Underwater Robotics Market Size & Trends:

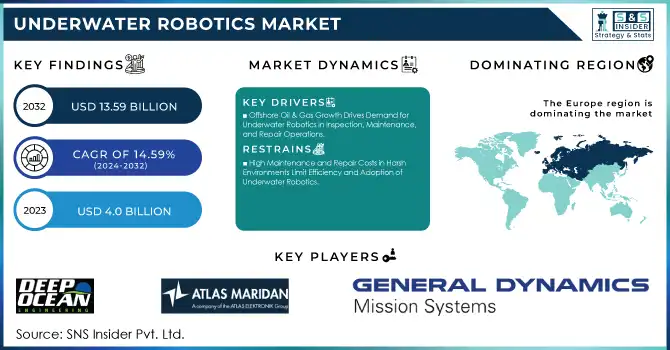

The Underwater Robotics Market Size was valued at USD 4 billion in 2023 and is expected to reach USD 13.59 billion by 2032, growing at a CAGR of 14.59% from 2024-2032.

The underwater robotics market is witnessing significant expansion, fueled by technological advancements and the increasing demands of industries such as oil and gas, marine research, defense, and offshore infrastructure. These technological advancements have resulted in the creation of more advanced robotic systems capable of executing intricate tasks at deeper levels and with improved accuracy.

To get more information on Underwater Robotics Market - Request Free Sample Report

As these technologies advance, the need for underwater robotics keeps increasing, especially for their capacity to gather essential data, observe underwater ecosystems, and investigate areas that were previously unreachable. For instance, in January 2025, scientists in China created an underwater robot that can get close to the seabed without creating disturbances. This advancement tackles difficulties in traversing rough landscapes, including barriers and inclines, thereby broadening the possible uses of underwater robots in sensitive and intricate settings.

The increasing demand is primarily because underwater robots can improve operational efficiency and reduce human risk in hazardous underwater settings. For instance, in the oil and gas sector, these robots are crucial for tasks such as inspecting and repairing pipelines, while in the defense field, they are being utilized more for surveillance and detecting mines. In June 2024, researchers funded by NSF created AI-driven autonomous underwater vehicles to improve marine conservation initiatives by effectively gathering data on species distribution and ecosystem dynamics. With the expansion of these applications, sectors are progressively depending on these systems for a wider array of tasks, driving the swift growth of the market and emphasizing the necessity for even more sophisticated solutions to address these varied and changing challenges.

Looking to the future, the market presents immense possibilities as the fusion of artificial intelligence, autonomous features, and real-time data analysis revolutionizes underwater robotics. These advancements will allow robots to function more independently and adjust to changing environments, leading to reduced costs and increased overall market demand. In September 2024, Beam introduced the first AI-powered autonomous underwater vehicle, improving efficiency and lowering expenses in inspections of offshore wind farms. Additionally, as sectors aim to harness sustainable resource management and underwater extraction, the demand for specialized underwater robotics will keep increasing, creating fresh opportunities for technological advancement and market growth.

Underwater Robotics Market Dynamics

Drivers

-

Offshore Oil & Gas Growth Drives Demand for Underwater Robotics in Inspection, Maintenance, and Repair Operations

With the increase in offshore oil and gas exploration, the need for sophisticated underwater robotics is rising. Remotely operated vehicles and autonomous underwater vehicles have become crucial for examining, maintaining, and fixing offshore infrastructure in difficult and extreme underwater conditions. These vehicles offer notable benefits, like minimizing reliance on human divers in hazardous environments, boosting operational efficiency, and increasing safety during underwater operations. As deepwater drilling initiatives grow increasingly intricate, the capacity of ROVs and AUVs to carry out vital tasks like pipeline assessments, equipment maintenance, and underwater construction has rendered them indispensable in the sector. As exploration efforts reach further into distant regions, underwater robotics advance, addressing the growing demand for accurate and dependable operations in extreme ocean depths.

-

Technological Advancements Enhance Efficiency, Durability, and Capabilities of Underwater Robotics for Expanded Market Applications

The ongoing development of underwater robotics technology is greatly improving their effectiveness and adaptability in multiple sectors. Advancements in robotics have resulted in the development of stronger, smarter systems featuring enhanced navigation, data gathering, and instant communication abilities. These improvements allow robots to function more independently in intricate settings, execute tasks with increased accuracy, and endure severe underwater circumstances. The incorporation of artificial intelligence and machine learning enhances decision-making capabilities and boosts operational efficiency. These advancements in technology are creating new opportunities for underwater robotics, allowing for their application in a broader array of fields, including scientific exploration, environmental surveillance, and industrial activities. As these technologies progress, the capacity for underwater robotics to address difficult tasks and generate operational savings grows even larger, enhancing their market attractiveness and application.

