Brain Computer Interface Market Report Scope & Overview:

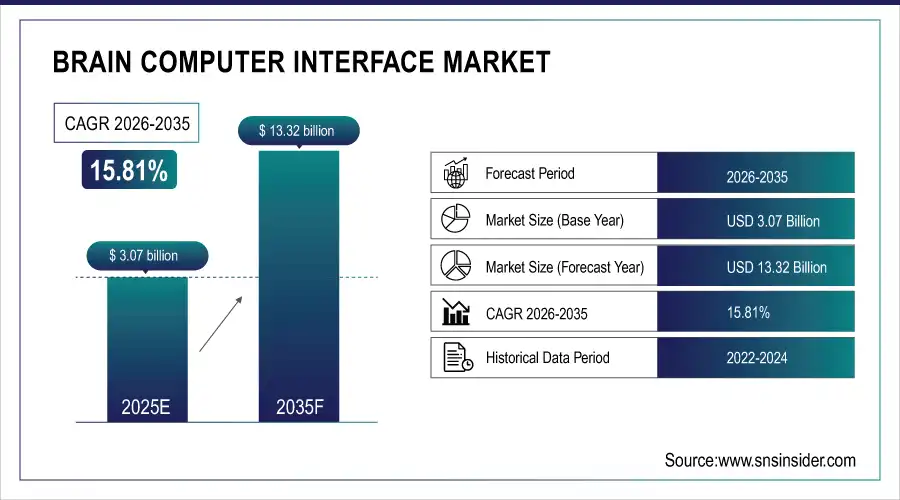

The brain computer interface market size is estimated at USD 3.07 billion in 2025 and is expected to reach USD 13.32 billion by 2035, growing at a CAGR of 15.81% over the forecast period of 2026-2035.

The global brain computer interface market trend is rising prevalence of neurological disorders, including stroke, epilepsy, and spinal cord injuries, on account of aging population, increasing incidence of neurodegenerative diseases, and advancements in neural signal processing technologies are impacting the growth of the market. Increasing awareness and adoption of assistive technologies are other catalysts to this market trend as patients and healthcare providers become increasingly aware of BCI capabilities and are more willing to invest in these innovative solutions, which will lead to growth in the medical and military applications market, both domestically and globally.

For instance, in March 2024, growing awareness and improved accessibility drove a 22% increase in BCI clinical trials for paralysis and motor disorders in North America, boosting early adoption and medical application development.

Brain Computer Interface Market Size and Forecast:

-

Market Size in 2025E: USD 3.07 billion

-

Market Size by 2035: USD 13.32 billion

-

CAGR: 15.81% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Brain Computer Interface Market - Request Free Sample Report

Brain Computer Interface Market Trends

-

The increasing prevalence of neurological disorders, paralysis and neurodegenerative diseases is bringing forth the need for advanced and effective BCI systems.

-

Developing patient-specific interfaces based on neural patterning, cognitive abilities, and specific medical conditions for better signal accuracy.

-

Wireless BCIs, signal processing with AI, and machine learning algorithms to improve device performance and reduce latency are introduced.

-

Using cloud computing, edge AI and remote monitoring platforms for real-time data analysis, patient tracking, and adaptive learning systems.

-

Demand for non-invasive headsets, wearable EEG devices, and hybrid systems to help convenience, safety and more widespread adoption.

-

Collaborations between medical device companies, tech giants, neuroscience research centers and AI firms to develop novel BCI solutions and improve clinical outcomes.

-

FDA, EMA and local authorities promoting standardized guidelines for clinical trials, safety protocols, and efficacy testing, and public awareness of BCI applications.

