Type 1 Diabetes Market Report Scope and Overview:

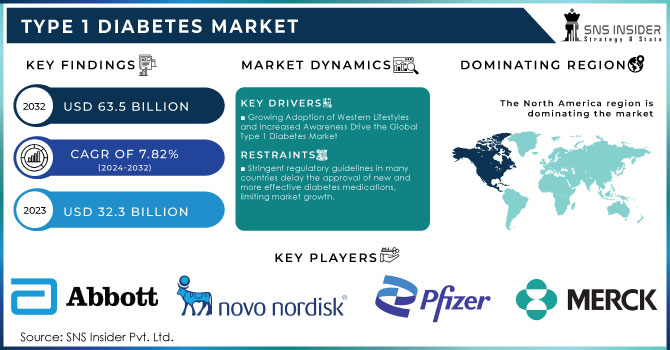

The Type 1 Diabetes Market Size was valued at USD 34.83 billion in 2024 and is expected to reach USD 63.61 billion by 2032 and grow at a CAGR of 7.82% over the forecast period 2025-2032.

The Type 1 diabetes market is changing with innovations in insulin delivery systems, continuous glucose monitoring (CGM) technologies, and advanced research into stem cell therapies and immunomodulation. The latest trend in this market is one of the most exciting artificial pancreases. Automated insulin delivery systems use a CGM device and an insulin pump to allow precise, real-time matching between glucose levels and the delivery of insulin. The Medtronic MiniMed 670G was the first of FDA-approved hybrid closed-loop systems that would adjust and automatically change insulin administration levels to maintain optimal glucose control. 4 Tandem Diabetes Care's tX2 with Control-IQ technology advances this further by including automatic correction boluses, meaning it keeps enhancing control of glucose levels while decreasing patient intervention.

Many CGM technologies are now integrated into the management of Type 1 diabetes, including Dexcom's G6 and Abbott's FreeStyle Libre, which vastly improves self-management by using real-time glucose data that can be used by the patient or provider to make good decisions. Some of the benefits these bring are higher accuracy, longer wear time, and better fit with the digital health platform all of which make diabetes more manageable. In this connection, linking CGMs to cell phones and smartwatches allows one to continuously monitor their glucose levels and share the data, which is helpful for children and their caregivers.

Get more information on Type 1 Diabetes Market - Request Free Sample Report

Type 1 Diabetes Market Size and Forecast:

-

Market Size in 2024: USD 34.83 Billion

-

Market Size by 2032: USD 63.61 Billion

-

CAGR: 7.82% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Type 1 Diabetes Market Highlights:

-

Innovative treatments are expanding beyond insulin and CGM systems to include stem cell therapies targeting pancreatic beta-cell regeneration and immunomodulation therapies such as Treg cell therapy and monoclonal antibodies like teplizumab

-

Government initiatives supporting research, early detection, and affordable treatment, such as Canada’s USD 33 million funding for diabetes research, are boosting market growth

-

Increasing adoption of Western diets, sedentary lifestyles, and rising awareness of Type 1 diabetes risks drive demand for treatments and advanced management technologies

-

Wider availability of health insurance enables more people to afford long-term diabetes management and sophisticated therapies

-

Development of insulin delivery systems, CGM devices, and novel therapies enhances patient outcomes and quality of life

-

Stringent regulatory processes delay market entry of new therapies, increasing development costs and slowing overall market expansion

Apart from expanding insulin delivery and CGM systems, treatment through novel stem cell therapies and immunomodulation is now possible with the disease. Stem cell therapy specifically targets the regeneration of the beta cells within the pancreas that produce insulin. Companies such as ViaCyte have led the way in developing encapsulated cell replacement therapy. Theses of immunomodulation therapies consist of Treg cell therapy and monoclonal antibodies such as teplizumab, supporting the prevention of autoimmune attacks on beta cells, and presenting hopeful solutions that could be curative or preventive. These innovations are transforming the market of Type 1 diabetes. They can provide patients with very effective tools for handling their conditions, maybe enabling long-term remission or even cures. Indeed, growth in this market is primarily cultivated through ongoing research, clinical trials, and advancements in medical technologies, all of which contribute to an individual's quality of life in handling Type 1 diabetes.

The recent efforts of the government to combat diabetes are the key growth drivers of the Type 1 diabetes market. Such initiatives mainly encompass different actions, policies, and programs enforced to reduce the risk of developing this disease as well as to ensure accessibility to wide-reaching, quality, and low-cost treatment and care for those affected. For instance, in July 2023, the Canadian government collaborated with JDRF Canada, which received USD 33 million to be invested in 12 research projects meant for preventing, detecting, managing, and treating diabetes. This also supports the building of a national screening research consortium to accelerate early-stage, pre-symptomatic screening for Type 1 diabetes. Those government programs announced are likely to raise demand for Type 1 diabetes treatments and technologies.

