Neurorehabilitation Market Report Scope and Overview:

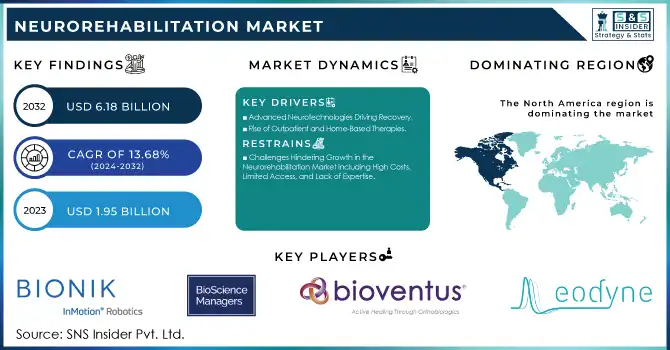

The Neurorehabilitation Market was valued at USD 2.22 billion in 2024 and is expected to reach USD 6.18 billion by 2032, growing at a CAGR of 13.68% over the forecast period 2025-2032.

The neurorehabilitation market is experiencing rapid growth, fueled by the increasing prevalence of neurological disorders and the adoption of advanced therapeutic technologies. For instance, according to the World Health Organization (WHO), globally, 15 million people suffer a stroke annually, with nearly 5 million left permanently disabled, underscoring the critical need for effective rehabilitation solutions. Similarly, traumatic brain injuries affect approximately 69 million individuals each year, further driving demand for neurorehabilitation services.

Technological advancements have revolutionized the field of neurorehabilitation. For instance, virtual reality (VR)-based interventions have shown significant promise in motor function recovery. For Instance, A study published in the Journal of NeuroEngineering and Rehabilitation demonstrated that VR-based therapy improved upper limb motor function in 65% of post-stroke patients compared to conventional methods. Additionally, robotic-assisted therapy devices such as exoskeletons are increasingly utilized to facilitate repetitive motion exercises, which are crucial for motor recovery. For example, devices like the EksoNR and Lokomat have been widely adopted in rehabilitation centers, demonstrating improved patient outcomes.

Get more information on Neurorehabilitation Market - Request Sample Report

Neurorehabilitation Market Size and Forecast:

-

Market Size in 2024: USD 2.22 billion

-

Market Size by 2032: USD 6.18 billion

-

CAGR (2025–2032): 13.68%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Neurorehabilitation Market Highlights:

-

Advanced neurotechnologies such as BCIs and TMS enhance recovery and reduce long-term disabilities.

-

AI tools help design personalized treatment plans and predict patient recovery.

-

Home-based and outpatient therapies improve patient convenience and adherence.

-

High costs of robotic and VR systems limit accessibility in some regions.

-

Shortage of trained neurologists and therapists affects service availability.

-

Lack of standardized protocols and limited insurance coverage restrict access to treatments.

Artificial intelligence (AI) is another transformative factor in this market. AI algorithms are being employed to design personalized treatment plans based on patient data, enhancing recovery efficiency. For example, AI-driven tools have successfully predicted patient recovery trajectories in stroke rehabilitation, allowing for optimized therapy sessions. Despite these advancements, challenges persist. Rehabilitation services are often expensive, with advanced robotic systems costing upwards of USD 100,000, limiting their accessibility in low-income regions. Moreover, a study cited by the American Heart Association revealed that only 30% of stroke patients in developing countries receive adequate rehabilitation.

Neurorehabilitation Market Drivers:

-

Advanced Neurotechnologies Driving Recovery

The integration of advanced neurotechnologies, such as brain-computer interfaces (BCIs) and non-invasive neurostimulation techniques like transcranial magnetic stimulation (TMS), is transforming the neurorehabilitation landscape. These technologies are crucial in enhancing neuroplasticity, which is the brain's ability to reorganize itself by forming new neural connections. This process is particularly beneficial for patients recovering from strokes, spinal cord injuries, or other neurological conditions. By promoting the brain's natural ability to heal and adapt, these technologies are leading to better recovery outcomes, reducing long-term disabilities, and accelerating rehabilitation timelines. The increasing adoption of these cutting-edge treatments is significantly driving the growth of the neurorehabilitation market.

