Meat Substitutes Market Report Scope & Overview:

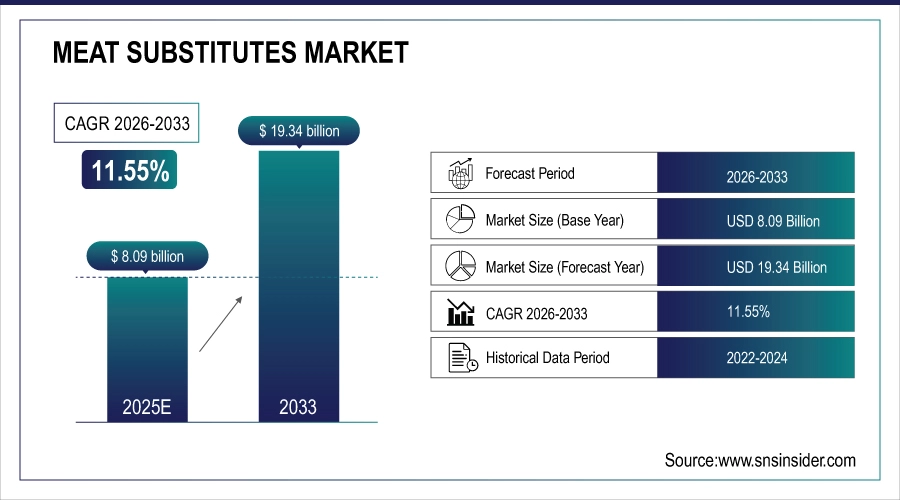

The Meat Substitutes Market Size is valued at USD 8.09 Billion in 2025E and is projected to reach USD 19.34 Billion by 2033, growing at a CAGR of 11.55% during the forecast period 2026–2033.

The Meat Substitutes Market analysis report delivers comprehensive insights on market size, expansion rates, competitive positioning, and future potential. Growing interest in healthier diets and eco-friendly protein choices will fuel demand, supported by wider retail access and continuous advancements in product flavor, texture, and nutritional value.

Meat substitute consumption is projected to reach 7.9 million tons in 2025, driven by rising vegan and flexitarian demand.

Market Size and Forecast:

-

Market Size in 2025: USD 8.09 Billion

-

Market Size by 2033: USD 19.34 Billion

-

CAGR: 11.55% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Meat Substitutes Market - Request Free Sample Report

Meat Substitutes Market Trends:

-

Growing shift to plant-based diets is changing consumer eating patterns and expanding protein choices.

-

Quick-service restaurant (QSR) proliferation of meat alternatives is driving mainstream visibility and trial.

-

More innovative ingredients including pea, fungi and algae are being used to enhance texture and the nutritional profile.

-

Rising demand for clean-label, non-GMO and allergen-free product launches is attracting consumers with health-oriented minds.

-

Developments in food technology, such as precision fermentation and cell-culture platforms, are enabling product innovation.

-

Increasing digital vendors/door of opportunities to the customers so that they can buy and consume thereby easily increasing market share.

U.S. Meat Substitutes Market Insights:

The U.S. Meat Substitutes Market is projected to grow from USD 2.51 Billion in 2025E to USD 5.80 Billion by 2033, at a CAGR of 11.08%. Expansion is driven by increasing health consciousness, the growing adoption of plant-based diets and expanding retail and food service with new, premium meat substitutes in important urban markets.

Meat Substitutes Market Growth Drivers:

-

Growing health-conscious consumer base increasingly replacing traditional meat with plant-based proteins for better nutrition and wellbeing.

Growing health consciousness is significantly driving the Meat Substitutes Market growth, as consumers seek healthier and more sustainable alternatives to conventional meat. The rising awareness around links between diet, cholesterol, obesity and long-term health is driving more of us to plant-based options. The proliferation of fitness focussed lifestyles and clean label which facilitates on-pack communication around benefits such as being high in protein, low in fat and featuring clean ingredients has also helped to drive adoption with the product appealing across consumer group.

