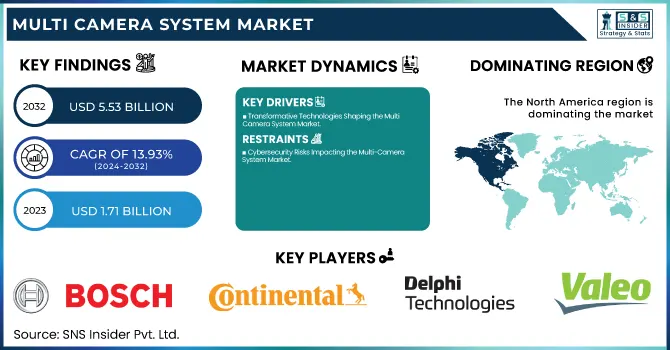

Multi Camera System Market Size & Growth:

The Multi Camera System Market Size was valued at USD 1.71 Billion in 2023 and is expected to reach USD 5.53 Billion by 2032, growing at a CAGR of 13.93% during 2024-2032. This growth is driven by several key factors, including technological adoption rates, regulatory impacts, and consumer preferences. Advances in imaging technology and artificial intelligence have significantly enhanced the capabilities of multi-camera systems, making them indispensable in various applications such as automotive, surveillance, and consumer electronics.

To Get more information on Multi Camera System Market - Request Free Sample Report

Additionally, increasing regulatory requirements for safety and security in vehicles are fueling demand for advanced driver assistance systems (ADAS) that utilize multi-camera configurations. Moreover, the rising consumer preference for enhanced imaging quality and functionalities, particularly in smartphones and smart home devices, is further propelling market expansion.

Multi Camera System Market Dynamics:

Drivers:

-

Transformative Technologies Shaping the Multi-Camera System Market

The multi-camera system market is witnessing remarkable growth, fueled by advancements in imaging technology, especially high-resolution sensors and artificial intelligence. These innovations significantly improve the performance and adaptability of multi-camera systems across diverse applications, such as automotive, security, and consumer electronics. Recent studies indicate that the capacity to capture high-quality images and intelligently process data is transforming how industries utilize surveillance and assistance technologies. This technological evolution enhances user experiences while addressing rising regulatory requirements for safety and efficiency. Additionally, the widespread availability of sensor technologies like CMOS/CCD camera sensors, accelerometers, gyroscopes, and NFC interfaces plays a crucial role. With around 5.5 billion smartphones equipped with these sensors, data collection and processing capabilities are significantly enhanced. The integration of NFC interfaces in approximately 2.2 billion devices further facilitates contactless transactions, emphasizing the importance of these technologies in everyday life.

Restraints:

-

Cybersecurity Risks Impacting the Multi-Camera System Market

The multi-camera system market is significantly limited by cybersecurity risks resulting from increased connectivity. As these systems are integrated into various applications, they become more susceptible to hacking and unauthorized access, threatening data privacy and security. Such vulnerabilities can dissuade potential users, particularly in critical sectors like security and surveillance. The necessity for comprehensive cybersecurity measures is crucial, as data breaches can lead to substantial financial losses, damage to reputation, and regulatory challenges. Manufacturers are compelled to focus on developing secure multi-camera systems to mitigate these risks, which may elevate operational costs and ultimately affect market growth.

Opportunities:

-

Transforming Multi-Camera Systems Through AI and Automation

The architecture of multimodal AI consists of three layers: modal-specific processors, cross-modal integration, and a unified representation system. Innovations like Vision Transformer architectures achieve 96.2% accuracy in object detection while minimizing computational overhead. Natural language processing units can handle complex linguistic structures with 92.4% accuracy for 2048 tokens per batch. Attention-based mechanisms enable effective feature correlation with 83.7% accuracy, optimizing performance at 157 GFLOPS. AI-driven automation in security management streamlines critical tasks, significantly enhancing incident response times. By facilitating real-time data analysis and decision-making, AI-powered multi-camera systems can adapt to dynamic environments, broadening their applications across sectors like automotive, retail, and smart cities, ultimately driving market growth.