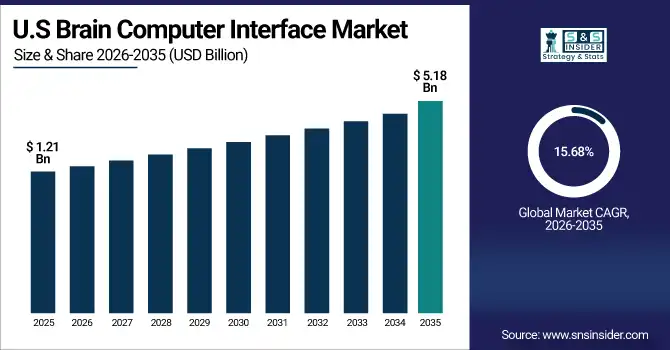

The U.S. brain computer interface market is estimated at USD 1.21 billion in 2025 and is expected to reach USD 5.18 billion by 2035, growing at a CAGR of 15.68% from 2026-2035. The U.S. has the highest market share as the brain computer interface market is highly affected due to the prevalence of neurological disorders, increased research funding, and the presence of developed healthcare infrastructure. Market growth is boosted by advanced neuroscience research facilities, relatively high access to medical and consumer-grade BCI devices, and greater healthcare spending on innovative technologies. Moreover, regulatory backing along with early adoption of novel invasive and non-invasive BCI systems catapult the U.S. as the largest regional market globally.

Brain Computer Interface Market Growth Drivers:

-

Technological Advancements in Neural Signal Processing are Driving the Brain Computer Interface Market Growth

Technological advancements take the center stage as a growth driver for the brain computer interface market share, and are driven by the introduction of AI-powered algorithms, wireless connectivity, and miniaturized electrode systems for increased accuracy and patient comfort. These signal detection, real-time processing, and adaptive learning solutions are driving the base market, the penetration of medical and military applications, and increasing the market share globally.

For instance, in June 2025, AI-enabled non-invasive BCI systems accounted for ~24% of the total U.S. BCI device sales, reflecting growing patient preference and expanding market share.

Brain Computer Interface Market Restraints:

-

High Cost and Limited Accessibility are Hampering the Brain Computer Interface Market Growth

This high price and limited availability of brain computer interface systems restrain the growth of brain computer interfaces, as many patients are non-treated with expensive devices and surgeries. This may lead to low rates of uptake, low market penetration, and a chronic therapy. This leads to endangerment in patient outcomes and slow market adoption in areas with low healthcare budgeting and BCI device insurance.

Brain Computer Interface Market Opportunities:

-

Expansion into Consumer and Entertainment Applications Drive Future Growth Opportunities for the Brain Computer Interface Market

The opportunity in the expansion into consumer and entertainment markets of brain computer interfaces within gaming interfaces, virtual reality link up functionality, and smart home controls. The solutions provide immersive experiences, control of devices without using hands, and also have features that enable disabled people to use the devices. The direct in house access to functioning drugs will increase and enrich quality of life due to the improved user experience, increased convenience, and price – especially in the developed technized markets – that ultimately could lead in increase of consumer recognition and a promising market expansion potential.

For instance, in March 2024, the NIH stated 5.4 million Americans are paralyzed, evidence of a growing patient population and need to deliver effective BCI rehabilitation options.

Brain Computer Interface Market Segment Analysis

-

By product, non-invasive BCI held the largest share of around 58.42% in 2025E, and is expected to register the highest growth with a CAGR of 16.24%.

-

By application, healthcare segment dominated the market with approximately 44.67% share in 2025E, while entertainment & gaming is expected to register the highest growth with a CAGR of 17.38%.

-

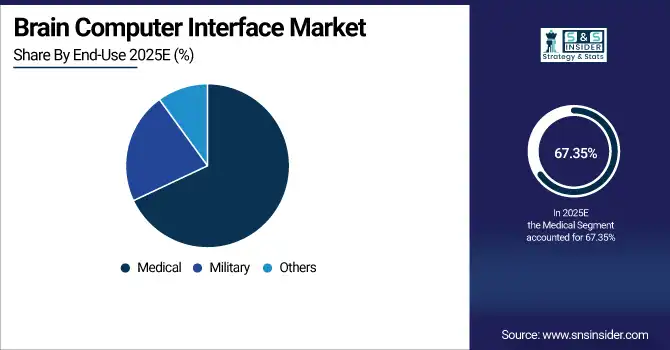

By end-use, medical accounted for the leading share of nearly 67.35% in 2025E, and is expected to register the highest growth with a CAGR of 16.12%.

