High Sensitivity Information Solutions Market Report Scope & Overview:

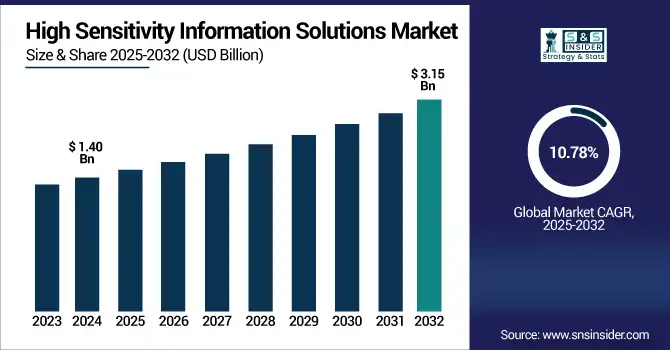

High Sensitivity Information Solutions Market was valued at USD 1.40 billion in 2024 and is expected to reach USD 3.15 billion by 2032, growing at a CAGR of 10.78% from 2025-2032.

To Get more information on High Sensitivity Information Solutions Market - Request Free Sample Report

The High Sensitivity Information Solutions Market growth is driven by increasing concerns over data breaches, regulatory compliance mandates like GDPR and HIPAA, and the rising volume of sensitive digital information across sectors.

-

Since the enforcement of GDPR, EEA Supervisory Authorities have logged over 144,000 queries or complaints and recorded 89,000 data breaches, with 63% resolved and 37% still open.

-

In the U.S., the Office for Civil Rights has received more than 374,000 HIPAA complaints since 2003, conducting 1,193 compliance reviews and resolving 99% of them.

Rapid digital transformation in industries such as healthcare, financial services, and government has intensified the need for robust data protection tools.

-

The proliferation of cloud computing and remote work environments has further fueled demand, with 52% of organizations citing cloud-based services as driving PKI (Public Key Infrastructure) growth, followed by zero-trust strategies (50%), remote-work needs (43%), and IoT adoption (43%).

Additionally, increasing investments in cybersecurity technologies and AI-powered threat detection systems are contributing to market expansion, especially among large enterprises and data-sensitive SMEs.

U.S. High Sensitivity Information Solutions Market was valued at USD 0.37 billion in 2024 and is expected to reach USD 0.48 billion by 2032, growing at a CAGR of 10.63% from 2025-2032.

Growth is driven by rising data breaches, strict regulatory compliance, increased adoption of cloud and remote work, and the growing need for advanced encryption, identity management, and access control solutions across data-sensitive industries like healthcare, finance, and government.

Market Dynamics

Drivers

- Rising threat landscape across critical sectors increases demand for real-time monitoring and protection of high-sensitivity digital assets.

Rising cyber threats, especially in sectors like defense, finance, and healthcare, are compelling organizations to adopt advanced information solutions that offer high sensitivity in threat detection and data protection. The need to safeguard intellectual property, customer data, and classified records from evolving breaches has accelerated market growth. Organizations are increasingly deploying solutions with heightened sensitivity, AI-powered analytics, and rapid incident response features. These systems not only detect nuanced anomalies but also help comply with strict global data privacy laws, strengthening enterprise resilience against sophisticated and persistent cyberattacks.

-

The Cybersecurity and Infrastructure Security Agency (CISA) continues to issue real-time ransomware alerts and coordinate sector-wide cyber defense efforts in the U.S. and globally.

-

In 2023, 167 million Americans’ healthcare records were exposed in cyber incidents. In response, the Biden Administration proposed new federal cybersecurity rules for the healthcare sector, including mandatory encryption and an estimated $9 billion implementation cost.

Restraints

- Lack of awareness and skilled personnel hinders effective utilization and scalability of high-sensitivity information solutions across industries.

