Nuclear Decommissioning Services Market Report Scope & Overview:

Get More Information on Nuclear Decommissioning Services Market - Request Sample Report

The Nuclear Decommissioning Services Market size was valued at USD 6.3 billion in 2023 and is expected to grow to USD 10.20 billion by 2032 and grow at a CAGR of 5.5% over the forecast period of 2024-2032.

Decommissioning is referred to as the withdrawal of all the fuel from the nuclear power plant, taking down the project facilities, and restoring the site. Nuclear Decommissioning Services monitor and supervise the decommissioning of nuclear power plants and other nuclear facilities. This service covers decommissioning planning, review of final waste disposal concepts, and engagement with regulatory bodies. It is very essential to control and review the handling, dismantling, storing, and transporting of radioactive materials. To maintain the safety and security at a nuclear power plant and other nuclear facilities operator, supplier, and authorities uses the decommissioning services.

The decommissioning of the nuclear power plant and other nuclear facilities is the final stage in the life cycle of that nuclear power plant. The operating life of any nuclear plant is pre-designed which is 40-60 years. To make available the site for other purposes, the end-stage nuclear power has to be decommissioned and cleaned up. After dismantling the plant radioactive material is moved, handled, and stored in another place which may cause radiological contamination, accidents, long-term environmental damage, harm to the public health, and economic damage.

The main objective of nuclear decommissioning service is to ensure the protection of the environment and people by reducing the residual radionuclides in the facilities and material on the plant site. This service helps to recycle, reuse, or dispose of radioactive material safely.

Market Dynamics

Drivers

-

The dismantling of the older nuclear plant

-

Increasing government support after nuclear accidents in their countries

-

Rising safety concern

-

Increasing need for upgradation and digitization of nuclear services

-

Growing government initiative to dismantle the older nuclear power plant

The lifespan of any reactor is 40-60 years generally. After this period, it is difficult to operate the reactor with the same efficiency. The radioactive waste takes a long period of time to degrade therefore nuclear decommissioning can take several years. For this, at the end stage of the nuclear plant, it should be dismantled to protect the environment from the hazard of radioactive waste. Furthermore, the government made high investments and took the initiative to use renewable energy resources to curb greenhouse gas emissions driving the market of nuclear decommissioning services globally. In addition, increasing technological advancement and digitalization in nuclear services propel the market in the future.

Restrain

-

High cost associated with the dismantling of the reactor

-

Issues regarding disposal of waste and decontamination

The disposal of radioactive waste takes a very long time so maintaining and managing the waste disposal and contamination produced due to the dismantling requires a high cost which hampers the growth of the nuclear decommissioning market.

Opportunities

-

Increasing adoption of renewable energy sources

-

Increasing R&D activities along with the adoption of new and efficient technologies

Challenges

-

Various stringent regulations and standards imposed by the regulatory authorities

Impact of COVID-19

Various industries have faced major challenges during the COVID-19 pandemic. The nuclear sector is no exception to that. Shortage of labor, restrictions of social distancing on on-site workers, stringent lockdown imposed by the government, and most importantly supply chain disruption have restricted the nuclear decommissioning service market globally. Due to the travel restrictions and limited staff and experts available at the project site faced the extension risk of end dates of projects.

Impact of Russia-Ukraine War:

The conflict between Russia and Ukraine has had a significant impact on the nuclear decommissioning services market The war has caused a disruption in the supply chain of nuclear decommissioning services, as many companies in the industry have been affected by the political and economic instability in the region. This has led to delays in the decommissioning process, which can have serious consequences for the environment and public health. Furthermore, the conflict has also led to a decrease in demand for nuclear decommissioning services, as many countries have become more hesitant to invest in nuclear energy due to the geopolitical risks associated with it. This has resulted in a decrease in revenue for companies in the industry, which has made it more difficult for them to continue providing high-quality services.

Impact of Recession:

The nuclear decommissioning services market has been significantly impacted by the recent recession. This has resulted in a decrease in demand for these services, as many companies have been forced to cut costs and reduce their budgets. As a result, the market has become increasingly competitive, with companies struggling for a smaller pool of contracts.

Key Market Segmentation

On the basis of Reactor Type, the Nuclear Decommissioning Services Market is further segmented into Pressurized Water Reactors (PWR), Boiling Water Reactor (BWR), Pressurized Heavy Water Reactor (PHWR), Gas Cooled Reactor (GCR), and Others.

On the basis of Strategy, the Nuclear Decommissioning Services Market is classified into Immediate Dismantling, Deferred Dismantling, and Entombment.

Immediate Dismantling: It is also called early Site Release where the nuclear facility is removed immediately from regulatory control after the termination of the regulated activities. The last stage dismantling and decontamination of the radioactive waste begin within a few months depending upon the nuclear facility.

