Ventilator Market Report Scope and Overview:

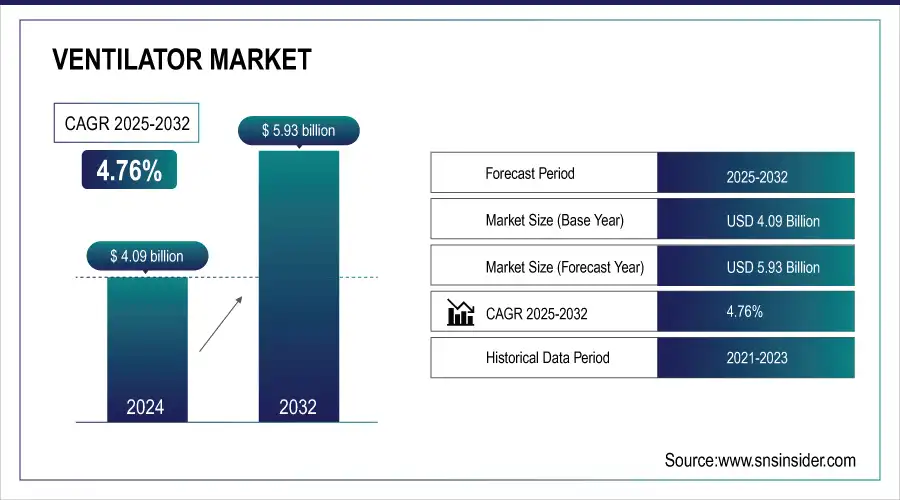

The Ventilator Market size was valued at USD 4.09 billion in 2024 and is forecasted to expand to USD 5.93 billion by 2032, with a CAGR of 4.76% from 2025 to 2032

This report identifies the growing incidence and prevalence of respiratory conditions, resulting in a growing need for ventilator support in various geographies. The study focuses on trends in ventilator prescription and use, considering regional differences driven by healthcare infrastructure and the burden of disease. It also delves into healthcare expenditure on ventilation support based on government, commercial, private, and out-of-pocket spending, as well as price dynamics and costs affecting affordability and access. The report also examines technology developments such as AI-enabled ventilators and portable devices, as well as the effect of global events like pandemics on supply chain mechanisms and market growth.

Get More Information on Ventilator Market - Request Sample Report

Ventilator Market Size and Forecast:

-

Market Size in 2024 USD 4.09 Billion

-

Market Size by 2032 USD 5.93 Billion

-

CAGR 4.76% from 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025–2032

-

Historical Data 2021–2023

Ventilator Market Highlights:

-

Rising prevalence of chronic respiratory diseases, aging populations, and post-COVID ICU admissions are fueling ventilator demand.

-

Technological advancements such as AI-driven, IoT-enabled, and non-invasive ventilation solutions are improving patient care and adoption.

-

Government subsidies, favorable reimbursement policies, and investments in healthcare infrastructure are boosting market penetration.

-

High costs, limited reimbursement in developing regions, shortage of trained professionals, and regulatory hurdles remain key restraints.

-

Product recalls, infection risks, and semiconductor shortages pose additional challenges to growth.

-

Expanding opportunities lie in homecare and portable ventilators, low-cost innovations for emerging markets, and growing healthcare investment/medical tourism.

Ventilator Market Drivers:

-

The ventilator market is driven by the rising prevalence of chronic respiratory diseases, including COPD, sleep apnea, and asthma, which affect over 260 million people worldwide.

The rising rate of ICUs admissions for respiratory distress and post-COVID complications has further fueled demand. Furthermore, advancements in technology like AI-driven ventilators, remote monitoring, and non-invasive ventilation solutions have improved patient care and fueled adoption. The aging population of the world, especially those above 65 years, is another key driver, as older people are more prone to respiratory diseases needing ventilatory support. In addition, government programs and investments in critical care facilities have prompted hospitals and healthcare centers to invest in upgrading ventilator systems. For instance, during the COVID-19 pandemic, various governments subsidized the production of ventilators, making them more accessible. The increasing use of home healthcare and portable ventilators also drives market growth, serving patients with chronic respiratory diseases who need long-term ventilation assistance outside of hospitals. The advent of wearable and hybrid ventilators, enhancing mobility and comfort, is also driving demand further. Favorable reimbursement policies for ventilator care in developed economies are also raising patient affordability and access, contributing to the growth of the market.