Despite increasing threats, many organizations are not fully aware of the need for or the capabilities of high-sensitivity information solutions. This knowledge gap results in underutilization or misconfiguration of deployed tools, which diminishes their effectiveness. Moreover, a shortage of skilled cybersecurity professionals makes it difficult for enterprises to maintain and scale these solutions effectively. Without trained staff to manage sensitivity thresholds, incident response, and compliance auditing, businesses struggle to leverage full benefits. This constraint significantly limits market penetration, particularly in developing economies and resource-strapped sectors such as education and small-scale manufacturing.

Opportunities

- Growing adoption of cloud infrastructure and digital transformation initiatives creates demand for advanced high-sensitivity data protection tools.

The surge in digital transformation and cloud adoption has expanded data footprints across decentralized systems, increasing the risk to sensitive information. Enterprises are migrating workloads to multi-cloud and hybrid environments, where traditional perimeter-based security proves insufficient. This shift presents an immense opportunity for high-sensitivity solutions designed to operate in complex, cloud-native ecosystems. These tools offer granular visibility, automated anomaly detection, and policy enforcement across dynamic workloads. Vendors can capitalize by offering scalable, cloud-integrated sensitivity platforms tailored for diverse use cases in fintech, e-commerce, and digital healthcare.

-

80% of organizations deploy multiple public cloud environments, while 72% adopt hybrid cloud architectures that blend public, private, and on-premise systems.

-

The U.S. government’s “Cloud Smart” strategy guides federal agencies toward comprehensive cloud adoption, emphasizing security, workforce development, and procurement optimization as core implementation pillars.

Challenges

- Managing data sensitivity across hybrid and multi-cloud environments introduces complexity in standardizing protection policies and visibility.

As enterprises embrace hybrid and multi-cloud architectures, maintaining consistent data sensitivity standards becomes challenging. Data often moves across public clouds, private clouds, and on-premise systems, making it difficult to apply uniform protection rules and real-time visibility. The lack of interoperability between platforms complicates centralized sensitivity monitoring and compliance auditing. Moreover, fragmented control increases the risk of blind spots and inconsistent threat responses. This challenge requires vendors to innovate adaptive and interoperable solutions that can standardize data classification and sensitivity controls across highly distributed environments.

Segment Analysis

By Organizational Size

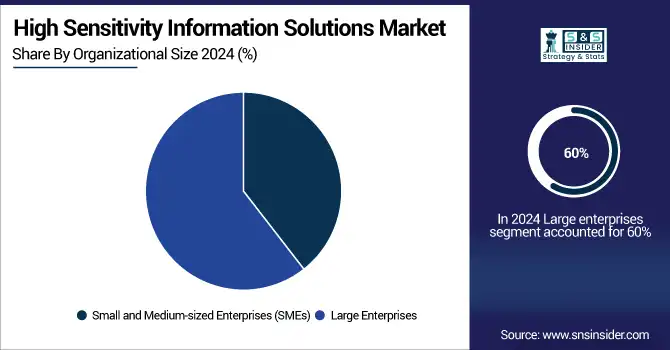

Large enterprises dominated the market in 2024 with around 60% revenue share due to their complex data environments, large-scale operations, and strict compliance requirements. These organizations prioritize comprehensive high-sensitivity solutions to protect intellectual property, customer records, and operational data. With larger cybersecurity budgets and dedicated IT teams, they adopt advanced technologies like encryption, AI-driven monitoring, and zero-trust architecture to mitigate threats and ensure regulatory compliance globally.

Small and Medium-sized Enterprises (SMEs) are projected to grow at the fastest CAGR of 11.84% from 2025 to 2032 due to rising digital adoption and growing cyber threats. Increasing affordability of cloud-based sensitivity solutions and regulatory pressure are pushing SMEs to invest in protection tools. With accessible AI-driven platforms and managed services, SMEs are embracing scalable, easy-to-deploy solutions to safeguard customer data and meet evolving compliance standards cost-effectively.

