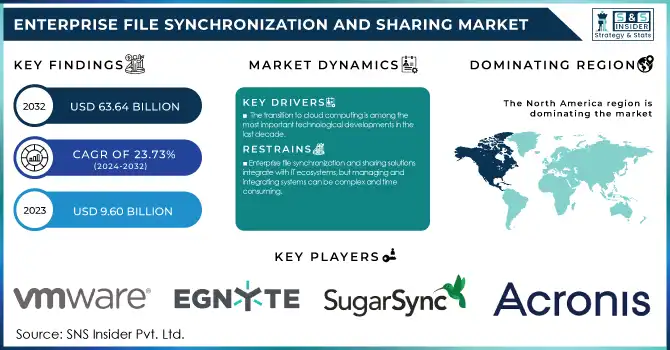

Enterprise File Synchronization and Sharing Market Key Insights:

The Enterprise File Synchronization and Sharing Market size was valued at USD 9.60 Billion in 2023 and is expected to reach USD 63.64 Billion by 2032, growing at a CAGR of 23.73% over the forecast period 2024-2032.

To Get More Information on Enterprise File Synchronization and Sharing Market - Request Sample Report

The enterprise file synchronization and sharing (EFSS) market is experiencing significant growth due to rising global IT spending and increased demand for enterprise software solutions that enable businesses to operate efficiently and securely. With 84.7% of software projects focused on enterprise applications, the need for secure EFSS solutions is critical for seamless data exchange across platforms, ensuring both data security and regulatory compliance. Additionally, business automation initiatives, accounting for 53.6% of software development projects are driving demand for EFSS tools that support workflow automation and effective data management. Notably, 38.5% of projects target retail and e-commerce sectors, underscoring the essential role of EFSS in real-time file sharing, collaboration, streamlined operations, and enhanced supply chain management.

The adoption of Enterprise File Synchronization and Sharing solutions is further fueled by the need for integration with enterprise software ecosystems, such as CRM platforms, ERP systems, and collaboration tools like Microsoft Teams, Slack, and Zoom. This capability enhances workflow efficiency and collaborative productivity. Modern EFSS platforms provide not only file sharing and storage but also collaborative editing, version control, and automated backup, ensuring employees have real-time access to up-to-date information. Many EFSS solutions also incorporate AI and machine learning to improve usage analytics, automate file tagging and categorization, and enhance search capabilities for efficient file retrieval.

Market Dynamics

Drivers

- The transition to cloud computing is among the most important technological developments in the last decade.

Companies of various sizes are increasingly embracing cloud-based solutions because of their scalability, affordability, and straightforward integration with current IT systems. Cloud-based enterprise file synchronization and sharing tools provide numerous advantages that conventional on-premise solutions are unable to offer. These tools enable companies to save files in the cloud, allowing access from any location with an internet connection. This degree of accessibility is essential for contemporary businesses that function in a worldwide market and need adaptability to respond to shifting market circumstances. In addition, cloud-based solutions provide automatic updates, guaranteeing that organizations consistently have access to the newest features and security fixes. The cloud's built-in scalability enables companies to modify storage requirements in line with expansion, eliminating the necessity for substantial infrastructure spending. Consequently, the increasing dependence on cloud computing is a major factor motivating the uptake of enterprise file synchronization and sharing solutions.

- As organizations increasingly manage large amounts of sensitive data, maintaining data security has emerged as a critical priority.

Regulatory compliance mandates, including the General Data Protection Regulation (GDPR) in Europe, HIPAA in the U.S., and several sector-specific rules, are compelling organizations to implement safer practices for data management and sharing. Solutions for enterprise file synchronization and sharing are essential in this context as they provide strong security features, such as encryption, access controls, and activity tracking. These characteristics assist organizations in reducing the likelihood of data breaches and guarantee that sensitive information is accessible solely to authorized personnel. Furthermore, these solutions provide audit trails and version tracking, allowing organizations to monitor how files are accessed and changed over time. Adhering to data protection laws is vital not just for preventing legal repercussions but also for preserving customer confidence. As security and compliance demands grow stricter, organizations are adopting enterprise file synchronization and sharing solutions to safeguard data and uphold compliance.

Restraints

- Although solutions for enterprise file synchronization and sharing are meant to work with current IT ecosystems, managing and integrating various systems can be intricate and require significant time.

