Multi-camera Vision Inspection Systems Market Report Scope & Overview:

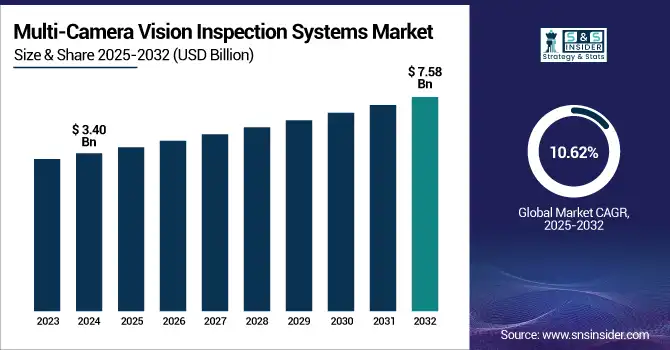

The Multi-camera Vision Inspection Systems Market Size was valued at USD 3.40 billion in 2024 and is expected to reach USD 7.58 billion by 2032 and grow at a CAGR of 10.62% over the forecast period 2025-2032.

To Get more information on Multi-camera Vision Inspection Systems Market - Request Free Sample Report

The worldwide Multi-camera Vision Inspection Systems Market is growing strongly with mounting demand for high-speed accurate inspection in automotive, electronics, and manufacturing sectors. Development of AI, machine vision, and automation technologies is making systems more capable, and the move towards Industry 4.0 and smart factories keeps driving adoption among both developed and emerging economies.

-

Rockwell Automation states that integrating 3D machine vision with automation systems can improve quality and quantity of data capture, aiding in real-time quality control and minimizing waste.

-

In September 2024, they introduced FactoryTalk Analytics VisionAI, a cutting-edge inspection solution leveraging artificial intelligence (AI) and machine learning to revolutionize quality control in manufacturing.

The U.S. Multi-camera Vision Inspection Systems Market size was USD 0.62 billion in 2024 and is expected to reach USD 1.26 billion by 2032, growing at a CAGR of 8.25% over the forecast period of 2025–2032.

The U.S. Market is picking up speed as demand increases for high-speed, reliable inspection solutions in production settings. The nation's robust manufacturing base, combined with a desire to reduce defects and increase throughput, is driving adoption. Technological innovation and early smart vision technology integration are also driving market growth across major industrial industries.

According to research, in 2024 45% of U.S. manufacturers plan to integrate AI and machine learning in their vision inspection systems within the next five years, boosting operational performance.

Multi-camera Vision Inspection Systems Market Dynamics

Key Drivers:

-

Increasing Automation in Manufacturing Processes Drives the Adoption of Multi-camera Vision Inspection Systems for Enhanced Efficiency and Accuracy.

Increasing adoption of automation in various manufacturing industries is the prime factor of the Systems Market. With the trend that line operation in the industry becomes automated to improve productivity and reduce human errors, the requirement for high speed, high precision and high reliability in inspection is also increasing. Cutting down defect detection time, enhancing product quality and streamlining production processes are some of the many reasons multi-camera systems have become indispensable for companies that have to comply with levels of quality and want to get the most of their operational workflows.

A study by Rockwell Automation revealed that 88% of UK manufacturers have invested or plan to invest in AI and machine learning within the next 12 months, with quality control being a primary application.

Restrain:

-

Limited Ability to Accurately Inspect Complex or Non-Standardized Products with Multi-camera Vision Inspection Systems.

The complexity involved in performing the accurate inspection of difficult complex or non-standardized products. Although the multi-camera systems offer high performance when it comes to regular, consistent products, more complicated items with diverse shapes and sizes or complex geometry products can genera l ly not be processed in the same way. If they do, using of multi-camera systems for reliable and accurate inspections can be difficult and thus limit their application in some specific fields of industries because of the highly customized product properties or of specific designs in production line.

Opportunities:

-

Advancements in AI and Machine Learning Offer New Growth Potential for Multi-camera Vision Inspection Systems in Automated Quality Control.

Combining artificial intelligence (AI) and machine learning with multi-camera vision systems is a major opportunity for market growth. These technologies upgrade defect detection levels by allowing systems to learn and recognize new conditions, enhancing precision and efficiency. Multi-camera systems driven by AI can deliver real-time analysis of data, optimizing manufacturing and minimizing operational expenses even further. As more industries adopt AI-based solutions, this technology creates new opportunities for innovation and market growth.

In 2024, NVIDIA's Multi-Camera Tracking AI Workflow achieved a HOTA score of 68.7%, using a dataset with 953 cameras and over 100 million bounding boxes, showcasing advanced multi-camera tracking capabilities.

Challenges:

-

Integration Complexities and Compatibility Issues with Existing Manufacturing Systems Hinder the Seamless Adoption of Multi-camera Vision Inspection Systems.

