Micro-Location Technology Market Size & Growth Insights:

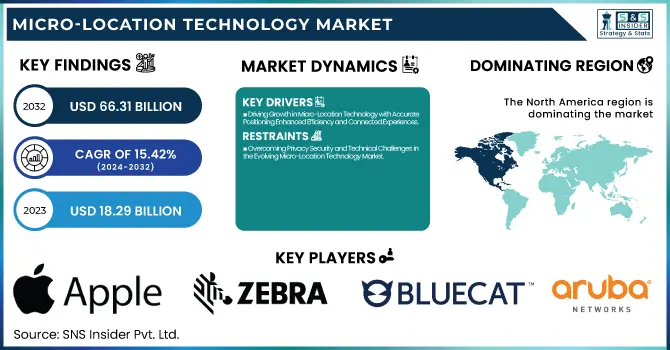

The Micro-Location Technology Market Size was valued at USD 18.29 Billion in 2023 and is expected to reach USD 66.31 Billion by 2032 and grow at a CAGR of 15.42% over the forecast period 2024-2032. With the advances in technologies like Bluetooth Low Energy (BLE), ultra-wideband (UWB), and RFID (Radio-frequency identification), the micro-location technology market continues to gain momentum in the U.S. Such solutions find applications in asset tracking, indoor positioning, and proximity marketing, most predominantly in the retail, healthcare, and logistics sectors.

To Get more information on Micro-Location Technology Market - Request Free Sample Report

Micro-location technologies are also becoming more popular among companies that use them to streamline operations, improve customer experiences, and manage their assets. Cisco and Aruba Networks are among the major players in the market as they offer innovative solutions to enable enterprises to track and manage the physical locations of businesses, individuals, and devices over some time thus responding to the increased demand for real-time visibility across various industries.

The U.S. market for micro-location technology was valued at USD 4.30 billion in 2023 and is expected to attain a CAGR of 15.38% between 2024 and 2032. Increasing usage of this technology in retail, healthcare, and logistics sectors is facilitating growth. Moreover, the growing need for real-time asset tracking, improved customer engagement, and operational efficiency drives the growth of the market in the region.

Micro-Location Technology Market Dynamics

Key Drivers:

-

Driving Growth in Micro-Location Technology with Accurate Positioning Enhanced Efficiency and Connected Experiences

There is a massive growth in the micro-location technology market due to increasing demand for accurate indoor positioning solutions. Many retail, healthcare, and logistic industries must be using micro-location technologies to increase operational efficiency and higher customer experiences at a huge speed. BLE beacons are commonly used in retail for personalized marketing to enhance the shopping experience. The healthcare sector, on the other hand, uses these solutions for patient tracking, staff tracking, and asset tracking. Furthermore, the increasing acceptance of Ultra-Wideband (UWB) for high-accuracy tracking applications, especially in smart building and manufacturing units is driving market growth. Micro-location technology is propelled by smartphones, wearables, and IoT devices, the increasing penetration of which is creating the demand for connected technologies that seamlessly integrate humans and systems with the environment to provide sensing and location services.

Restrain:

-

Overcoming Privacy Security and Technical Challenges in the Evolving Micro-Location Technology Market

There are challenges in the Micro-Location Technology Market due to privacy and data security concerns. Since micro-location solutions allow users to track their real-time movements, they also come with a risk of unauthorized access, data breaches, and misuse of user data. This is crucial in industries such as retail and healthcare that handle private data. That has led to widespread concerns for businesses deploying location-tracking solutions that they are complying with data protection regulations like GDPR and CCPA. Moreover, the challenges that technical limitations (ex. signal interference from dense environments or multi-story buildings) can bring for deploying robust micro-location systems can also affect the accuracy and reliability of the location.