40% of consumers report actively reducing meat intake for health reasons, boosting demand for plant-based substitutes.

Meat Substitutes Market Restraints:

-

Higher prices of plant-based products compared to conventional meat are limiting wider consumer adoption and market growth.

Higher prices of plant-based meat alternatives compared to conventional animal protein remain a major restraint for the Meat Substitutes Market. Premium pricing is cause of concern for affordability particularly in markets such as emerging where price consciousness is so high. Consumers often don’t understand what it is worth when alternatives are more expensive and attempt to perform in the same way as meat. At the same time, economic uncertainty and possible inflation with shifting spending priorities all weigh against a willingness to pay a premium.

Meat Substitutes Market Opportunities:

-

Expanding foodservice and fast-casual partnerships offer opportunities to introduce plant-based meat to wider mainstream consumer audiences.

Expanding partnerships with foodservice chains and fast-casual restaurants present a major opportunity for the Meat Substitutes Market. The visibility and the rate of trial by consumers is massively amplified specifically when QSRs and popular dining names continue to drop plant-based options on their menus. These partnerships mainstream meat alternatives and present them as convenient, delicious and accessible to people who aren't vegan. Meanwhile, placements within common dining formats can enable brands to accelerate the scale curve, reinforce and broaden demand generation and connect niche health-minded buyers with everyday consumers.

Plant-based meat options featured in 35% of new fast-food menu launches in 2025, reflecting growing consumer demand for convenient, mainstream meat alternatives.

Meat Substitutes Market Segmentation Analysis:

-

By Source, Soy-based held the largest market share of 38.45% in 2025, while Pea-based is expected to grow at the fastest CAGR of 13.89% during 2026–2033.

-

By Product Type, Burger Patties dominated with a 29.84% share in 2025, while Nuggets are projected to expand at the fastest CAGR of 14.47% during the forecast period.

-

By Category, Frozen accounted for the highest market share of 54.92% in 2025, while Refrigerated is anticipated to record the fastest CAGR of 13.65% through 2026–2033.

-

By Distribution Channel, Supermarkets & Hypermarkets held the largest share of 46.73% in 2025, while Online Retail is expected to grow at the fastest CAGR of 15.27% during 2026–2033.

By Category, Frozen Dominate While Refrigerated Gains Traction Quickly:

Frozen segment dominated the market due to longer shelf life, consistent product quality and convenient storage in retail and foodservice serving stores. Manufacturers also have more flexibility with logistics and less waste, so the frozen format wins on the operational side. Chilled are the fastest growing segment due to demand of fresh, ready to cook products from modern retail chiller cabinets. Cooler pack advancements and quick preparation times are factors. In 2025, 280 million refrigerated units were sold through supermarkets and specialty stores globally.

By Source, Soy-based Dominates While Pea-based Surges Ahead:

Soy-based segment dominated the market owing to its well-established presence, high level of consumer awareness and applicability across various meat substitute forms. And with a reliable production stream, nutritional profile and economical way to mass produce and infiltrate the market, most major food manufacturers opt for soya. Pea based is the fastest growing segment, gaining great momentum with consumers looking for allergen friendly, non-GMO and highly digestible protein bases. In 2025 alone, 1.9 million metric tons of pea-based ingredients were utilized across product formulations, reflecting accelerating adoption.

By Product Type, Burger Patties Lead While Nuggets Accelerate Rapidly:

Burger Patties segment dominated the market as relatively easily embraced by both flexitarian and traditional meat consumer, who also prefer more familiar product form that is nearest to that of traditional taste & texture. Foodservice and retail brands have prominently featured plant-based patties as key SKUs and have generated significant consumer trial and repeat. Nuggets is the fastest growing segment, as families and younger generations are looking for snack-style options that are convenient. In 2025, 410 million packs of plant-based nuggets were sold, indicating rapid mainstream penetration.