By Solution Type

Data Encryption Solutions dominated the market with a 28% revenue share in 2024 due to their critical role in securing sensitive information across storage, transit, and communication channels. As cyberattacks rise and regulatory bodies demand strong data safeguards, organizations are prioritizing encryption to protect business-critical information. Widely adopted across industries, encryption ensures confidentiality, integrity, and compliance, forming the backbone of any robust high-sensitivity data protection strategy.

Identity and Access Management (IAM) is expected to grow at the fastest CAGR of 12.65% from 2025 to 2032, driven by increasing need for secure, role-based access in hybrid and remote work environments. Organizations are adopting IAM systems to manage digital identities, enforce authentication protocols, and minimize insider threats. Rising demand for zero-trust security frameworks and regulatory-driven identity governance further fuels rapid IAM adoption across sectors.

By End User Industry

The healthcare sector led the market with 22% revenue share in 2024 due to its extensive use of electronic health records (EHRs), patient data systems, and medical IoT devices. Healthcare organizations face strict regulations like HIPAA and require high-sensitivity solutions to prevent data breaches and ensure patient privacy. The sector’s growing digital transformation and vulnerability to ransomware also drive the strong demand for advanced protection tools.

The retail sector is projected to grow at the fastest CAGR of 12.26% from 2025 to 2032 due to rapid digitalization, rise in e-commerce, and increasing volume of sensitive customer data. Retailers are deploying high-sensitivity solutions to secure payment information, prevent identity theft, and comply with PCI DSS standards. Cloud POS systems and omnichannel platforms require enhanced security, fueling demand for scalable data protection strategies in retail.

By Compliance and Regulatory Requirements

General Data Protection Regulation (GDPR) held the largest revenue share of 28% in 2024 due to its strict enforcement, broad jurisdiction, and global impact on data governance. Organizations worldwide that handle EU citizens' data must comply with GDPR requirements, prompting heavy investments in sensitivity classification, encryption, and breach response solutions. Its influence has led to widespread implementation of robust data security practices across industries.

The California Consumer Privacy Act (CCPA) is projected to grow at the fastest CAGR of 12.98% between 2025 and 2032 due to rising awareness of digital rights and increased enforcement at the state level. Businesses in the U.S. are investing in high-sensitivity solutions to meet CCPA mandates for transparency, consumer data access, and opt-out mechanisms. Expanding privacy regulations across other U.S. states further fuels CCPA-driven adoption.

By Deployment Model

Cloud-based solutions led the market in 2024 with a 49% revenue share due to their flexibility, scalability, and cost-effectiveness in securing high-sensitivity data across remote and hybrid environments. Enterprises prefer cloud-native platforms that support real-time analytics, automated data classification, and seamless compliance. The shift to SaaS, remote work, and multi-cloud ecosystems has accelerated the adoption of cloud-based security solutions across all major industries.

Hybrid solutions are projected to grow at the fastest CAGR of 12.88% from 2025 to 2032 due to rising enterprise demand for security customization, data residency compliance, and infrastructure control. Organizations with sensitive workloads are leveraging hybrid architectures to integrate on-premise systems with cloud-based flexibility. This approach enables centralized governance, dynamic threat response, and sector-specific compliance, making hybrid models attractive across finance, healthcare, and government sectors.

Regional Analysis

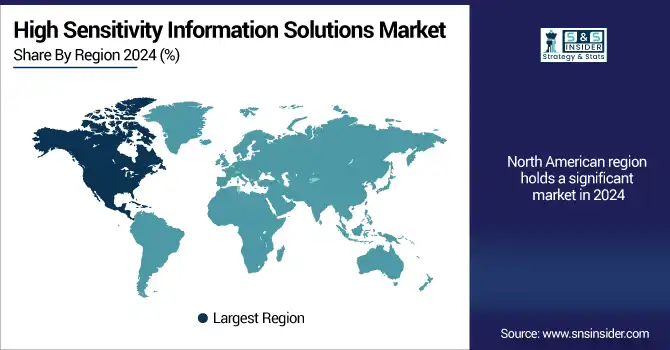

North America dominated the market in 2024 due to its advanced cybersecurity infrastructure, early adoption of data protection regulations, and high digitalization across sectors like finance, defense, and healthcare. The presence of leading technology vendors, strong regulatory enforcement (e.g., HIPAA, CCPA), and increased enterprise spending on high-sensitivity information solutions have established North America as the primary hub for large-scale, compliance-driven data security deployments.