Opportunity:

-

Cloud-Based Micro-Location Solutions Driving Growth with Smart Cities AI and Digital Transformation

Cloud-based micro-location solutions are seeing burgeoning growth with the deployment of such solutions increasing, thus, providing a plethora of opportunities for the market. Cloud integration provides increased scalability, flexibility, and data management, making it a perfect match for companies that want cost-effective solutions. In addition, the growing influence of smart cities and connected infrastructure has further increased the demand for real-time positioning solutions to enhance traffic management, facilitate public safety, and develop navigation systems. Improvements in AI, machine learning, and data analytics also create new opportunities for predictive insights and automated decision-making in location tracking. With the digitalization of industries, a large growth opportunity is available for the players providing solutions that match the evolving customer requirements.

Challenges:

-

Addressing Integration Complexity and Awareness Challenges for Enhanced Micro-Location Technology Adoption

One of the most important challenges is the integration complexity between various micro-location technologies such as BLE, Wi-Fi, and UWB. Advanced technical knowledge and careful planning are necessary to ensure seamless communication across diverse hardware and software ecosystems. Moreover, low awareness regarding micro-location solutions in SMEs limits the adoption rate. The slower uptake in the market is largely due to many organizations failing to see the value these systems offer. Tackling these integration challenges and increasing education surrounding what the technology can achieve is going to be key in crossing the most significant roadblocks to enable precise adoption across industries.

Micro-Location Technology Market Segments Analysis

By Technology

Bluetooth Low Energy was the most widely used technology in the Micro-Location Technology Market in 2023, holding around 45.5% of the total market share. Some of the critical factors that will help BLE dominate are its wide adoption by different industries such as retail, healthcare, and smart buildings. The low power consumption, low cost, and high accuracy indoor positioning capabilities of UWB have made UWB an ideal solution for enterprises, and businesses with location services. In retail, for example, BLE beacons are widely used for customer engagement, personalized marketing, and in-store navigation.

Ultra-wideband is projected to experience the fastest CAGR from 2024 to 2032. UWB offers greater precision, provides location services with lower latency, and is more robust in complex environments, all of which help UWB-enabled devices to be used in asset tracking, access control, and indoor navigation systems. With increasing integration in smartphones, wearables, and industrial applications, the growth potential of UWB is further compounded, making it one of the key enablers of complex micro-location solutions in the years to come.

By Application

In 2023 the Retail sector held the maximum market share which is 37.7% of the total market share. This is due to the increasing adoption of Bluetooth Low Energy (BLE) beacons for personalized marketing, customer tracking, and in-store navigation. Retailers also have micro-location solutions to enhance consumer engagement, increase store operational efficiency, and improve inventory management. Using these technologies can help businesses with targeted promotions & product placement and understanding customer behavior to an extent.

It is estimated that the Transport and Logistics sector will witness the fastest CAGR during the forecast period 2024-2032. Increased need for asset tracking, fleet management solutions, and warehouse optimization are driving this growth. This sector is still employing technologies such as Ultra-Wideband (UWB) and Wi-Fi Positioning Systems, as they offer high accuracy for monitoring the movements of shipments, equipment, and vehicles. Micro-location technology is set to drive operational efficiency as global supply chains become increasingly complex.

By Deployment Type

On-premises deployment dominated the Micro-Location expertise Market in 2023 with a share of approximately 56.7%. This once again came out to be the most dominant due to its increased security of data, reliability, and control of operations. On-premises solutions are preferred by industries such as health care, retail, and manufacturing that require the ability to manage sensitive data as well as those that depend on consistent performance without internet dependence. Moreover, enterprises having intricate infrastructure mostly go for on-premises settings to attain higher customization and compatibility with the existing systems.

It is anticipated that during the period from 2024 to 2032, cloud deployment will manifest the highest CAGR. The increasing use of datasphere cloud solutions due to their affordable, scalable, and remotely performing structure. Cloud-based micro-location platforms allow businesses to operate across multiple sites, analyze data in real-time, and obtain actionable insights with little upfront infrastructure investment. With the rising pace of digital transformation in all sectors, the overall requirement for cloud-based solutions that are centralized and adaptable is going to rise immensely.

