n-Butanol Market Report Scope & Overview:

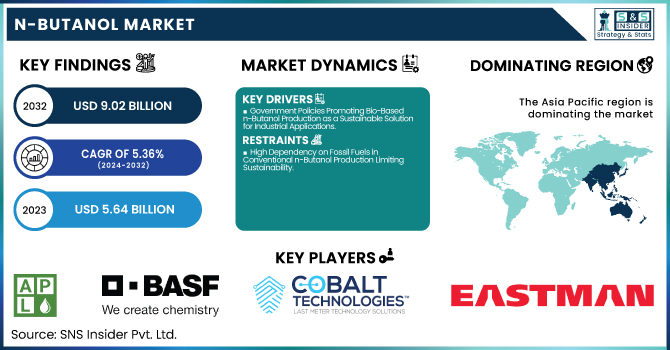

The n-Butanol Market Size was valued at USD 5.64 Billion in 2023 and is expected to reach USD 9.02 Billion by 2032, growing at a CAGR of 5.36% over the forecast period of 2024-2032.

To Get more information on n-Butanol Market - Request Free Sample Report

The n-Butanol market is evolving rapidly, driven by several transformative factors. Government initiatives are boosting market growth, especially through policies that support bio-based production. Our report explores advancements in catalytic technologies for n-Butanol synthesis, which are enhancing production efficiency and output. Additionally, n-Butanol’s growing role as a solvent in the pharmaceutical industry is contributing significantly to its demand, as it becomes an essential component in drug formulations. The report also highlights the impact of industry-specific regulations on n-Butanol usage, particularly in sectors like paints, coatings, and pharmaceuticals, where compliance with safety and environmental standards is crucial. These insights provide a comprehensive view of the key drivers shaping the n-Butanol market’s future.

The US n-Butanol Market Size was valued at USD 862.9 Million in 2023 and is expected to reach USD 1450 Million by 2032, growing at a CAGR of 5.94% over the forecast period of 2024-2032.

The US n-Butanol market is expanding due to increased demand across various industries, particularly in paints and coatings, automotive, and pharmaceuticals. Strong government policies promoting renewable energy and green chemistry are also contributing to growth, with the U.S. Environmental Protection Agency (EPA) advocating for more sustainable solvents. Moreover, advancements in catalytic technologies by U.S. companies such as Dow Chemical are improving production efficiency. The growing pharmaceutical sector, where n-Butanol is used as a solvent in drug formulations, further accelerates market demand. Additionally, the rising trend of bio-based n-Butanol production, driven by companies like Gevo, is bolstering the market's growth prospects.

n-Butanol Market Dynamics

Drivers

-

Government Policies Promoting Bio-Based n-Butanol Production as a Sustainable Solution for Industrial Applications

Governments worldwide, especially in regions like the United States and Europe, are actively supporting the growth of sustainable chemicals, including bio-based n-Butanol, through various initiatives and policies. For example, the U.S. Environmental Protection Agency (EPA) and European Union (EU) have set regulations encouraging the use of renewable resources, which significantly boosts demand for bio-based chemicals. Bio-based n-Butanol offers a sustainable alternative to conventional petrochemical-based production, aligning with the global shift towards reducing carbon footprints and dependence on fossil fuels. Several U.S. companies like Gevo and BioAmber are leading the charge in bio-based n-Butanol production, leveraging renewable feedstocks such as plant biomass to reduce greenhouse gas emissions. Government incentives, such as tax credits and grants for renewable energy and chemical production, are making the transition to bio-based solutions more attractive. The growing global trend of adopting greener products, especially in industries like automotive, coatings, and chemicals, ensures that bio-based n-Butanol will continue to be a key driver in the market's expansion, offering an environmentally friendly solution to traditional production methods.

Restraints

-

High Dependency on Fossil Fuels in Conventional n-Butanol Production Limiting Sustainability

One of the major restraining factor faced by the n-Butanol market is its dependence on fossil fuels for production. Conventional n-Butanol is primarily derived from petrochemical sources such as propylene, which not only contributes to environmental degradation but also ties the production process to the volatile nature of global oil prices. This reliance on fossil fuels for n-Butanol production creates sustainability issues, particularly as the world shifts toward greener and more environmentally friendly chemical solutions. Despite the availability of alternative, bio-based production methods, the fossil fuel-based approach remains dominant, making it challenging for the market to achieve true sustainability. Companies that rely on this traditional production method face increasing pressure from both governments and consumers to adopt more sustainable practices. For instance, regulatory bodies like the U.S. Environmental Protection Agency (EPA) are introducing stricter emissions regulations, which could make fossil fuel-based production more costly and less competitive. Additionally, as public awareness of environmental concerns grows, companies that continue to rely on petrochemical-derived n-Butanol may face reputational damage and reduced demand from eco-conscious consumers and industries.