By Product, Non-Invasive BCI Leads the Market, and Registers Fastest Growth

The Non-invasive BCI segment generated the largest revenue share of 2025 at about 58.42% because of its safer profile, ease of use, and lower cost than surgical alternatives. New technologies, such as EEG-based headsets, consumer grade devices, and wearable BCI systems. Compared, the invasive BCI segment will grow at its highest CAGR of nearly 16.24% in 2026-2035 due to the increasing need for accessible brain monitoring, gaming applications, and smart home integration. There are several reasons for this, including increasing awareness of neurotechnology, the availability of cheap consumer devices, and technological improvements in signal quality.

By Application, the Healthcare Segment Dominates, while Entertainment & Gaming Shows Rapid Growth

The healthcare segment held the largest revenue share of approximately 44.67% in 2025, owing to the critical need for rehabilitation solutions, assistive communication devices, and treatment of neurological disorders. Key factors driving this renaissance are increased patient awareness and early diagnosis, physician preference for prescribing BCI-based therapies for stroke and paralysis patients.

The entertainment & gaming segment is predicted to grow at the strongest CAGR of approximately 17.38% during 2026–2035, driven by increasing adoption of immersive gaming experiences and virtual reality integration. Some causes include enhanced awareness of neurogaming technologies, better affordability, and consumer demand for innovative interactive experiences.

By End-Use, Medical Leads, and Registers Fastest Growth

The medical segment accounted for the largest share of the brain computer interface market with about 67.35%, owing to its critical applications in treating paralysis, enabling communication for locked-in patients, and supporting cognitive rehabilitation. Reasons driving the neurological disorder treatment market include increasing patient preference for advanced assistive technologies and neuroprosthetics. It will also grow at the fastest rate, with a CAGR of around 16.12% between 2026 and 2003, since medical BCI systems can offer revolutionary solutions, restore motor function and enable independent living. They are largely driven by increased research funding and clinical trial success, supported by strong regulatory policies and reimbursement policies in developed countries.

Brain Computer Interface Market Regional Highlights:

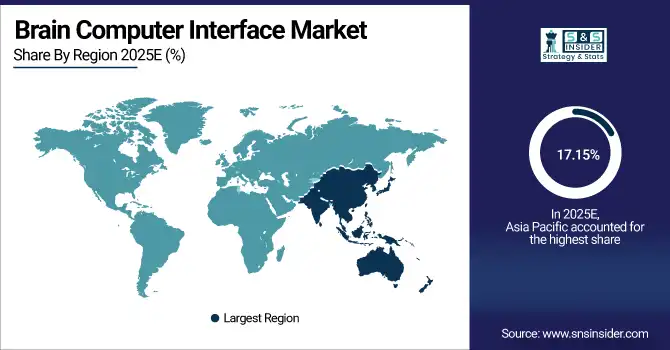

Asia Pacific Brain Computer Interface Market Insights:

Asia Pacific is the fastest-growing segment in the brain computer interface market with a CAGR of 17.15%, as the awareness about neurotechnology, government support for healthcare innovation, and expanding research infrastructure in developing nations is growing. Factors including rapid urbanization, rising elderly population with neurological conditions, and growing uptake of medical and consumer BCI devices are stimulating the market growth. Both tech companies’ investments and university research partnerships have also contributed significantly towards improving development capabilities, particularly in China, Japan and South Korea. Government programs and neuroscience education campaigns also promote early detection and appropriate treatment. Asia Pacific growth is driven by a lower manufacturing cost in comparison to Western markets, and the growing cost and availability of non-invasive and partially invasive systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Brain Computer Interface Market Insights:

North America accounted for the highest revenue share of approximately 41.53% in 2025 of the brain computer interface market, owing to the high rates of neurological disorders, strong medical research ecosystem, and public awareness of assistive technologies. Pushing factors include easy availability of advanced BCI systems, high diagnosis rates, strong venture capital funding, and increased acceptance of novel invasive and non-invasive devices. Furthermore, government projects, early-stage research grants, and increased healthcare spending on neurotechnology are ensuring market dominance and substantial revenues in the global sales of brain computer interface systems.