Type 1 Diabetes Market Drivers:

-

Growing Adoption of Western Lifestyles and Increased Awareness Drive the Global Type 1 Diabetes Market

The rise in the incidence of Type 1 diabetes primarily occurs due to the growing prevalence of Western diets and sedentary lifestyles, which support high fat intake and low physical activity levels. The increasing adoption of these lifestyle conditions globally has resulted in a broad diabetes epidemic. Additionally, accessibility to health insurance is now increasingly available in many more parts of the world, an equally important growth driver for the market. The ability of more people to access insurance makes long-term diabetes management possible for a larger number of people due to affordable expensive medications and treatments for diabetes, which would otherwise be too expensive.

More awareness of Type 1 diabetes and its impact on long-term health also drives the market. Today, more people are enlightened on the risks and complications associated with the disease, including the potential impacts on their organs and general health status. Increased awareness also entices earlier diagnosis and more proactive management of the condition than before, and this increases demand for effective diabetes treatments and technologies. The more people become aware of the need to maintain optimum glucose control, the more the demand will be for sophisticated systems to administer insulin, CGM devices, and innovative therapies. These are expected to fuel the growth in the market for Type 1 diabetes as a whole.

Type 1 Diabetes Market Restraints:

-

Stringent regulatory guidelines in many countries delay the approval of new and more effective diabetes medications, limiting market growth.

Stringent regulatory guidelines across numerous countries significantly impact the pace at which new and more effective diabetes medications reach the market. Regulatory authorities require extensive clinical trials, rigorous safety evaluations, and comprehensive efficacy data before granting approval. While these measures ensure patient safety and drug reliability, they often result in prolonged approval timelines, delaying the availability of innovative treatments. This slowdown restricts market expansion by limiting the introduction of novel therapies that could address unmet medical needs or offer improved outcomes. Consequently, pharmaceutical companies face increased development costs, delayed returns on investment, and restrained growth opportunities within the diabetes therapeutics sector.

Type 1 Diabetes Market Segment Analysis:

By Device Type

The insulin pump segment dominated the Type 1 diabetes market with a 38.9% share primarily because of its ability to provide continuous and precise insulin delivery; this coupled with improved glycemic control with minimal patient intervention makes the insulin pump a dominant player in the market. Insulin pumps, for instance, include hybrid closed-loop systems like Medtronic's MiniMed 670G and Tandem Diabetes Care's X2 with Control-IQ is the one most utilized because it dynamically adjusts insulin doses automatically in real-time glucose levels, meaning that this product essentially reduces risks of hypo and hyperglycemia tremendously, thus improving the overall quality of life of the patients. This category's fastest-growing is an insulin pen. This is because it is considered very convenient, affordable, and easy to use, making it the best choice in homecare settings where the patient would be looking for a less cumbersome alternative to syringes or pumps.

By Insulin Type

Long-acting insulin dominated the market in 2024 with a 52.1% share because it offers a steady, sustained level of insulin that can help in the maintenance of baseline glucose control throughout the day and night. Reduced frequency of administration increases its demand among patients as well as healthcare providers. The rapid-acting insulin segment is the growth leader as they are to be administered with every meal; hence, they play a very significant role in the insulin pump system that often requires these preparations as a substitute for the natural insulin responses to food.

By Distribution Channel

The hospital pharmacies segment dominated the market in 2024 due to a larger volume of prescriptions of insulin and device formulations within the clinical setting, particularly among newly diagnosed patients or those requiring intensive care. Online pharmacies, though, were growing at the fastest pace, given the surging shift towards digital health solutions, besides convenience and availability of subscription-based services for insulin and diabetes management supplies.

By End User

Homecare settings were the dominant market in 2024 due to various novel advances in insulin delivery systems, such as pumps and pens, which enable patients to manage the condition by themselves, thus reducing their hospital visits. The figure is growing rapidly in hospitals and clinics because patients are increasing in number and need professional diabetes management, particularly at early diagnosis and treatment stages and continuous monitoring and adjustment of regimens.

Type 1 Diabetes Market Regional Analysis:

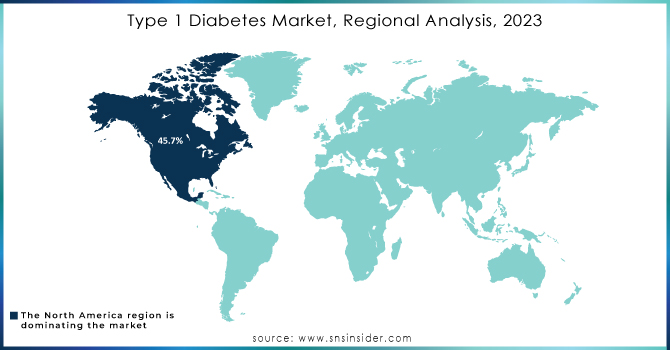

North America Type 1 Diabetes Market Trends:

North America held the largest revenue share in the global Type 1 diabetes market in 2024, accounting for 45.7% of the market. The primary driver is the growing number of patients, particularly children and adolescents. Additionally, strong participation by major pharmaceutical players in R&D for new diabetes treatments is accelerating market growth in the region.