Restraints

-

High Maintenance and Repair Costs in Harsh Environments Limit Efficiency and Adoption of Underwater Robotics

The upkeep and fixing of underwater robots in extreme underwater conditions pose considerable difficulties for the sector. These robots are frequently utilized in hard-to-reach or deep-ocean sites, where repair access is restricted, resulting in prolonged inactivity. The need for specialized tools and knowledge for repairs can drive up maintenance expenses, thereby raising operational costs for businesses. Furthermore, the intricate nature of underwater robotics implies that even small malfunctions or deterioration can result in expensive repairs, adversely affecting operational efficiency. Consequently, companies in industries like oil and gas, marine research, and environmental monitoring need to consider elevated maintenance expenses and potential operational setbacks. These challenges may lower the overall efficiency and dependability of underwater robots, hindering their broad acceptance and sustained usage in the market.

-

Environmental Concerns Over Marine Life Disturbance and Ecosystem Impact May Slow Underwater Robotics Market Growth

The possible environmental effects of underwater robotics are an increasing worry, especially in relation to their influence on marine organisms and ecosystems. While underwater robots are utilized for diverse tasks like exploration, inspection, and research, they may unintentionally disrupt fragile marine ecosystems, including coral reefs and habitats of marine species. The sounds produced by certain robots and their actions can interfere with wildlife behavior, impacting migration routes, reproduction, and foraging. Moreover, worries regarding the possibility of pollution or habitat damage from the mechanical activities of these robots may result in tighter environmental regulations. These issues could hinder the uptake of underwater robotics in areas where environmental conservation is crucial or where regulations are tightening. The growing focus on ecological sustainability poses a challenge for businesses aiming to implement these technologies more widely.

Underwater Robotics Market Segment Analysis

By Type

In 2023, the Remotely Operated Vehicle (ROV) segment dominated the Underwater Robotics Market, capturing approximately 79% of the revenue share. This dominance can be attributed to the widespread use of ROVs in offshore oil and gas operations, where their ability to conduct inspections, repairs, and maintenance at significant depths is crucial. Additionally, their versatility and reliability in complex underwater environments make ROVs the preferred choice for various industries, including marine research and military applications, contributing to their substantial market share.

The Autonomous Underwater Vehicle (AUV) segment is expected to grow at the fastest compound annual growth rate of about 17.82% from 2024 to 2032. The increasing demand for AUVs is driven by their ability to operate autonomously without human intervention, enabling longer missions and more efficient data collection for scientific research, environmental monitoring, and military defense. As technology advances, AUVs are becoming more cost-effective and versatile, further accelerating their adoption across a wide range of industries, positioning them for rapid market growth.

By Application

In 2023, the Commercial Exploration segment led the Underwater Robotics Market, capturing the highest revenue share of approximately 42%. This dominance is primarily driven by the growing demand for underwater robots in offshore oil and gas exploration, mining, and renewable energy projects, where their ability to perform inspections, maintenance, and data collection at extreme depths is critical. The high operational efficiency and the cost-effective nature of underwater robotics in commercial applications contribute significantly to the strong market share in this segment.

The Scientific Research segment is poised for the fastest growth, with a projected compound annual growth rate of about 16.07% from 2024 to 2032. The increasing use of underwater robotics in environmental monitoring, oceanographic research, and marine biology is fueling this growth. As the need for precise data collection in remote underwater ecosystems intensifies, scientific institutions are increasingly adopting autonomous underwater vehicles for long-duration exploration and real-time data analysis, driving rapid expansion in this sector.

Underwater Robotics Market Regional Outlook

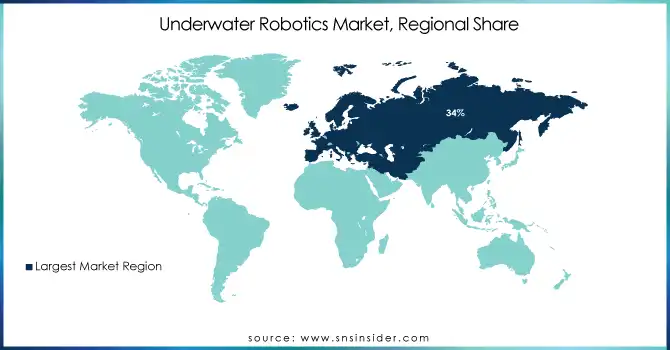

In 2023, Europe led the Underwater Robotics Market, accounting for approximately 34% of the revenue share. This dominance can be attributed to the region’s strong presence in industries such as offshore oil and gas, maritime defense, and renewable energy, where underwater robotics play a critical role in operations. Europe’s well-established infrastructure, technological advancements, and the presence of key industry players contribute to the region’s continued leadership in the market.

