Mobile Application Market Report Scope & Overview:

The Mobile Application Market Size was valued at USD 245.71 Billion in 2023 and is expected to reach USD 813.07 Billion by 2032 and grow at a CAGR of 14.3% over the forecast period 2024-2032. The Market is driven by key performance indicators (KPIs) such as ARPU, app download rates, and active user statistics, offering insights into monetization and engagement. Consumer behavior metrics, including session duration, retention, and uninstall rates, help analyze user interaction. Subscription-based revenue trends highlight the rise of premium models, in-app purchases, and freemium offerings. Advertising revenue share tracks mobile ad earnings, while app category performance compares growth across gaming, entertainment, and e-commerce. Security statistics monitor data breaches, while cloud-based app deployment and emerging technologies like AI, AR/VR, and blockchain shape future trends. Developer ecosystem insights reflect innovation and industry expansion.

Get More Information on Mobile Application Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Growing Adoption of AI and AR/VR Technologies Drives the Mobile Application Market Growth

The increasing integration of AI and AR/VR technologies is a significant driver for the Mobile Application Market. AI-powered applications enhance user experiences through personalized recommendations, chatbots, and voice assistants, while AR/VR-based apps transform sectors such as gaming, retail, real estate, and healthcare by offering immersive experiences. Companies like Google and Apple have introduced AI-driven app development tools, further accelerating innovation. For instance, Apple’s ARKit and Google’s ARCore enable developers to create AR-based mobile applications, boosting market demand. Additionally, AI-driven automation in mobile apps improves efficiency in industries like fintech, healthcare, and e-commerce. As mobile devices become more powerful, AI and AR/VR adoption will continue to rise, fueling market expansion.

Restrain:

-

High App Development Costs and Complex Maintenance Restrain the Mobile Application Market Growth

Despite rapid growth, high development and maintenance costs remain a key restraint for the Mobile Application Market. Creating a high-quality, feature-rich mobile application requires significant investment in development, testing, and deployment, often making it inaccessible to small and medium-sized enterprises (SMEs). Moreover, ongoing updates, security patches, and compatibility with new OS versions add to long-term expenses. Developers must also account for cross-platform compatibility, ensuring smooth functionality across Android, iOS, and other platforms. Additionally, cloud infrastructure costs for hosting, storage, and data processing can further strain budgets. Companies like Microsoft and IBM offer low-code/no-code development platforms to mitigate costs, but these solutions have limitations in customization. As businesses seek cost-effective alternatives, budget constraints may hinder the adoption of advanced mobile applications, slowing market growth.

Opportunities:

-

Rising Demand for Subscription-Based and In-App Purchase Models Creates Lucrative Opportunities in the Mobile Application Market

The increasing shift toward subscription-based and in-app purchase (IAP) revenue models presents significant opportunities in the Mobile Application Market. Consumers are willing to pay for premium services, exclusive content, and ad-free experiences, driving the adoption of subscription-based apps across gaming, entertainment, fitness, and productivity segments. Streaming giants like Netflix and Spotify have successfully implemented subscription models, while gaming apps leverage IAP for in-game enhancements. Apple and Google’s introduction of subscription-based app monetization further validates this trend, allowing developers to generate consistent revenue. Additionally, enterprise mobile applications, including SaaS-based productivity tools, are embracing subscription pricing, increasing market potential. As digital payments and mobile wallets grow in popularity, seamless payment integration enhances user convenience, further boosting adoption. The shift towards subscription and IAP models ensures steady revenue streams, making it a key growth opportunity for developers and businesses.