Europe Brain Computer Interface Market Insights:

The brain computer interface market in Europe is the second-dominating region after North America on account of an increase in the prevalence of stroke and spinal cord injuries, strong healthcare infrastructure, and increasing awareness among patients about rehabilitation technologies. Rising uptake of medical and research-grade BCI systems, advanced neuroscience facilities, favorable reimbursement policies, and government-backed disability support programs are also contributing to the sustained growth of the market in leading European countries.

Latin America (LATAM) and Middle East & Africa (MEA) Brain Computer Interface Market Insights:

In Latin America, and Middle East & Africa, the growing incidence of neurological conditions and increase in healthcare awareness with access to assistive technologies support the brain computer interface market growth. The rising popularity of non-invasive devices and telemedicine integration, along with public health initiatives, will aid early diagnosis and treatment adoption. The increasing urban population and increasing disposable income in these regions are continuing to encourage market growth.

Brain Computer Interface Market Competitive Landscape:

Neuralink Corporation (est. 2016) is a neurotechnology company that focuses on developing implantable brain-machine interfaces to restore autonomy for people with paralysis. It uses cutting-edge electrode arrays and surgical robotics to produce revolutionary invasive BCI systems with high-bandwidth neural communication capabilities.

-

In January 2025, it successfully completed a second human implant trial demonstrating improved motor control and cursor navigation, advancing its mission to restore function for paralyzed individuals and expand clinical applications.

Medtronic plc (est. 1949) is a well-known global medical technology company focused on chronic disease management and surgical innovations. It invests in neurostimulation and brain sensing technologies with the hopes of revolutionizing the treatment of neurological disorders with effective, safe, and minimally invasive BCI solutions.

-

In March 2024, launched a closed-loop deep brain stimulation system with adaptive algorithms in the United States for treating Parkinson's disease, enhancing personalized therapy, symptom control, and patient quality of life.

Blackrock Neurotech (est. 2008) is a global leader in brain-computer interface technology. The company's medical-grade neural interface portfolio focuses on restoring movement and communication for paralyzed patients, and features a strong research collaboration pipeline to complement the strong market presence in both clinical and research settings.

-

In November 2024, received FDA Breakthrough Device Designation for its next-generation cortical implant targeting upper limb restoration in tetraplegia patients, strengthening its clinical portfolio and expanding treatment possibilities.

Brain Computer Interface Market Key Players:

-

Neuralink Corporation

-

Medtronic plc

-

Blackrock Neurotech

-

Synchron Inc.

-

Kernel

-

Emotiv Inc.

-

NeuroSky Inc.

-

Compumedics Limited

-

Advanced Brain Monitoring Inc.

-

g.tec medical engineering GmbH

-

NIHON KOHDEN CORPORATION

-

Natus Medical Incorporated

-

ANT Neuro

-

Brain Products GmbH

-

OpenBCI

-

Cognionics Inc.

-

BrainCo Inc.

-

NextMind (acquired by Snap Inc.)

-

Paradromics Inc.

-

CTRL-labs (acquired by Meta)

-

MindMaze

-

Neurolief Ltd.

-

Brainlab AG

-

BrainQ Technologies Ltd.

-

Cortec GmbH

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.07 Billion |

| Market Size by 2035 | USD 13.32 Billion |

| CAGR | CAGR of 15.81% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Invasive, Partially Invasive BCI, Non-invasive) • By Application (Healthcare, Communication & Control, Smart Home Control, Entertainment & Gaming) • By End Use (Medical, Military, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Neuralink Corporation, Medtronic plc, Blackrock Neurotech, Synchron Inc., Kernel, Emotiv Inc., NeuroSky Inc., Compumedics Limited, Advanced Brain Monitoring Inc., g.tec medical engineering GmbH, NIHON KOHDEN CORPORATION, Natus Medical Incorporated, ANT Neuro, Brain Products GmbH, OpenBCI, Cognionics Inc., BrainCo Inc., NextMind (acquired by Snap Inc.), Paradromics Inc., CTRL-labs (acquired by Meta), MindMaze, Neurolief Ltd., Brainlab AG, BrainQ Technologies Ltd., Cortec GmbH |