The United States is dominating the High Sensitivity Information Solutions Market due to stringent data regulations, high cybersecurity spending, and advanced enterprise IT infrastructure.

Asia Pacific is expected to grow the fastest driven by rapid digital transformation, rising internet penetration, and increasing awareness of data privacy risks. Governments across the region are introducing stricter data protection laws, prompting enterprises to invest in high-sensitivity solutions. Growing IT outsourcing, expanding cloud adoption, and the proliferation of digital financial services are accelerating demand, particularly in emerging economies like India, China, and Southeast Asian countries.

China is dominating the High Sensitivity Information Solutions Market in Asia Pacific due to its massive digital ecosystem, regulatory mandates, and investments in data security technologies.

Europe holds a significant share in the High Sensitivity Information Solutions Market driven by stringent data protection laws like GDPR, high cybersecurity awareness, and strong adoption across industries such as finance, healthcare, and manufacturing, particularly in Germany, France, and the UK.

Germany is dominating the High Sensitivity Information Solutions Market in Europe due to strong industrial data protection norms and advanced cybersecurity implementation across sectors.

Middle East & Africa and Latin America are emerging markets in the High Sensitivity Information Solutions space, driven by increasing cyber threats, digitalization, and growing regulatory focus. Adoption is rising in sectors like banking, energy, and government across major urban centers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

High Sensitivity Information Solutions Market companies are Cerner Corporation, McKesson Corporation, Picis Clinical Solutions, iSOFT Group Limited, Allscripts Healthcare Solutions, CompuGroup Medical, Optum, Siemens Healthineers, Epic Systems, IBM Corporation, Oracle Corporation, Microsoft Corporation, Symantec (by Broadcom Inc.), Thales Group, Dell Technologies, Check Point Software Technologies Ltd., Trend Micro Inc., Palo Alto Networks, CyberArk Software Ltd., SailPoint Technologies.

Recent Developments:

-

2025 – Metomic released an AI‑powered Data Classification solution to automatically discover, classify, and secure sensitive data at scale across Google Workspaces.

-

2024 – NIST finalized updated guidelines (Rev 3) for protecting Controlled Unclassified Information (CUI), improving clarity and providing machine‑readable formats for implementing sensitive‑information controls.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.40 Billion |

| Market Size by 2032 | USD 3.15 Billion |

| CAGR | CAGR of 10.78% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution Type (Data Encryption Solutions, Access Control Management, Data Masking Tools, Identity and Access Management (IAM), Data Loss Prevention (DLP)) • By Deployment Model (On-premises Solutions, Cloud-based Solutions, Hybrid Solutions) • By End User Industry (Healthcare, Financial Services, Government and Public Sector, Retail, Education) • By Organizational Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises) • By Compliance and Regulatory Requirements (General Data Protection Regulation (GDPR), Health Insurance Portability and Accountability Act (HIPAA), Payment Card Industry Data Security Standard (PCI DSS), Federal Information Security Management Act (FISMA), California Consumer Privacy Act (CCPA)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cerner Corporation, McKesson Corporation, Picis Clinical Solutions, iSOFT Group Limited, Allscripts Healthcare Solutions, CompuGroup Medical, Optum, Siemens Healthineers, Epic Systems, IBM Corporation, Oracle Corporation, Microsoft Corporation, Symantec (by Broadcom Inc.), Thales Group, Dell Technologies, Check Point Software Technologies Ltd., Trend Micro Inc., Palo Alto Networks, CyberArk Software Ltd., SailPoint Technologies |