Deferred Dismantling: It is also called a safe enclosure. In this strategy, the final removal of controls is postponed for a very long period of time. Until the decommissioning and decontamination activities start the nuclear facility has to be placed into a safe configuration.

Entombment: In this strategy, the facility is placed into a condition that allows the remaining radioactive material to remain on-site without removing it totally. According to this strategy, the size of the site area is reduced, and store the remaining radioactivity into a long-lived structure such as concrete.

On the basis of Capacity, the Nuclear Decommissioning Services Market is further bifurcated into Below 100 MW, 100 – 1000 MW, and Above 1000 MW.

By Reactor Type

-

Pressurized Water Reactors (PWR)

-

Boiling Water Reactor (BWR)

-

Pressurized Heavy Water Reactor (PHWR)

-

Gas Cooled Reactor (GCR)

-

Others

By Strategy

-

Immediate Dismantling

-

Deferred Dismantling

-

Entombment

By Capacity

-

100 MW

-

100 – 1000 MW

-

Above 1000 MW

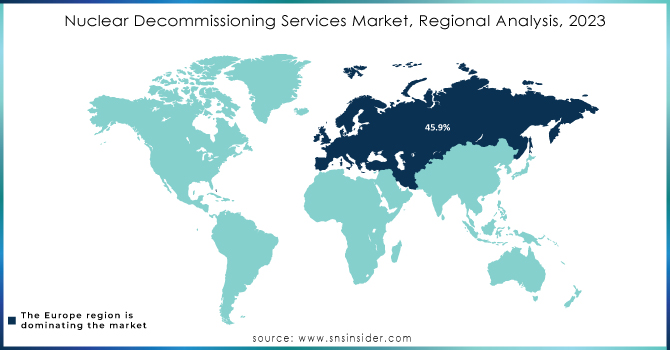

Regional Analysis

Europe region held the largest market share of about 45.9% in 2021 and it is expected to grow with a CAGR of about 5.6% during the forecast period. This growth is attributed to the large investment and stringent regulations imposed by the government to support nuclear decommissioning in Europe. Reduction in the consumption of nuclear energy in order to reduce the environmental hazard of nuclear energy dismantling of the nuclear power plant is rising rapidly. This factor propels the nuclear decommissioning market in Europe significantly.

North America is the fastest-growing region of the nuclear decommissioning service market with a CAGR of about 5.9% during the predicted period. Increasing adoption of renewable energy sources and rapid advancements in technology driving the market of nuclear decommissioning market in this region.

Need any customization research on Nuclear Decommissioning Services Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Orano Group, Babcock International Group PLC, Westinghouse Electric Company LLC, AECOM, Studsvik AB, Bechtel Corporation, GE Hitachi Nuclear Energy, Ansaldo Energia, Jacobs (CH2M Hill Company Ltd.), Magnox Ltd. and other players

Key Market Trends:

-

According to projections from the International Atomic Energy Agency (IAEA), a significant portion of the world's nuclear electrical generating capacity is expected to be retired by 2030. Specifically, between 12% and 25% of the capacity that was available in 2020 will be decommissioned. This trend is already underway, with 203 nuclear power reactors having been shut down globally, and 21 of them fully decommissioned. Additionally, over 150 fuel cycle facilities and approximately 450 research reactors have been decommissioned.

-

In 2022, Hunterston B became the first of EDF's nuclear power stations to cease generation and begin decommissioning. By 2028, EDF anticipates that all seven of its AGR stations will have ceased power generation and be in various stages of decommissioning. Only one of the existing stations, Sizewell B, a pressurized water reactor, will continue to generate low-carbon electricity. EDF has been tasked by the government with removing all used fuel from the reactors and fuel ponds, which account for over 99% of the radioactive material at each site.

| Report Attributes | Details |

| Market Size in 2023 | USD 6.3 Bn |

| Market Size by 2032 | USD 10.20 Bn |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Reactor Type (Pressurized Water Reactor (PWR) • Boiling Water Reactor (BWR), Pressurized Heavy Water Reactor (PHWR), Gas Cooled Reactor (GCR), and Others) • By Strategy (Immediate Dismantling, Deferred Dismantling, Entombment) • By Capacity (Below 100 MW, 100 – 1000 MW, and Above 1000 MW) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Orano Group; Babcock International Group PLC; Westinghouse Electric Company LLC; AECOM; Studsvik AB; Bechtel Corporation; GE Hitachi Nuclear Energy; Ansaldo Energia; Jacobs (CH2M Hill Company Ltd.); Magnox Ltd. |

| Key Drivers | • The dismantling of the older nuclear plant • Increasing government support after nuclear accidents in their countries |

| Market Opportunities | • Increasing adoption of renewable energy sources • Increasing R&D activities along with the adoption of new and efficient technologies |