Medical Equipment Rental Market Size:

Get More Information on Medical Equipment Rental Market - Request Sample Report

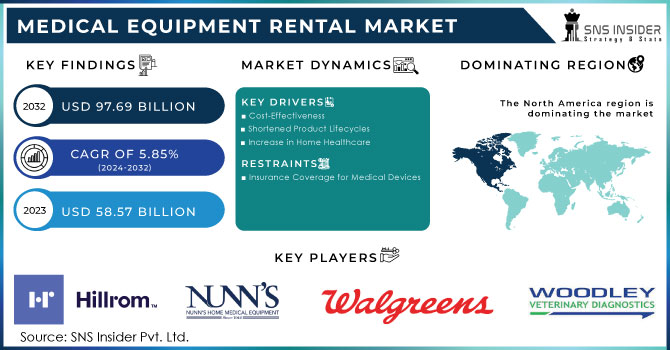

The Medical Equipment Rental Market was valued at USD 58.57 Billion in 2023 and is expected to reach USD 97.69 billion by 2032 and grow at a CAGR of 5.85% over the forecast period 2024-2032.

The medical equipment rental market is experiencing robust growth, fueled by the increasing adoption of rental devices and surging demand for technologically advanced medical equipment. Rapid advancements in medical technology have led to the development of more sophisticated and effective devices, resulting in higher prices. This price escalation is driving healthcare providers toward leasing rather than purchasing equipment, a trend gaining global momentum over the past few decades. By opting for rental solutions, healthcare providers can enhance infrastructure while minimizing capital expenditure, ensuring the sustainability of this growth model.

Despite these positive trends, the availability of insurance coverage for certain medical devices could pose a challenge to the rental market's expansion. However, factors such as shortened product lifecycles and the need for continuous technological upgrades are expected to further propel market growth. With global R&D spending having tripled from USD 726 billion in 2000 to USD 2.4 trillion in 2019, innovation in medical devices is accelerating, leading to more advanced and expensive equipment, which drives demand for rental solutions.

The rising popularity of home healthcare is another key driver of market growth, fueled by a growing geriatric population and the increasing prevalence of disabilities. According to the World Health Organization (WHO), the global population aged 60 years and above is expected to grow from 1 billion in 2022 to 1.4 billion by 2030, and to 2.1 billion by 2050. This demographic shift significantly boosts the demand for rental devices, particularly for home-based care.

Additionally, the rising incidence of disabilities due to conditions like muscular dystrophy, spinal injuries, and neurological disorders such as Parkinson's disease, which has seen its global prevalence double over the past 25 years, is contributing to the growing demand for patient care devices. Despite the positive market trajectory, government grants and provisions for disabled individuals, which reduce the need for renting equipment, may limit the market's full potential.

Supply chain dynamics also play a crucial role in the market's development. The rental model offers flexibility, allowing healthcare providers to access the latest technology without the burden of ownership, thereby aligning supply with the rapid pace of innovation.

Government initiatives are increasingly supporting the rental model as well. Several countries are introducing policies that encourage the leasing of medical equipment to reduce healthcare costs and improve accessibility. Additionally, some governments are providing incentives for the adoption of advanced medical devices through rental agreements, further bolstering market growth.

Recent developments in the market reflect these trends. Major players in the industry are expanding their rental portfolios to include the latest digital health technologies, such as wearable devices and remote monitoring systems. Companies are also investing in partnerships with healthcare providers to offer tailored rental solutions that meet specific needs, particularly in underserved regions. The rise of home healthcare has led to the development of rental services specifically designed for home-based care, including the provision of mobility aids, respiratory devices, and other essential equipment.

Overall, the medical equipment rental market is poised for continued growth, driven by technological advancements, a shift towards leasing, and a growing demand for home healthcare solutions.

Medical Equipment Rental Market Dynamics

Drivers:

-

Cost-Effectiveness:

The high cost of purchasing medical equipment is pushing healthcare providers, particularly smaller clinics and hospitals, to opt for rental solutions. Renting allows them to access the latest technology without substantial upfront investment, reducing financial strain and allowing for better resource allocation.

-

Shortened Product Lifecycles:

With the rapid advancement of medical technology, product lifecycles are becoming shorter. Healthcare providers need to keep pace with these changes to remain competitive, making rentals a more viable option as it offers flexibility and access to the latest devices without the risk of obsolescence.

-

Increase in Home Healthcare:

The growing trend towards home healthcare, driven by the preference for home-based care and reduced hospital stays, is fueling the demand for rental medical equipment. This trend is particularly strong in managing chronic conditions and post-operative care.

-

Rising Prevalence of Disabilities:

The increasing incidence of disabilities due to conditions such as muscular dystrophy, spinal injuries, and neurological disorders like Parkinson’s disease is driving the demand for patient care devices. As the global disabled population grows, so does the need for accessible and affordable medical equipment, making rental options more appealing.

Restraints:

-

Insurance Coverage for Medical Devices:

One of the primary restraints on the medical equipment rental market is the availability of insurance coverage for certain medical devices. Insurance plans often cover the cost of purchasing equipment, which can reduce the demand for rental options. Patients and healthcare providers may prefer owning equipment if it is partially or fully covered by insurance, thereby limiting the growth potential of the rental market.

Medical Equipment Rental Market Segmentation Analysis

By Type:

Durable Medical Equipment segment dominated the market in 2023 with a 42.8% share, driven by the increasing demand for wheelchairs, walkers, and hospital beds. It is growing rapidly due to the aging population and the rise in chronic diseases requiring long-term care. Electronic/Digital Equipment is the fastest-growing segment, due to the rapid advancement in digital health technologies, such as wearable devices and remote monitoring systems. These innovations are increasingly adopted for their ability to enhance patient care, streamline diagnostics, and manage chronic conditions more effectively.

