Defect Detection Market Key Insights:

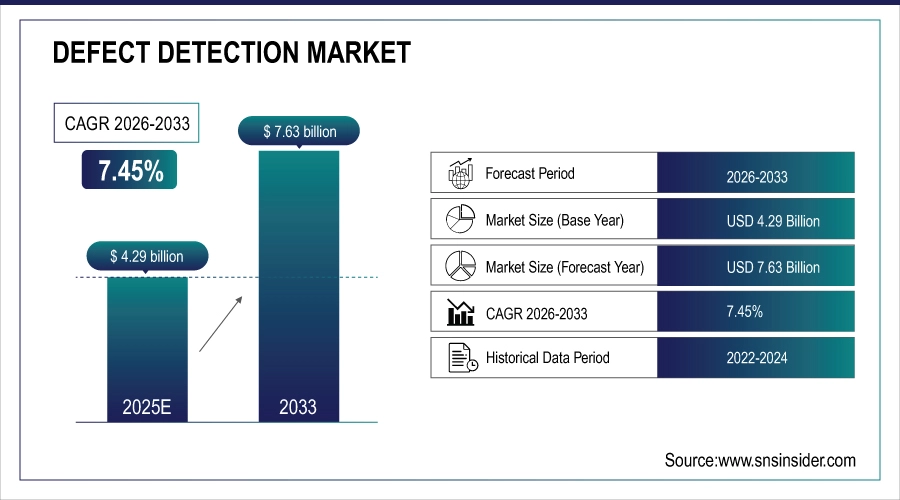

The Defect Detection Market Size was valued at USD 4.29 Billion in 2025E and is expected to reach USD 7.63 Billion by 2033, and grow at a CAGR of 7.45% over the forecast period 2026-2033.

The rising trend of automation across various industries is significantly driving the growth of the defect detection market. As industries increasingly adopt automated processes to enhance efficiency and minimize human error, the demand for advanced defect detection systems has surged. These systems enable real-time monitoring, faster detection, and more accurate results in manufacturing and production environments, aligning with the broader trend of Industry 4.0. Automation technologies are becoming indispensable, especially in sectors like automotive, electronics, and packaging, where quality control is paramount. The integration of machine learning and artificial intelligence (AI) into defect detection systems allows for faster and more reliable identification of defects, reducing the chances of errors in product assembly and manufacturing lines.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 4.29 Billion

-

Market Size by 2033 USD 7.63 Billion

-

CAGR of 7.45% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Get more information on Defect Detection Market - Request Sample Report

Defect Detection Market Trends:

-

Adoption of IoT-enabled smart sensors for real-time monitoring of manufacturing processes and equipment conditions.

-

Expansion of predictive maintenance strategies to minimize downtime and extend machine life.

-

Integration of AI and advanced analytics for defect detection, trend identification, and process optimization.

-

Shift toward highly automated and interconnected smart factories under Industry 4.0 frameworks.

-

Enhanced decision-making through data-driven insights and early corrective action capabilities.

The U.S. Defect Detection Market size was valued at approximately USD 1.37 Billion in 2025 and is expected to witness substantial growth in the coming years, driven by increasing adoption of Industry 4.0 technologies, automation, and IoT solutions across key industries. The market growth is fueled by strong demand from automotive, aerospace, electronics, and pharmaceutical sectors, where robust defect detection systems are critical to ensuring product quality and safety.

Defect Detection Market Growth Drivers:

-

Revolutionizing Defect Detection through Industry 4.0 and IoT Integration in Smart Manufacturing

The integration of Industry 4.0 and Internet of Things (IoT) technologies has significantly transformed manufacturing, ushering in the era of smart factories where processes are highly automated and interconnected. At the heart of this transformation is the use of IoT-enabled smart sensors embedded in machines, continuously monitoring variables such as temperature, pressure, vibration, and machine wear. This real-time data collection enables immediate defect detection and allows manufacturers to address production issues early, preventing defects from escalating. Additionally, IoT facilitates predictive maintenance, where systems analyze patterns over time to predict equipment failures before they occur, reducing downtime and enhancing operational efficiency. These systems also employ advanced AI and data analytics to identify trends, pinpoint root causes of defects, and suggest corrective actions, ultimately improving decision-making.

Defect Detection Market Restraints:

-

Overcoming Data Management Challenges in IoT-Driven Defect Detection Systems

As manufacturing environments increasingly adopt IoT technologies for defect detection, managing the vast amounts of real-time data generated has become a critical challenge. The complexity of processing, storing, and analyzing this data requires advanced infrastructure and skilled personnel. With real-time monitoring crucial for identifying defects promptly, manufacturers must invest in scalable solutions to handle the data load. Advanced technologies like AI-driven analytics, edge computing, and cloud-based solutions are vital to managing data effectively, ensuring faster decision-making, and minimizing the risk of inefficiencies in defect detection systems.

