Warehouse Management System Market Size:

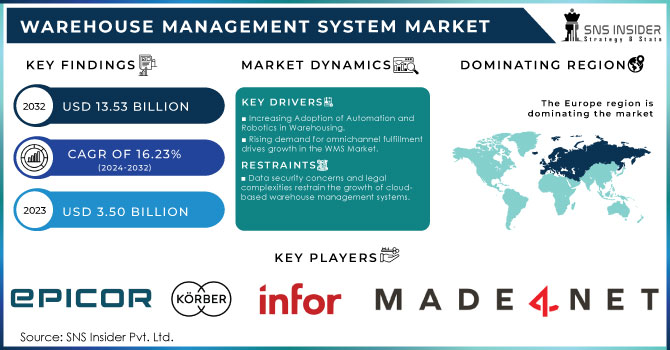

The Warehouse Management System Market Size was valued at USD 4.06 Billion in 2024 and is expected to reach USD 13.53 Billion at 16.23% CAGR by 2025-2032

Get more information on Warehouse Management System Market - Request Sample Report

The warehouse management systems (WMS) market is growing rapidly as companies strive to boost operational efficiency, cut costs, and enhance inventory accuracy. During 2023, there was a strong increase in the U.S. e-commerce market, making up around 20% of overall retail sales, which was a notable increase compared to past years. Consumer demand for convenience, competitive pricing, and faster delivery options propelled e-commerce revenue in the U.S. to approximately USD 1.06 trillion. Mobile commerce was crucial, accounting for more than 40% of all e-commerce transactions, showcasing the growing dependence on smartphones for shopping online. The growth of online shopping has greatly influenced the adoption of warehouse management systems.

The healthcare sector also takes advantage of WMS solutions to improve effectiveness and adherence to regulations. WMS is essential in a field where precise inventory control is vital for patient safety, as it aids in monitoring medical supplies and medications to prevent expiration or misplacement. Healthcare facilities are emphasizing automation for their supply chains, with approximately 75% of major healthcare institutions having either already integrated or are currently in the process of incorporating Warehouse Management Systems (WMS) to enhance operational effectiveness. Furthermore, the increasing popularity of digital healthcare programs has led to a growing need for cloud-based WMS solutions, which now represent close to 40% of WMS implementations in the healthcare sector.

Key Warehouse Management System Market Trends:

-

Rising adoption of automation and robotics in warehouses, including autonomous guided vehicles and drones, to enhance efficiency and reduce labor dependency.

-

Increasing integration of WMS applications with automated systems for real-time inventory tracking, order execution, and cost-effective scalability.

-

Growing influence of e-commerce and omnichannel retail driving demand for WMS solutions that support multi-channel fulfillment.

-

Real-time inventory visibility enabling efficient stock transfers across locations, ensuring balanced supply for online, in-store, and mobile platforms.

-

Enhanced returns management through WMS systems, addressing the critical needs of the expanding e-commerce industry.

Warehouse Management System Market Growth Drivers:

-

Increasing Adoption of Automation and Robotics in Warehousing.

Automation and robotics have played a vital role in the rapid integration of Warehouse Management Systems applications. During the past decade, automation has been a growing trend in the business world. This is especially true in the rising popularity of automated robots and machines. In the warehouse industry, automation has provided a solution for managing the increasing number of goods and information related to the goods. Companies are also more focused on providing faster and more efficient delivery services to achieve better customer satisfaction. Therefore, WMS application will have a higher demand in integrating and tracking the inventory and in the timely direction and administration of order execution. In addition, automated systems controlled with WMS application can manage data and facilitate order and goods tracking in real-time ensuring swift delivery. There are many examples of robots and robotic systems employed for automated systems, such as autonomous guided vehicles which are used to sort and deliver products, and drones products. One main advantage of such a system is that it will be easier to increase the number of products as the need arises, which will be also a cost-effective and time-efficient operation. WMS application will also allow automated systems to be used to deal with increasingly larger and more complex warehouse tasks as the markets become global.

-

Rising demand for omnichannel fulfillment drives growth in the WMS Market.

The WMS market has been greatly influenced by the rapid expansion of e-commerce and the move towards omnichannel retail. Consumers anticipate quick and smooth delivery experiences on different platforms including online, in-store, and mobile shopping. The expectation has compelled companies to reassess their supply chain tactics to stay competitive. Warehouse Management Systems help businesses effectively handle multi-channel fulfillment processes by maximizing inventory distribution, tracking in real-time, and forecasting demand. WMS makes it easier to combine various sales channels into one system, ensuring that businesses can satisfy consumer needs for fast and precise deliveries. Having visibility of inventory in real-time enables companies to promptly transfer stock among different locations, making sure all channels are well-stocked without putting too much strain on one warehouse. Moreover, WMS systems facilitate the simple handling of returns, an essential aspect of the expanding e-commerce industry.