By Digital Equipment:

In this category, others were the dominant sub-segment in 2023 with 62.7% share while Ventilators is the fastest growing segment due to their critical role in respiratory care, especially during the COVID-19 pandemic. The need for advanced, reliable ventilators has surged, with hospitals and homecare settings increasingly opting for rental solutions to manage fluctuating patient loads.

By Application:

Hospitals remained the dominant segment in 2023 with a 52.7% share, requiring a wide range of equipment on a rental basis to manage costs and address fluctuating patient volumes. Hospitals' demand for rental equipment is also propelled by budget constraints and the need for high-quality, up-to-date equipment. Personal/home care is the fastest-growing segment, driven by the rise in home-based care for chronic and geriatric patients. The increasing preference for homecare settings due to comfort and cost-effectiveness drives this growth.

By Homecare:

Chronic and Geriatric Patients dominated the segment in 2023 with a 44.3% share, reflecting the global trend of an aging population requiring long-term care. This segment's growth is accelerated by the rising prevalence of chronic conditions like arthritis, diabetes, and cardiovascular diseases. Preventive Care/Monitoring is the fastest-growing sub-segment, driven by the increasing focus on early disease detection and management, reducing the need for more intensive hospital care.

By Hospitals:

In 2023, Others was the dominated segment within the medical equipment rental market with a 64.4% share, encompassing a wide range of specialized equipment and services not covered by the major categories. However, Medical Nursing Homes emerged as the fastest-growing segment, driven by the increasing need for specialized, long-term care facilities that provide comprehensive medical and support services for aging populations. This growth reflects a rising demand for cost-effective and specialized care solutions tailored to chronic and geriatric patients.

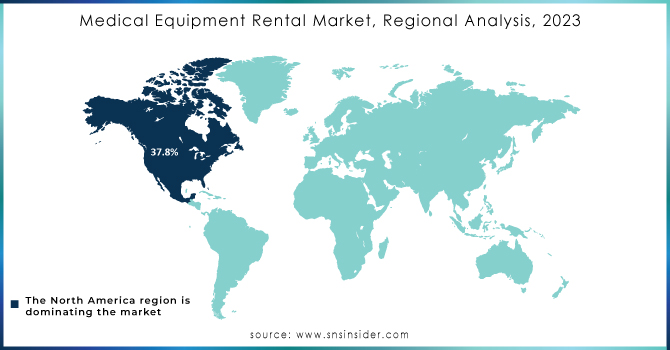

Medical Equipment Rental Market Regional Insights

North America dominated the Medical Equipment Rental Market in 2023 with a 37.8% share, primarily due to the region's advanced healthcare infrastructure and increasing demand for homecare medical devices. The growing aging population and high prevalence of chronic diseases, such as diabetes and cardiovascular conditions, contribute significantly to the market's dominance. In the U.S., companies like MedOne Group and US Med-Equip provide a wide range of rental options, from ventilators to mobility devices, catering to both homecare and institutional needs. The presence of leading healthcare providers and favorable reimbursement policies further bolster the market's growth in this region.

Asia-Pacific is the fastest-growing region in the Medical Equipment Rental Market, driven by the expanding healthcare sector, increasing healthcare expenditure, and rising awareness of medical equipment rental options. Countries like India and China are witnessing rapid growth due to a large patient base, increasing government initiatives to improve healthcare access, and the growing adoption of advanced medical technologies. In this region, companies such as Rent4Health in India and SMS Asia cater to the rising demand for affordable medical equipment rental services, particularly in the homecare segment for chronic and geriatric patients.

Need any customization research on Medical Equipment Rental Market - Enquiry Now

Key Players

-

US Med-Equip, Inc.

-

Woodley Equipment Company Ltd.

-

Walgreen Co.

-

Meridian Group International

-

Mizuho Leasing Company, Limited

-

GE HealthCare and others

Recent Developments

-

Hill-Rom Holdings, Inc. (July 2024) announced the expansion of its rental services in North America, focusing on durable medical equipment (DME). This expansion aims to meet the rising demand for advanced mobility solutions and patient care devices in homecare settings, driven by the aging population and increasing prevalence of chronic conditions.

-

US Med-Equip, Inc. (June 2024) strengthened its market position by acquiring additional warehouse spaces in key U.S. locations, enabling faster delivery of critical care equipment to hospitals and healthcare providers. This move addresses the growing need for timely access to medical devices during emergencies, particularly in rural and underserved areas.

-

Siemens Financial Services, Inc. (May 2024) launched a new leasing program targeting small and mid-sized healthcare facilities across Europe. This program aims to make high-end diagnostic and imaging equipment more accessible, addressing the financial barriers that smaller institutions face when upgrading their technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 58.57 Billion |

| Market Size by 2032 | US$ 97.69 Billion |

| CAGR | CAGR of 5.85 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By type (Durable Medical Equipment, Electronic/Digital Equipment, Storage and Transport, Personality Mobility Device) • By Digital Equipment (Ventilators, Insulin Pump, Others) • By Application (Personal/Homecare, Institutional, Hospitals) • By Homecare (Chronic and Geriatric Patients, Preventive Care/Monitoring, Short Term and Outpatient Care) • By Hospitals (Negative Wound Pressure, Medical Nursing Homes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hill-ROM Services, Inc., Nunn’s Home Medical Equipment, US Med-Equip, Inc., Woodley Equipment Company Ltd., Walgreen Co.,Westside Medical Supply, Inc., Meridian Group International, Mizuho Leasing Company, Limited, Med One Group, GE HealthCare |

| Key Drivers | • Cost-Effectiveness • Increase in Home Healthcare • Rising Prevalence of Disabilities |

| Restraints | • Insurance Coverage for Medical Devices |