Drug Delivery Systems Market Size Analysis:

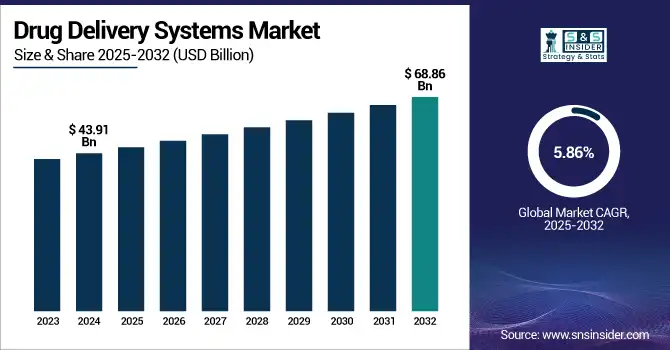

The Drug Delivery Systems Market was valued at USD 43.91 billion in 2024 and is expected to reach USD 68.86 billion by 2032 and grow at a CAGR of 5.86% over the forecast period of 2025-2032.

To Get more information on Drug Delivery Systems Market - Request Free Sample Report

The drug delivery systems market is expanding at a significant pace as the need for targeted therapies, biologics, and self-administration technologies is on the rise. Advancements such as smart injectables, transdermal patches, and inhalation devices improve treatment effectiveness and patient adherence. The increasing prevalence of chronic disease, combined with rising R&D expenditure and regulatory approvals, is driving market growth.

The U.S. drug delivery systems market size was valued at USD 14.84 billion in 2024 and is expected to reach USD 22.89 billion by 2032, growing at a CAGR of 5.64% over the forecast period of 2025-2032.

The U.S. dominates the North American drug delivery systems market due to better healthcare infrastructure, the presence of major pharmaceutical and medtech companies, and high adoption of novel delivery technology. Its strong position is reinforced by high R&D investments and a high chronic disease burden.

Drug Delivery Systems Market Dynamics:

Drivers

-

An Increasing Number of Development Focused on Drug Delivery Technologies is Helping Drive the Growth of the Market.

Ongoing innovation in drug delivery technologies is changing the administration of medications, making the treatments more effective and convenient for the patients. Smart injectors with embedded sensors, for instance, correct dosing and monitor compliance, and transdermal patches provide a minimally invasive and continuous drug delivery route. Utilizing nanotechnology at the cellular level allows for targeted delivery of the drugs, leading to better uptake of drugs and fewer side effects. All these technological developments improve treatment efficacy and increase patient compliance, thus boosting the market for novel delivery systems.

In June, Aptar Digital Health announced a partnership with SHL Medical to improve the injectable treatment experience by combining Aptar’s SaMD platform with SHL Medical’s connected drug delivery solutions, such as the Molly Connected Cap.

-

Rise In the Demand for Self-Administration is Fueling the Market Growth

The people are leaning more towards self-administration of drugs, due to the convenience of avoiding more hospital visits and to save costs. Home-based management of chronic diseases has become a great demand, and patients are willing to use drug delivery devices such as autoinjectors, inhalers, and portable infusion pumps. This change is backed by a simple device design with minimal training requirements. Self-administration enhances the compliance of the patients and gives them authority, which is primarily driving the growth of the drug delivery systems market.

Restraint

-

Stringent Regulatory Approvals are Restraining the Market from Growing

Developing a new drug delivery system is an elaborate process and ideally relies on regulatory frameworks by the FDA, the EMA, and regional agencies. They need significant clinical trials in order to show that devices are safe, effective, and high-quality before procurement from these agencies. The approval takes a lot of time and money− it usually entails many stages of trials and extensive paperwork. Tackling extensive regulatory scrutiny translates to delayed time-to-market for innovative delivery systems (both novel platforms and reformulated ones), increased costs of development, and uncertainty for manufacturers, all of which can hamper overall market growth. Those regulations are also different from one country to another, which increases the complexity for companies that would need their products to be launched on an international scale.

Drug Delivery Systems Market Segmentation Analysis:

By Type

An injectable segment dominated the market with a 58.14% market share in 2024, due to its extensive applications in the treatment of chronic diseases, including diabetes, cancer, and autoimmune diseases. Because injectables provide fast-acting action, high bioavailability, and targeted dosing, they are a preferred route of administration for both acute and chronic therapies. The dominance of the Biologics segment can also be attributed to the growing burden of chronic diseases, rising biologics consumption, as well as increasing self-administration devices such as autoinjectors and prefilled syringes. Moreover, ongoing innovation related to subcutaneous and intramuscular delivery systems has broadened their utility across a wider range of therapeutic areas.