Warehouse Management System Market Restraints:

-

Data security concerns and legal complexities restrain the growth of cloud-based warehouse management systems.

Due to the increasing complexity and integration of Warehouse Management Systems with cloud-based technology, as well as the advances in AI and other data-driven technologies, the increased focus was placed on businesses on the security and privacy of their data. WMS systems contain extremely sensitive types of information, including stock levels, information about suppliers, and purchase orders, details of customers and their orders. For this reason, they attract the highest levels of attention from cyber-attackers, data breaches, and leaks, which eventually lead to high financial costs, lawsuits, and sanctions, as well as a bad reputation in case a company is unable to protect the data of its clients and workers. Moreover, the legal landscape is highly complex, with special data protection provisions, such as GDPR in the EU, which must be adjusted by the management and users of warehouse data. This means that companies that use WMS which stores data in the cloud may be risking non-compliance, whereas the dangers of cyber breaches may prevent them from using the storage. This type of market condition works as a major restraint of market growth, particularly for those businesses whose main concern is data security.

Warehouse Management System Market Segment Analysis:

By Component

The services sector dominated the market in 2024 with an 80% market share, providing vital assistance and tailor-made solutions to customers. Services consist of various activities such as consulting, implementation, training, and ongoing support, which are essential for the effective implementation of WMS solutions. This part assists companies in customizing their WMS to meet specific operational requirements and guarantees seamless integration with current systems. Corporations such as Manhattan Associates and JDA Software provide comprehensive service bundles, which consist of system integration and user training, making it easier to shift to automated warehouse operations.

The software sector of the Warehouse Management System (WMS) market is to account for experiencing rapid growth, due to technological advancements and a growing demand for streamlined inventory control. More and more companies are embracing cloud-based solutions that provide scalability, flexibility, and real-time data analytics. Software solutions improve operational efficiency by automating tasks such as order picking, keeping track of inventory, and processing shipments, leading to decreased errors and increased productivity. SAP and Oracle are examples of companies that offer extensive WMS software that can easily connect with current ERP systems, providing functions like demand prediction, data analysis, and mobile availability.

By Deployment

The cloud segment led the market in 2024 with a 55% market share. Cloud-based WMS solutions provide various benefits, including scalability, lower IT costs, and improved accessibility from any location with internet access. Companies can take advantage of cutting-edge analytics, up-to-the-minute data, and automatic updates without requiring costly hardware purchases. Companies such as SAP with their SAP S/4HANA Cloud and Oracle with Oracle Cloud WMS demonstrate top cloud-based solutions.

The on-premises deployment is accounted to have a rapid growth rate during 2025-2032. This deployment method allows organizations to have full authority over their data and systems, offering increased levels of customization and security. Nonetheless, it necessitates a substantial initial investment in infrastructure and continued upkeep expenses. Companies like Manhattan Associates still favor them due to their strong data governance policies, offering robust on-premises WMS solutions.

Warehouse Management System Market Regional Analysis:

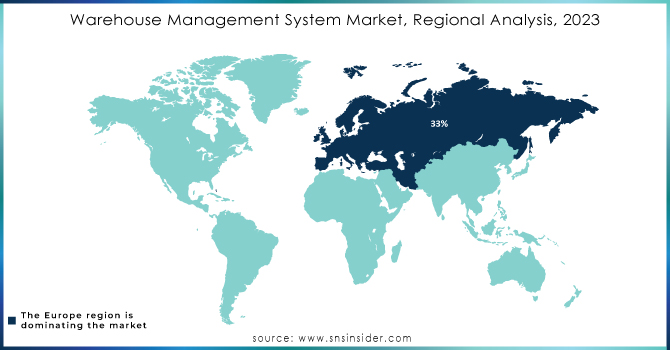

Europe Warehouse Management System Market Insights

Europe dominated the market in 2024 with a market share of 33%, as the region’s logistics and manufacturing industries are relatively strong. Leading countries, including Germany, the United Kingdom, and France, are increasingly driven to implement more advanced WMS tools to become more efficient and cost-effective in their operations. Moreover, Europe’s market attractiveness is justified by the increasing demand for automation and digitalization across the region, which is also beneficial for supply chain management. Thus, some major companies, including SAP, Oracle, and Manhattan Associates, have a strong presence on the market and offer valuable solutions and services that meet the varied requirements of European organizations.

Asia Pacific Warehouse Management System Market Insights

The Asia-Pacific region is accounted to have the fastest CAGR during the forecast period 2025-2032. Chemicalsization, growing e-commerce, and new distribution companies working in expanding markets such as China, India, and Japan should expect significant advancements in warehouse automation and logistics sectors. Moreover, the new and young tech companies will have a chance to alter and bring more innovations with the help of advanced analytics and AI-driven solutions. For example, Alibaba and Panasonic are two representative examples of the current regional WMS co-customers that attempt to achieve better operational and customer service outcomes.

