Nuclear Robots Market Size & Growth Trends:

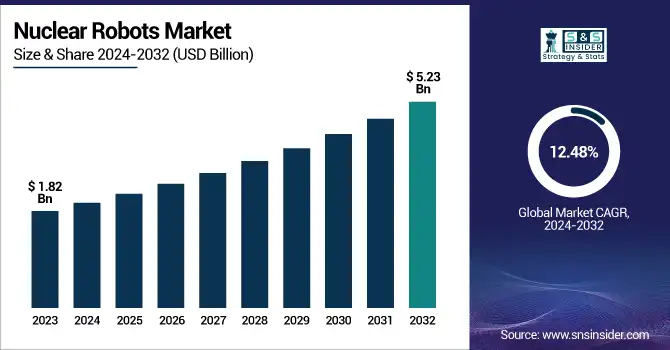

The Nuclear Robots Market was valued at USD 1.82 billion in 2023 and is expected to reach USD 5.23 billion by 2032, growing at a CAGR of 12.48% over the forecast period 2024-2032.

To Get more information on Nuclear Robots Markett - Request Free Sample Report

Several advancements in robot design such as enhancing accuracy, mobility, and autonomous operation, drive the growth of the nuclear robots market. To make these plants safer and more efficient, several measures built on robotics innovations have been taking increased strides in following along the energy transition road to help automate hazardous tasks. Increased capabilities enabled by technological innovations like AI, machine learning, and advanced sensors allow robots to perform ever more complex operations in increasingly challenging environments. Forward deployment across a range of nuclear applications, such as reactor inspection, decommissioning, and waste management, is increasingly commonplace, enhancing efficiency and minimizing endangerment to personnel.

In 2024, projects such as the Container Counting and Inventory Verification through Detectors on Robotic Inspection Platforms (IV-DRIP) began at the U.S. Department of Energy's National Nuclear Security Administration (NNSA), which utilizes robots for nuclear material container inspections at the Nevada National Security Site. Argonne National Lab also designed a dual-arm telerobotic cleanup system for use in hazardous waste sites, which it successfully demonstrated at Oak Ridge National Lab. Officials said the moves reflect the growing use of robotic systems at U.S. nuclear facilities to improve safety and efficiency.

The U.S. Nuclear Robots Market is estimated to be USD 0.50 Billion in 2023 and expected to reach USD 1.41 Billion by 2032 is projected to grow at a CAGR of 12.26%. Expansion of the U.S. nuclear robots market owing to the development of nuclear robotics technology including AI and advanced sensing, which improves the operational efficiency and safety of nuclear plants. The market is also being propelled by the rising adoption of reactor inspections, waste management, and decommissioning, supported by government initiatives and financing.

Nuclear Robots Market Dynamics

Key Drivers:

-

Driving Forces Behind the Growth of Nuclear Robots Market with Aging Infrastructure and Safety Demands

Aging nuclear infrastructure is a major driver for the nuclear robots market, as the complex ecosystems that constitute the nuclear power generation process have a high potential for both employee safety and process efficiency improvements. As numerous reactors are now meeting their place-operational-decision-point, this challenge has increased the demand for robotics and automation solutions for decommissioning and waste handling. This enables these robots to carry out difficult tasks in areas of dangerous radiation without having to endanger the lives of human beings. In addition, stringent government regulations and international-level safety standards have further incentivized nuclear plant operators to use sophisticated robotics in their inspection, maintenance, and cleanup operations. Market Dynamics The increasing number of inspections of nuclear plants as well as the ongoing global attention on sustainable and safe nuclear energy can boost growth in the market.

Restrain:

-

Challenges in Designing Stable Nuclear Robots and High Costs Impacting Innovation and Adoption Timelines

The complexity of designing robots that are capable of functioning stably in highly radioactive and unpredictable environments is one of the key restraints in the global nuclear robot market. It is going to need to be filled with a protective layer, unique resources, and several protection systems, mounting the latter entry on a focused advancement path. The costs involved in certifying and testing new robotic systems before they can even be deployed in a nuclear environment are also substantial, as the industry itself is highly regulated. This impacts the innovation and adoption timelines. Also, older facilities tend to have a lack of standardization making integrations with legacy infrastructure technically difficult.