-

Rise of Outpatient and Home-Based Therapies

Another major driver of growth in the neurorehabilitation market is the shift toward outpatient and home-based therapy options. With healthcare systems worldwide focusing on improving patient access and reducing costs, these alternatives are gaining significant traction. Home-based therapies offer patients the convenience of receiving treatment in the comfort of their own homes, without the need for frequent hospital visits. This not only enhances patient comfort but also promotes better adherence to rehabilitation programs. Additionally, outpatient services are making rehabilitation more accessible to populations in both developed and emerging markets. As a result, this trend is expanding the reach of neurorehabilitation services, particularly for those who may not have easy access to traditional inpatient rehabilitation centers.

Neurorehabilitation Market Restraints:

-

Challenges Hindering Growth in the Neurorehabilitation Market including High Costs, Limited Access, and Lack of Expertise

High costs associated with advanced technologies like robotic-assisted systems, brain-computer interfaces, and virtual reality platforms are a primary restraint. With devices costing over USD 100,000, many smaller healthcare facilities, particularly in low-income regions, cannot afford these innovations, limiting accessibility and adoption. Additionally, the shortage of skilled professionals, such as neurologists and therapists trained to use these complex systems, further hampers the market's growth. In developing countries, the lack of such expertise exacerbates the issue, delaying the widespread implementation of advanced neurorehabilitation therapies. Limited awareness of these technologies among patients and caregivers also plays a crucial role in slowing adoption. Cultural preferences for traditional methods and a lack of knowledge about the benefits of modern therapies hinder patients from seeking advanced treatments. Furthermore, the absence of standardized protocols and regulations creates uncertainty for healthcare providers and manufacturers, delaying the introduction of new technologies. Finally, inadequate insurance coverage and reimbursement policies make it difficult for many patients to access cutting-edge treatments, especially in economically disadvantaged areas, deepening healthcare access disparities. These factors combined pose significant challenges to the neurorehabilitation market's growth.

Neurorehabilitation Market Segment Analysis:

By Type

Neuro-robotic devices were the dominant segment in the neurorehabilitation market in 2024. These devices integrate robotics with neurorehabilitation therapies, enhancing patient recovery by facilitating repetitive movement, which promotes neuroplasticity. They are particularly effective in treating stroke, spinal cord injuries, and other neurological conditions. Neuro-robotic devices accounted for 45% of the market share in 2023. Their high functionality, precision, and ability to deliver personalized therapy made them a go-to choice in rehabilitation centers, especially in well-funded healthcare facilities that can accommodate these advanced technologies.

Brain-computer interfaces emerged as the fastest-growing segment throughout the forecast period. BCIs enable direct communication between the brain and external devices, bypassing damaged neural pathways to restore lost functions. They are being increasingly used in treating neurological conditions such as stroke, traumatic brain injury, and Parkinson’s disease. The rapid advancements in BCI technology, along with its expanding clinical applications in neurorehabilitation, are driving the growth of this segment.

By Application

Brain stroke was the dominant application in the neurorehabilitation market in 2024, accounting for around 35% of the market share. This is due to the high prevalence of stroke worldwide and the increasing focus on rehabilitation for recovery. Stroke patients require intensive rehabilitation therapies, particularly in motor function and cognitive recovery, where neurorehabilitation technologies like neuro-robotic devices and BCIs play a significant role in improving recovery outcomes.

Traumatic Brain Injury emerged as the fastest-growing application over the forecast period. The growing prevalence of TBI, especially in younger populations, military personnel, and athletes, combined with the increasing adoption of advanced neurorehabilitation techniques, is fueling this segment's growth. Technologies like neuro-robotic devices and BCIs are increasingly being used to enhance recovery outcomes, focusing on motor and cognitive rehabilitation for TBI patients.