Ventilator Market Restraints:

-

The ventilator market faces significant restraints, primarily due to the high cost of advanced ventilators, making them inaccessible to low-income and underdeveloped regions.

A severe shortage of trained healthcare workers, particularly in low-resource environments, restricts the use of ventilators even when they are available. Also, strict regulatory clearances for producing and commercializing ventilators prolong the time-to-market, slowing innovation and adoption. Recurrent product recalls for safety issues like software error or failure in oxygen supply are a significant restraint. For instance, in 2022, one of the prominent ventilator makers recalled more than 5 million devices because they posed a risk of contamination, which had a significant effect on market trust and sales. The high cost of maintenance and technical operation requirements of ventilators, especially in ICU, also discourage healthcare facilities from upgrading frequently. In some developing countries, restrictive reimbursement policies also limit patient access to high-tech ventilatory services, especially home-based ventilators. Additionally, the danger of ventilator-associated pneumonia (VAP) and other hospital-acquired infections from extended ventilation poses a challenge in critical care environments, prompting healthcare professionals to look for alternative treatments. The worldwide semiconductor shortage has also affected the production of ventilators, as contemporary devices depend on microprocessors and sensors for sophisticated functions.

Ventilator Market Opportunities:

-

The ventilator market presents substantial opportunities, particularly with the rising demand for homecare ventilators and non-invasive ventilation (NIV) solutions.

The increasing trend towards telehealth and remote patient monitoring is encouraging innovation in smart ventilators with AI-based analytics and real-time monitoring. The development of transport and portable ventilators is creating new avenues for field hospitals and emergency care, increasing the accessibility of critical care. Low-cost ventilator development for emerging markets is a highly rewarding opportunity, with startups and government-sponsored programs racing toward affordable products. For instance, several firms have created low-cost, 3D-printed ventilators, with lower production costs. Moreover, the application of IoT and cloud-based data analytics within ventilators enhances patient outcomes through predictive maintenance and automatic ventilation adjustment. Increased interest in hybrid ventilators capable of both invasive and non-invasive functions offers flexibility in clinical use. In addition, rising investment in healthcare facilities within developing economies will fuel ventilator adoption in emergency care and hospital settings. The growth of medical tourism across the Middle East and Asia is also supporting ventilator demand as foreign patients look for specialized respiratory treatment. Increasing partnerships between healthcare providers and ventilator vendors will expand market penetration and accessibility, boosting growth opportunities.

Ventilator Market Segment Analysis:

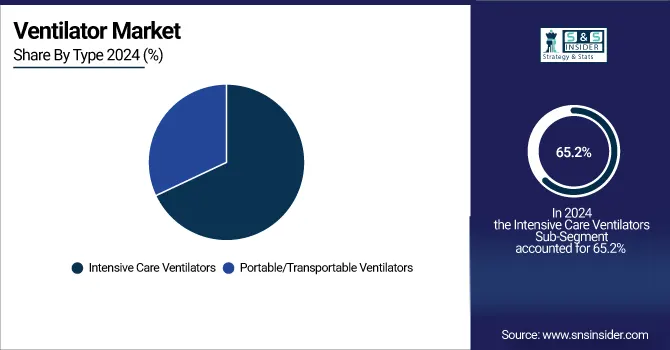

By Type

In 2024, Intensive Care Ventilators dominated the market with the highest share of 65.2%, fueled by the strong demand in hospital ICUs for the treatment of critically ill patients with respiratory failure, such as those with ARDS, COPD, and severe pneumonia. The ongoing demand for sophisticated ventilators with multimodal capabilities, high accuracy, and AI integration further cemented their leadership.

The Portable/transportable ventilator segment is the most rapidly growing segment because of increasing demand for in-home care and emergency medical services (EMS) and due to technological advancements in lightweight, battery-operated, and smart-connectivity ventilators. Growing preference for home-based respiratory care and growth in ambulance fleets and air medical transport services are driving this segment's fast growth.

By Age Group

Adult & Pediatric Ventilators shared 78.5% market share in 2024 on account of greater prevalence of long-term respiratory ailments such as COPD and obstructive sleep apnea among adults. Greater ICU admissions, age factors, and respiratory complications from post-COVID-19 have maintained demand for these ventilators.

The Neonatal/Infant Ventilator market is expanding at the highest rate due to the increasing incidence of neonatal respiratory distress syndrome (NRDS) and preterm deliveries. Improvements in non-invasive and hybrid ventilation technologies specific to neonates are improving survival rates and driving demand for dedicated infant ventilators.