Challenges:

-

Overcoming Barriers and the Significance of User Training in Multi-Camera System Adoption

User training is a significant challenge in the adoption of multi-camera systems, as these advanced technologies often come with complex features and functionalities that require a certain level of expertise to operate effectively. For organizations looking to implement multi-camera systems, investing in comprehensive training programs is essential to ensure that users can maximize the system's capabilities. This training may include understanding camera configurations, data analysis, and troubleshooting techniques. Moreover, without proper training, users may struggle to leverage the system for optimal security and surveillance, leading to underutilization of the technology. Consequently, organizations may face difficulties in justifying the investment in multi-camera systems, as the anticipated benefits could diminish if staff members are not adequately prepared to use them efficiently.

Multi Camera System Market Segmentation Overview:

By Function

The Advanced Driver Assistance Systems (ADAS) segment dominates the Multi-Camera System Market, accounting for approximately 69% of the revenue in 2023. This accounts for a large share due to the rising demand for improved vehicle safety and automation features, with automakers increasingly implementing multi-camera systems for lane-keeping assistance, adaptive cruise control, and collision avoidance. Growing imaging technology and artificial intelligence continuously augment the performance of ADAS, and consequently, it becomes one of the hottest investment and innovation areas in the automotive industry. With regulatory pressures for safety compliance growing, ADAS solutions are expected to make up an increasing bet of the market, which further strengthens its leading position.

The Park Assist segment is poised to be the fastest-growing area in the Multi-Camera System Market over the forecast period from 2024 to 2032. The fast-paced progress of the parking assistance systems market is attributed to the growing integration with vehicles of advanced parking solutions, due to consumer demand for improved safety and convenience. 3D View Systems: Most systems have multi-angle views that contribute to 360-degree visibility, allowing the driver to maneuver and park their vehicle with more accuracy. As urbanization accelerates and parking space becomes more and more scarce, automated parking solutions are becoming in demand. Additionally, better sensor technology paired with improved artificial intelligence is boosting the reliability and accuracy of Park Assist systems, which makes them even more appealing to consumers. Consequently, this particular segment is projected to draw substantial investments and technological advancements, further cementing its growth trajectory.

By Vehicle

The Passenger Segment accounted for the largest revenue share in the Multi-Camera System Market, representing approximately 78% in 2023. This dominance is chiefly attributed to the growing need for safety features and advanced driver assistance systems (ADAS) in passenger cars. Automakers are now developing more multi-camera systems to offer features like blind-spot monitoring, lane-keeping assistance, and 360-degree view capabilities, as consumers place more emphasis on safety and convenience. Furthermore, increasing vehicle electrification and smart technology adoption are substantial factors driving the demand for multi-camera systems in passenger vehicles. It is anticipated that improvements in the overall driving experience and reduced accidents will continue to contribute heavily to passenger segment revenue in the coming years.

The commercial segment is poised to be the fastest-growing sector in the Multi-Camera System Market over the forecast period from 2024 to 2032. The growth is majorly due to increasing implementation of sophisticated surveillance and monitoring solutions across industries, such as logistics, retail, and transportation. The impact of multi-camera systems on business Multi-camera systems are becoming the bedrock of many successful businesses. In commercial applications, real-time monitoring, remote access and intelligent analytics are becoming integral features, as they provide analytics to make data-driven decisions. The increasing number of smart cities and integrated security solutions are also driving the the growth of the commercial segment, making it a prime target for multi-camera system manufacturers and investors.