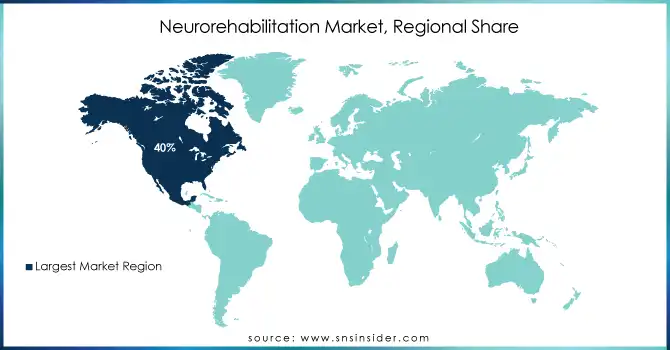

Neurorehabilitation Market Regional Analysis:

North America Neurorehabilitation Market Trends:

North America held the largest share of the market, accounting for around 40% in 2024. This dominance is attributed to advanced healthcare systems, high adoption of cutting-edge technologies like neuro-robotic devices and brain-computer interfaces, and substantial investments in neurorehabilitation research and development. The United States, in particular, has a well-established market due to the increasing number of stroke, traumatic brain injury, and spinal cord injury cases, as well as the presence of key market players.

Asia-Pacific Neurorehabilitation Market Trends:

The Asia Pacific region is anticipated to be the fastest-growing neurorehabilitation market. This is driven by rising healthcare awareness, improving infrastructure, and an increase in the incidence of neurological disorders. Countries like China and India are witnessing an uptick in demand for neurorehabilitation services due to expanding healthcare access and growing investment in medical technology, making it the key growth region moving forward.

Europe Neurorehabilitation Market Trends:

Europe represents a significant share of the neurorehabilitation market, supported by strong healthcare infrastructure, favorable reimbursement policies, and growing adoption of advanced rehabilitation technologies. The region is witnessing increasing demand for robotic-assisted therapies and virtual reality-based rehabilitation programs. Countries such as Germany, the U.K., and France are leading in terms of innovation and adoption, driven by rising neurological disorder prevalence and supportive government initiatives for rehabilitation services.

Latin America Neurorehabilitation Market Trends:

Latin America is experiencing steady growth in the neurorehabilitation market, driven by improving healthcare facilities, rising awareness of neurological care, and gradual adoption of advanced rehabilitation technologies. Brazil and Mexico dominate the regional market due to higher healthcare investments and the presence of specialized neurorehabilitation centers. However, limited reimbursement structures and affordability constraints in some parts of the region remain challenges to widespread adoption.

Middle East & Africa Neurorehabilitation Market Trends:

The Middle East & Africa region shows emerging opportunities for the neurorehabilitation market, primarily fueled by expanding healthcare infrastructure and government initiatives to modernize medical services. Countries like Saudi Arabia, the UAE, and South Africa are leading the adoption of advanced rehabilitation systems. However, overall market penetration remains lower compared to other regions due to limited specialist availability and high treatment costs, though increasing investments in healthcare are expected to drive future growth.

Need any customization research on Neurorehabilitation Market - Enquiry Now

Neurorehabilitation Market Key Players:

-

Bionik Laboratories Corp.(InMotion ARM, InMotion Hand)

-

BioScience Managers Ltd. – Rex Bionics Ltd (Rex Robot)

-

Bioventus – Bioness Inc. (Ness H200, Ness L300)

-

DIH– Hocoma AG (Lokomat, Armeo, Valedo)

-

Ekso Bionics Holdings, Inc. (EksoGT)

-

Eodyne (Neurorehabilitation technologies)

-

Neofect (Smart rehabilitation systems)

-

Neuro Rehab VR (VR-based rehabilitation solutions)

-

Reha Technology AG (Robotic rehabilitation systems)

-

ReWalk Robotics Ltd. (ReWalk Exoskeleton)

-

Abbott Laboratories (Neuromodulation therapies)

-

Helius Medical Technologies (Portable neurostimulation devices)

-

Medtronic Inc. (Deep Brain Stimulation systems)