Defect Detection Market Segment Analysis:

By Application

In 2025E, the packaging segment led the defect detection market, capturing around 72% of revenue. This growth is driven by the need for high-quality packaging to ensure product safety, shelf-life, and brand integrity in industries like food, pharmaceuticals, and consumer goods. Automation in packaging lines, coupled with innovations in machine vision, AI, and IoT, has significantly enhanced defect detection capabilities, enabling faster, more accurate inspections. Additionally, increasing focus on sustainability and safety regulations has spurred demand for advanced defect detection systems. Companies like Cognex, SICK AG, and Keyence have introduced cutting-edge solutions to further drive market growth.

By Offering

In 2025E, the hardware segment dominated the defect detection market, accounting for approximately 44% of the revenue. This growth is driven by the vital role of hardware components like IoT-enabled sensors, cameras, machine vision systems, and robotic arms in ensuring precision and reliability in manufacturing. Advances in sensor technology allow for real-time monitoring of production processes, detecting issues such as machine wear and misalignment. Additionally, machine vision systems enhance accuracy in detecting surface defects. Integration with Industry 4.0 technologies and the affordability and scalability of hardware solutions further fuel the segment's growth, enabling seamless expansion in automated systems.

Defect Detection Market Regional Analysis:

North America Defect Detection Market Insights

In 2025E, North America held the largest revenue share of approximately 39% in the defect detection market, driven by its advanced manufacturing capabilities, high adoption of Industry 4.0 technologies, and significant investments in automation and IoT solutions. Key industries like automotive, aerospace, electronics, and pharmaceuticals rely on robust defect detection systems to ensure quality and safety. The region benefits from rapid automation, technological innovation, and strict regulatory standards. Notable company developments include Cognex’s high-speed inspection systems for automotive and packaging, National Instruments’ AI-powered platform for electronics, and Omron’s AI-based vision inspection systems for precision and speed.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia Pacific Defect Detection Market Insights

In 2025E, the Asia-Pacific (APAC) region became the fastest-growing market for defect detection, driven by industrial expansion, automation, and significant technological investments. Countries like China, Japan, South Korea, and India are key players, with growing demand across automotive, electronics, consumer goods, and pharmaceuticals sectors. The region’s strong manufacturing base and the push for AI and IoT integration boost demand for advanced defect detection solutions. Additionally, cost-effective, scalable systems are especially popular in emerging markets like India and Southeast Asia. Companies such as Keyence, Cognex, and Omron are enhancing offerings in the region, fueling market growth.

Europe Defect Detection Market Insights

Europe’s defect detection market is driven by advanced manufacturing sectors, stringent quality standards, and strong adoption of Industry 4.0 technologies. Automotive, aerospace, and electronics industries lead demand for smart sensors, AI, and machine vision systems. Regulatory compliance, focus on reducing defects, and predictive maintenance adoption are strengthening the region’s competitive edge in smart manufacturing.

Latin America (LATAM) and Middle East & Africa (MEA) Defect Detection Market Insights

LATAM and MEA defect detection markets are expanding steadily, supported by industrial automation, infrastructure development, and increasing manufacturing investments. Key industries such as oil & gas, mining, automotive, and food processing are adopting smart inspection solutions to enhance quality and reduce downtime. Growing awareness of predictive maintenance and IoT integration fuels long-term growth opportunities.

Defect Detection Market Key Players:

Some of the Defect Detection Market Companies are

-

Keyence Corporation

-

Omron Corporation

-

Siemens AG

-

Teradyne Inc.

-

National Instruments Corporation

-

Panasonic Corporation

-

Teledyne Technologies

-

Zebra Medical Vision

-

Basler AG

-

Vision Systems Inc.

-

ISRA VISION AG

-

MVTec Software GmbH

-

Applied Robotics

-

Schneider Electric

-

Robot System Products

-

Matrox Imaging

Competitive Landscape for Defect Detection Market:

Zebra Technologies provides advanced machine vision and industrial automation solutions that support defect detection in manufacturing and logistics. Its smart cameras, sensors, and AI-driven imaging systems enable precise inspection, quality control, and real-time monitoring, helping industries reduce errors, improve efficiency, and ensure consistent product quality across diverse applications.

-

On October 25, 2024, Zebra Technologies launched the AltiZ 4200 at VISION, a high-resolution laser enabling advanced 3D point cloud creation for enhanced defect detection and quality inspection.

| Report Attributes | Details |

| Market Size in 2025E | USD 4.29 Billion |

| Market Size by 2033 | USD 7.63 Billion |

| CAGR | CAGR of 7.45% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Application (Manufacturing, Packaging) • By Vertical (Pharmaceuticals, Electronics & Semiconductors, Food And Packaging, Automotive, Metals & Machinery) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cognex, Keyence, Omron, Hexagon, Siemens, Teradyne, National Instruments, SICK, Panasonic, Teledyne, Zebra Medical Vision, Basler, Vision Systems, ISRA VISION, MVTec, Datalogic, Applied Robotics, Schneider Electric, Robot System Products, and Matrox Imaging. |