New systems that are not compatible with legacy machines can result in inefficient operations, installation lags and expense. It can be challenging to have systems integrate seamlessly, and extensive customization may be necessary, which is a time-consuming and expensive task. These technical challenges could slow vision system adoption in markets that are already committed to older equipment, thus reducing overall market penetration.

Multi-camera Vision Inspection Systems Market Segment Analysis:

By End User

The automotive segment dominated in Multi-camera Vision Inspection Systems Market share 33.08% in 2024. This domination is fuelled by the growing demand for accuracy in manufacturing vehicles, as multi-camera systems lead to the best operations, quality control, and safety standards. Keyence Corporation and Cognex Corporation are firms that have developed sophisticated multi-camera systems to inspect automotive parts like engines, bodies, and electronics. The increasing trend of electric vehicles and autonomous vehicles also increases demand for high-performance inspection systems at a faster rate. All these advancements are crucial for meeting high-quality standards and minimizing defects in car manufacturing processes.

The healthcare segment is fastest CAGR of 12.13% during the period of 2025-2032 within the Multi-camera Vision Inspection Systems Market. There is an increasing need for precise and automatic inspection in medical devices, pharmaceuticals and laboratory equipment The demand for this type of inspection is driving growth. Siemens Healthineers and Zeiss Group have worked on high-end multi-camera vision systems for the inspection of medical instruments and devices for the adherence to high regulatory standards. The application of these systems into medical applications production lines increases the efficiency and accuracy of where they are use, which in turn is safe for medical products and adds to their acceptance in this dynamic sector.

By Product Type

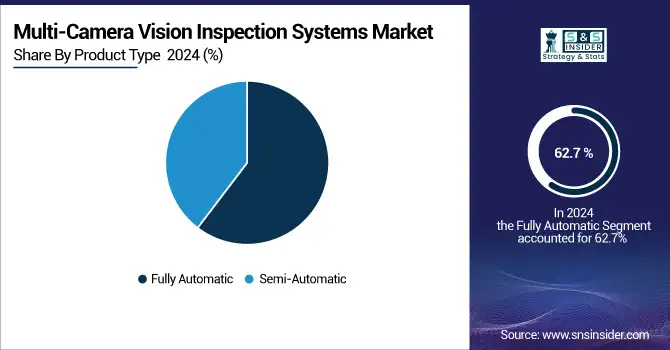

The Fully Automatic segment has dominated in market share and accounted for 62.7% of the revenue in 2024 because the demand is increasing for high-precision, high-throughput solutions across industries like automotive, electronics, and packaging. SICK AG and Teledyne FLIR are leading the development of fully automated systems with defect detection and quality control being improved with very little human intervention. These systems allow for continuous operation and lower downtime for production, thus further enhancing manufacturing efficiency. The trend towards automation, particularly in mass production, drives the segment's dominance of the Market to satisfy the growing demand for speedy and uniform inspection processes in various industries.

The Semi-Automatic segment is also expected to fastest CAGR of 11.91% during the period between 2025 and 2032 due to the increased need for flexible and economical inspection solutions. Baumer Group and Omron Automation are introducing semi-automatic vision systems that integrate automated and manual processes, providing flexibility and greater precision in reduced production runs. These systems are especially advantageous for low-volume industries or highly customized products. The growth of the segment, with a rising value forecast, is driven by the use of hybrid systems that offer both automation advantages and operator intervention, balancing cost and performance.

By Component

Hardware segment dominated in the Market with a share of 57.99% in revenue in 2024 due to the demand for high-quality, high-performance hardware components including cameras, sensors, and light systems. Organizations such as Panasonic Corporation and Sony Corporation are evolving hardware technology through the provision of higher resolution, faster processing cameras. These technologies are crucial to sectors such as the automotive, electronic, and pharmaceutical industries, as high-speed and accurate flaw detection is a necessity. The advancement in hardware continually allows multi-camera systems to satisfy higher demands for speed and accuracy in inspections.

The Software segment is expected the fastest CAGR of 11.92% during the forecast period of 2025 to 2032, driven by advancements in AI and machine learning technologies. Multi-camera vision inspection systems industry players like NI (National Instruments) and Octopus Systems are improving software offerings for multi-camera vision inspection systems, allowing enhanced image processing, real-time analytics, and detection of defects. Software advancements complement and integrate well with sophisticated hardware for more automated, efficient, and smart inspection practices. As companies seek to have more intelligent inspection systems, the development of the software segment is spearheaded by the growing demand for real-time processing of high-precision data and decision-making.

By Technology

The Machine Vision segment has dominated in market share at 46.34% in 2024 due to the critical requirement for high-precision, high-speed automated inspections in various industries. Sony Corporation and MVTec Software GmbH are developing imaging technologies with specialized hardware and software to drive defect detection. These solutions are particularly important for industries such as electronics and automotive, where inspection precision significantly affects product quality and production process. Machine vision remains the basis of manufacturing process improvement with minimal human intervention and maximum automation.