By Display

The 3D segment accounted for the largest share of revenue in the Multi-Camera System Market, approximately 60% in 2023. This dominance is attributed to increasing demand for advanced imaging solutions that offer depth perception alongside improved accuracy across various applications, including robotics, automotive, and augmented reality. For industries that demand an elevated level of detail and accuracy, 3D multi-camera systems are essential as they allow better object identification, environment mapping, and spatial examination. As autonomous vehicles, smart manufacturing, and other sectors continue to adopt more advanced technologies, 3D imaging is quickly becoming a standard for quality control and performance monitoring in many industries. The 3D segment is anticipated to remain prominent within the multi-camera system market, owing to the continued implementation of such solutions in industries.

The 2D segment is the fastest-growing in the Multi-Camera System Market during the forecast period of 2024-2032. This growth is mainly attributed to the growing usage of 2D imaging solutions in applications such as surveillance, industrial automation, and consumer electronics. Due to the low-cost and simple design, the 2D systems 2D systems are appealing for companies that need better efficient ways of doing things but does not want a large capital investment. The rapid evolution of image processing technologies, coupled with the growing need for real-time data analytics, also facilitates the 2D segment growth. As industries seek efficient monitoring solutions, the 2D segment is poised for rapid expansion.

By Automation

The Level 1 segment dominated the Multi-Camera System Market in 2023, accounting for approximately 75% of the total revenue. The significant growth in this segment can be attributed to the usage of fusion imaging in diverse industries, with the automotive and surveillance sectors being the prominent application that can require high-quality imaging along with real-time data processing. High demand for safety in automobiles including advanced driver-assistance systems (ADAS), has driven the growth of Level 1 systems owing to improved visibility and detection. In addition, the growing implementation of multi-camera applications in smart cities and infrastructure construction has cemented the leading position of this segment and has become a key area for the overall market pattern.

The Level 4 segment is poised to be the fastest-growing area within the Multi-Camera System Market over the forecast period from 2024 to 2032. This growth is primarily driven by advancements in autonomous vehicle technologies, where Level 4 automation allows for fully autonomous driving under certain conditions without human intervention. As automakers increasingly invest in sophisticated sensor technologies, including multi-camera systems, the demand for enhanced perception capabilities is surging. These systems provide comprehensive environmental awareness, enabling vehicles to navigate complex urban environments safely. Moreover, regulatory support and increasing consumer acceptance of autonomous driving solutions further contribute to the rapid expansion of the Level 4 segment, positioning it as a pivotal element in the future of transportation and mobility.

Multi Camera System Market Regional Analysis:

North America is the dominant region in the multi-camera system market, accounting for approximately 50% of the share in 2023. This leadership is fueled by the rapid adoption of advanced imaging technologies across sectors like automotive, security, and consumer electronics. Major automotive manufacturers and tech companies in the U.S. and Canada drive innovation, particularly in autonomous vehicles and enhanced driver-assistance systems. The U.S. is at the forefront of technological advancements and smart city initiatives that utilize multi-camera systems for improved surveillance and traffic management. Additionally, increasing regulatory support for safety features and rising consumer demand for security solutions contribute to North America being the fastest-growing market, reinforced by a strong commitment to research and development and a solid infrastructure for deploying these technologies.

Europe is projected to be as the fastest-growing region in the multi-camera system market from 2024 to 2032, due to significant investment in smart technology and infrastructure by nations including Germany, France, and the United Kingdom. Germany is at the forefront of automotive innovations, coupling its driver-assistance technologies with multi-camera systems for further protection of the driver. France and the UK, on the other hand, are moving forward with smart city initiatives that incorporate these technologies for urban planning and public safety. Further, strict regulatory frameworks promoting the road safety and security increase the adoption of multi-camera systems, while ongoing technology developments and a commitment to sustainability ensure Europe continues to be an expanding market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major players in Multi Camera System Market along with their product:

-

Bosch (Germany) - (Automotive multi-camera systems, driver assistance systems)

-

Continental AG (Germany) - (Multi-camera systems for vehicles, sensor fusion technologies)

-

Delphi Technologies (United States) - (Advanced driver assistance systems, automotive cameras)

-

Denso Corporation (Japan) - (Camera systems for ADAS, image sensors)