By Interface

In 2024, Invasive Ventilation dominated the market with a 62.8% share, due to its critical application in ICU care for patients in need of long-term mechanical ventilation because of serious respiratory distress, surgery, and acute lung injury. Government expenditure on critical care facilities further increased its demand.

The Non-Invasive Ventilation (NIV) segment is growing the most because of heightened homecare acceptance, reduced ventilator-associated infection risk, and enhanced patient comfort. Enhanced awareness, cost-saving, and advances in helmet and mask-based NIV products are fueling accelerated growth.

By Mode

Volume-mode ventilators dominated the market with a 55.1% market share in 2024 due to their extensive application in ICU wards where accurate tidal volume delivery is essential for the treatment of acute respiratory disorders. Their consistency in ensuring constant oxygenation levels contributed to their being the preferred mode for critically ill patients.

The Combined-Mode Ventilator category is growing most rapidly, as it combines volume and pressure modes to provide adaptive and flexible ventilation assistance. The increasing need for individualized ventilation therapy, AI-controlled ventilators, and multimodal respiratory treatments is driving this growth.

By Care Setting

At 71.4% market share, Hospitals & Clinics were the leading segment in 2024 due to the huge number of ICU admissions, government expenditure on critical care, and the requirement for advanced ventilator systems within hospitals. The availability of specialty respiratory care units further contributed to this dominance.

The Home Care Setting segment is experiencing the maximum growth owing to the transition towards home-based ventilatory support, increasing demand for non-invasive solutions, and the evolution of portable and wearable ventilators. Boosted reimbursement policies and cost benefits as opposed to extended hospitalization are fueling this trend.

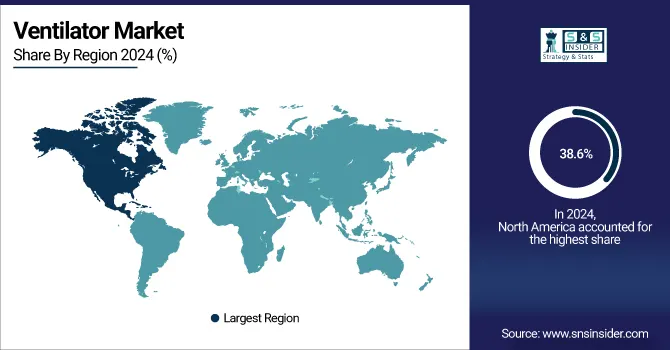

Ventilator Market Regional Analysis:

North America Ventilator Market Trends:

In 2024, North America accounted for the largest share of the ventilator market with 38.6% global market share due to superior healthcare infrastructure, elevated ICU admission rates, and substantial government spending on critical care. The United States was at the forefront in the region due to superior reimbursement policies, increased prevalence of chronic respiratory diseases (including COPD and sleep apnea), and ongoing improvements in ventilator technology. Canada also played a role in market growth through growing homecare ventilator uptake and government-supported ICU expansions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Ventilator Market Trends:

Europe was the second-largest market and included Germany, the U.K., and France. The market experienced rising demand for ventilators because of a rising population of elderly people, high incidence of respiratory diseases, and strict healthcare regulations guaranteeing high-quality care for patients. The growth of non-invasive ventilation solutions also helped to grow the market.

Asia-Pacific Ventilator Market Trends:

Asia-Pacific was the fastest-growing market, fueled by growing ICU admissions, rising government spending on healthcare infrastructure, and enhanced awareness of ventilatory support in the home environment. China and India dominated the region's growth owing to fast-paced urbanization, rising incidence of respiratory conditions, and enhanced healthcare spending. Growing medical tourism in Southeast Asia also accelerated the adoption of ventilators, especially in hospitals and home care.

Latin America Ventilator Market Trends:

Latin America showed steady growth in 2024, driven by expanding public and private healthcare investments and rising demand for critical care equipment. Brazil and Mexico led the regional market due to increasing prevalence of chronic respiratory diseases, improved ICU infrastructure, and growing penetration of non-invasive ventilators. Government-backed initiatives to expand access to critical care and the presence of international manufacturers also contributed to regional development.

Middle East & Africa Ventilator Market Trends:

The Middle East & Africa market demonstrated moderate but growing adoption of ventilators in 2024. Growth was supported by improving healthcare systems, rising government funding for ICU expansions, and greater emphasis on preparedness for respiratory emergencies. The Gulf countries, particularly Saudi Arabia and the UAE, drove demand through investments in advanced healthcare facilities and rising adoption of homecare ventilators. In Africa, market growth was mainly driven by international aid programs and increasing focus on expanding access to critical care in urban hospitals.