The Asia Pacific region is expected to grow at the fastest compound annual growth rate of about 17.03% from 2024 to 2032. This growth is driven by rapid industrialization, increasing investments in offshore oil and gas exploration, and the expanding focus on environmental sustainability in countries like China, Japan, and India. As these economies continue to invest in cutting-edge technology and research, the demand for underwater robotics in commercial and scientific applications is anticipated to surge, positioning Asia Pacific as the fastest-growing region in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ATLAS MARIDAN Aps (ATLAS Scan, ATLAS DP)

-

Deep Ocean Engineering, Inc. (Remote Operated Vehicle (ROV) Systems, Docking Systems)

-

General Dynamics Mission Systems, Inc. (Bluefin-21 ROV, Bluefin-12)

-

ECA GROUP (AUVs, ROVs)

-

International Submarine Engineering Limited (AUVs, ROVs)

-

Eddyfi Technologies (ECT-Scanner, ROV-Optics)

-

Oceaneering International, Inc. (ROV Systems, Smart ROV)

-

Saab AB (Seaeye Falcon, Seaeye Leopard)

-

TechnipFMC plc (Schilling Robotics ROV, ROV Tools)

-

Soil Machine Dynamics Ltd. (Work-Class ROVs, Survey ROVs)

-

Fugro N.V. (ROVs, AUVs)

-

Teledyne Marine (Teledyne Gavia AUV, Teledyne SeaBotix ROVs)

-

Atlas Elektronik GmbH (Seafox, SeaPilot)

-

Kongsberg Maritime (Hydroid AUVs, Kongsberg ROVs)

-

Schilling Robotics LLC (a TechnipFMC company) (DeepWater ROV, ROV Tools)

-

Forum Energy Technologies, Inc. (Triton ROV, Forum ROV Systems)

-

Hydroid, Inc. (a Kongsberg company) (Hydroid Remus AUVs, Hydroid Remus 6000)

-

BIRNS, Inc. (BIRNS Apollo, BIRNS Nautilus)

-

Perry Slingsby Systems (a Triton Group company) (ROVs, Tooling Systems)

-

Seabotix, Inc. (a Saab company) (LBV150 ROV, LBV300 ROV)

-

Subsea 7 S.A. (ROV Services, AUV Services)

-

VideoRay LLC (Pro4 ROV, Mission Specialist ROV)

-

DOF Subsea AS (ROV Services, AUV Services)

-

Komatsu (Lunar Excavator, Autonomous Underwater Robot)

Recent Developments:

-

At CES 2025, Komatsu unveiled two innovative technologies: a lunar excavator designed for low-gravity environments and an autonomous underwater robot for construction tasks. These advancements highlight Komatsu’s focus on pioneering machinery for extreme applications, positioning the company as a leader in future industrial solutions.

-

In September 2024, SLB, Subsea7, and C-Power formed a partnership to explore the use of ocean energy for subsea operations. They will test C-Power’s SeaRAY autonomous offshore power system in challenging ocean conditions at the PacWave South site off Oregon, focusing on cost-effective, low-carbon energy solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4 Billion |

| Market Size by 2032 | USD 13.59 Billion |

| CAGR | CAGR of 14.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV)) • By Application (Defense & Security, Commercial Exploration, Scientific Research, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ATLAS MARIDAN Aps, Deep Ocean Engineering, Inc., General Dynamics Mission Systems, Inc., ECA GROUP, International Submarine Engineering Limited, Eddyfi Technologies, Oceaneering International, Inc., Saab AB, TechnipFMC plc, Soil Machine Dynamics Ltd., Fugro N.V., Teledyne Marine, Atlas Elektronik GmbH, Kongsberg Maritime, Schilling Robotics LLC, Forum Energy Technologies, Inc., Hydroid, Inc., BIRNS, Inc., Perry Slingsby Systems, Seabotix, Inc., Subsea 7 S.A., VideoRay LLC, DOF Subsea AS, Komatsu. |

| Key Drivers | • Offshore Oil & Gas Growth Drives Demand for Underwater Robotics in Inspection, Maintenance, and Repair Operations. • Technological Advancements Enhance Efficiency, Durability, and Capabilities of Underwater Robotics for Expanded Market Applications. |

| RESTRAINTS | • High Maintenance and Repair Costs in Harsh Environments Limit Efficiency and Adoption of Underwater Robotics. • Environmental Concerns Over Marine Life Disturbance and Ecosystem Impact May Slow Underwater Robotics Market Growth. |