Opportunities

-

Untapped Potential in Emerging Economies Driving Demand for n-Butanol in Industrial Applications

Emerging economies, particularly in Asia-Pacific, Latin America, and Africa, present untapped opportunities for n-Butanol market growth. As industrialization accelerates in these regions, the demand for solvents, coatings, plastics, and other chemical products is expected to rise substantially, directly driving the demand for n-Butanol. In countries such as India, China, Brazil, and South Africa, rapid urbanization, infrastructure development, and the expansion of manufacturing sectors are contributing to a growing need for industrial chemicals. The increasing adoption of n-Butanol in industries such as automotive, construction, and agriculture in these regions is expected to fuel market growth. Additionally, as the middle class in these economies expands, there is a growing demand for consumer goods that require n-Butanol-based products, such as paints, coatings, and adhesives. Companies looking to capitalize on this growth can establish manufacturing facilities or form partnerships in these regions to capture the emerging demand for n-Butanol. The untapped potential of these high-growth markets presents significant opportunities for market players to expand their reach and solidify their presence in the global n-Butanol market.

Challenge

-

Stringent Environmental Regulations on Chemical Production Limiting n-Butanol Market Growth

Stringent environmental regulations governing the chemical industry are becoming a significant challenge for the n-Butanol market. Regulations set by agencies like the U.S. Environmental Protection Agency (EPA), the European Chemicals Agency (ECHA), and other regional bodies are pushing for stricter environmental standards in chemical production, including solvent emissions and waste management. Since n-Butanol production is traditionally linked to petrochemical processes, manufacturers must invest in costly technologies to meet these regulations. This includes adopting cleaner production methods, reducing emissions, and ensuring that n-Butanol production is more environmentally friendly. Compliance with these regulations can be financially burdensome, especially for smaller players who lack the resources to implement new technologies. In some cases, companies may be required to invest heavily in equipment upgrades or face penalties, which could deter new entrants from entering the market. Additionally, meeting the evolving standards and obtaining certifications can slow down production processes, affecting market growth and profitability.

n-Butanol Market Segmental Analysis

By Grade

In 2023, the Industrial segment dominated the n-Butanol market with a market share of approximately 50.3%. This dominance can be attributed to the widespread use of n-Butanol in various industrial applications, such as manufacturing plastics, solvents, and chemical intermediates. For example, organizations like the American Chemistry Council emphasize the importance of n-Butanol in producing key chemicals and materials used across numerous sectors, including automotive and construction. Moreover, the push for eco-friendly production processes is driving industries to adopt bio-based n-Butanol alternatives, further solidifying the Industrial segment's leading position. As major industrial players such as BASF and Dow Chemical invest in sustainable production technologies, the Industrial segment is expected to continue thriving, meeting the growing demand for high-performance solvents and chemicals in the global market.

By Application

In 2023, the Direct Solvents application segment dominated the n-Butanol market, accounting for a market share of 40.5%. This dominance is largely due to the widespread use of n-Butanol as a solvent in various formulations across multiple industries, including paints, coatings, and adhesives. According to the American Coatings Association, the effectiveness of n-Butanol as a solvent contributes significantly to the performance of paint and coating products, making it a preferred choice for manufacturers. Furthermore, n-Butanol's versatility allows it to dissolve a wide range of substances, enhancing its appeal in formulations for the pharmaceutical and chemical industries. Companies like Eastman Chemical and LyondellBasell have also recognized this demand, investing in the production of high-quality n-Butanol to serve the growing needs of solvent applications. As regulatory pressures increase for safer and more effective solvents, the Direct Solvents segment is well-positioned to maintain its dominance in the n-Butanol market.

By End-use Industry

In 2023, the Building & Construction segment emerged as the dominant force in the n-Butanol market, with a market share of 25%. The construction industry heavily relies on n-Butanol for various applications, including the production of adhesives, sealants, and coatings, which are essential for structural integrity and durability. According to the National Association of Home Builders, the ongoing recovery in the construction sector, particularly in residential and commercial projects, has fueled demand for high-performance materials that utilize n-Butanol. Additionally, the increasing focus on energy efficiency and sustainable building practices is driving the adoption of advanced materials that incorporate n-Butanol-based products. Leading companies such as Henkel and Sika are capitalizing on this trend by developing innovative n-Butanol formulations that enhance product performance and environmental compliance. As the building and construction market continues to expand, the dominance of the Building & Construction segment in the n-Butanol market is expected to strengthen further.