By Distribution Channel, Supermarkets & Hypermarkets Lead While Online Retail Expands Fastest

Supermarkets & Hypermarkets segment dominated the market due to its high product visibility, large varieties of products, releases of new private labels and easy reach for urban and suburban consumers. They’ve been cemented in place by the placement of the advertising, in-store sampling and shelf space. Online Retail are the fastest-growing segment as digital grocers are taking off with consumers who want convenience, subscription models and more product discovery. In 2025, 72 million online orders for plant-based meat products were placed globally, highlighting the shift toward digital-first purchasing behavior.

Meat Substitutes Market Regional Analysis:

North America Meat Substitutes Market Insights:

The North America Meat Substitutes Market dominates the landscape with a 37.62% share, due to increasing awareness about health and for long-term sustainability, rising shift of consumer preferences toward plant-based eating habits and thinking process that converts it into predominance rather being a choice amongst masses. Customers are looking for high-protein, low-cholesterol and clean label products, resulting in adoption at retail and foodservice. The expansion of supermarket offerings and partnerships in fast food chains, along with ongoing product innovation in taste and texture also serve to consolidate the dominant position of North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Meat Substitutes Market Insights:

The U.S. meat substitutes market is primarily driven by growing consumer demand for healthier and more sustainable protein alternatives alongside a growing recognition of the environmental impact of diets. Though taste profiles, textures and clean label formulations underpin product differentiation, as relationships with top fast-food chains and retail availability continue to increase accessibility in the U.S., which is a critical market for plant-based meat adoption.

Asia-Pacific Meat Substitutes Market Insights:

The Asia-Pacific Meat Substitutes Market is the fastest-growing region, projected to expand at a CAGR of 12.95% during 2026–2033. Growth is driven by growing health consciousness, expanding vegetarian and flexitarian base, and booming urbanization in China, India, Japan and Australia. The growth is being further stoked by the expansion of retail networks, penetration of e-commerce and innovative plant-based product launches. Enhanced regional manufacturing capacity and the increasing number of government policies related to sustainable food are also contributing to APAC’s rapid market expansion.

China Meat Substitutes Market Insights:

The China Meat Substitutes Market is primarily driven by health awareness, urbanization and the need for plant protein-based alternative products. It’s spread has been hastened by rapid e-commerce growth, cutting-edge product debuts and solid government backing for sustainable food systems. China is also instrumental to driving the APAC market, due to its sheer consumer base and digital retail influence.

Europe Meat Substitutes Market Insights:

The Europe Meat Substitutes Market is driven by rise in health consciousness, environmental concern and demand for sustainable sources of protein. Innovations in products and adoption of a variety of healthy dairy beverages are being fueled by nations including Germany, France and the UK that boast robust retail networks along with established foodservice channels. Increasing plant-based product lines, marketplace collaborations and demand from consumers for clean-label high protein alternatives are driving growth, positioning Europe as a leading area for innovation in plant-based meat products.

Germany Meat Substitutes Market Insights:

Germany plays a crucial role in the Europe Meat Substitutes Market, driven by strong consumer inclinations toward plant-based proteins, healthful eating habits and sustainable environment. Growth is aided by extended distribution at retail, new product innovation and government programs to grow alternative proteins. Growing demand for environmentally-friendly products and clean-label goods continue to buoy Germany’s position in the regional market.

Latin America Meat Substitutes Market Insights:

The Latin America Meat Substitutes Market is growing steadily as urbanization and rising health awareness drive demand for plant-based proteins. Increased penetration is facilitated by expanded retailer coverage and foodservice presence in Brazil, Mexico and Argentina. Rising expansion of e-commerce, sustainability efforts and growing availability of advanced products are also favoring regional market growth.

Middle East and Africa Meat Substitutes Market Insights:

The Middle East & Africa Meat Substitutes Market is driven by health awareness, urbanization and demand for sustainable protein options. Growth is supported by strengthened retail network, penetration of foodservice channel and new product introductions. Major markets such as Saudi Arabia, UAE and South Africa are driving regional growth and market evolution.