Numerous organizations depend on a mix of on-site and cloud tools, and incorporating a new file synchronization and sharing solution with these current tools may pose technical difficulties. Compatibility problems might occur, necessitating further customization or the implementation of middleware solutions to guarantee seamless interoperability. At times, the integration process can cause interruptions in business functions, as staff find it challenging to adapt to the new tools or face technical issues. Additionally, handling various solutions, including file-sharing services, project management applications, and cloud storage providers, can lead to administrative burdens and heighten the likelihood of mistakes. Organizations might encounter challenges in implementing consistent security policies across various platforms, making compliance efforts more complex. Consequently, companies might hesitate to adopt new file synchronization and sharing solutions if they view the integration and management process as overly complicated or resource-demanding.

Key Segmentation Analysis

By Offering

The solutions segment led the market with a 60% market share in 2023. This section includes software solutions aimed at facilitating secure file storage, synchronization, and sharing among organizations. These solutions provide centralized management, collaborative tools, and sophisticated security measures like encryption, adherence to data regulations, and management of user access. Companies favor these solutions due to their scalability, ease of use, and compatibility with other enterprise systems. They optimize processes and improve teamwork, rendering them essential for contemporary companies that require effective and safe file handling.

The services segment is expected to witness the fastest expansion in the enterprise file synchronization and sharing market throughout 2024-2032. With companies increasingly depending on cloud infrastructure and remote teams, the need for managed services and support has skyrocketed. Firms providing these services assist organizations in tailoring their enterprise file synchronization and sharing solutions, integrating them with current systems, and facilitating seamless adoption. Examples consist of consulting companies such as Accenture or service providers like IBM Global Services, which assist organizations in choosing, installing, and maintaining enterprise file synchronization and sharing systems. Moreover, managed services guarantee ongoing optimization, security assessments, and compliance supervision.

By Deployment

The cloud segment led the market in 2023, holding 65% of the market share, due to the scalability, availability, and adaptability that cloud-based solutions provide, allowing companies to handle and synchronize files from any location with internet connectivity. Companies like Google Drive, Dropbox Business, and Microsoft OneDrive for Business. These platforms enable employees to share and retrieve files from a distance, promoting smooth collaboration among teams, which is particularly important in the current hybrid and remote work settings.

The on-premises is expected to grow at a faster CAGR from 2024 to 2032. This expansion is mainly fueled by businesses needing improved data management, security, and compliance, particularly in industries such as finance, healthcare, and government. Examples of on-premises EFSS solutions are Nextcloud and OwnCloud, enabling companies to store and share files in their private data centers. Large corporations and organizations utilizing on-premises solutions gain complete control over file access, auditing features, and integration with internal IT security systems, ensuring data privacy by regulatory standards.

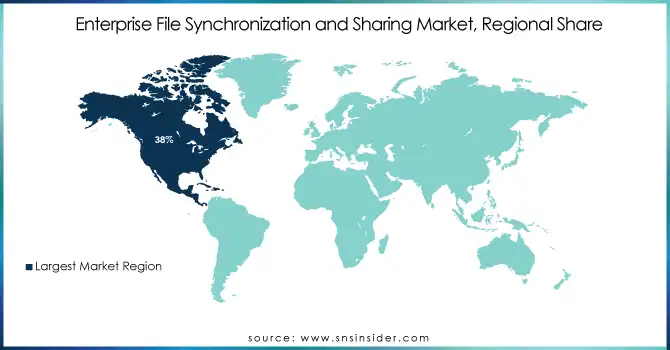

Regional Analysis

In 2023, North America dominated the enterprise file synchronization and sharing Market, securing approximately 38% of the overall market share. This leadership is fueled by significant digital adoption and cloud infrastructure presence in the U.S. and Canada. North America hosts a variety of technology leaders, such as Microsoft, IBM, and Dropbox, whose strong enterprise file synchronization and sharing offerings address the region's focus on cybersecurity, data security, and regulatory adherence. These organizations have created platforms like Microsoft OneDrive and IBM’s FileNet, commonly utilized by businesses for secure, instantaneous file sharing among devices and divisions.

The Asia-Pacific is anticipated to become the fastest-growing region between 2024 and 2032, driven by swift digital transformation and increasing enterprise uptake of cloud technologies in nations such as China, India, and Japan. APAC companies, from startups to major corporations, are progressively adopting enterprise file synchronization and sharing solutions to assist a distributed workforce and fulfill the growing need for remote access and data-sharing features. Firms such as Tencent in China and Zoho in India are enhancing the enterprise file synchronization and sharing environment in the area with offerings that enable collaboration, ensure regulatory compliance, and maintain data security.