Opportunity:

-

Opportunities in AI IoT Robotics for Enhanced Autonomy Clean Energy and Global Nuclear Infrastructure Growth

One of the biggest opportunities is further combining AI, IoT, and other advanced sensors with nuclear robots for enhanced autonomy as well as data-driven diagnostics and predictive maintenance. Advances in aerial and underwater robotics can also create additional use cases in radiation mapping and deep-site exploration, especially in areas not previously accessible. Moreover, the construction of new nuclear infrastructure in developing countries reinforces future robotics demand for construction, operation, and safety assessment. Partnerships between new-tech start-ups and the nuclear sector can also speed up progress and push the market. The demand for nuclear robotics will grow with the international priority on clean energy.

Challenges:

-

Challenges in Expertise Navigation and Data Transmission Hindering Adoption and Operation of Nuclear Robots

A major problem is the lack of expertise to operate and maintain such complex nuclear robotic systems. This skills deficit translates into slower operational performance and slower adoption of these technologies. Moreover, outdoor real-time navigation and manipulation of robots in diverse, lead-rich, and messy spaces is an unsolved problem, particularly when well-known solutions to localization systems e.g., GPS and GPS-like systems, cannot perform. Maintaining accurate and stable robotic motion while transmitting the necessary data in such adverse conditions remains a significant challenge. Specialized training and collaboration between robotics engineers and nuclear experts are likewise necessary to achieve practical implementation.

Nuclear Robotics Industry Segmentation Outlook

By Type

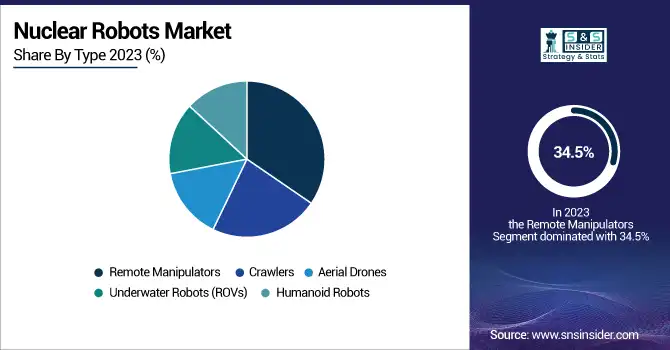

Remote Manipulators are dominating the nuclear robots market as of 2023 with a dominating market share of 34.5%. Such systems are applicable at nuclear plants for activities including radioactive waste processing and sorting, and also decommissioning tasks. The operability of precise human-like movements at a distance makes them essential in high-radiation environments they keep workers safe while ensuring the work gets done.

The Aerial Drones segment is expected to register the highest CAGR from 2024 to 2032 owing to increasing utilization in radiation detection, structural inspection, & environmental monitoring. The ability to reach inaccessible or dangerous areas fast is a huge asset for nuclear site assessments, particularly in events following an accident. AI and sensor technology are rapidly making drones more autonomous, accurate, and efficient leading to increasing adoption of these airborne robots for use in in active nuclear power plants and decommissioning projects. Such a move is in keeping with the wider trend in the nuclear sector that has seen an option for more automation and remote monitoring.

By End Use

The Nuclear Waste handling segment in the nuclear robots market held a large revenue share of 29.6% in 2023. This high demand results from the essential requirement for the disposal and manipulation of radioactive waste material while preventing humans from enveloping radiative materials and areas. This segment sees the mass deployment of Robots to attain precision, efficiency, and regulatory compliance with very high safety standards. They are crucial in reducing health risks and operational downtime, given their capability to work in zoned sections of low space and high pollution.