In February 2023, key player, Innovation Zed, announced that it has received the CE mark for its InsulC.

The inhalation segment is predicted to be fastest during the forecast years, owing to factors such as being easy to administer, the presence of mechanisms that promote patient compliance, safety, and efficacy against common diseases such as asthma and COPD. The rising prevalence of pulmonary diseases and technological advancement in smart inhalers are the major growth drivers for the market. In addition, the segment is witnessing an increase in adoption for systemic drug delivery in diabetes management and pain management, among others.

By Device Type

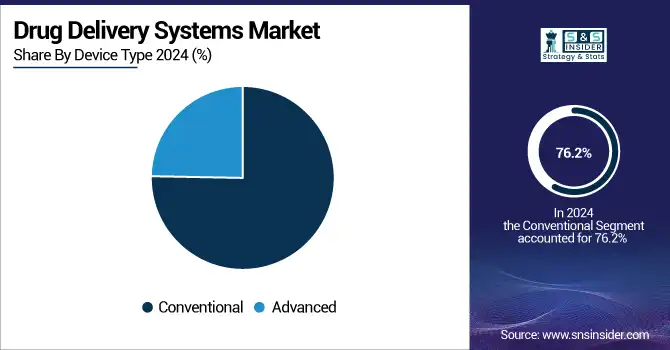

The conventional segment led the drug delivery systems market with a 76.2% market share in 2024 due to the wide acceptance, cost effectiveness, and presence of extensive infrastructure in developed and developing regions. Despite the remarkable potential of mRNA therapeutics, central to their position on the pharmaceutical landscape will remain the tried-and-true delivery methods of oral tablets and capsules, syringes, and topical formulations due to their known efficacy, usability, and wide availability. This makes these systems also suitable for mass production, and their reliance on existing supply chains and healthcare systems provides a more reliable solution for various treatments, especially in the hospital and clinical setting.

The advanced segment is estimated to be the fastest-growing segment due to the increasing need for specificity, personalization, and lower invasiveness in treatment. This has further fueled the development of novel drug delivery devices such as microneedle patches, implantable systems, and the use of nanotechnology-based carriers, which aim to achieve greater precision in treatment while minimizing side effects and maximizing patient compliance during treatment. Adoption is also powered by increasing digital health investments and the incorporation of wireless connectivity and sensors into drug delivery platforms. This push towards home-based and chronic disease management, combined with these innovations, makes the advanced device segment one of the largest drivers for future market growth.

By Distribution Channel

In 2024, the drug delivery systems market was dominated by the hospital pharmacies segment with around 61.08% market share, owing to hospitals being usually the primary point of care for patients needing specialized and acute treatments. Hospital pharmacies provide immediate access to complex drug delivery systems such as injectable products, infusion pumps, and long-acting products or devices that must be administered or monitored by a professional. Hospital pharmacies are a key distribution channel, particularly for chronic and/or life-altering conditions, as they are staffed with skilled healthcare professionals and equipped with infrastructure to dispense complicated drug regimens.

The retail pharmacies segment is anticipated to grow fastest during the forecast years, as patients would prefer ease of access to medication and the ability to self-administer medication. Factors such as expansion of over-the-counter availability, increasing home healthcare, and a rise in awareness regarding personalized medicine & treatment are also providing a strong push to the demand for retail pharmaceuticals. The growth is also attributable to the development of a range of drug delivery technologies, including autoinjectors and inhalers that are intended for easy nonclinical use.

Regional Insights:

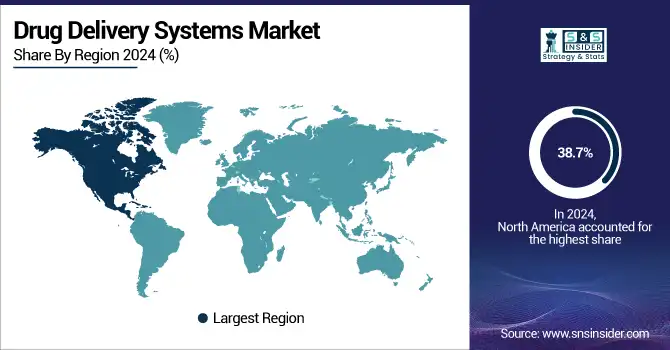

North America dominated the drug delivery systems market with around 38.7% market share in 2024, owing to an established healthcare system, high healthcare expenditure, and a large number of leading pharmaceutical and biotechnology companies present in this region. These early adopters of disruptive technologies such as smart injectables, controlled-release formulations, and connected drug delivery devices result in the region being better positioned than the rest of the globe. Moreover, supportive regulatory structures, a well-integrated reimbursement system, and a high burden of chronic diseases, including diabetes, cancer, and cardiovascular diseases, ensure the rising need for efficient and patient-centered drug delivery solutions. A major factor of regional growth is attributed to the U.S. due to its high investments in research and development, along with numerous product launches.