Meat Substitutes Market Competitive Landscape:

Beyond Meat, headquartered in El Segundo, California, is a leader in plant-based protein innovation. Famed for its plant-based meats that look, taste and even sizzle just such as conventional meat, the brand leads its industry via not only continued R&D but successful retail partnerships. Its signature products are burgers, sausages and ground meat that target health-conscious consumers and those who care about the environment. Strategic partnerships with fast food chains, widespread distribution channels and focus on clean-label, non-GMO ingredients are what has helped establish its market leadership and brand recall.

-

In October 2025, Beyond Meat launched Beyond Burger IV and Beyond Beef IV at Erewhon stores, featuring cleaner ingredients such as pea, faba bean, and lentil proteins, along with heart‑healthy avocado oil for improved nutrition.

Impossible Foods, based in Redwood City, California, is a pioneer in plant-based meat substitutes, emphasizing technological innovation to recreate meat flavor through ingredients including heme. The company claims to have kick-started the market ahead of its peers with innovative product formulations that are drawing in more than just vegetarians and flexitarians, but delivering a real alternative to meat. Key partnerships with top restaurants, fast food chains and grocers have increased the visibility and dominance of its brand, sustainability story and consumer engagement around plant-based protein space.

-

In March 2025, Impossible Foods introduced Steak Bites and Beef Sliders, its “meatiest” plant-based offerings yet. The company also expanded its spicy chicken lineup with nuggets, patties, and tenders, enhancing taste, protein content, and consumer appeal.

Quorn Foods, headquartered in Stokesley, United Kingdom, is one of the earliest and most recognized brands in the meat substitutes market, specializing in mycoprotein-based products. Health potions front given its vintage, revolutionary product range & credibility amongst health-conscious consumers. Mince, nuggets and fillets are products Quorn aims to offer a balance of nutrition, sustainability and taste. Strategic Investments in new territories, quality assurance and a clear marketing focus on healthy and eco-friendly eating has enabled Quorn to become the market leader and enjoy a growing brand loyalty.

-

In August 2025, Quorn revamped its frozen product range including Mince, Pieces, Strips, and Swedish Balls, simplifying ingredients to three to four per product, removing artificial additives, and highlighting “High in Protein” on new consumer-friendly packaging.

Meat Substitutes Market Key Players:

Some of the Meat Substitutes Market Companies are:

-

Beyond Meat

-

Impossible Foods

-

Quorn Foods

-

MorningStar Farms

-

Gardein

-

Tofurky

-

Amy’s Kitchen

-

Field Roast

-

Lightlife Foods

-

Dr. Praeger’s Sensible Foods

-

Sweet Earth Foods

-

The Vegetarian Butcher

-

VBites Foods

-

Sunfed Meats

-

Alpha Foods

-

Next Meats

-

All Vegetarian, Inc.

-

Good Catch Foods

-

Novameat

-

Prime Roots

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 8.09 Billion |

| Market Size by 2033 | USD 19.34 Billion |

| CAGR | CAGR of 11.55% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Soy-based, Wheat-based, Pea-based, Mycoprotein, Rice & Other Grains, Others) • By Product Type (Tofu, Tempeh, Seitan, Burger Patties, Nuggets, Sausages, Meatballs, Others) • By Category (Frozen, Refrigerated, Shelf-stable) • By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Beyond Meat, Impossible Foods, Quorn Foods, MorningStar Farms, Gardein, Tofurky, Amy’s Kitchen, Field Roast, Lightlife Foods, Dr. Praeger’s Sensible Foods, Sweet Earth Foods, The Vegetarian Butcher, VBites Foods, Sunfed Meats, Alpha Foods, Next Meats, All Vegetarian, Inc., Good Catch Foods, Novameat, Prime Roots |