The most rapidly expanding type during the forecast period (2024-2032) is expected to be nuclear decommissioning. As an increasing number of old nuclear reactors go beyond the end of their life, the need for robotic systems to decommission and decontaminate these facilities is growing fast. Such tasks include structural dismantling, contamination assessment, and debris clearing, which can be best performed by robots. Rising global emphasis on the protection of the environment and regulatory compliance is fostering the use of robots in decommissioning activities.

Nuclear Robots Market Regional Analysis

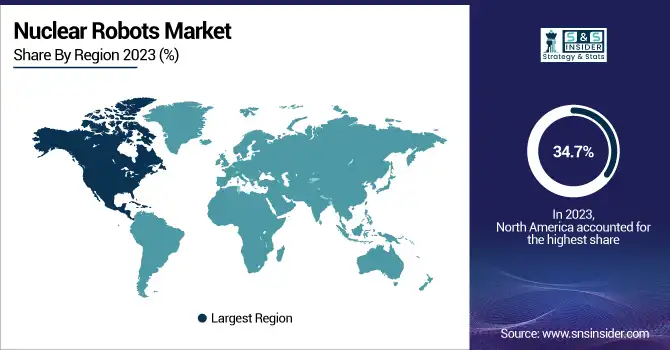

North America has the largest market for nuclear robots in 2023, accounting for 34.7% of the market due to its extensive nuclear infrastructure as well as decommissioning projects ongoing in the region. Especially, the U.S. uses robotic systems for maintenance, waste, or radiation handling in toxic environments. One of the most infamous is the Hanford Site, a superfund site in Washington, where remotely piloted robots are being used to clean up one of the most contaminated environments on the planet. Further, entities such as the U.S. Department of Energy (DOE) have made several investments to research robotics related to nuclear applications, which will bolster the North American market.

Asia Pacific is expected to witness the highest CAGR from 2024 to 2032, owing to the growing investment in nuclear power and the rising safety concerns. With the increase in countries such as China, Japan, and India expanding their nuclear energy programs, there is an increasing demand for robotic solutions for construction, inspection, and safety operations. As an example, Japan expanded the utilization of nuclear robots for radiation measurement and reactor decontamination after the Fukushima Daiichi incident. China has invested in robotics for its rapidly advancing fleet of nuclear power plants, and also to integrate technology to improve operational safety and efficiency.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in the Nuclear Robots Market are:

-

Boston Dynamics (Spot)

-

iRobot (Terabot)

-

FANUC (M-20iA)

-

ABB (IRB 6700)

-

KUKA Robotics (KR Quantec)

-

Intuitive Surgical (da Vinci Surgical System)

-

Yaskawa Electric (Motoman GP Series)

-

Clearpath Robotics (Grizzly)

-

Toshiba (Sora)

-

Adept Technology (Adept Viper)

-

Schaft Robotics (Schaft Robot)

-

Kawasaki Robotics (RS007N)

-

Robot System Products (RP Robot)

-

Brokk (Brokk 50)

-

Lovelace Robotics (Lovelace-LS)

Recent Trends

-

In March 2025, Boston Dynamics expanded its collaboration with NVIDIA to enhance the AI capabilities of its Atlas humanoid robot, integrating NVIDIA's Isaac GR00T and Jetson Thor platforms.

-

In April 2024, Yaskawa Electric Corporation will invest EURO 32 million to build new robot assembly and distribution facilities in Kočevje, Slovenia. The expansion aims to enhance production capacity and streamline distribution across Europe, the Middle East, and Africa.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.82 Billion |

| Market Size by 2032 | USD 5.23 Billion |

| CAGR | CAGR of 12.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Remote Manipulators, Crawlers, Aerial Drones, Underwater Robots (ROVs), Humanoid Robots) • By End Use (Nuclear Waste Handling, Nuclear Decommissioning, Radiation Cleanup, Nuclear Power Plants, Research & Exploration, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Boston Dynamics, iRobot, FANUC, ABB, KUKA Robotics, Intuitive Surgical, Yaskawa Electric, Clearpath Robotics, Toshiba, Adept Technology, Schaft Robotics, Kawasaki Robotics, Robot System Products, Brokk, Lovelace Robotics. |