Asia-Pacific Type 1 Diabetes Market Trends:

The Asia-Pacific region is witnessing the fastest growth in the Type 1 diabetes market, primarily due to the relatively lower cost of care compared to other regions. Increasing awareness, expanding healthcare infrastructure, and government initiatives to support diabetes management are also contributing to market expansion.

Europe Type 1 Diabetes Market Trends:

Europe’s growth in the Type 1 diabetes market is driven by increased consumer healthcare expenditures and advancements in health technologies. Germany is emerging as a rapidly growing country due to significant increases in early diabetes screenings and preventive measures.

Latin America Type 1 Diabetes Market Trends:

The Latin American market is growing with the introduction of new technologies for insulin delivery for both Type 1 and Type 2 diabetes patients. Continuous development of healthcare infrastructure and adoption of advanced diabetes management solutions are expected to further fuel market growth from 2024 to 2032.

Middle East & Africa Type 1 Diabetes Market Trends:

Growth in the Middle East and Africa is supported by rising awareness of diabetes management, government initiatives to improve healthcare access, and increasing investment in diabetes care infrastructure. Adoption of modern insulin delivery devices and expanding diagnostic facilities are also driving market expansion in the region.

Need any customization research on Type 1 Diabetes Market - Enquiry Now

Type 1 Diabetes Market Key Players:

-

Eli Lilly and Company

-

Merck & Co., Inc.

-

Novo Nordisk A/S

-

Sanofi S.A.

-

AstraZeneca PLC

-

Novartis AG

-

Pfizer Inc.

-

Macrogenics, Inc.

-

DiaVacs, Inc.

-

Biodel, Inc.

-

Boehringer Ingelheim GmbH

-

Mannkind Corporation

-

Abbott Laboratories

-

Astellas Pharma Inc.

-

GlaxoSmithKline PLC

-

Johnson & Johnson (Pharmaceutical Division)

-

Bayer AG (Pharmaceuticals)

-

Bristol-Myers Squibb Company

-

Amgen Inc.

-

Regeneron Pharmaceuticals, Inc.

Type 1 Diabetes Market Competitive Landscape:

Eli Lilly and Company, founded in 1876 and headquartered in Indianapolis, is a global pharmaceutical leader specializing in diabetes, oncology, immunology, and neuroscience treatments. The company develops innovative therapies, including insulin and oral GLP-1 drugs. Recent highlights include orforglipron’s successful Phase 3 trial, advancing regulatory submissions for obesity and diabetes.

-

In August 2025: Eli Lilly and Company, founded in 1876 and headquartered in Indianapolis, is a global pharmaceutical leader specializing in diabetes, oncology, immunology, and neuroscience treatments. The company develops innovative therapies, including insulin and oral GLP-1 drugs, with orforglipron’s successful Phase 3 trial advancing regulatory submissions for obesity and diabetes.

AstraZeneca, founded in 1999 and headquartered in Cambridge, UK, is a global biopharmaceutical company specializing in oncology, cardiovascular, renal, metabolic, respiratory, and autoimmune therapies. The company develops innovative medicines, including biologics and cell therapies. Recently, it advanced a Treg cell therapy for Type 1 diabetes through its collaboration with Quell Therapeutics.

-

In November 2024: AstraZeneca selected a Treg cell therapy candidate from Quell Therapeutics for Type 1 diabetes, advancing preclinical and clinical development. The partnership includes milestone payments, CMC support from Quell, and plans for first-in-human trials to explore immune-based treatments for autoimmune disorders.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 34.83 Billion |

| Market Size by 2032 | USD 63.61 Billion |

| CAGR | CAGR of 7.82% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Insulin Pen, Insulin Syringe, Insulin Pump, Insulin Jet Injectors) • By Insulin Type (Long-Acting Insulin, Rapid-Acting Insulin) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) • By End User (Homecare Settings, Hospitals & Clinics, Academic & Research Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Eli Lilly and Company, Merck & Co., Inc., Novo Nordisk A/S, Sanofi S.A., AstraZeneca PLC, Novartis AG, Pfizer Inc., Macrogenics, Inc., DiaVacs, Inc., Biodel, Inc., Boehringer Ingelheim GmbH, Mannkind Corporation, Abbott Laboratories, Astellas Pharma Inc., GlaxoSmithKline PLC, Johnson & Johnson (Pharmaceutical Division), Bayer AG (Pharmaceuticals), Bristol-Myers Squibb Company, Amgen Inc., Regeneron Pharmaceuticals, Inc. |