-

Valeo (France) - (Multi-camera systems for smart parking and driving assistance)

-

Magna International (Canada) - (Advanced camera systems for vehicles, ADAS solutions)

-

NVIDIA (United States) - (AI-powered camera systems for autonomous vehicles)

-

Panasonic (Japan) - (High-definition cameras and imaging systems)

-

Aptiv (United States) - (Integrated camera systems for ADAS)

-

Mobileye (Israel) - (Advanced camera systems for vehicle automation and safety)

-

Ambarella (United States) - (Camera processing solutions and systems-on-chip for multi-camera setups)

-

OmniVision Technologies (United States) - (Image sensors for automotive and consumer cameras)

-

Blackmagic Design (Australia) - (Professional multi-camera solutions and digital film cameras)

-

DJI (China) - (Multi-camera drone systems and gimbals)

-

Red Digital Cinema (United States) - (High-resolution digital cinema cameras with multi-camera capabilities)

-

GoPro (United States) - (Action cameras and multi-camera setups for content creation)

-

Axis Communications (Sweden) - (Network cameras and video surveillance solutions)

-

Amazfit (China) - (Smartwatches with camera integration for fitness tracking)

-

Samsung Electronics (South Korea) - (Multi-camera systems for smartphones and surveillance)

-

Logitech (Switzerland) - (Multi-camera systems for streaming and video conferencing)

-

Nikon (Japan) - (Digital cameras and multi-camera systems for photography)

-

Microsoft (United States) - (Camera systems for mixed reality and video conferencing)

-

Hikvision (China) - (Security cameras and multi-camera surveillance systems)

-

Sony (Japan) - (Image sensors and multi-camera systems for various applications)

-

Canon (Japan) - (Digital cameras and multi-camera systems for photography and video)

List of companies that provide raw materials and components for the multi-camera system market:

-

Sony Corporation

-

OmniVision Technologies, Inc.

-

STMicroelectronics

-

Texas Instruments

-

Qualcomm Technologies, Inc.

-

Analog Devices, Inc.

-

NXP Semiconductors

-

Himax Technologies, Inc.

-

ON Semiconductor

-

Lattice Semiconductor

Recent Development

-

July 24, 2024, Continental is expanding the type of products it offers in the automotive aftermarket, with a focus on sustainability and breakthrough technologies. Expanding into new product segments like sensors for ADAS or radar and camera modules, and eco-friendly multi V-belts made from renewable materials.

-

October 8, 2024, OMNIVISION announced the NVIDIA Holoscan sensor processing platform and NVIDIA Jetson platform for edge AI and robotics have verified OMNIVISION's total camera system, including the OG02B10 color global shutter image sensor and OAX4000 ASIC image signal processor. Will be a demonstration of the assembly of these technologies in humanoid robots with multi-camera sensing for the first time this week at VISION 2024, Stuttgart, Germany. The advancement will aid high-resolution image capture and AI functions critical for humanoid robots, though they represent the emerging market, which is projected to exceed USD13 billion by 2028.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.71 Billion |

| Market Size by 2032 | USD 5.53 Billion |

| CAGR | CAGR of 13.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Function (Park Assist, ADAS) • By Vehicle (Passenger, Commercial) • By Display (2D, 3D) • By Automation (Level 1, Level 2 & 3, Level 4) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch (Germany), Continental AG (Germany), Delphi Technologies (United States), Denso Corporation (Japan), Valeo (France), Magna International (Canada), NVIDIA (United States), Panasonic (Japan), Aptiv (United States), Mobileye (Israel), Ambarella (United States), OmniVision Technologies (United States), Blackmagic Design (Australia), DJI (China), Red Digital Cinema (United States), GoPro (United States), Axis Communications (Sweden), Amazfit (China), Samsung Electronics (South Korea), Logitech (Switzerland), Nikon (Japan), Microsoft (United States), Hikvision (China), Sony (Japan), Canon (Japan). |