Do You Need any Customization Research on Enterprise File Synchronization and Sharing Market - Inquire Now

Key Players

The major key players in the Enterprise File Synchronization and Sharing Market are:

-

Acronis (Acronis Files, Acronis Cyber Protect Cloud)

-

SugarSync Inc. (SugarSync for Business, SugarSync Personal Cloud)

-

Egnyte Inc. (Egnyte Connect, Egnyte Protect)

-

Citrix Systems Inc. (Citrix ShareFile, Citrix Content Collaboration)

-

VMware Inc. (Workspace ONE, AirWatch)

-

Google LLC (Google Drive, Google Workspace)

-

Dropbox Inc. (Dropbox Business, Dropbox Advanced)

-

Thru (Thru Enterprise File Transfer, Thru Drive)

-

Syncplicity LLC (Syncplicity by Axway, SyncDrive)

-

Accellion Inc. (Kiteworks, Accellion File Transfer Appliance)

-

Box Inc. (Box Business, Box Enterprise)

-

Microsoft Corporation (OneDrive for Business, SharePoint)

-

BlackBerry Ltd. (BlackBerry Workspaces, BlackBerry UEM)

-

OpenText Corporation (OpenText Core Share, OpenText Hightail)

-

Intralinks (Intralinks VIA, Intralinks Dealspace)

-

Citrix Systems Inc. (Citrix Content Collaboration, ShareFile)

-

Tresorit (Tresorit Business, Tresorit Enterprise)

-

OwnCloud (OwnCloud Enterprise, OwnCloud Online)

-

Sync.com Inc. (Sync for Teams, Sync Business)

-

pCloud AG (pCloud for Business, pCloud Drive)

Providers of software components to these key players:

-

Oracle Corporation - Database and cloud integration solutions.

-

McAfee LLC - McAfee Data Loss Prevention (DLP) and encryption components.

-

Dell Technologies Inc. - Virtualization and storage management solutions.

-

Amazon Web Services (AWS) - Cloud infrastructure and security solutions.

-

Cisco Systems, Inc. - Network security and compliance tools.

-

Symantec Corporation - Data protection and security tools.

-

Red Hat Inc. - Open-source infrastructure and middleware software.

-

IBM Corporation - IBM Security and analytics software.

-

Broadcom Inc. - Enterprise cloud data protection.

-

Trend Micro Inc. - Endpoint security and cloud security software.

Recent Developments

-

September 2024: Microsoft introduced new functionalities for OneDrive for Business, featuring integration with the CoPilot AI assistant and improved collaboration options for educational institutions and businesses.

-

November 2023: VMware has broadened its collaboration with Liquit. Liquit, which is a division of Recast Software, currently assists in powering the Enterprise App Repository (EAR) in Workspace ONE for applications on Windows.

-

August 2023: OpenText revealed an enhancement of its partnership with Google Cloud to provide AI-driven integrations that will assist organizations in leveraging their data on Google Cloud for a competitive edge.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.60 Billion |

| Market Size by 2032 | USD 63.64 Billion |

| CAGR | CAGR of 23.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solution, Services) • By Deployment (On-premises, Cloud) • By Application (File Storage and Backup, Content Management System, Mobile Access & Productivity, Document Collaboration, Analytics & Reporting, Others) • By Business Size (SMEs, Large Enterprises) • By Business Function (Human Resources, Sales & Marketing, Legal, Finance & Accounting, IT) • By End User (BFSI, Healthcare, Media & Entertainment, IT & Telecom, Retail, Government, Transportation & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acronis, SugarSync Inc., Egnyte Inc., Citrix Systems Inc., VMware Inc., Google LLC, Dropbox Inc., Thru, Syncplicity LLC, Accellion Inc., Box Inc., Microsoft Corporation, BlackBerry Ltd., OpenText Corporation, Intralinks, Tresorit, OwnCloud, Sync.com Inc., pCloud AG |

| Key Drivers | • The transition to cloud computing is among the most important technological developments in the last decade. • As organizations increasingly manage large amounts of sensitive data, maintaining data security has emerged as a critical priority. |

| RESTRAINTS | • Although solutions for enterprise file synchronization and sharing are meant to work with current IT ecosystems, managing and integrating various systems can be intricate and require significant time. |