-

Tyromotion GmbH (Amadeo, Diego, Pablo)

-

Cyberdyne Inc. (HAL Exoskeleton)

-

Myomo Inc. (MyoPro Orthosis)

-

Fourier Intelligence (ExoMotus, ArmMotus)

-

MindMaze (MindMotion GO, MindPod)

-

Motek Medical (GRAIL, C-Mill)

-

Rex Bionics Ltd. (Rex Exoskeleton)

Neurorehabilitation Market Competitive Landscape:

Kemtai is an Israeli healthtech startup founded in 2019. The company specializes in AI-powered computer vision technology to deliver real-time, sensor-free motion tracking and corrective feedback for home-based rehabilitation and fitness. Their platform, Kemtai CARE, enables healthcare providers to remotely monitor patient adherence and performance.

-

In Dec 2024, The Mondino Foundation partnered with Kemtai to launch a groundbreaking research initiative aimed at assisting Parkinson's patients with Pisa Syndrome. The project will utilize Kemtai CARE's advanced computer vision platform to help patients maintain their rehabilitation progress post-hospitalization, supporting ongoing recovery at home.

Neuro-Optometric Rehabilitation Association (NORA), founded in 1990, is an interdisciplinary organization dedicated to advancing neuro-optometric care. It focuses on providing comprehensive visual rehabilitation services, promoting professional knowledge, increasing awareness of neuro-optometric needs, and supporting collaboration among specialists for patients with brain injuries.

-

In September 2024, the Neuro-Optometric Rehabilitation Association appointed Barbara Barclay, a leader in eye-tracking technology and health tech, as its new Executive Director, effective October 1. Barclay's expertise will drive the organization's efforts to advance neurorehabilitation.

Strolll is a UK-based digital therapeutics startup founded in 2020, specializing in augmented reality (AR) solutions for neurorehabilitation. In August 2024, the company secured a $3 million partnership with Cleveland Clinic to integrate its AR platform with the clinic's Dual-task Augmented Reality Treatment (DART) module, aimed at enhancing gait and cognitive function in Parkinson's patients. This collaboration also includes an equity stake for Cleveland Clinic in Strolll.

-

In Aug 2024, Strolll secured a USD 3 million partnership with the Cleveland Clinic to expand its augmented reality neurorehabilitation platform for Parkinson’s disease. Under the exclusive software license agreement, Cleveland Clinic will also become a shareholder in Strolll, helping extend prescribed AR rehab into patients' homes.

Trilife Hospital, established in 2013, is a multispecialty healthcare provider located in Kalyan Nagar, Bangalore. In March 2024, the hospital inaugurated a 60,000 sq. ft. Neuro Rehabilitation and Sports Medicine Center, one of the city's largest outpatient facilities, equipped with advanced technology to enhance patient care and recovery.

-

In March 2024, Trilife Hospital unveiled a state-of-the-art Neuro Rehabilitation and Sports Medicine Center to revolutionize outpatient care. Spanning 60,000 square feet, the new facility is one of the largest in the city and features the latest equipment and technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.22 billion |

| Market Size by 2032 | USD 6.18 billion |

| CAGR | CAGR of 13.68% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Neuro-Robotic Devices, Non-Invasive Stimulators, Brain-Computer Interfaces) • By Application (Brain Stroke, Parkinson's Disease, Multiple Sclerosis, Spinal Cord Injury, Traumatic Brain Injury, Cerebral Palsy, Others) • By End User (Rehabilitation Centers, Hospitals, Clinics) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Bionik Laboratories Corp., BioScience Managers Ltd. – Rex Bionics Ltd., Bioventus – Bioness Inc., DIH – Hocoma AG, Ekso Bionics Holdings Inc., Eodyne, Neofect, Neuro Rehab VR, Reha Technology AG, ReWalk Robotics Ltd., Abbott Laboratories, Helius Medical Technologies, Medtronic Inc., Tyromotion GmbH, Cyberdyne Inc., Myomo Inc., Fourier Intelligence, MindMaze, Motek Medical, Rex Bionics Ltd. |