Ventilator Market Key Players:

-

ResMed — Astral Series, AirCurve Series, Stellar Series

-

Getinge AB — Servo-u, Servo-air, Servo-n

-

Koninklijke Philips N.V. — Trilogy Evo, Trilogy 100, Trilogy 200, V60, V680

-

Drägerwerk AG & Co. KGaA — Evita V800, Evita XL, Savina 300, Oxylog 3000 Plus

-

Baxter (Hillrom) — Hillrom MetaNeb, Life2000 Ventilator

-

Asahi Kasei Corporation — R series ventilators (Elisee series, Monnal range through subsidiary)

-

Air Liquide — Monnal T60, Monnal T75, Monnal T50

-

Flexicare (Group) Limited — VentiLogic Plus, VentiLogic LS

-

Nihon Kohden Corporation— NKV-550, NKV-330

-

Vyaire Medical, Inc. — Bellavista 1000, Vela, LTV Series, ReVel

-

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. — SV800, SV600, SV300

-

Metran Co., Ltd. — Mini Ventilator MVP-10, NKV-1800

-

MAGNAMED — FlexiMag Plus, BabyMag, RespiraMag

-

Airon Corporation — pNeuton Model A, pNeuton Model S

-

TRITON Electronic Systems Ltd. — Triton AVS, Triton MVP

-

Hamilton Medical — Hamilton G5, Hamilton C6, Hamilton T1, Hamilton MR1

-

GE Healthcare — CARESCAPE R860, Engström Carestation

-

Smiths Medical — Pneupac ParaPAC Plus, Pneupac babyPAC, Portex ventilators

-

Fisher & Paykel Healthcare — Optiflow system, AIRVO 2, MR850 ventilator humidification systems

-

ZOLL Medical Corporation — EMV+ Portable Ventilator, Z Vent

Ventilator Market Competitive Landscape:

Getinge, founded in 1904 in Sweden, is a global provider of medical technology solutions focusing on healthcare and life sciences. The company offers products and services in surgery, intensive care, cardiovascular procedures, sterilization, and infection control. With operations in over 40 countries, Getinge supports improved clinical outcomes and patient safety worldwide.

-

In March 2025, Getinge introduced Neural Pressure Support (NPS) for its Servo-u ventilator system, enhancing both invasive and non-invasive ventilation. Expanding on its personalized ventilation modes, NAVA and NIV NAVA, the new NPS modes offer greater lung and diaphragm protection, giving clinicians more advanced options for tailored patient care.

Baxter International, founded in 1931 and headquartered in the United States, is a global healthcare company providing essential products for critical care, nutrition, renal, hospital, and surgical applications. With a strong focus on life-saving therapies and medical technologies, Baxter serves patients and healthcare professionals in over 100 countries worldwide.

-

In May 2024, Baxter issued a recall for its Life2000 ventilator due to a potential failure in the battery charging dongle, which could lead to device malfunction. The FDA has classified this as a high-risk recall, citing possible severe injury or death if the device continues to be used.

| Report Attributes | Details |

| Market Size in 2024 | USD 4.09 billion |

| Market Size by 2032 | USD 5.93 billion |

| CAGR | CAGR of 4.76% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Intensive Care Ventilators, Portable/Transportable Ventilators] • By Age Group [Adult & Pediatric Ventilators, Neonatal/Infant Ventilators] • By Interface [Hybrid Ventilation, Non-Invasive Ventilation, Invasive Ventilation] • By Mode [Combined-Mode Ventilators, Volume-Mode Ventilators, Pressure-Mode Ventilators, Other Ventilators] • By Care Setting [Hospitals & Clinics, Ambulatory Care Centers, Emergency Medical Services, Home Care Settings] |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ResMed, Getinge AB, Koninklijke Philips N.V., Drägerwerk AG & Co. KGaA, Baxter (Hillrom), Asahi Kasei Corporation, Air Liquide, Flexicare (Group) Limited, Nihon Kohden Corporation, Vyaire Medical Inc., Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Metran Co. Ltd., MAGNAMED, Airon Corporation, TRITON Electronic Systems Ltd., Hamilton Medical, GE Healthcare, Smiths Medical, Fisher & Paykel Healthcare, ZOLL Medical Corporation. |