Asia Pacific is anticipated to exhibit the fastest growth with a 6.68% CAGR over the forecast period, attributed to evolving healthcare infrastructure, growing healthcare expenditure, and awareness towards better treatment methods in this region. However, factors such as an increasing number of chronic diseases along with a large and aging population in countries such as China, India, and Japan are anticipated to accelerate demand for novel drug delivery technologies in the Asia Pacific region. In addition, a rise in regulations, increased local manufacturing capabilities, and government initiatives to increase healthcare access are propelling rapid market growth. This region would also grow due to the underlying interest of global players in investing in the potential Asian markets, which are expected to grow tremendously in the forecast years.

The drug delivery systems market in Europe is witnessing considerable growth due to prominent factors propelling market growth. The mature healthcare ecosystem and a focus on research and development have enabled the region to create novel drug delivery technologies. The growing elderly population, coupled with increasing incidences of chronic illnesses such as diabetes, cardiovascular diseases, and cancer, has augmented the need for convenient drug delivery methods that are easy to use and user-friendly. Additional factors that are further expected to boost market growth include the advancements in technology, such as nanotechnology-based delivery systems, as well as the personalized medicine approach. Furthermore, partnerships amongst pharmaceutical creators and drug delivery technology firms are also supporting and accelerating the development and commercialization of advanced therapeutics in Europe.

In April 2025, B. Braun Medical obtained approval from the U.S. Food and Drug Administration (FDA) for the utilization of Piperacillin and Tazobactam in its DUPLEX Drug Delivery System.

Germany dominated the European drug delivery systems market. Its advanced healthcare system and significant investment in R&D alongside major pharmaceutical firms maintain the country at the forefront. The country's innovation around drug delivery technologies, such as controlled-release systems and self-injectable devices, will fit the rapidly expanding need for targeted and efficacious treatment modalities.

The drug delivery systems market in Latin America is expanding moderately owing to an increase in the number of chronic diseases, a growing geriatric population, and rising investments in the healthcare sector. The market expansion in this region is due to various factors, including the focus on treatment schemes that are patient-centric and the usage of advanced technologies such as smart inhalers and auto-injectors.

The Middle East and Africa are leading to moderate growth, due to the rising incidence of chronic diseases such as diabetes and cardiovascular diseases. Demand is also driven by the growing geriatric populace in this region, as well as increasing adoption of drug delivery techniques are also fuelling the demand market. Also, countries such as Saudi Arabia, the UAE, and South Africa are investing heavily in their healthcare infrastructure, enabling research and use of innovative drug delivery technology.

Get Customized Report as per Your Business Requirement - Enquiry Now

Drug Delivery Systems Market Key Players

Johnson & Johnson Services, Inc., Pfizer Inc., Becton, Dickinson and Company (BD), 3M Company, Baxter International Inc., Roche Holding AG, Novartis AG, Antares Pharma, Inc. (Halozyme Therapeutics, Inc.), Gerresheimer AG, West Pharmaceutical Services, Inc., and other players.

Recent Developments

-

In April 2024, Johnson & Johnson MedTech launched the next-generation digital surgery platform, Polyphonic. The platform features cutting-edge capabilities such as pre-operative planning software, high-definition video, and telepresence offerings that help improve surgical accuracy and teamwork.

-

In July 2024, Pfizer Inc. announced the selection of its lead once-daily modified-release formulation of danuglipron, an oral glucagon-like peptide-1 (GLP-1) receptor agonist. The selection was made following data from an ongoing pharmacokinetic study. The company will initiate dose optimization studies during the second half of 2024 to assess multiple dosing regimens of the selected formulation, which will inform future registration-enabling trials.

Drug Delivery Systems Market Report Scope:

Report Attributes Details Market Size in 2024 USD 43.91 Billion Market Size by 2032 USD 68.86 Billion CAGR CAGR of 5.86% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments •By Type (Inhalation, Transdermal, Injectable, Others)

•By Device Type (Conventional, Advanced)

•By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Others)

Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Johnson & Johnson Services, Inc., Pfizer Inc., Becton, Dickinson and Company (BD), 3M Company, Baxter International Inc., Roche Holding AG, Novartis AG, Antares Pharma, Inc. (Halozyme Therapeutics, Inc.), Gerresheimer AG, West Pharmaceutical Services, Inc., and other players.