The Artificial Intelligence segment is expected to fastest CAGR of 11.82% from 2025 to 2032, as vision systems that are AI-based continue to improve and learn in ways similar to human vision. Google AI and Qualcomm are among those companies that are combining AI technology with vision systems to enhance the detection of defects, classification, and adaptive learning. Through the use of machine learning, these systems can learn and adapt continuously, eliminating human error and making automated quality control processes more efficient. AI integration is a revolutionary driver behind increased multi-camera vision inspection systems market growth.

Multi-camera Vision Inspection Systems Market Regional Analysis:

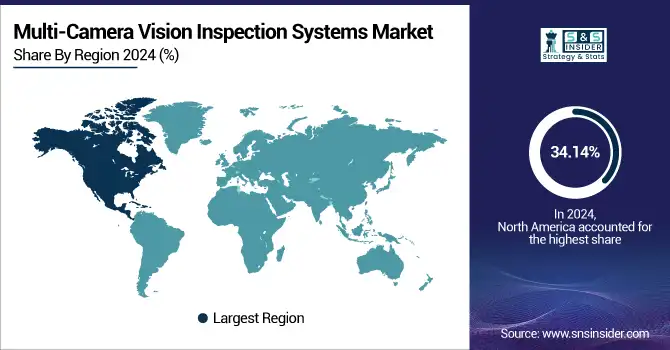

North America dominated the highest revenue percentage of 34.14% in the Multi-camera Vision Inspection Systems Market during 2024 due to a matured manufacturing industry and high need for sophisticated inspection technologies. Rockwell Automation and Teledyne DALSA have introduced advanced systems with improved imaging sensors and edge-computation features. Rockwell's integration in recent times of vision inspection with its FactoryTalk platform is a testament to how automation ecosystems are increasing. The focus of the region on precision manufacturing, especially aerospace, semiconductors, and food processing, continues to fuel multi-camera system demand and sustain the region's leadership in this market as the technological powerhouse.

-

The U.S. leads the North American Multi-camera Vision Inspection Systems Market because of its robust industrial automation base, early technology adoption of AI-based technologies, and availability of top players. Strong demand from automotive, electronics, and pharmaceutical industries also fuels its growth further.

The Asia Pacific is expanding at the fastest CAGR of 11.74% through 2025–2032, driven by growing electronics production centers and aggressive deployment of automation. Multi-camera vision inspection systems companies like Delta Electronics (Taiwan) and Advantech have come up with scalable multi-camera inspection platforms for applications in high-throughput environments. Delta's recent smart factory solutions featuring real-time vision analytics have been hugely popular in China and Southeast Asia. With escalating labor expenses and rising emphasis on the quality of products, Asian Pacific manufacturers are looking towards smart, computer-based inspection systems, thus becoming the most dynamic and fast-paced region in the world's market environment.

-

China leads the Asia Pacific Market with its huge manufacturing sector, robust support from the government for intelligent factories, and quick uptake of automation. Innovation by local players and increasing need for quality control also propel market growth.

Europe's Market is growing rapidly due to the availability of a strong manufacturing base and the rising focus on operational efficiency. The region is aided by large-scale implementation of robotics and vision technology in precision-intensive industries. Innovation incentives and regulations conducive to automation also underpin Europe's competitive advantage in this market.

-

Germany is in the lead for the European Market because of its robust industrial bases, automation expertise, and early application of Industry 4.0. Big fish such as Siemens and Bosch are pushing innovation, helping Germany become a technology mecca for inspection.

The Middle East & Africa (MEA) and Latin America are experiencing consistent growth in the Market. South Africa and Brazil are spearheading the growth, spurred by the need for industrial automation and quality control. Both areas focus on hardware development, with services witnessing the fastest growth, spurred by manufacturing technology advancements.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Multi-camera Vision Inspection Systems Market are:

Major Key Players in Multi-camera Vision Inspection Systems Market are Matrox, Panasonic, Sony, Cognex, FLIR Systems, Basler, Teledyne Technologies, Ametek, Omron, Toshiba and others.

Recent Development:

-

April 2025, i-PRO released Active Guard Server Software (Version 2.1.0) this version added support for AI Processing Relay with Luxriot VMS, improved installer, and introduced a dark mode interface.

-

December 2024, IDS Imaging Development Systems released the uEye Live Camera Series, this series includes the uEye SCP and uEye SLE models, designed for industrial process monitoring with features like RTSP streaming and onboard recording.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.40 Billion |

| Market Size by 2032 | USD 7.58 Billion |

| CAGR | CAGR of 10.62% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Fully Automatic, Semi-Automatic) •By End User (Automotive, Healthcare, Manufacturing, Industrial, Others) •By Component (Hardware, Software, Services) •By Technology (Machine Vision, Artificial Intelligence, Image Processing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Matrox, Panasonic, Sony, Cognex, FLIR Systems, Basler, Teledyne Technologies, Ametek, Omron, Toshiba. |