Challenges:

-

Data Privacy Concerns and Regulatory Compliance Pose Challenges for the Mobile Application Market Growth

Data privacy concerns and stringent regulatory compliance requirements present significant challenges for the Mobile Application Market. With increasing cyber threats and data breaches, users demand greater transparency and control over their personal information. Regulations like GDPR, CCPA, and India’s Digital Personal Data Protection Act impose strict data handling and consent policies, requiring app developers to enhance security measures. Companies like Apple have implemented App Tracking Transparency (ATT) to improve user privacy, impacting targeted advertising revenues for businesses relying on user data. Additionally, compliance with multiple international regulations increases operational complexity and legal risks. Developers must invest in robust encryption, secure data storage, and transparent privacy policies to maintain consumer trust. Failure to comply can result in heavy penalties, legal actions, and reputational damage. As data protection regulations evolve, mobile application providers must continuously adapt, making privacy and compliance a persistent challenge for the industry.

Segments Analysis

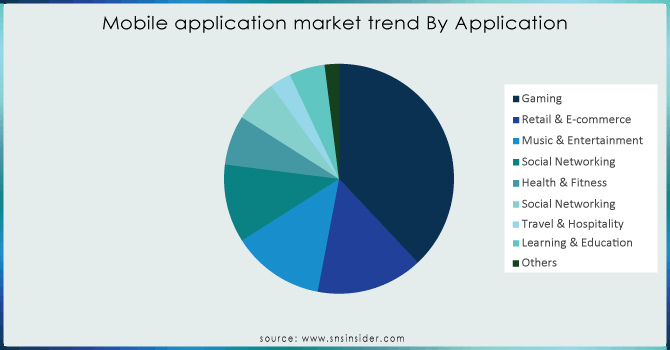

By Application

The Gaming segment emerged as the dominant application in the Mobile Application Market, accounting for 43% of total revenue in 2023. The increasing popularity of mobile gaming, driven by advancements in smartphone technology, 5G connectivity, and cloud gaming services, has fueled this growth. Companies like Tencent, Activision Blizzard, and Ubisoft have been investing heavily in mobile game development.

Tencent’s Honor of Kings and PUBG Mobile have consistently ranked among the highest-grossing mobile games, while Activision Blizzard’s Call of Duty: Mobile has further strengthened the segment.

Additionally, the rise of gaming subscription services, such as Apple Arcade and Google Play Pass, has contributed to user engagement and monetization. Cloud gaming platforms like NVIDIA GeForce NOW and Xbox Cloud Gaming allow users to play high-end games without high-end hardware, making mobile gaming more accessible.

The Music and Entertainment segment is expected to grow at the highest CAGR of 16.4% during the forecasted period, driven by the increasing demand for streaming services, digital content consumption, and personalized entertainment experiences. The proliferation of mobile-first entertainment platforms such as Netflix, Spotify, and YouTube have reshaped the way users engage with content.

The integration of virtual reality (VR) and AR in entertainment applications, such as Meta’s Horizon Worlds and Apple’s Vision Pro, is also transforming content consumption. As 5G networks expand globally, providing high-speed connectivity, seamless streaming, and interactive entertainment experiences will continue to propel the growth of the Mobile Application Market.

By Store

The Apple Store segment held the largest share of the Mobile Application Market, contributing 64% of total revenue in 2023. This dominance is attributed to Apple’s strong ecosystem, high consumer spending on premium apps, and the success of subscription-based services. Apple’s App Store generates significant revenue through in-app purchases, premium app downloads, and subscription services like Apple Music, Apple Arcade, and Apple TV+.

Additionally, Apple's strict app review policies ensure high-quality and secure applications, making it a preferred platform for developers targeting high-value customers. In 2023, Apple introduced new features such as enhanced privacy controls, in-app event promotions, and expanded support for alternative payment methods in select regions.

The Google Store segment is projected to grow at the highest CAGR of 15.8% in the forecasted period, driven by the increasing penetration of Android devices, the expansion of emerging markets, and Google's focus on app monetization strategies. Google Play Store benefits from a larger global user base, particularly in Asia-Pacific, Latin America, and Africa, where Android smartphones dominate.

The rise of budget-friendly smartphones from companies like Samsung, Xiaomi, and Oppo has contributed to the growing number of app downloads. In 2023, Google introduced features like Play Points rewards, AI-powered app discovery, and expanded support for Progressive Web Apps (PWAs) to enhance user experience.

