consumer awareness of the environmental effect of their food decisions, which is helping to steer the market's trajectory towards eco-friendly and health-conscious products.

Restraining Factors:

-

Consumer knowledge of the advantages and different forms of fiber is limited.

-

Creating appetizing high-fiber goods is difficult.

The market for dietary fibers has a huge difficulty in creating tasty high-fiber products. It is difficult to balance the nutritional advantages of more fiber with flavor and texture since more fiber might change a product's sensory character. Innovative formulation methods must be used by manufacturers to keep the intended flavor and mouthfeel while successfully adding the required fiber content. To promote greater consumer acceptability and the inclusion of high-fiber alternatives in regular diets, it is imperative to get over this obstacle.

Opportunities:

-

The growth of the urban population together with the ascent in awareness of the medicinal benefits of dietary strands.

-

An increase in the number of working women and their ability to purchase quality meals.

The demand for high-quality meals has been impacted by a substantial shift in consumer dynamics brought about by the increase in the number of working women. Working women are looking for convenient, wholesome, and high-quality food alternatives due to their increasing spending power and restricted time for dinner preparation. The food industry has responded to this trend by creating a variety of ready-to-eat and on-the-go items that satisfy the desires of this market segment for time- and health-conscious options.

Challenges:

-

Consumer knowledge of the advantages and variety of fiber sources is limited.

-

Preserving flavor and texture in food heavy in fiber.

The market for dietary fibers has substantial difficulty in maintaining the flavor and texture of meals that are high in fiber. Increased fiber concentration frequently results in changes to flavor and texture, which may affect customer approval. To combat these changes and make sure that the finished products continue to be enticing and satisfying to consumers' senses, manufacturers must use innovative formulation techniques, such as optimizing ingredient ratios and utilizing encapsulation technologies. This will promote greater adoption of fiber-rich options.

Impact of COVID-19:

Coronavirus decently affected the market for dietary strands. Dietary strands are generally utilized in various items, including dietary enhancements, creature feed, and drugs. Items containing dietary filaments are likewise used to further develop bulk and insusceptibility. This component prompted the popularity of dietary fiber items on the lookout.

Impact of Ongoing Recession

The dietary fiber market has become more complicated as a result of the current recession, which has an impact on consumer behavior and tastes. Cost consciousness may lead customers to more economical food alternatives even while demand for health-conscious items like dietary fibers may continue to grow. To manage the economic hurdles and continue market development, manufacturers may need to strike a compromise between offering affordable fiber-rich goods while preserving quality, innovation, and customer confidence.

Prices for vegetables, which account for 6% of the CPI overall, reached a seven-month high in June and are expected to increase 12% month over month in July 2023. According to the consumer price index for June 2023, the average price of frozen vegetables has increased by 18% over the previous year. With the highest rise of all supermarket goods, the average shelf price of frozen vegetables increased by 18% in the last year. Cereal inflation peaked in February at 15% for urban India and 18% for rural India, up from about 5% in April of the previous year.

Impact of Russia Ukraine War

The Russia-Ukraine conflict's effects on geopolitical stability might affect the dietary fiber sector. Dietary fiber components' sources and levels of availability may be impacted by trade conflicts, supply-chain interruptions, and regional economic instability. Changing production prices and the availability of dietary fiber products, may disrupt the dynamics of the market and make it harder for manufacturers to maintain a stable supply chain.

War between Russia and Ukraine disrupted the supply chain, raising the cost of goods including fruits and vegetables, cereals and grains, legumes, nuts and seeds. In the US, nut and seed inflation in April 2023 was 0.030 percent. Due to the drought in Europe, prices for olive oil and makhana have increased by more than 80% in a year and are predicted to climb much further in the following days. Last week, the cost of Arabica coffee rose by 6%, while the cost of Robusta rose by 3%.

Market Segmentation:

By Raw Material:

-

Fruits & Vegetables

-

Cereals & Grains

-

Legumes

-

Nuts & Seeds

By Product:

-

Soluble dietary fibers

-

Insoluble dietary fibers

By Application:

-

Food & Beverage

-

Pharmaceuticals

-

Animal Feed

-

Others

.png)

Get Customized Report as per Your Business Requirement - Request For Customized Report

Regional Analysis:

Asia Pacific dominates the market for dietary fibers and holds the biggest market share. One element anticipated to propel market growth in this domain is the rising customer desire for nourishing and practical food and drink. Fast-paced life has increased the demand for ready-to-eat meals, enabling producers to provide fiber-rich snack foods primarily targeted at health-conscious consumers.

North America held the largest market share in 2022 for products that boost immunity and general health. Nutritional care has substantially improved in the area as a result of consumer understanding of the ingredients in packaged food products. The new fashionable diets and lifestyles adopted by the people in the North American region have made the consumption of dietary fibers highly significant.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players:

BENEO, ADM, Lonza, Cargill, Incorporated, DuPont, Ingredion Incorporated, Roquette Frères, Puris, Emsland Group, and Kerry Inc. are the key players covered in the dietary fiber market.

Roquette Frères-Company Financial Analysis

Recent Development:

-

The German company KaTech, which offers advanced texture and stabilization solutions to the food and beverage sectors, was bought by Ingredion Incorporated in April 2022.

-

BENEO started building its chicory root fiber production facility in Chile in March 2021. This growth will aid BENNEO in securing its position in the world market for dietary fibres.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 35.86 Billion |

| Market Size by 2030 | US$ 75.10 Billion |

| CAGR | CAGR 9.68% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Raw Material (Fruits & Vegetables, Cereals & Grains, Legumes, and Nuts & Seeds) • by Product (Soluble Dietary Fiber and Insoluble Dietary Fiber) • by Application (Foods & Beverages, Pharmaceuticals, Animal Feed, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | BENEO, ADM, Lonza, Cargill, Incorporated, DuPont, Ingredion Incorporated, Roquette Frères, Puris, Emsland Group, and Kerry Inc. |

| Drivers | • Increase in consumer preference for typical goods. • An increase in concerns about preventative healthcare and the sustainability of dietary components |

| Market Challenges | • Consumer knowledge of the advantages and variety of fiber sources is limited. • Preserving flavor and texture in food heavy in fiber. |