North America Warehouse Management System Market Insights

The North America SiC device market is expanding rapidly, driven by strong demand in electric vehicles, renewable energy, aerospace, and defense sectors. Government initiatives promoting clean energy and EV adoption are accelerating deployment of SiC-based power electronics. Key industry players, robust R&D investments, and advanced manufacturing capabilities further strengthen market growth, positioning North America as a leader in developing high-performance SiC devices for energy-efficient and next-generation power applications

Latin America (LATAM) and Middle East & Africa (MEA) Warehouse Management System Market Insights

The LATAM and MEA SiC device markets are gaining momentum, fueled by rising investments in renewable energy, electrification projects, and power infrastructure upgrades. Growth in solar, wind, and grid modernization projects drives demand for SiC power semiconductors. Expanding EV adoption and industrial automation are also contributing factors. While still emerging markets, increasing government support, global partnerships, and infrastructure developments create significant opportunities for SiC device adoption across both regions

Get Customized Report as per your Business Requirement - Request For Customized Report

Warehouse Management System Market Key Players:

Some of the Warehouse Management System Market Companies are

-

Epicor (Epicor ERP, Epicor Prophet 21)

-

Korber AG (HighJump) (HighJump Warehouse Advantage, HighJump Transportation Management System)

-

Infor (Infor CloudSuite Industrial (SyteLine), Infor WMS)

-

Made4net (WarehouseExpert, TransportationExpert)

-

Manhattan Associates (Manhattan Active® Warehouse Management, Manhattan Active® Transportation Management)

-

Oracle (Oracle Fusion Cloud SCM, Oracle Warehouse Management Cloud)

-

PSI Logistics (PSIwms, PSIglobal)

-

Reply (LEA Reply™ WMS, Click Reply™)

-

SAP (SAP Extended Warehouse Management (EWM), SAP Integrated Business Planning (IBP))

-

Softeon (Softeon Warehouse Management System, Softeon Distributed Order Management (DOM))

-

Synergy Ltd (SnapFulfil, Synergy Voice)

-

Tecsys (Tecsys Elite™ WMS, Tecsys Streamline™)

-

Blue Yonder Group (Luminate Platform, Demand Planning)

-

Microsoft (Dynamics 365 Supply Chain Management, Dynamics 365 Intelligent Order Management)

-

IBM (Sterling Supply Chain Suite, IBM Maximo)

-

Descartes Systems Group (Descartes Warehouse Management, Descartes Transportation Management)

-

Ehrhardt Partner Group (LFS.wms, Lydia Voice)

-

Fishbowl Warehouse (Fishbowl Inventory, Fishbowl Time)

-

Infoplus (Infoplus WMS, Infoplus Analytics)

-

ShipHero (ShipHero WMS, ShipHero Fulfillment)

Competitive Landscape for Warehouse Management System Market:

Blue Yonder is a leading provider in the Warehouse Management System market, offering AI-driven and cloud-based solutions that optimize inventory, labor, and order fulfillment. Its WMS, integrated with the Luminate Platform, supports real-time visibility, predictive analytics, and automation, enabling businesses to enhance efficiency, accuracy, and responsiveness across supply chains.

-

January 2024: Blue Yonder released significant updates to its WMS, focusing on integrating artificial intelligence to improve supply chain visibility and operational efficiency. This enhancement aims to support companies in managing inventory more effectively while optimizing order fulfillment processes.

SAP is a global leader in the Warehouse Management System market, offering SAP Extended Warehouse Management (EWM) as part of its integrated supply chain solutions. Its WMS enables real-time visibility, advanced automation, and efficient inventory control. SAP supports large enterprises worldwide in optimizing warehouse operations, reducing costs, and improving fulfillment accuracy.

-

March 2023: SAP announced an upgrade to its WMS, incorporating machine learning algorithms to enhance demand forecasting and inventory management. This integration is designed to help businesses respond more quickly to market changes.

| Report Attributes | Details |

| Market Size in 2024 | USD 4.06 Billion |

| Market Size by 2032 | USD 13.53 Billion |

| CAGR | CAGR of 16.23% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software and Services) • By Deployment (Cloud, On-Premises) • By Application (Third-Party Logistics, Food & Beverages, Retail, Chemicals, Metals & Machinery, Automotive, Healthcare, E-commerce, Electricals & Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Epicor, Körber AG, Infor, Made4net, Manhattan Associates, Oracle, PSI Logistics, Reply, SAP, Softeon, Synergy Ltd, Tecsys, Blue Yonder Group, Microsoft, IBM, Descartes Systems Group, Ehrhardt Partner Group, Fishbowl Warehouse, Infoplus, ShipHero. |