Need any customization research on Mobile Applications Market - Enquiry Now

Asia Pacific held the largest share of the Mobile Application Market in 2023, accounting for approximately 35% of global revenue. This dominance is driven by the region’s massive smartphone user base, increasing internet penetration, and growing consumer spending on mobile applications.

Furthermore, mobile payments and e-commerce applications are thriving in Southeast Asia, where companies like Grab and Shopee continue to expand their digital ecosystems. With rising demand for mobile entertainment, fintech, and social networking applications, Asia Pacific remains the dominant force in the Mobile Application Market.

North America emerged as the fastest-growing region in the Mobile Application Market in 2023, with an estimated CAGR of 15.4% during the forecast period. The region’s growth is fueled by high consumer spending on mobile applications, advanced 5G adoption, and a strong developer ecosystem. The U.S. and Canada are leading markets, with significant revenue generated from subscription-based services such as Netflix, Disney+, and Spotify.

Additionally, North America is at the forefront of integrating AI, AR/VR, and blockchain into mobile applications, enhancing user engagement and app functionalities. The increasing adoption of mobile wallets, fintech applications, and on-demand services has further accelerated market expansion. With high disposable income, tech-savvy consumers, and strong innovation, North America continues to drive rapid growth in the Mobile Application Market.

Key Players

Some of the major players in the Mobile Application Market are:

-

Apple Inc. (App Store, Apple Music)

-

Google (Google Play Store, Google Maps)

-

Amazon.com, Inc. (Amazon Shopping App, Amazon Prime Video)

-

Gameloft (Asphalt 9: Legends, Modern Combat 5)

-

Netflix, Inc.(Netflix Mobile App, Netflix Games)

-

Practo (Practo Health App, Practo Ray)

-

cult.fit (cult.fit Fitness App, mind.fit Meditation App)

-

Ubisoft Entertainment (Assassin’s Creed Rebellion, Just Dance Now)

-

Xiaomi (Mi Fit, Xiaomi App Store)

-

Intellectsoft US (Mobile Banking Solutions, Enterprise App Development)

-

Microsoft (Microsoft Office Mobile, Xbox Game Pass App)

-

International Business Machines Corporation (IBM MobileFirst, IBM Watson Health App)

-

Cognizant (Cognizant Digital App Services, AI-Powered Enterprise Mobility Solutions)

-

CA Technologies, Inc. (CA Mobile API Gateway, CA App Experience Analytics)

-

Verbat Technologies (Custom Mobile App Development, Verbat AI Chatbot)

-

China Mobile Limited (Migu Video, China Mobile Cloud App)

-

Hewlett Packard Enterprise Development LP (HPE Mobile Center, HPE Intelligent Edge Mobile App)

Recent Developments

-

In September 2023, Google rolled out new functionalities on YouTube aimed at assisting creators in enhancing, crafting, and distributing content more efficiently. One feature, named 'Dream Screen,' enables creators to include AI-generated video or image backgrounds in YouTube Shorts. These updates are designed to assist creators in expanding their audience and simplifying time-consuming tasks.

-

Apple Inc. released Freeform, a new app for iPad, Mac, and iPhone, in December 2022. Freeform helps users arrange content on a versatile canvas, allowing them to share and work together on one platform. The application provides users with a range of colour choices and brush designs to create diagrams and include annotations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 245.71 Billion |

| Market Size by 2032 | US$ 813.07 Billion |

| CAGR | CAGR of 14.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Store Type (Google Store, Apple Store, Others) • By Application Type (Gaming, Music & Entertainment, Health & Fitness, Social Networking, Retail & e-Commerce, Travel & Hospitality, Learning & Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Google, Amazon.com, Inc., Gameloft, Netflix, Inc., Practo, cult.fit, Ubisoft Entertainment, Xiaomi, Intellectsoft US, Microsoft Corporation, International Business Machines Corporation, Cognizant, CA Technologies, Inc., Verbat Technologies, China Mobile Limited, Hewlett Packard Enterprise Development LP. |