By Distribution Channel

In 2023, the Direct Imports distribution channel dominated the n-Butanol market with a market share of 38.2%. This dominance can be attributed to the growing trend of companies sourcing raw materials directly from manufacturers abroad to secure competitive pricing and high-quality products. For instance, U.S. companies are increasingly importing n-Butanol from established producers in regions such as Asia and Europe, where large-scale production facilities enable cost-efficient manufacturing. The American Chemical Society notes that direct imports allow companies to bypass intermediary distributors, reducing overall supply chain costs and improving profit margins. Additionally, as demand for n-Butanol rises in sectors like paints, coatings, and pharmaceuticals, companies are strategically establishing relationships with overseas suppliers to ensure a steady supply of this essential solvent. As market dynamics continue to shift, the Direct Imports distribution channel is expected to maintain its leading position in the n-Butanol market, driven by strategic sourcing and cost efficiency.

n-Butanol Market Regional Outlook

In 2023, the Asia Pacific region dominated the n-Butanol market with an estimated market share of 40.3%. This dominance can be attributed to the rapid industrialization and urbanization occurring in countries like China and India, which are significantly increasing demand for industrial solvents and chemicals. For example, China is not only a leading producer of n-Butanol but also a significant consumer in sectors such as automotive and construction, driving the growth of high-performance chemicals. According to the China Petroleum and Chemical Industry Federation, the country’s chemical industry continues to expand, with n-Butanol playing a crucial role in various applications. Moreover, India’s growing pharmaceutical sector, where n-Butanol is used extensively as a solvent, further boosts regional demand. The presence of major manufacturers such as BASF and Mitsubishi Chemical in the region reinforces its position as a powerhouse for n-Butanol production and consumption. As these countries continue to expand their industrial capabilities, the Asia Pacific region is expected to maintain its dominant share in the global n-Butanol market.

On the other hand, the North America region emerged to be the fastest-growing region in the n-Butanol market during the forecast period, with a significant growth rate. This growth can be attributed to several factors, including the resurgence of the manufacturing sector and the increasing demand for eco-friendly and sustainable chemical solutions. The United States, in particular, is witnessing a renaissance in its chemical industry, driven by investments in green chemistry and the production of bio-based solvents. Companies like Gevo are leading efforts to develop bio-based n-Butanol, aligning with government initiatives aimed at reducing reliance on fossil fuels and promoting renewable resources. Additionally, the U.S. pharmaceutical market is expanding rapidly, with n-Butanol being increasingly used as a solvent in drug formulations. According to the American Chemical Society, the growth of the pharmaceutical industry, alongside regulatory support for sustainable chemical practices, positions North America for significant advancements in the n-Butanol market. As these trends continue, North America is expected to experience robust growth in n-Butanol consumption, solidifying its position in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Andhra Petrochemicals Ltd.

-

BASF SE

-

Cobalt Technologies

-

Formosa Plastics Corp

-

Grupa Azoty

-

INEOS Oxide Ltd

-

KH Neochem Co., Ltd.

-

Mitsubishi Chemical Corporation

-

OQ Chemicals

-

Oxochimie

-

Perstorp Holding AB

-

PetroChina Company Limited

-

Sinopec

-

The Dow Chemical Company

-

LG Chem Ltd.

-

Reliance Industries Ltd.

-

China National Petroleum Corporation (CNPC)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.64 Billion |

| Market Size by 2032 | USD 9.02 Billion |

| CAGR | CAGR of 5.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Industrial, Pharmaceutical, Others) •By Application (Plasticizers, Direct Solvents, N-Butyl Acetate, Glycol Ethers, Methacrylate Esters, Others) •By End-use Industry (Agriculture, Building & Construction, Paints & Coatings, Marine, Pharmaceutical, Chemical, Personal Care, Others) •By Distribution Channel (Retailers, Distributors & Traders, Direct Imports, Direct Company Sales, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, The Dow Chemical Company, Eastman Chemical Company, OQ Chemicals, Sasol Ltd, PetroChina Company Limited, Mitsubishi Chemical Corporation, Sinopec, KH Neochem Co., Ltd., INEOS Oxide Ltd and other key players |