By End-Use

Smartphones dominated the Micro-Location Technology Market in 2023, with over 41.7% market share of the total market. This dominance can be explained by the ever-growing presence of BLE, UWB, and NFC chips inside modern mobile phones. Such features facilitate indoor navigation, contactless payments, and location-based services, making smartphones a major catalyst for micro-location in sectors like retail, hospitality, and healthcare.

Consumer Electronics is anticipated to be the fastest-growing application segment from 2024 to 2032. It is due to the increasing demand for smart home devices, gaming consoles, and connected appliances. The expansion of IoT-based consumer electronics and the growing adoption of AI-based location tracking are expected to stimulate the demand. But as consumers increasingly adopt smarter and more connected ecosystems, micro-location technology will be a key enabler of device interconnectivity–impacting device interconnectivity, ultimately user experience–for both wearable technology and smart body-worn ecosystems.

Micro-Location Technology Market Regional Overview

North America held the biggest share of the Micro-Location Technology Market by 2023, with roughly 32.3% of the total market share. Leading this charge is the adoption of advanced technologies for multiple industries, including retail, healthcare, and logistics. Additionally, the presence of major technology companies within the area such as Apple, Google, and Cisco, who play a crucial role in contributing towards the ongoing integration of Bluetooth Low Energy (BLE) and Ultra-Wideband (UWB) to devices and services also promote the growth of the market. AirTag of Apple is one such example of improving service with UWB, as there is precise target tracking. Not only that, but larger retail chains such as Walmart use BLE beacon technology for in-store navigation, location-based offers, and customer engagement.

The Asia Pacific region is expected to register the highest CAGR from 2024-2032. Smart city projects, the number of smartphones in our pockets, and IoT infrastructure investments are on the rise the need for micro-location is clear. For example, in China, Alibaba adopts BLE beacon technology used in retail stores, which tracks the movement of customers and thus enhances the shopping experience. SoftBank has also rolled out UWB technology in Japan for better asset-tracking warehouses, improving operational efficiency. With many industries in Asia Pacific undergoing a rapid digital transformation, there is likely to be a step increase in the need for location-based solutions that can provide accurate and real-time data.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Micro-Location Technology Market are:

-

Apple Inc. (AirTag)

-

Cisco Systems, Inc. (DNA Spaces)

-

Zebra Technologies Corporation (MotionWorks)

-

BlueCats (BC2500 Bluetooth Beacon)

-

STANLEY Healthcare (AeroScout)

-

Aruba Networks (a Hewlett Packard Enterprise company) (Aruba Meridian)

-

Ubisense Limited (Dimension4)

-

Estimote, Inc. (Proximity Beacons)

-

Kontakt.io (Portal Beam)

-

Quuppa Oy (Quuppa Intelligent Locating System)

-

Centrak (a Halma Company) (RTLS Solutions)

-

Inpixon (Inpixon Mapping)

-

AiRISTA Flow (AiRISTA RTLS)

-

Sewio Networks (Sewio RTLS)

-

Ruckus Networks (part of CommScope) (Ruckus Analytics)

Recent Trends

-

In December 2024, United Airlines integrated Apple's Share Item Location feature for AirTag, enabling travelers to share lost luggage locations with airline staff for faster recovery. This makes United the first major carrier to adopt this feature.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.29 Billion |

| Market Size by 2032 | USD 66.31 Billion |

| CAGR | CAGR of 15.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Bluetooth Low Energy, Wi-Fi Positioning Systems, Ultra-Wideband, Near Field Communication) • By Application (Retail, Hospitality, Healthcare, Transport and Logistics) • By Deployment Type (On-premises, Cloud-based) • By End Use (Consumer Electronics, Smartphones, Wearable Devices, IoT Devices) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Cisco Systems, Inc., Zebra Technologies Corporation, BlueCats, STANLEY Healthcare, Aruba Networks, Ubisense Limited, Estimote, Inc., Kontakt.io, Quuppa Oy, Centrak, Inpixon, AiRISTA Flow, Sewio Networks, Ruckus Networks. |